Use Tax Exemption Templates

If you are looking to claim a use tax exemption or need information about use tax exemptions, you've come to the right place. We offer a comprehensive collection of documents and forms related to use tax exemptions to help you navigate the process seamlessly.

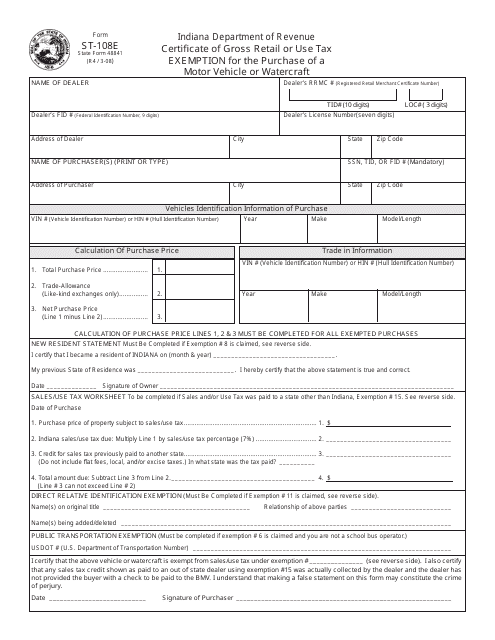

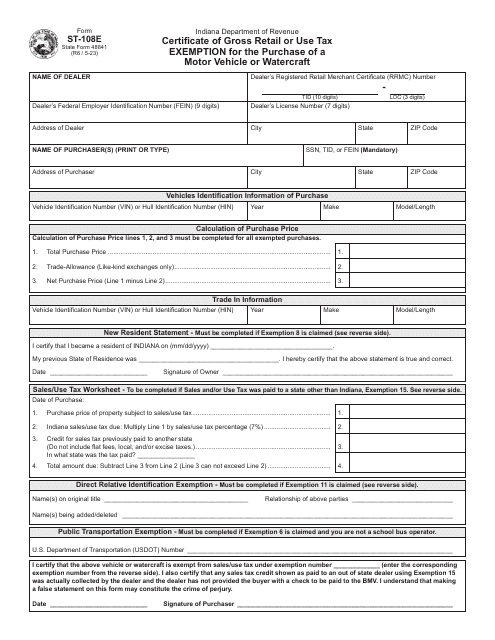

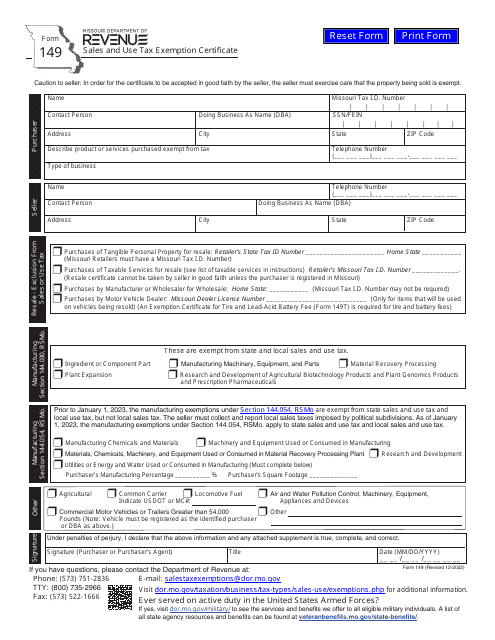

Our use tax exemption forms include the Form ST-108E Certificate of Gross Retail or Use Tax Exemption for the Purchase of a Motor Vehicle or Watercraft from Indiana, the OTC Form 13-36 Application for Sales/Use Tax Exemption for Volunteer Fire Departments from Oklahoma, and the Form Q-20 Use Tax Exemption on Motor Vehicles or Vessels Sold to or by Businesses from Connecticut, among others.

