Investment Report Templates

An investment report provides a comprehensive analysis of an individual or organization's investment portfolio. This report serves as a valuable tool for individuals, companies, and financial institutions to evaluate the performance of their investments and make informed decisions.

Also known as investment reporting or investments report, these documents provide detailed information about the various investments held by an entity. They typically include data on the types of investments, their market value, returns, and any income or dividends received.

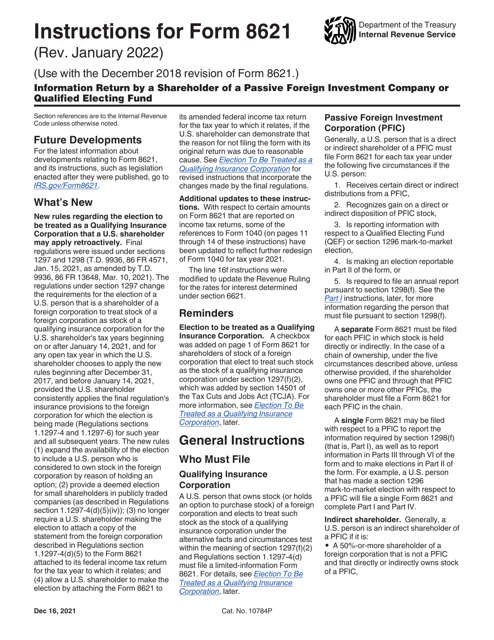

An investment report is essential for tax purposes as well, as it assists in filling out tax forms such as IRS Form 8621 Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund and IRS Form 1099-DIV Dividends and Distributions. These reports ensure compliance with regulatory requirements and provide a clear picture of the financial status of the investment portfolio.

