Business Property Templates

Are you a business owner or investor looking for information on managing and reporting your business property? Look no further than our comprehensive collection of documents on business property.

Business property refers to assets owned and used by businesses to carry out their operations. Whether you own industrial property in West Virginia or need to report the sales of business property to the IRS, we've got you covered.

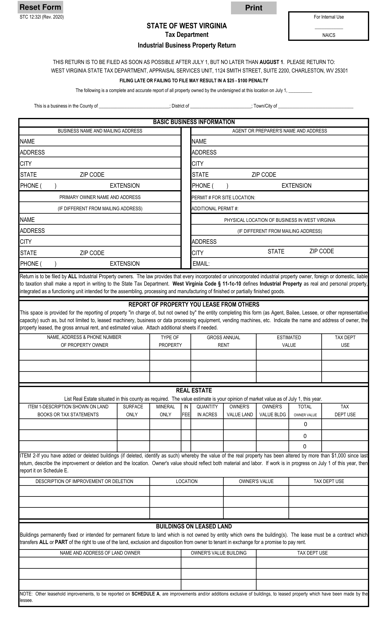

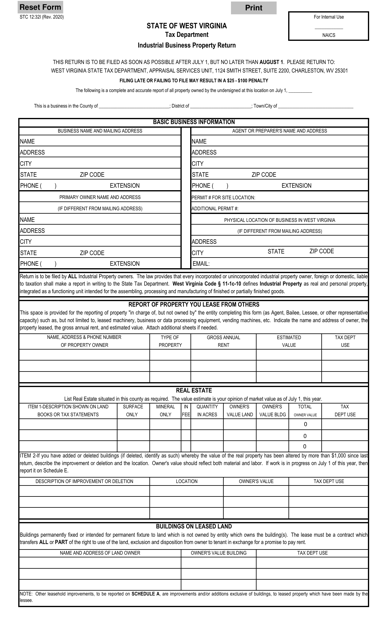

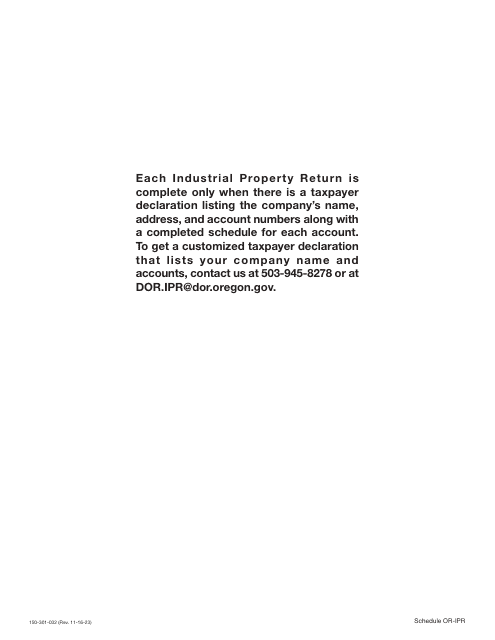

One of the key documents in this collection is the Form STC12:32I Industrial Business Property Return specific to West Virginia. This form is essential for businesses operating in the state to report their industrial property holdings.