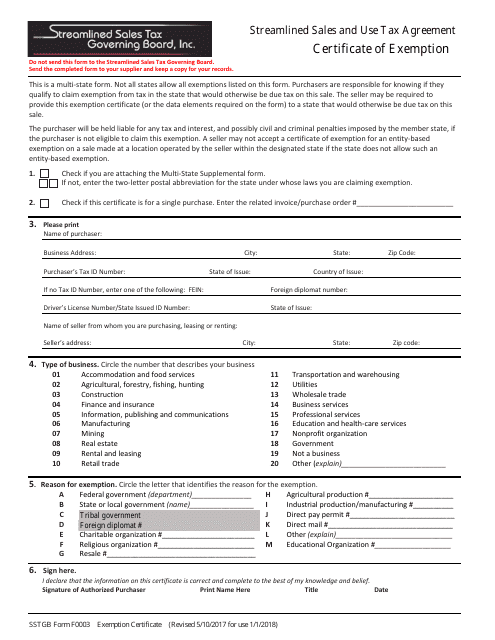

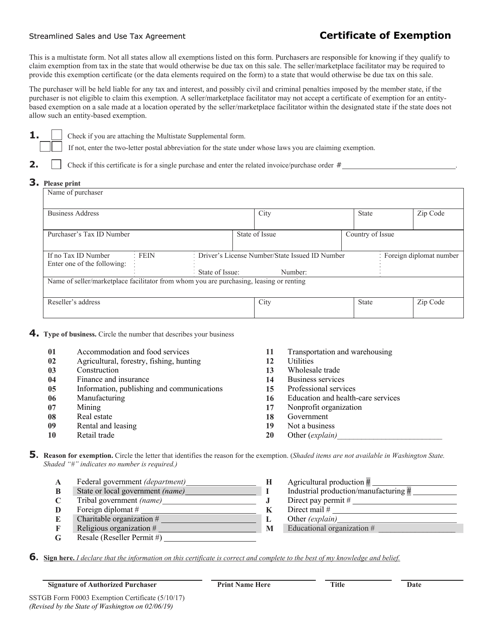

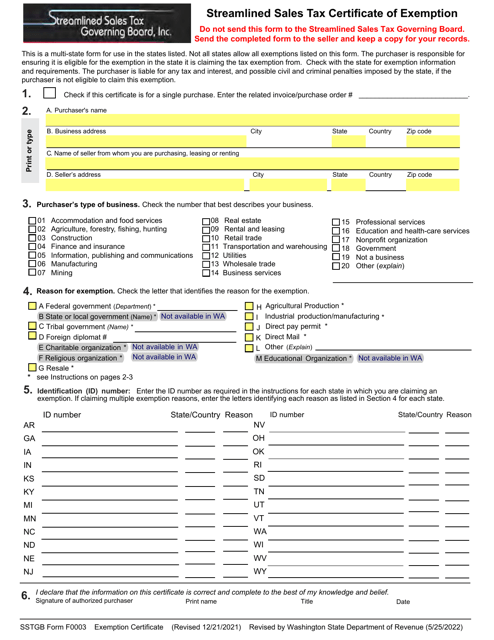

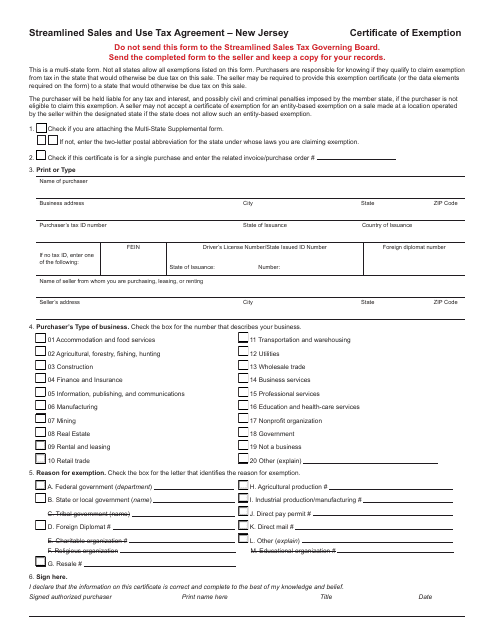

In addition to these specific forms, we also provide access to important documents like the Streamlined Sales and Use Tax Agreement - Certificate of Exemption from New Jersey and the Form ST-10B Sales and Use Tax Certificate of Exemption from Virginia.

Whether you are an individual or a business, understanding and utilizing use tax exemptions can save you time and money. Our user-friendly platform allows easy access to the information and forms you need to claim your exemption.

So, if you need assistance with use tax exemption forms or want to learn more about use tax exemptions, browse through our comprehensive collection of documents today. Take advantage of the alternate names such as use tax exemption form or use tax exemptions to quickly find the documents you need.

Documents:

44

This form is used for claiming exemption from paying gross retail or use tax while purchasing a motor vehicle or watercraft in Indiana.

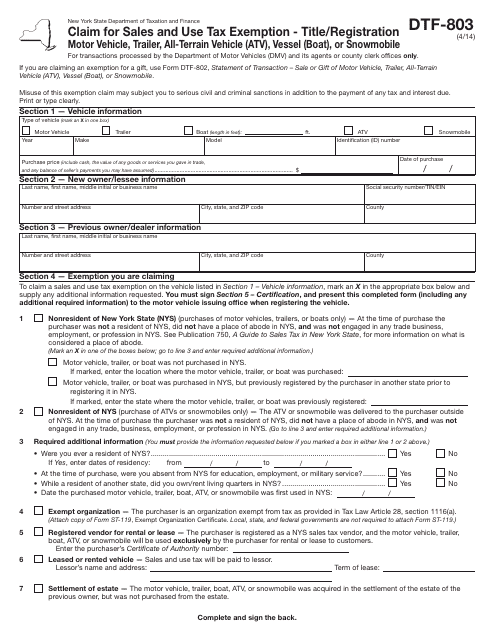

This form is used for claiming sales and use tax exemption when registering a title in New York.

