Nonprofit Organizations Templates

Are you a nonprofit organization looking for guidance and resources to help you navigate through the various legal and administrative aspects of your operations? Look no further! Our comprehensive collection of nonprofit organization documents is here to assist you every step of the way.

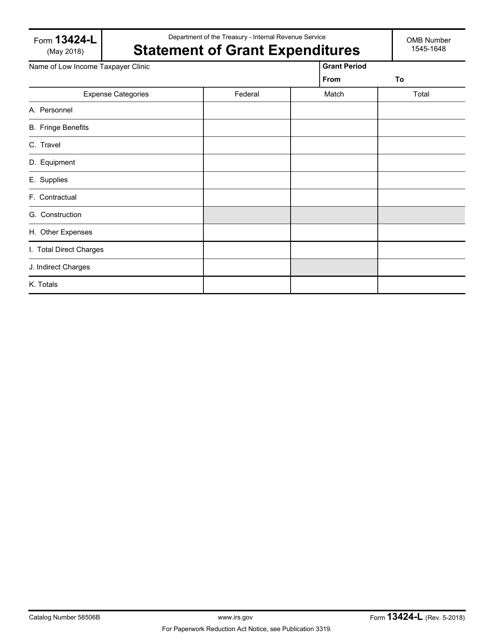

Our collection includes a wide range of forms and templates that are essential for nonprofit organizations. Whether you need to file reports, apply for grants, or keep track of your expenditures, we have the documents you need. Use our Final Grant Report Form to showcase the impact of your projects and secure future funding. Keep your finances in order with our Form PT-12 Expenditures of Pull Tab Funds, which is specifically designed for nonprofits in Illinois.

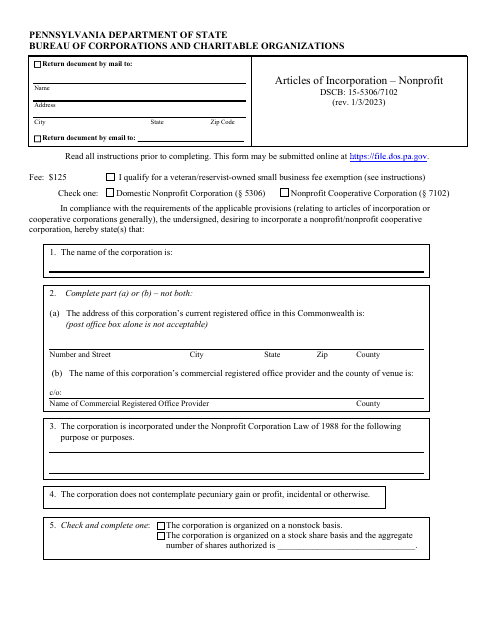

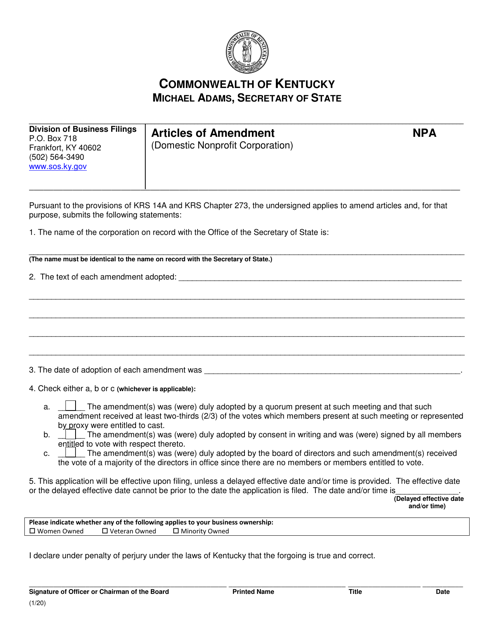

When it comes to legal matters, we have you covered as well. Our Form CSCL/CD-511 Restated Articles of Incorporation is a vital document for domestic nonprofit corporations in Michigan. For those in New Hampshire, our Form 11 Articles of Incorporation is an essential tool for establishing your nonprofit status.

In addition to these examples, our collection includes various other templates and samples that cover a wide range of topics relevant to nonprofit organizations. Whether you need a Sample Church Donation Receipt Letter or guidance on tax purposes, we have the resources you need to ensure compliance and efficiency.

Don't let the administrative burden overwhelm you. With our comprehensive collection of nonprofit organization documents, you can streamline your operations and focus on making a difference in your community. Browse our collection today and take the first step towards achieving your organization's goals.

(Note: Please omit this last part if it doesn't make sense contextually: "Nonprofit Organization Documentation: Your one-stop resource for all your nonprofit organization's documentation needs!")

