Sick Pay Templates

Are you looking for information on sick pay or sick pay forms? Look no further! We have a comprehensive collection of documents related to sick pay that will help you navigate the process smoothly.

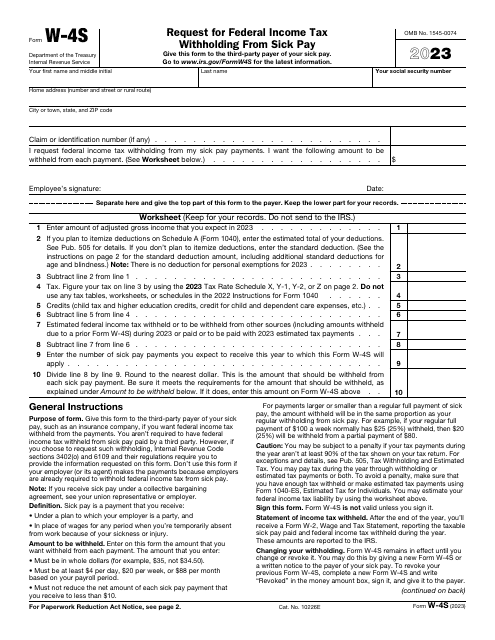

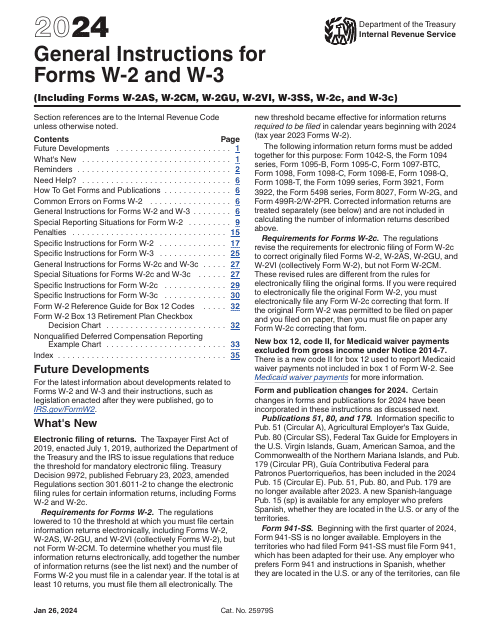

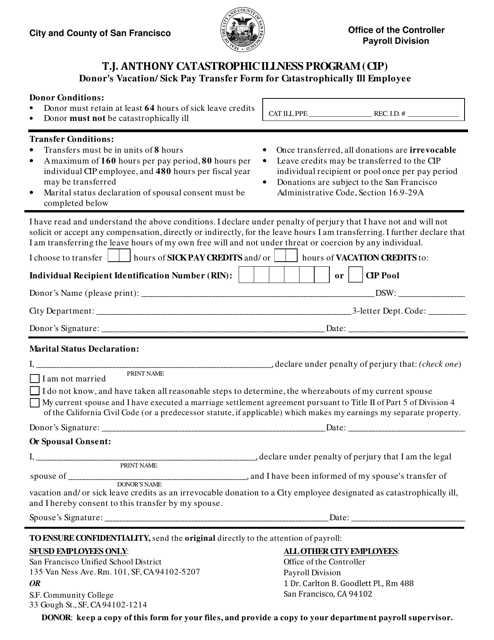

Our extensive range of documents includes forms, such as the IRS Form W-4S Request forFederal IncomeTax Withholding From Sick Pay, which is essential for managing your tax obligations when receiving sick pay. Additionally, we have the Donor's Vacation/Sick Pay Transfer Form for Catastrophically Ill Employee, which is specifically designed for the T.j. Anthony Catastrophic Illness Program (Cip) in the City and County of San Francisco, California.

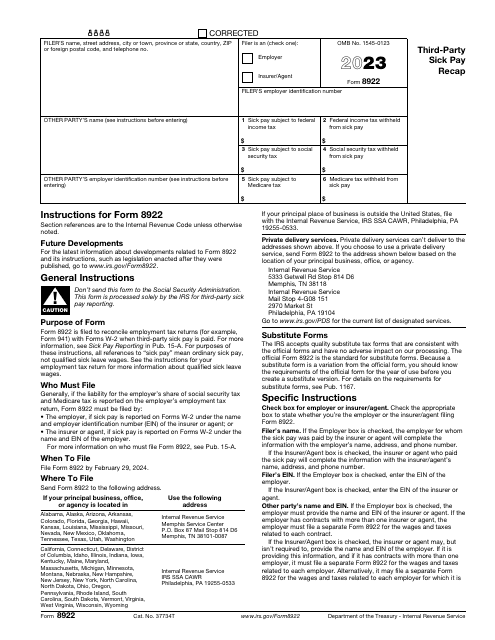

Not only do we offer various forms, but we also provide resources like the IRS Form 8922 Third-Party Sick Pay Recap. This document contains valuable information regarding the reporting and recapitulation of third-party sick pay, ensuring that you stay compliant and informed.