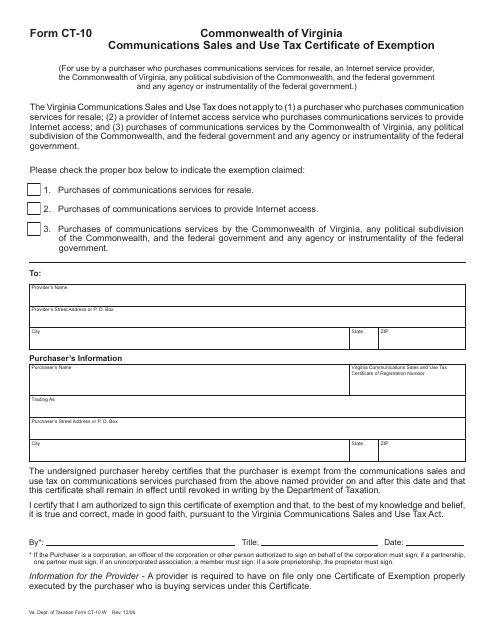

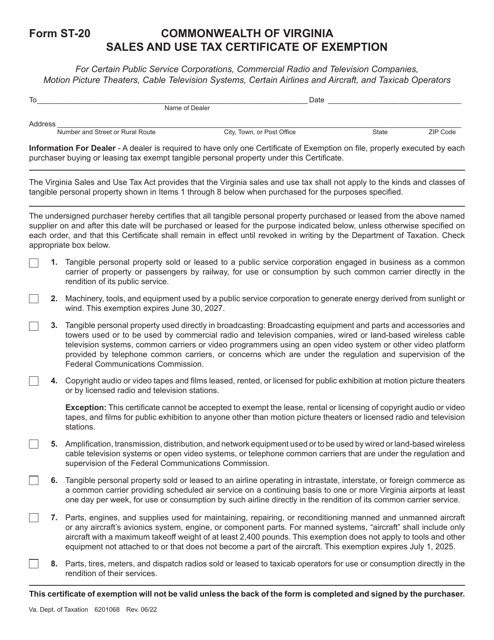

This form is used for obtaining a certificate of exemption from sales and use tax for communications services in the state of Virginia.

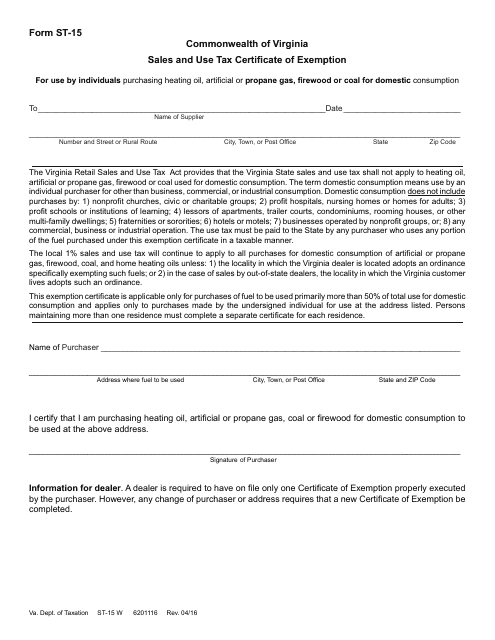

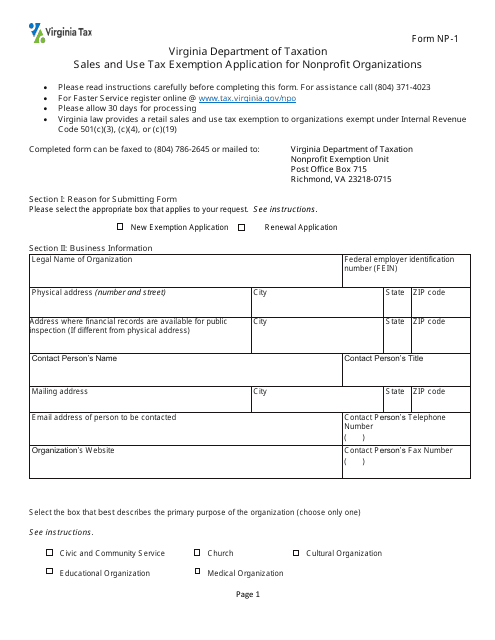

This form is used for claiming sales and use tax exemption in the state of Virginia.

