Assessment Roll Templates

Are you looking for information on assessment rolls? Look no further! On this webpage, we provide comprehensive details about assessment rolls, also known as assessment roll or assessment rolls. Assessment rolls are important documents that list the property valuations and assessments for a particular jurisdiction or region.

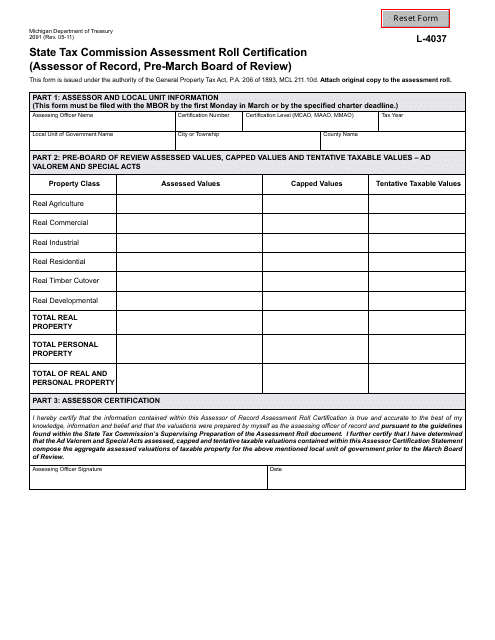

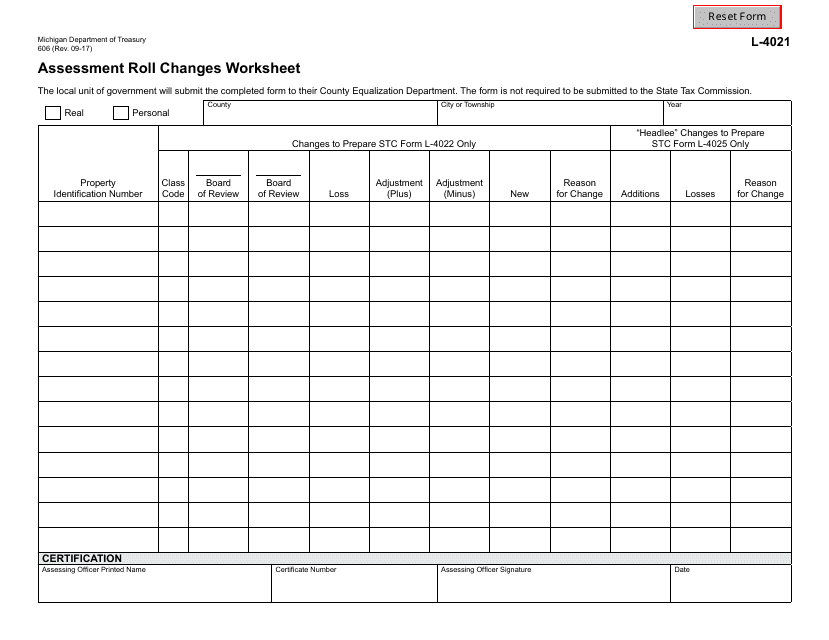

One example of an assessment roll document is the "Form 2691 (L-4037) State Tax Commission Assessment Roll Certification" in Michigan. This document certifies the accuracy of the assessment roll prepared by the State Tax Commission. Another example is the "Form 606 Assessment Roll Changes Worksheet" in Michigan, which allows for the recording of any changes made to the assessment roll.