Documents:

357

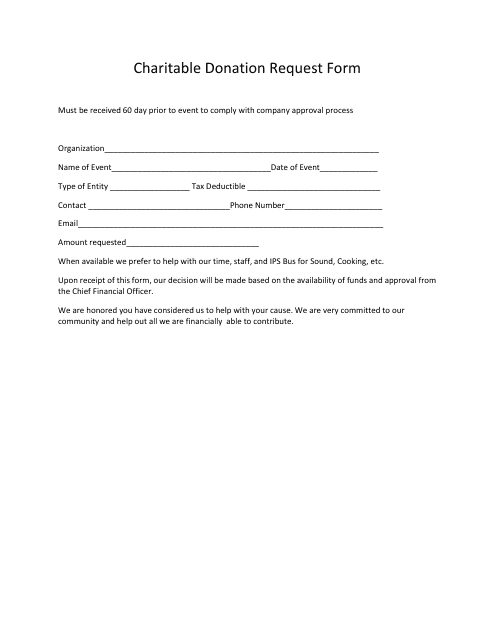

This document is a Donation Request Form for the Town of Atoka, Tennessee. It is used to request donations for specific causes or events in the town.

This form is used for submitting a final report for a grant received from the Community Foundation of the Northern Shenandoah Valley in Virginia.

This form is used for evaluating the performance of staff members at Greenlights, a nonprofit organization. It helps assess their effectiveness and contributions to the organization's success.

This form is used for assessing eligibility for Habitat for Humanity housing in Canada.

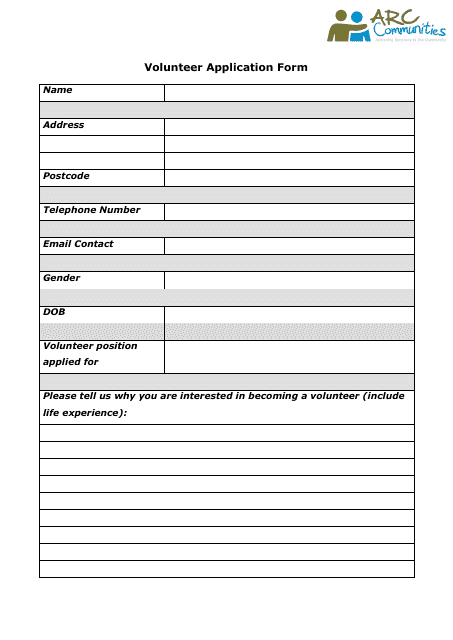

This form is used for applying to volunteer at ARC Communities.

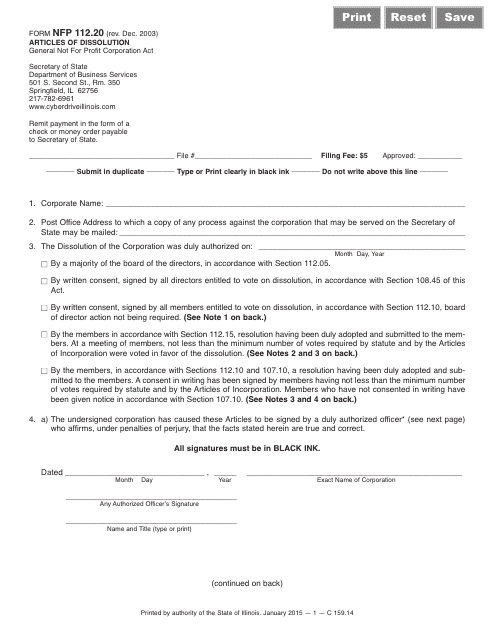

This form is used for filing Articles of Dissolution for a non-profit organization in Illinois.

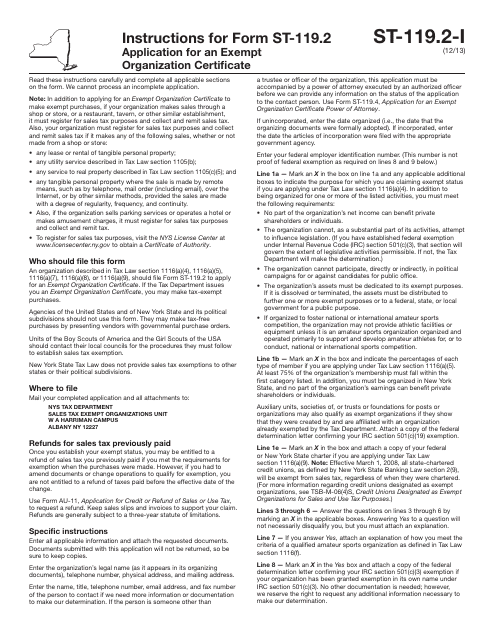

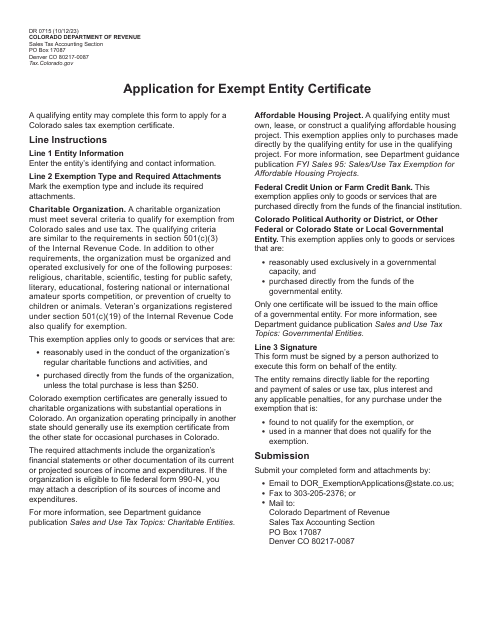

This document is used for applying for an Exempt Organization Certificate in New York.