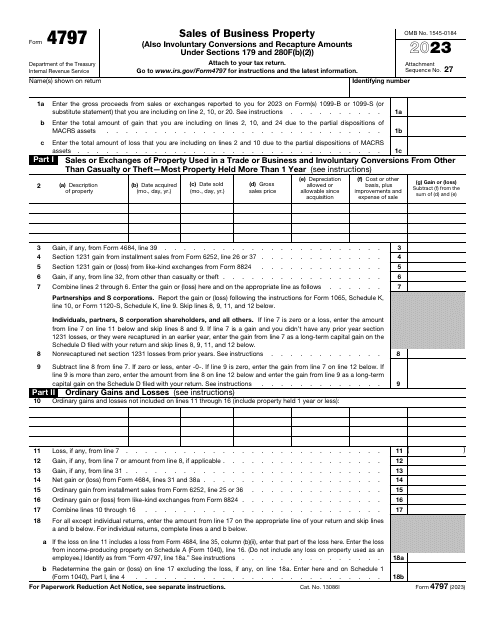

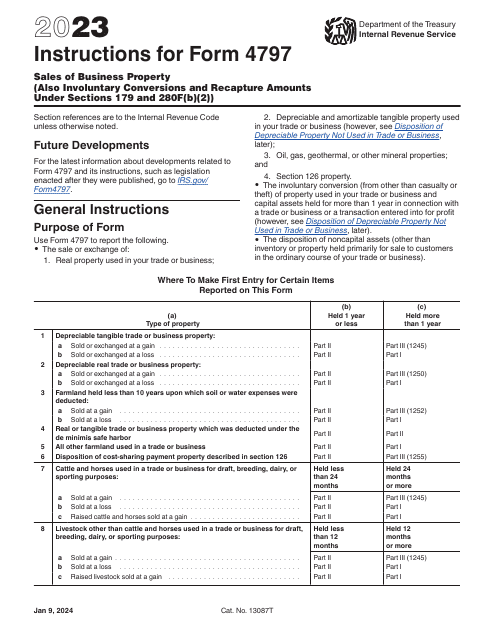

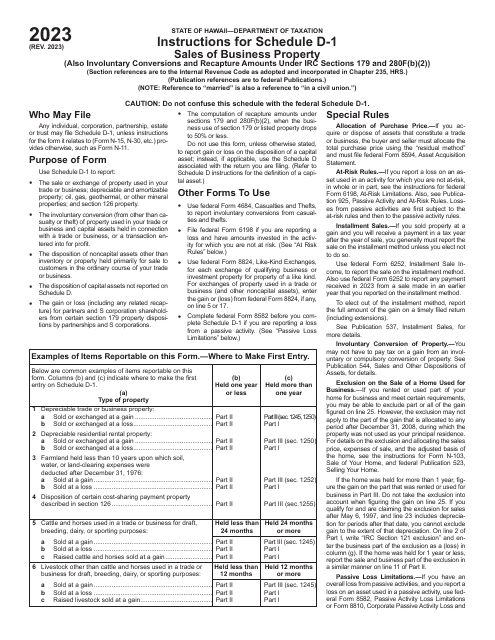

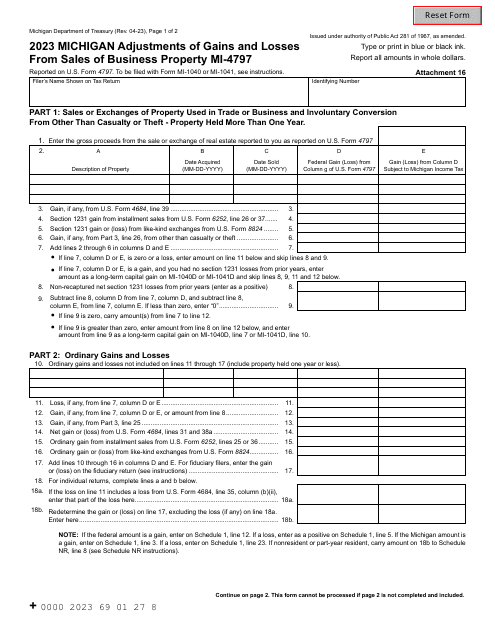

If you've recently sold business property, you'll need to file the IRS Form 4797 Sales of Business Property. Our documentation includes instructions on how to complete this form accurately and efficiently.