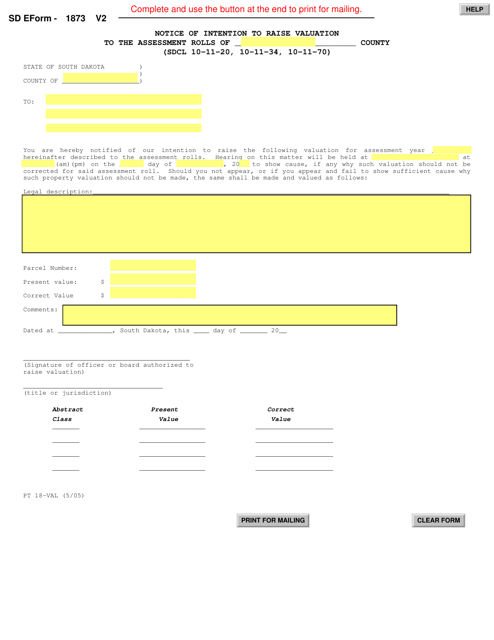

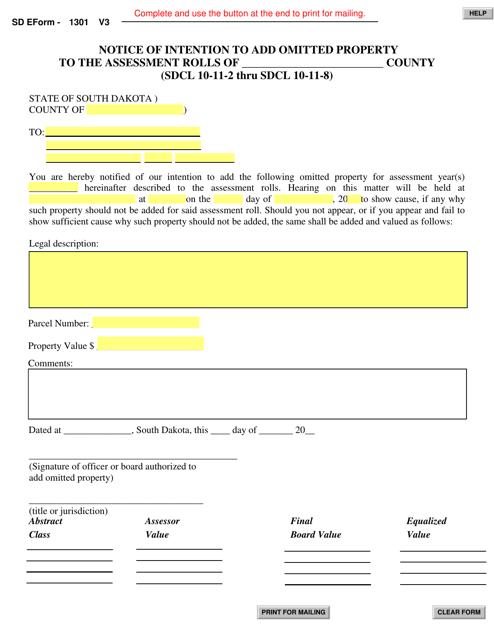

In addition to Michigan, assessment rolls are used in various other states such as South Dakota. In South Dakota, the "SD Form 1873 (PT18-VAL) Notice of Intention to Raise Valuation to the Assessment Rolls" is used to notify property owners of any changes in the valuation of their properties.

Assessment rolls play a crucial role in determining property taxes and ensuring fairness in property assessments. They are used by assessors, tax authorities, and property owners themselves to verify and review property valuations. It is important to understand assessment rolls and their implications to ensure accurate property assessments and fair taxation.

If you are interested in learning more about assessment rolls and how they are used, explore the information provided on this webpage. Stay informed and make informed decisions when it comes to property assessments and taxes.

Documents:

14

This form is used for the State Tax Commission Assessment Roll Certification in the state of Michigan.

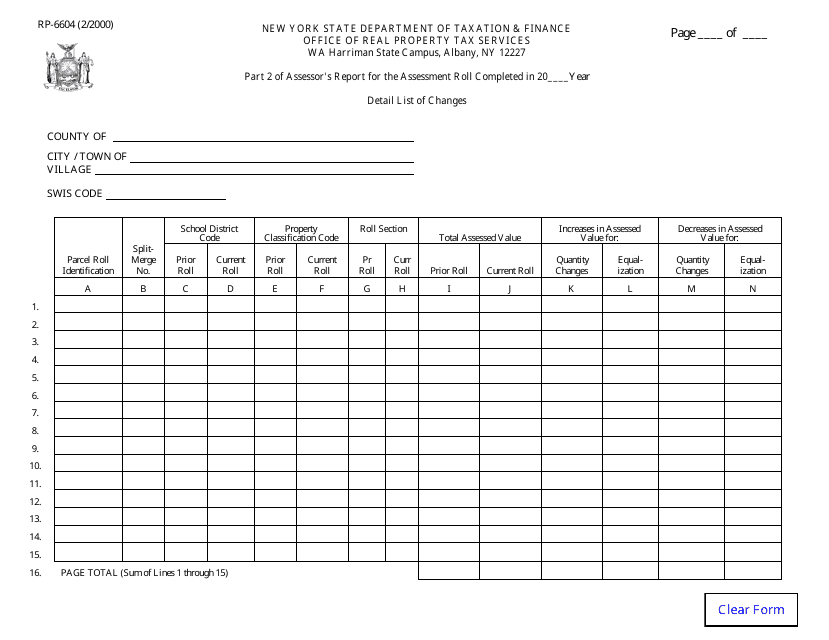

Form RP-6604 Part 2 of Assessor's Report for the Assessment Roll - Detail List of Changes - New York

This Form is used for providing a detailed list of changes to the Assessment Roll in New York. It is part 2 of the Assessor's Report.