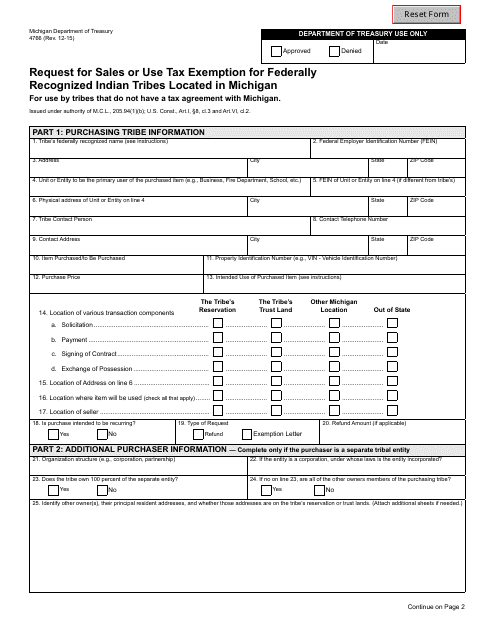

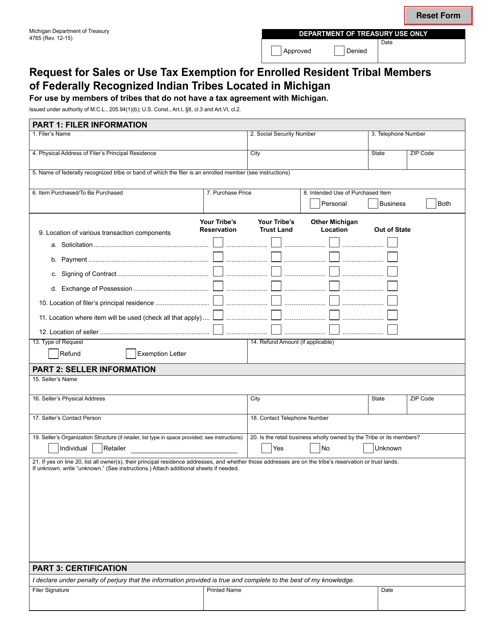

This form is used for requesting sales or use tax exemption for federally recognized Indian tribes located in Michigan.

This form is used for applying for a Certificate of Exemption under the Streamlined Sales and Use Tax Agreement in West Virginia.

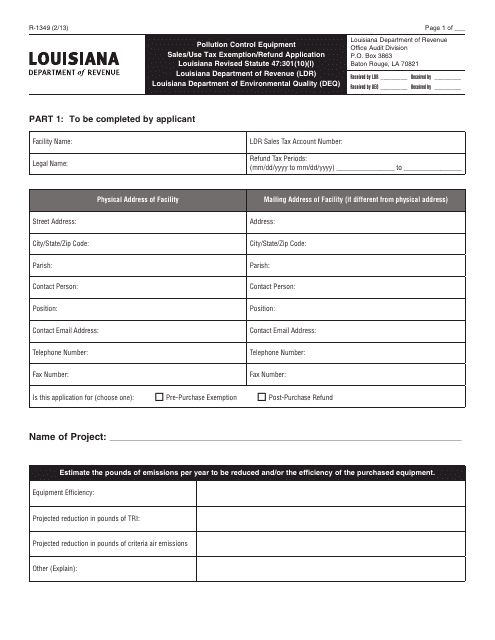

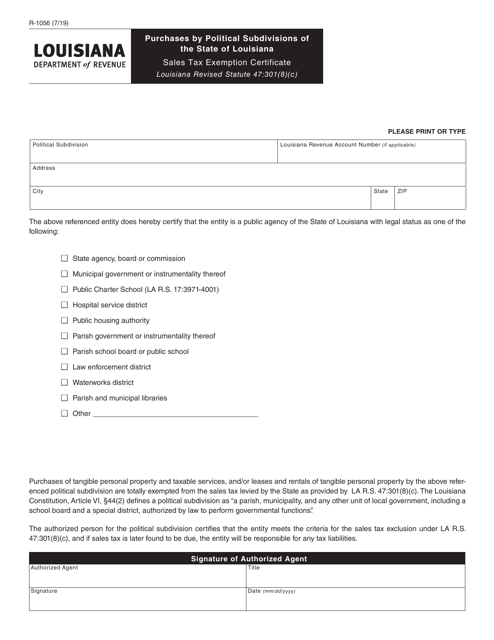

This type of document is an application form used in Louisiana to request an exemption or refund for sales or use tax related to pollution control equipment.