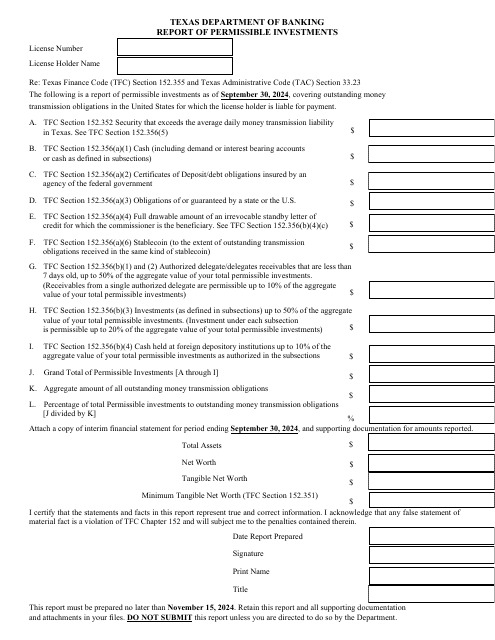

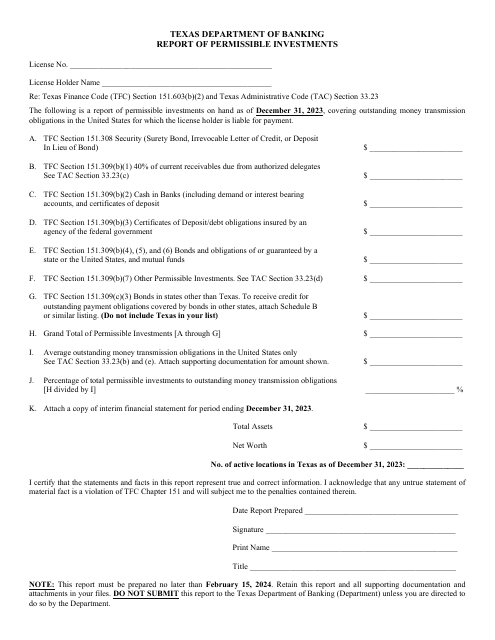

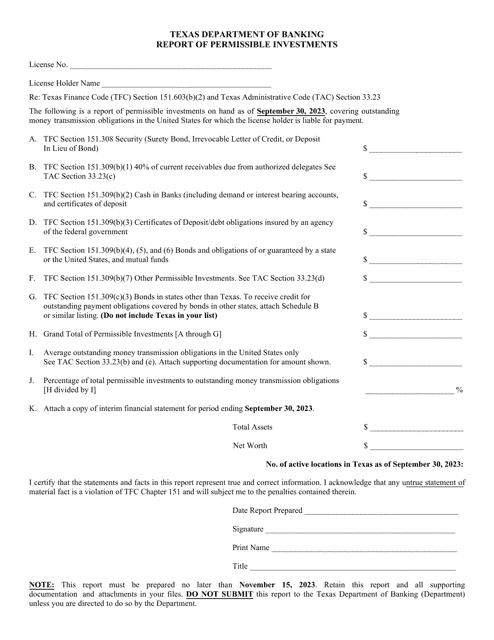

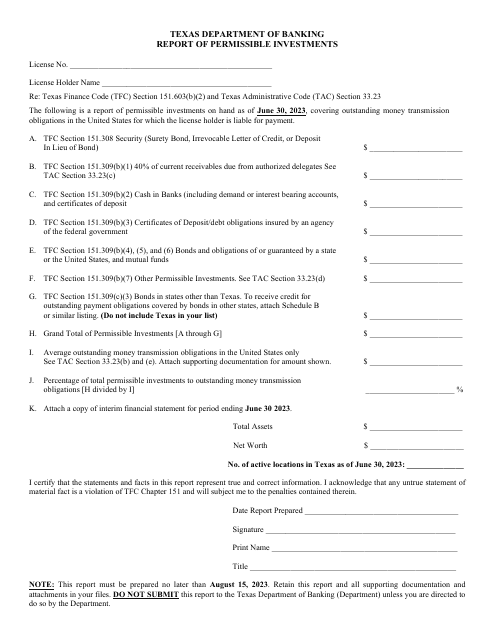

In addition, investment reports can also be specific to certain regions or jurisdictions. For example, the Report of Permissible Investments - 2nd Quarter - Texas and the Report of Permissible Investments - 4th Quarter - Texas highlight the permissible investment options within the state of Texas.

Whether you are an individual looking to evaluate your personal investments or a financial institution managing a portfolio for clients, an investment report offers valuable insights and data to guide informed decision-making and optimize investment strategies.

Documents:

13

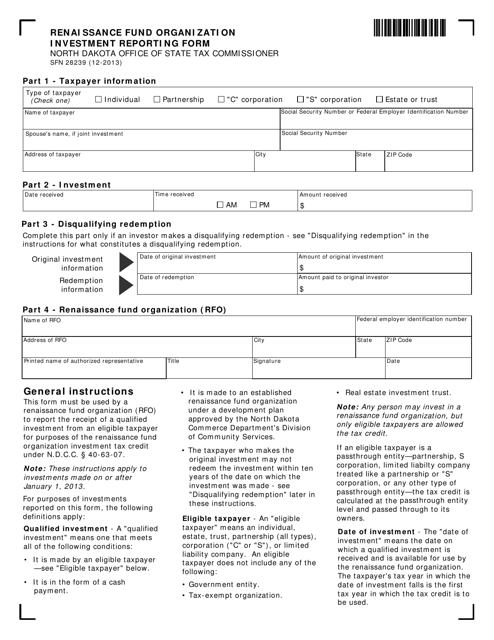

This form is used for reporting investment activities of the Renaissance Fund Organization in North Dakota.

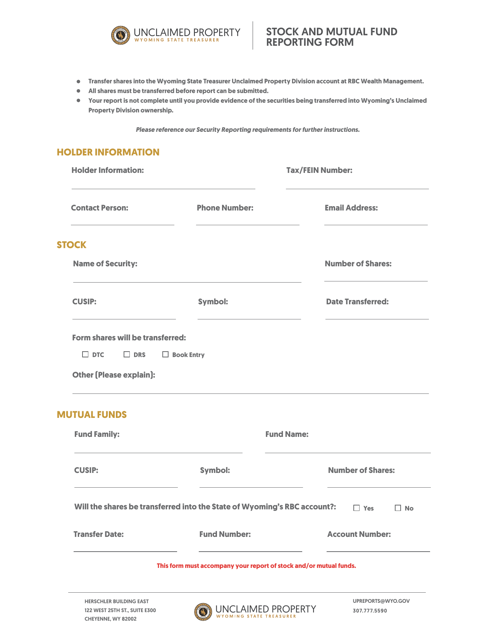

This form is used for reporting stocks and mutual funds in the state of Wyoming. It provides the necessary information for individuals or businesses to accurately report their investments in these assets.

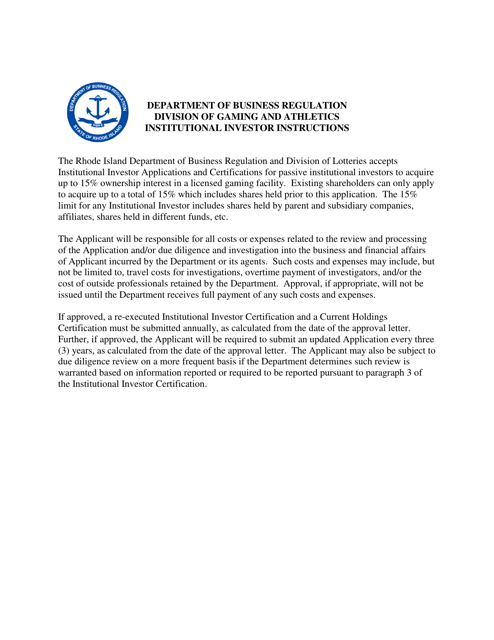

This form is used for applying as an institutional investor in Rhode Island.