This document is used for recording changes made to the assessment roll in the state of Michigan. It is a worksheet that helps assessors track and document any modifications made to the property assessments.

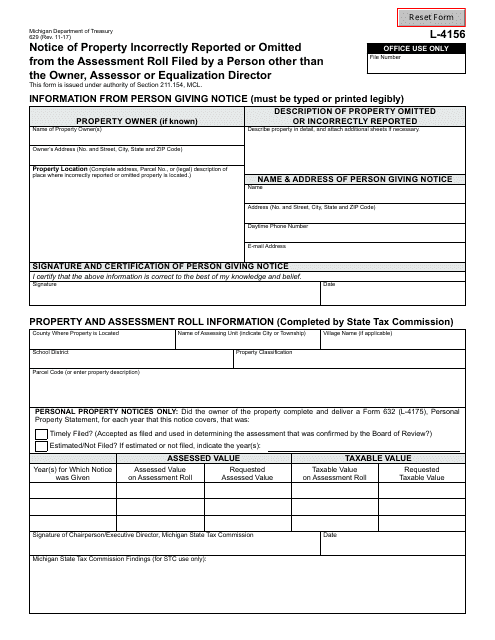

This form is used for notifying the Michigan assessor about incorrectly reported or omitted property on the assessment roll. This form can only be filed by someone other than the owner, assessor, or equalization director.

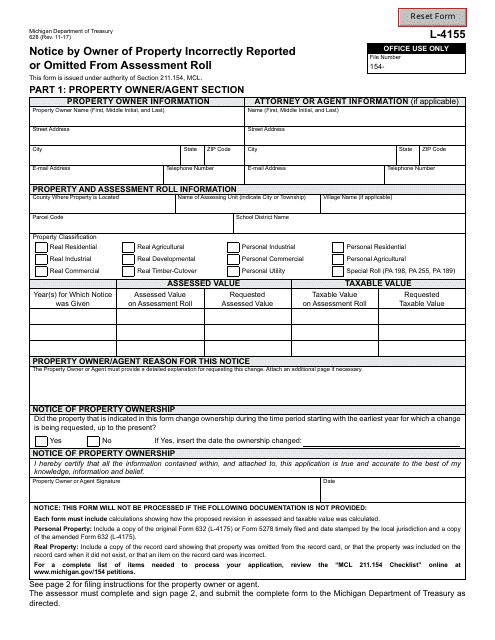

Form 628 Notice by Owner of Property Incorrectly Reported or Omitted From Assessment Roll - Michigan

This form is used for notifying the owner of a property in Michigan if it has been incorrectly reported or omitted from the assessment roll.

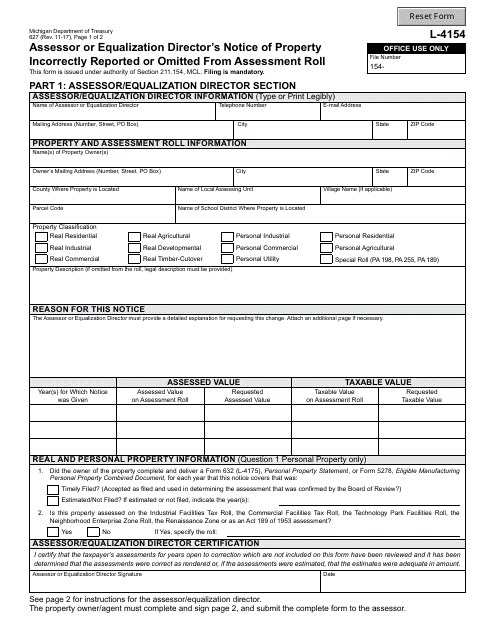

This Form is used for Michigan Assessor or Equalization Director to notify property owners of incorrect reporting or omission from the assessment roll.