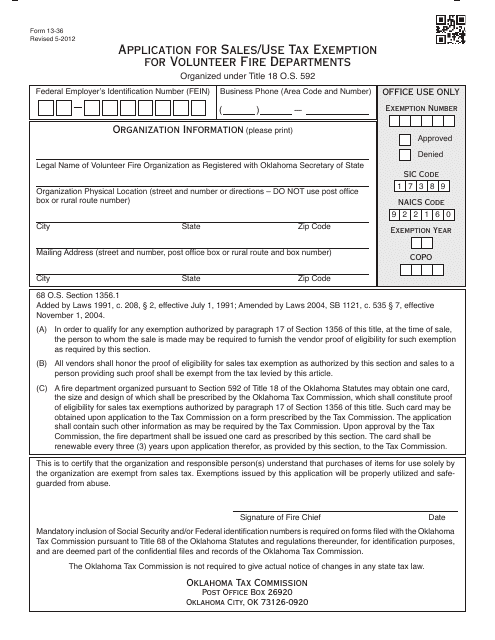

This document is used for volunteer fire departments in Oklahoma to apply for sales/use tax exemption.

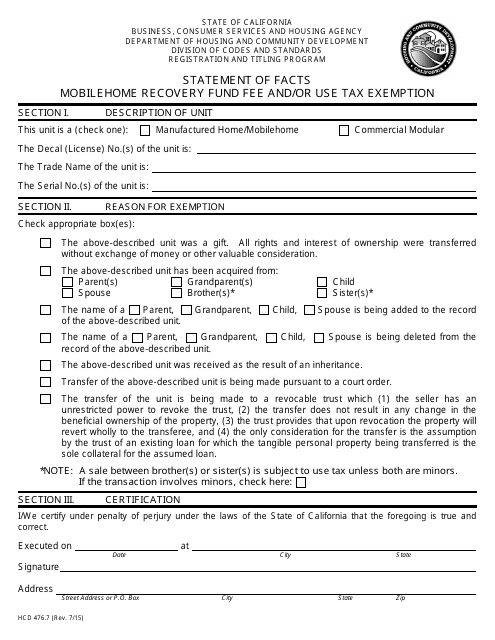

This form is used for claiming an exemption from the Mobilehome Recovery Fund Fee and/or Use Tax in California.

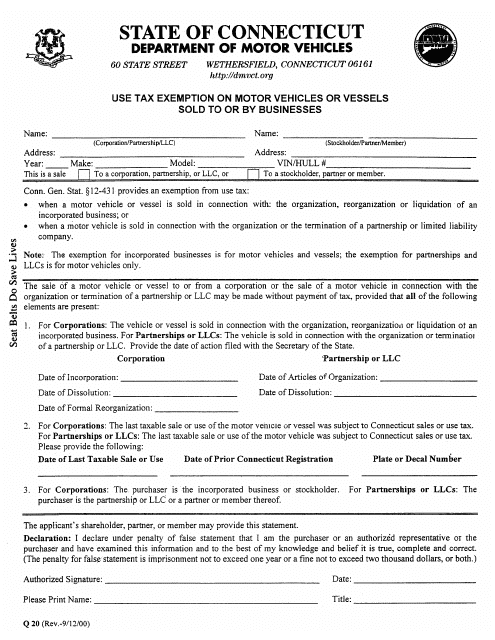

This form is used for claiming a tax exemption on motor vehicles or vessels sold to or by businesses in Connecticut.

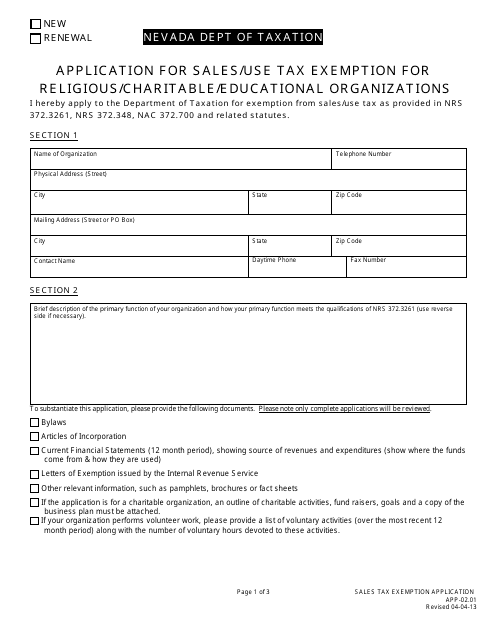

This form is used for religious, charitable, and educational organizations in Nevada to apply for sales and use tax exemption.