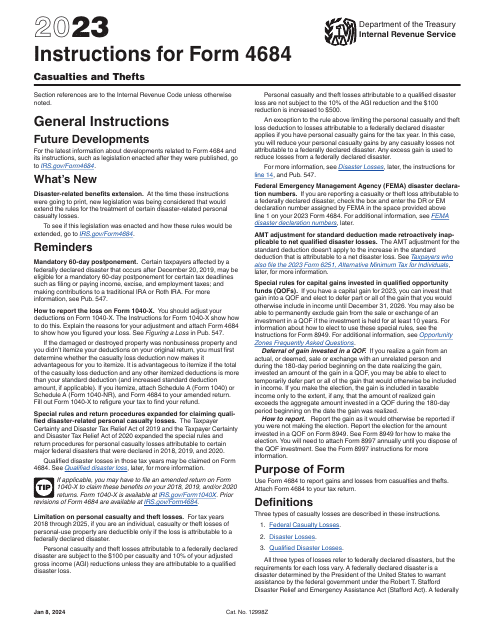

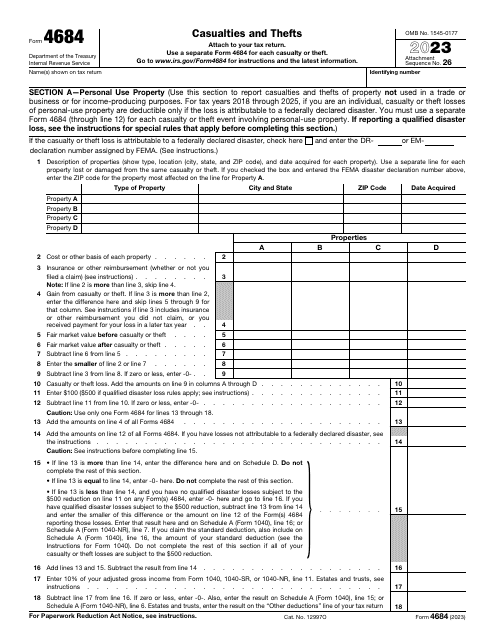

Accidents and theft can sometimes occur, and the IRS requires businesses to report such incidents. For this, you'll need the Instructions for IRS Form 4684 Casualties and Thefts. We provide a comprehensive guide on how to navigate this form and comply with the IRS regulations.

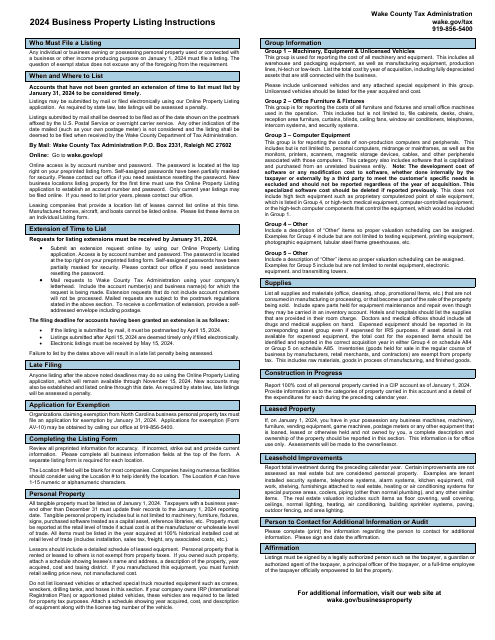

Locally, Wake County, North Carolina has its own set of requirements for listing business property. Our documentation includes instructions specific to Wake County, ensuring that businesses in the area stay compliant with local regulations.

From reporting your industrial property in West Virginia to navigating IRS forms and complying with local listing requirements, our collection of business property documents is an invaluable resource for any business owner or investor. Access the information you need to stay on top of your business's property management today.