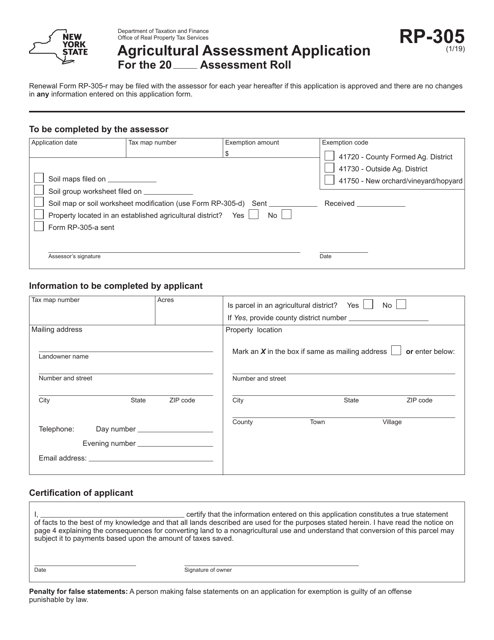

This form is used for applying for agricultural assessment in New York. It helps property owners receive tax benefits for qualifying agricultural land.

This document is a notice used in South Dakota to inform property owners of the intention to increase the assessed value of their property for tax purposes.

This document is used for notifying the assessor's office in South Dakota of any intention to add omitted property or valuation to the assessment rolls. It is important for property owners to make sure their property is correctly assessed for tax purposes.

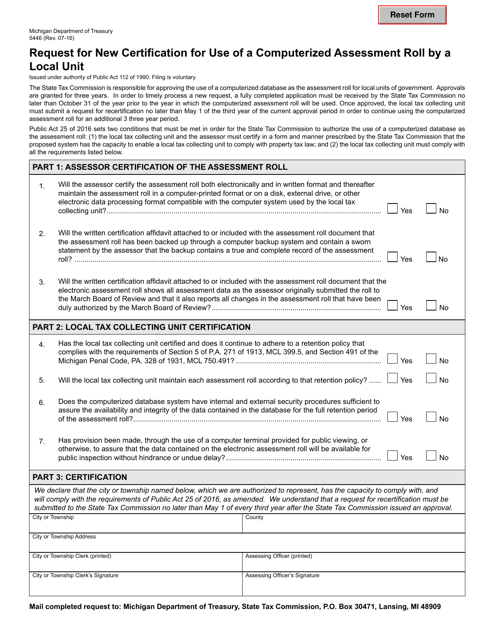

This Form is used for local units in Michigan to request a new certification for the use of a computerized assessment roll in property assessment.

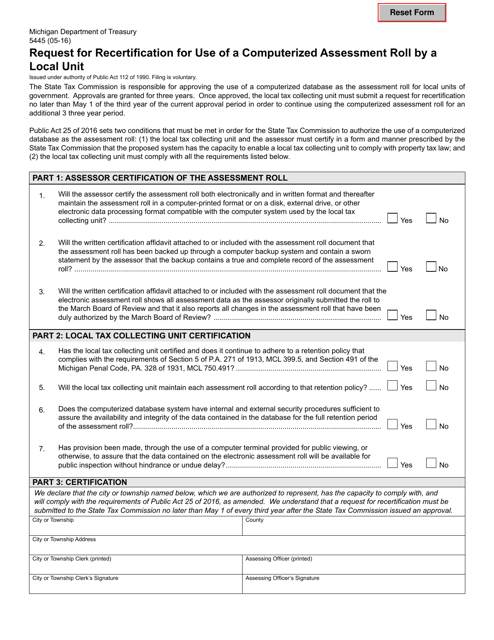

This form is used for requesting recertification to use a computerized assessment roll by a local unit in Michigan.