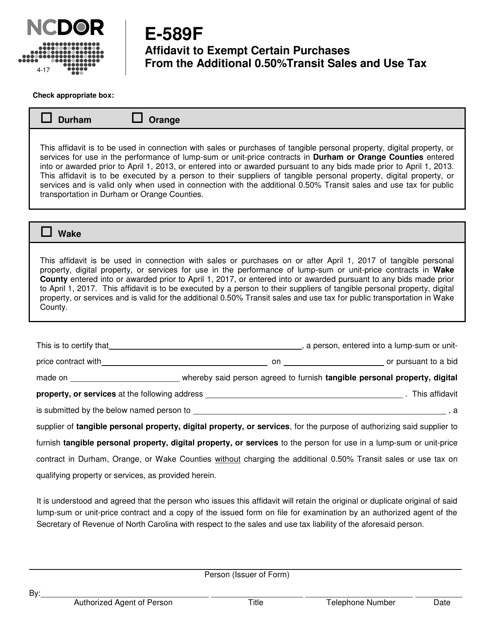

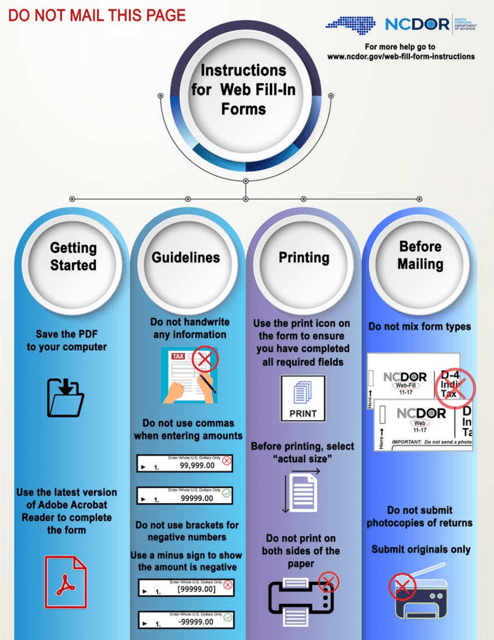

This form is used for requesting an exemption from the additional 0.50% transit sales and use tax on certain purchases in North Carolina.

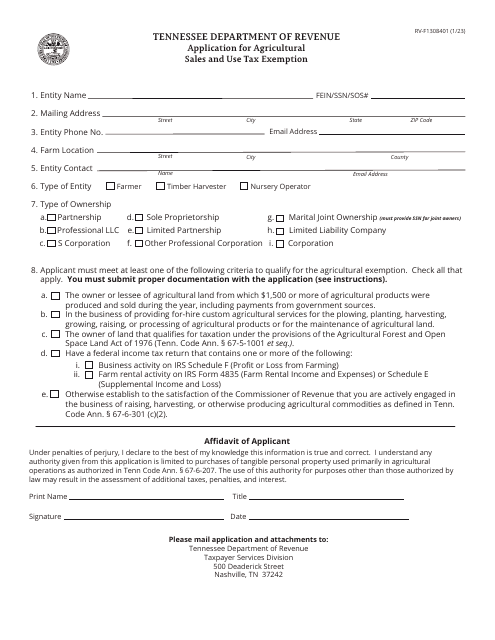

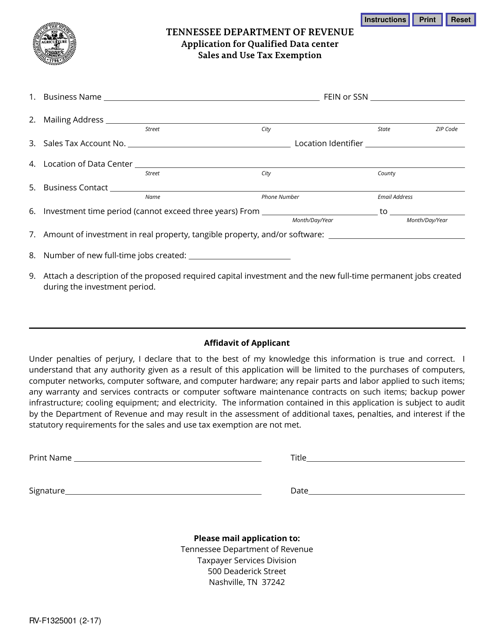

This form is used for applying for a sales and use tax exemption for qualified data centers in the state of Tennessee.

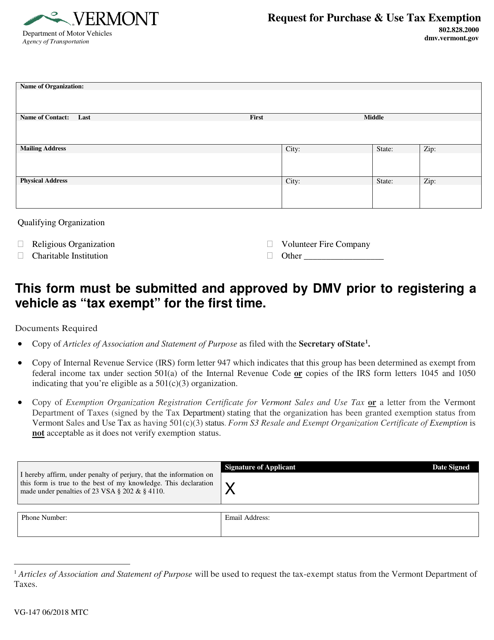

This form is used for requesting a purchase and use tax exemption in the state of Vermont.