Documents:

39

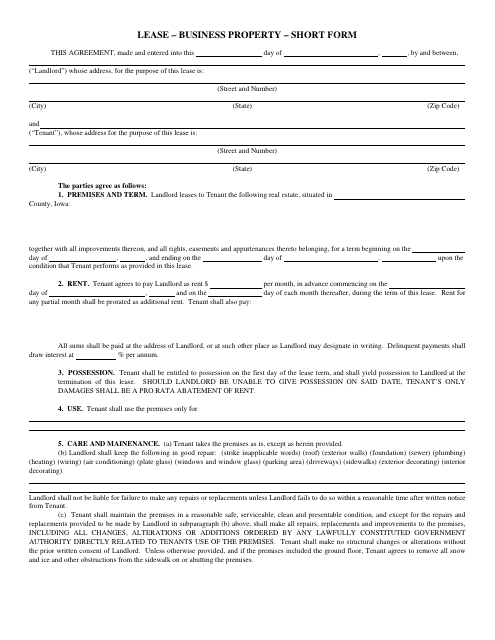

This document is a short form lease agreement for business property. It outlines the terms and conditions for renting a commercial space.

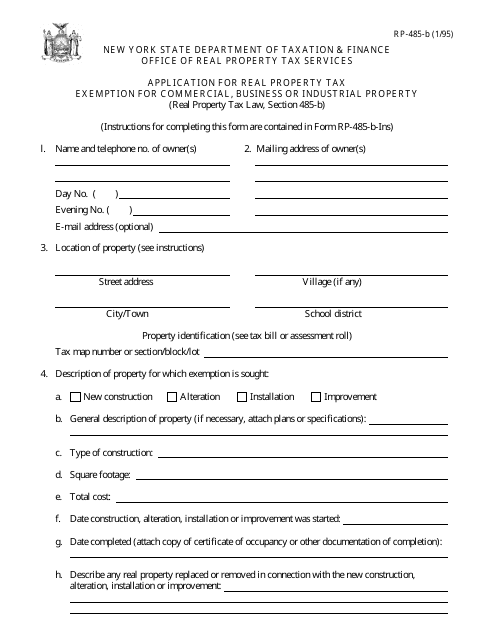

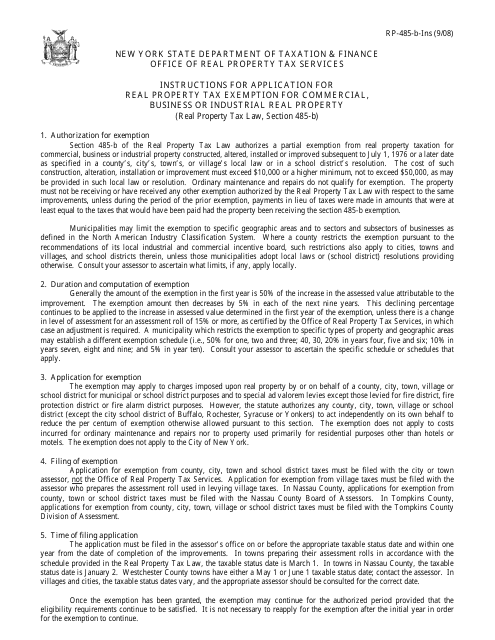

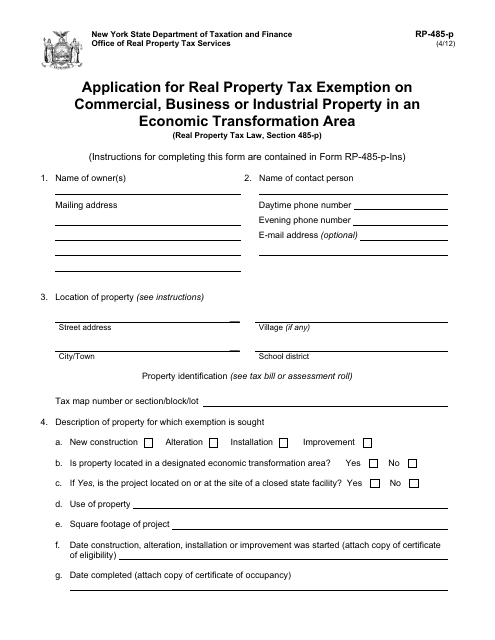

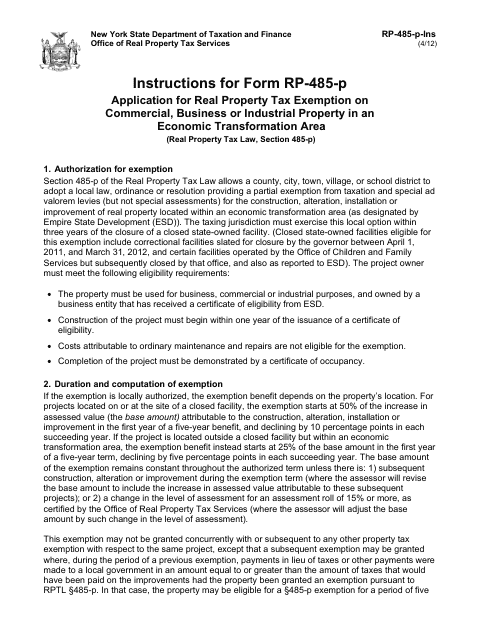

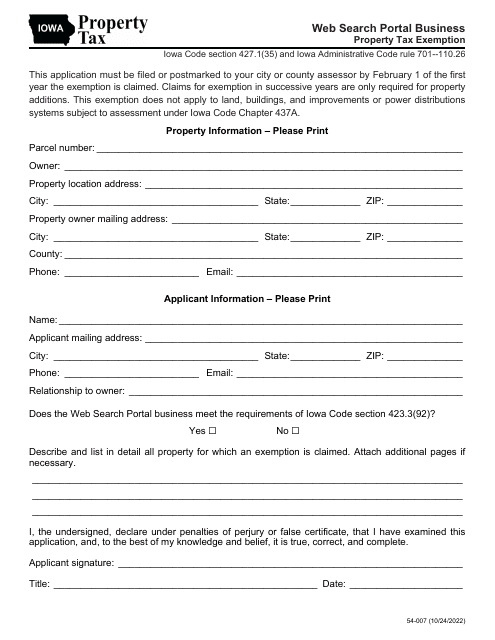

This form is used for applying for a real property tax exemption for commercial, business or industrial property in the state of New York. It allows property owners to potentially receive a tax exemption for their eligible properties.

This Form is used for applying for a real property tax exemption for commercial, business or industrial real property in New York.

This Form is used for applying for a tax exemption on commercial, business, or industrial property located in an Economic Transformation Area in New York.

This Form is used for applying for a real property tax exemption on commercial, business or industrial property in an Economic Transformation Area in New York.