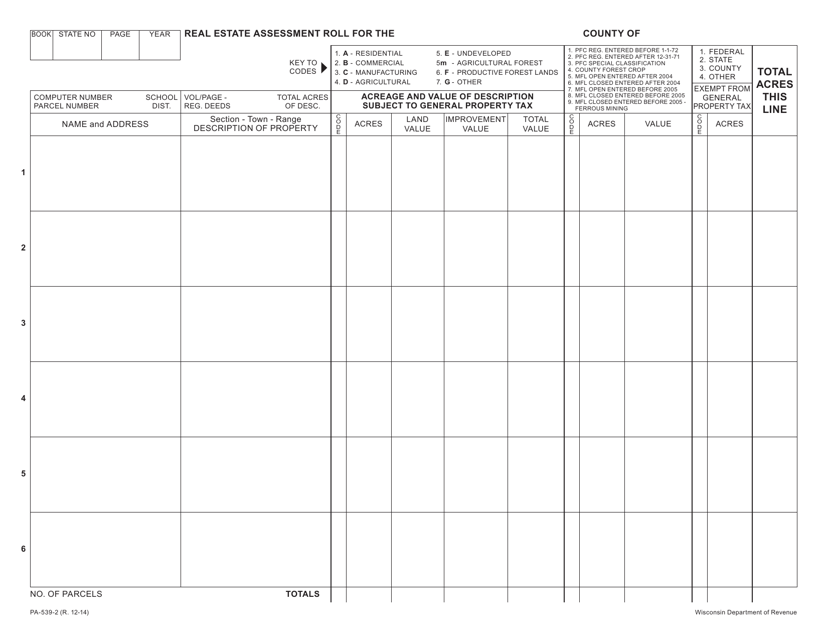

This form is used for accessing the real estate assessment roll in Wisconsin. It provides information about the assessed value of a property for tax purposes.

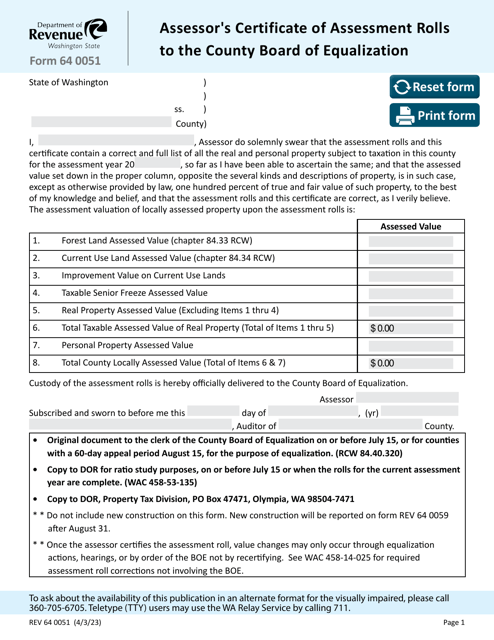

This form is used for the Assessor's Certificate of Assessment Rolls to the County Board of Equalization in Washington.

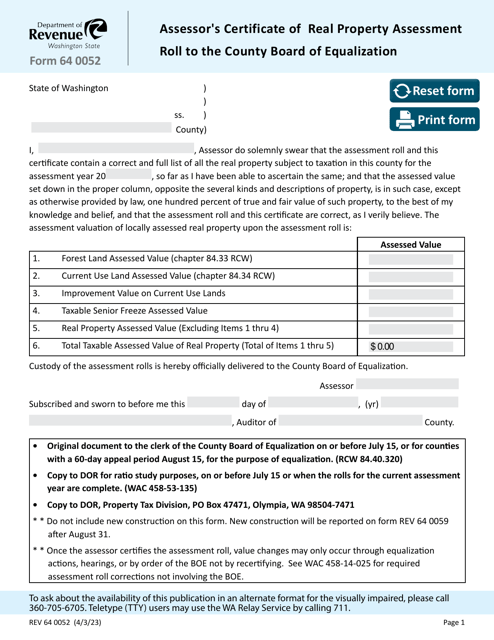

This Form is used for Assessor's Certificate of Real Property Assessment Roll to the County Board of Equalization in Washington.