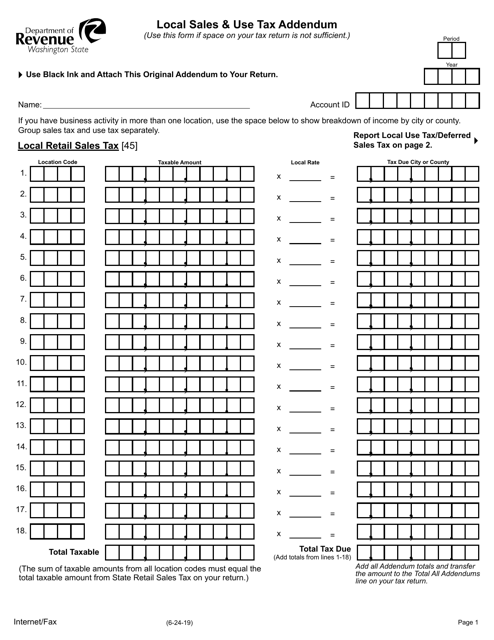

This Form is used for claiming exemption from sales and use tax in the state of Washington.

This document is an addendum to the Local Sales & Use Tax form in the state of Washington. It provides additional information or instructions related to calculating and reporting local sales and use taxes.

This form is used for requesting sales or use tax exemption for enrolled resident tribal members of federally recognized Indian tribes located in Michigan.

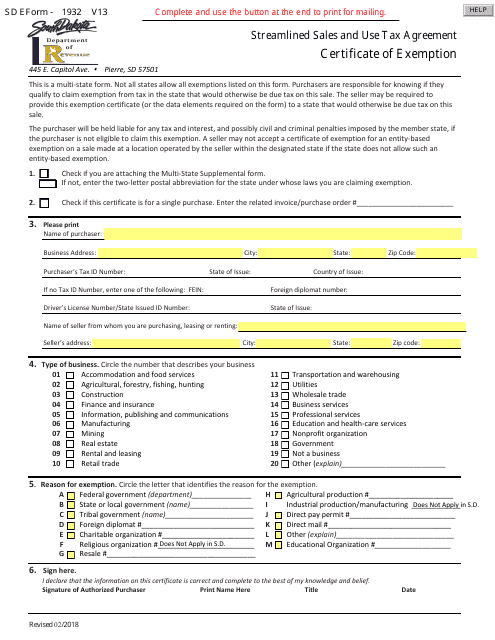

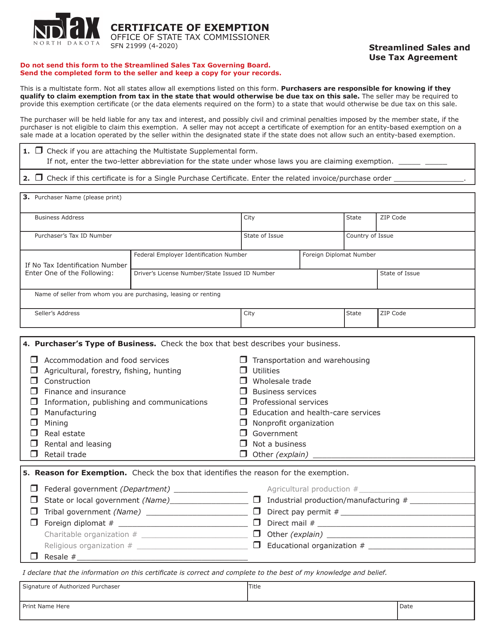

This form is used for claiming exemption from sales and use taxes in North Dakota as part of the Streamlined Sales and Use Tax Agreement.

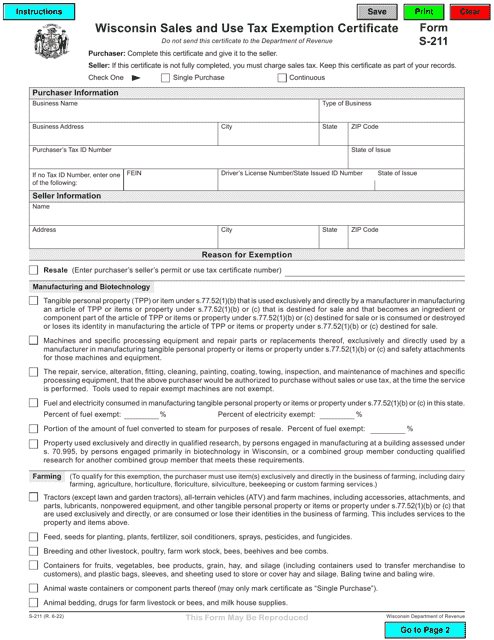

This Form is used for claiming exemption from sales and use tax in Wisconsin under the Streamlined Sales and Use Tax Agreement.

