Debt Assistance Templates

Are you overwhelmed by your debts and in need of help? Look no further than our debt assistance services. Our team of experts is here to guide you through the process of managing and reducing your debt, so you can regain control of your finances.

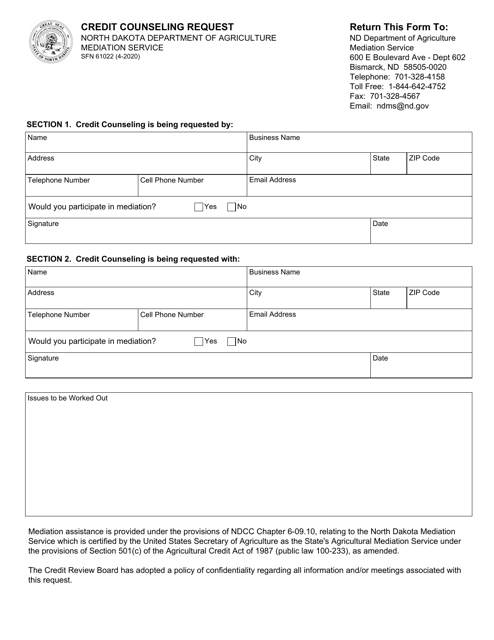

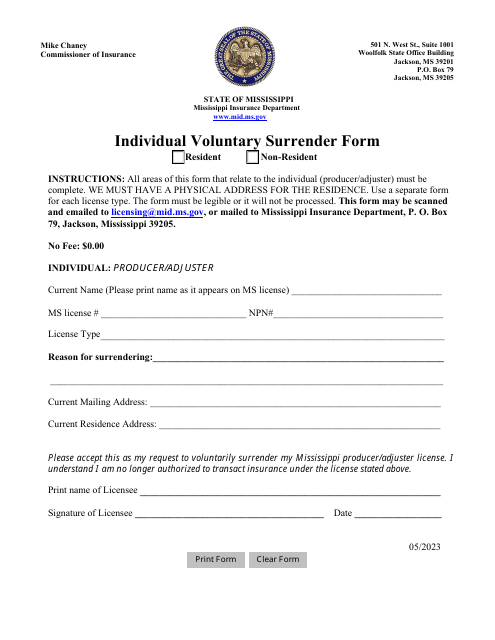

Whether you're struggling with credit card debt, personal loans, or other financial obligations, our debt assistance programs are designed to provide you with relief and support. We offer a range of services tailored to your specific needs, including debt settlement, credit counseling, and debt negotiation.

Our experienced professionals will work closely with you to develop a personalized plan that suits your financial situation. We understand the stress and burden that debt can cause, so our goal is to help you find a path to financial freedom. With our assistance, you can take the necessary steps to reduce your debt, improve your credit score, and ultimately achieve a more stable financial future.

Don't let debt hold you back any longer. Contact us today to learn more about our debt assistance programs and how we can help you overcome your financial challenges. Take control of your debt and start on the path to a brighter future.

Documents:

5

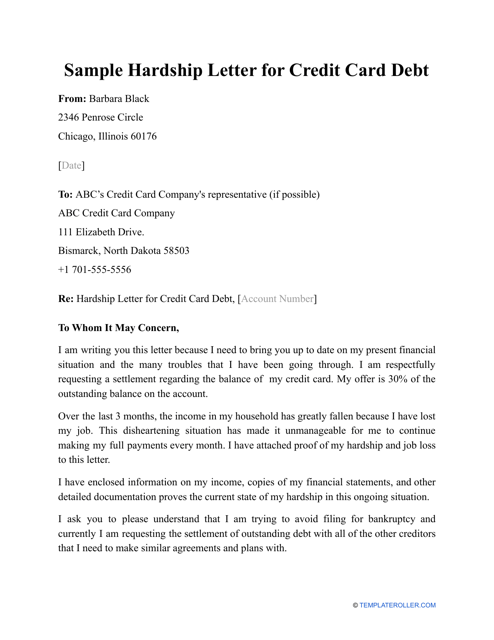

Owners of credit cards can reduce their debt by submitting a Hardship Letter explaining their situation to their credit card company.

This type of debt settlement letter is used by filers who want to decrease the debt on their credit card.

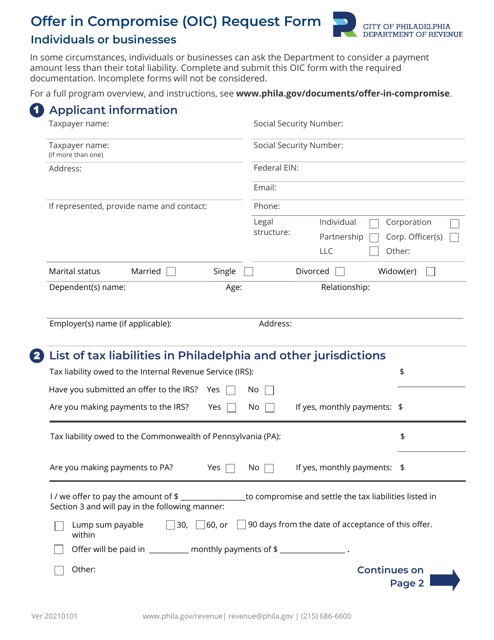

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.