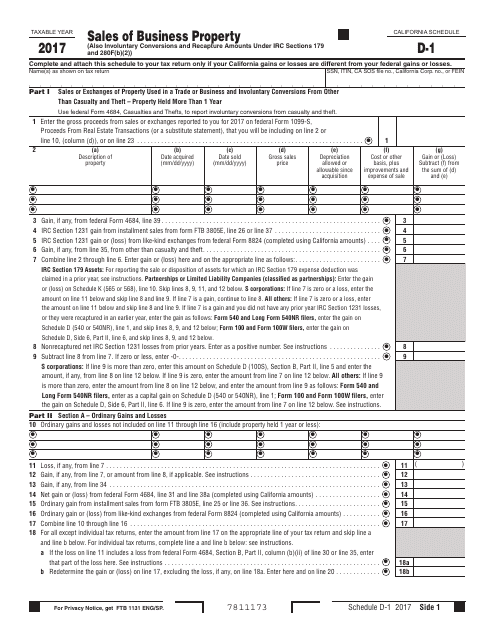

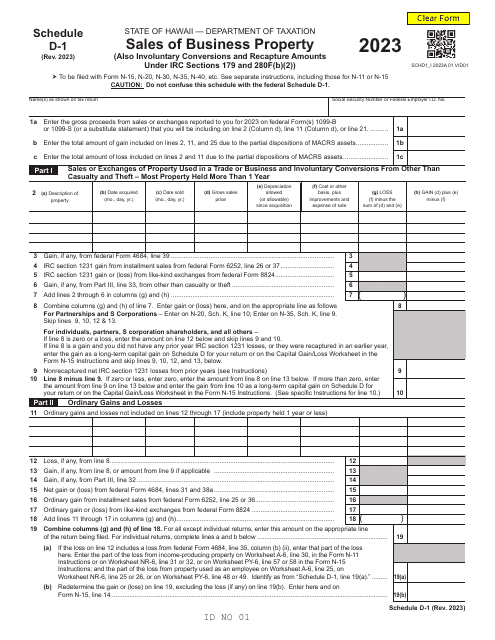

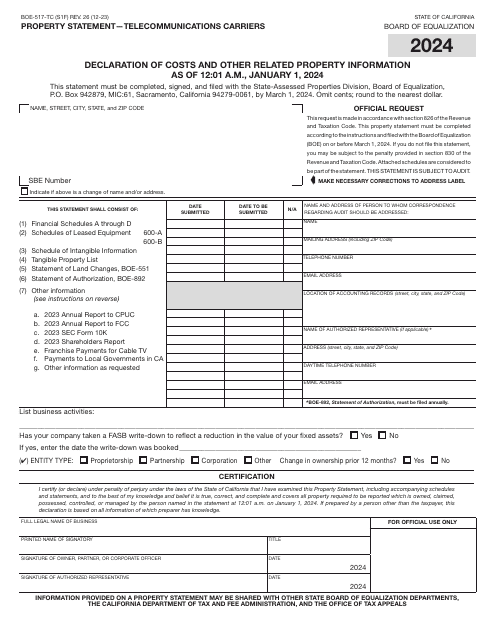

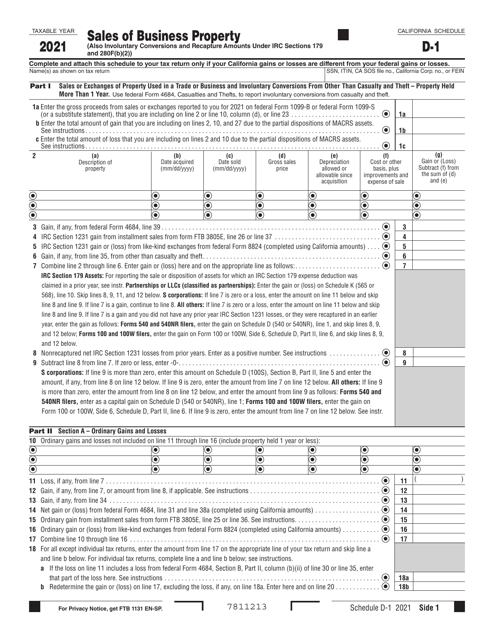

This form is used for reporting sales of business property in California on Form 540 Schedule D-1.

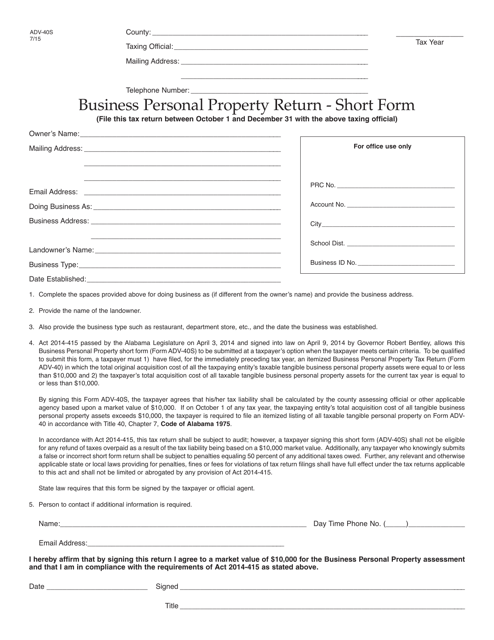

This Form is used for reporting business personal property in Alabama. It is a shorter version of the regular Form ADV-40 for easier filing.