Whether you are an employer or an employee, our collection of sick pay documents will guide you through the necessary steps and requirements. We understand that sick pay can be a complex topic, but with our resources, you'll have the tools you need to handle it efficiently.

Explore our selection of sick pay documents today and access the forms and information you need to navigate this process effectively. Don't let the intricacies of sick pay overwhelm you – we're here to help.

Documents:

18

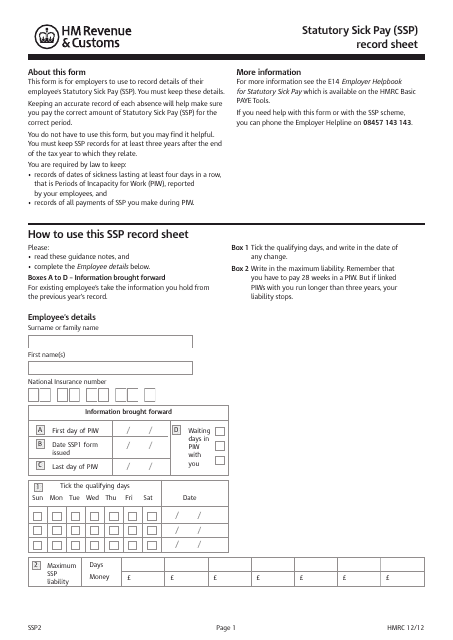

This form is used for keeping a record of Statutory Sick Pay (SSP) in the United Kingdom.

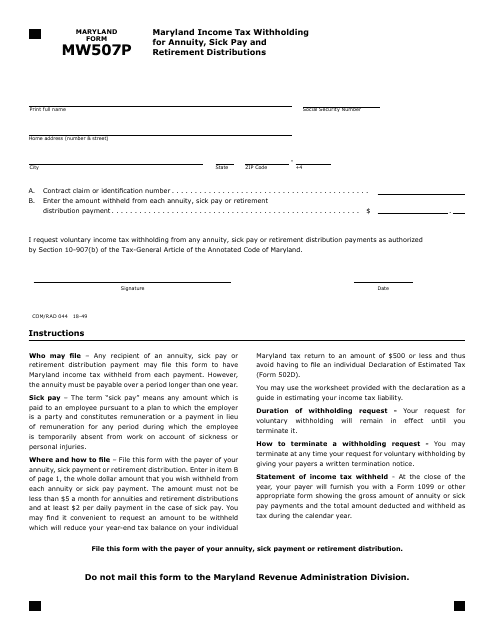

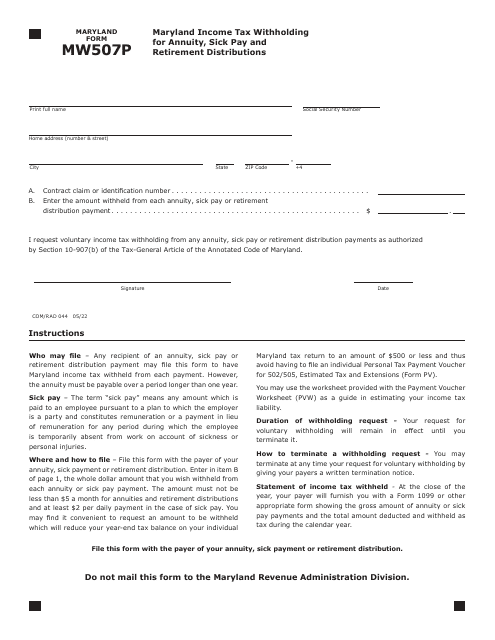

This form is used for Maryland residents to indicate their income tax withholding preferences for annuity, sick pay, and retirement distributions.

This form is used for transferring vacation or sick pay to a catastrophically ill employee under the T.j. Anthony Catastrophic Illness Program (CIP) in the City and County of San Francisco, California.

This Form is used for Maryland residents to specify their income tax withholding for annuity, sick pay, and retirement distributions.