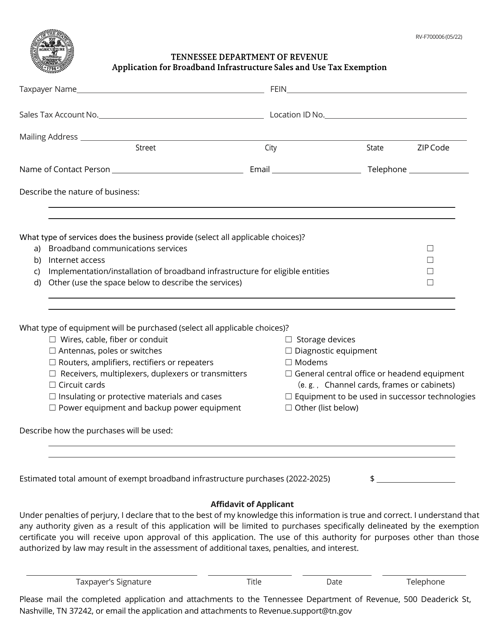

This Form is used for applying for a sales and use tax exemption for broadband infrastructure projects in Tennessee.

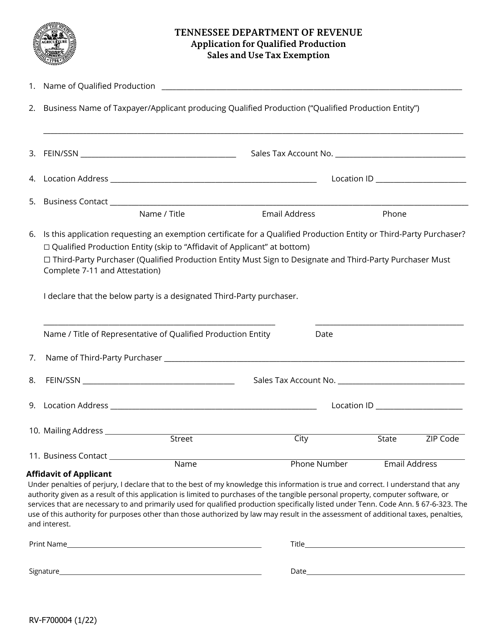

This form is used for applying for a qualified production sales and use tax exemption in Tennessee. It helps businesses in the production industry to claim exemptions on the sales and use tax for certain goods and services.

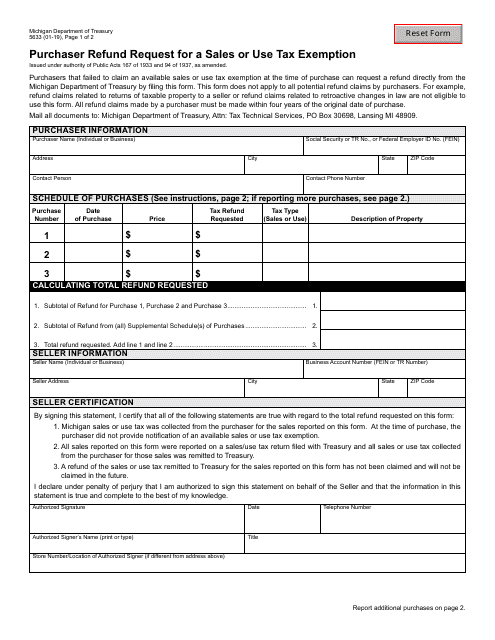

This form is used for requesting a refund for sales or use tax exemption in Michigan.

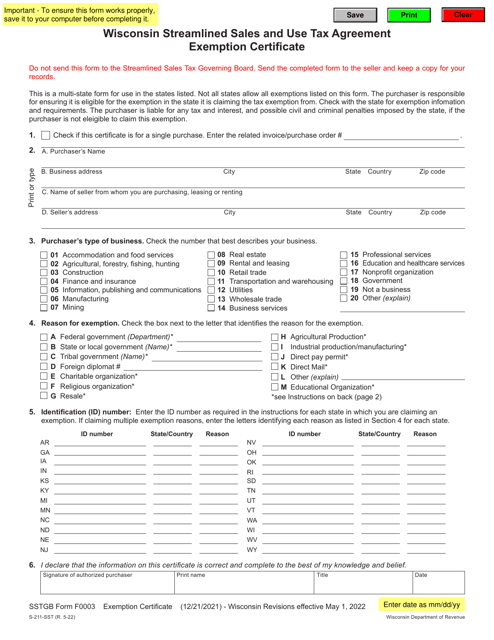

This document is a Certificate of Exemption specific to the state of New Jersey. It is used for streamlined sales and use tax purposes.