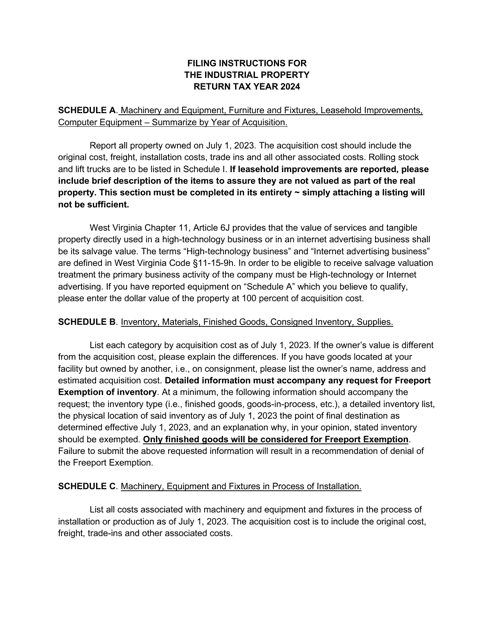

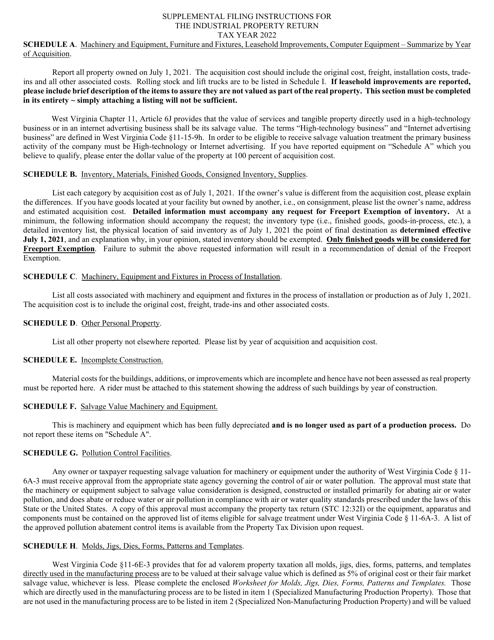

This form is used for reporting industrial business property in West Virginia. It must be filled out by property owners to provide information about their industrial assets for tax purposes.

This Form is used for filing the Industrial Business Property Return in West Virginia. The STC-12:32I form is specifically for businesses that own industrial properties and need to report their property details and value for tax purposes. It provides instructions on how to accurately complete the form and submit it to the appropriate tax authorities.

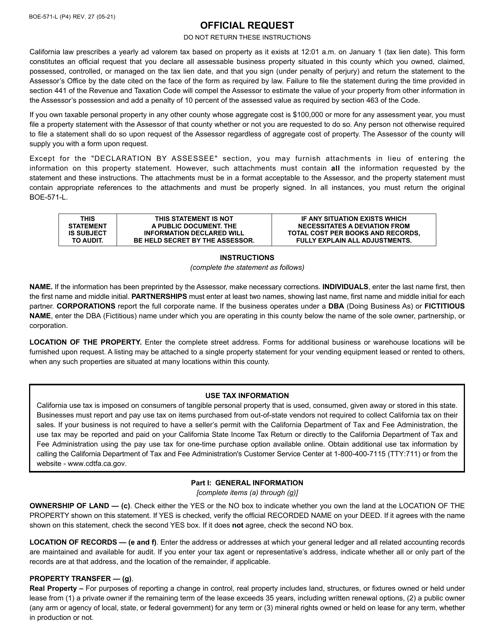

This document provides instructions for completing and submitting Form BOE-571-L, which is the Business Property Statement Form required by the County of San Diego, California.

This is a formal statement prepared by a taxpayer who wants to confirm their right to receive a tax deduction upon property damage or loss they sustained if the reason for it was a casualty or theft.