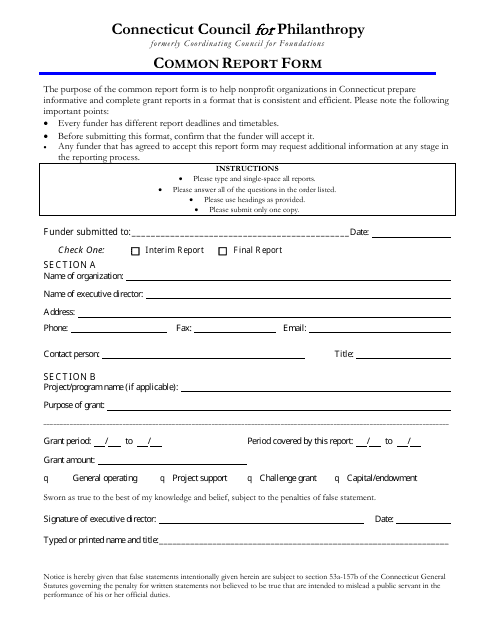

This form is used for reporting information to the Connecticut Council for Philanthropy.

This document is used for requesting donations for charitable purposes.

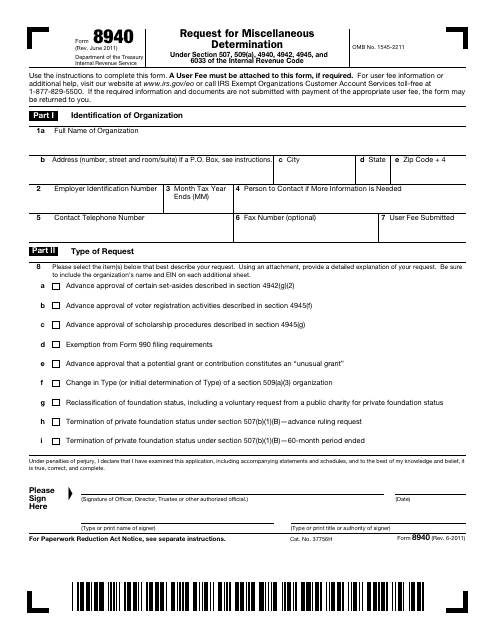

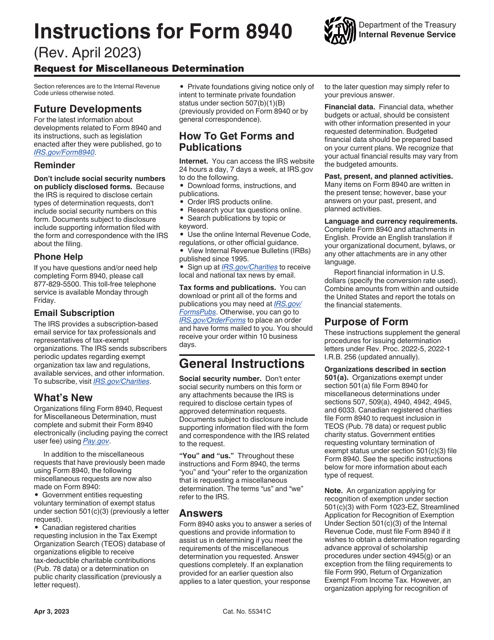

This form is used for requesting miscellaneous determinations from the IRS.

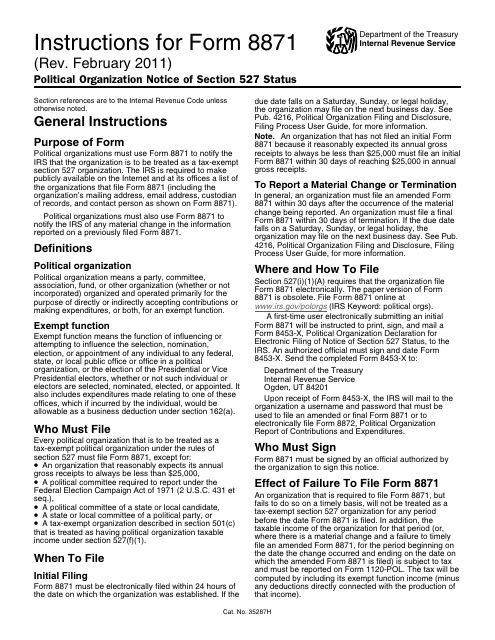

This Form is used for providing notice of section 527 status for political organizations to the IRS.

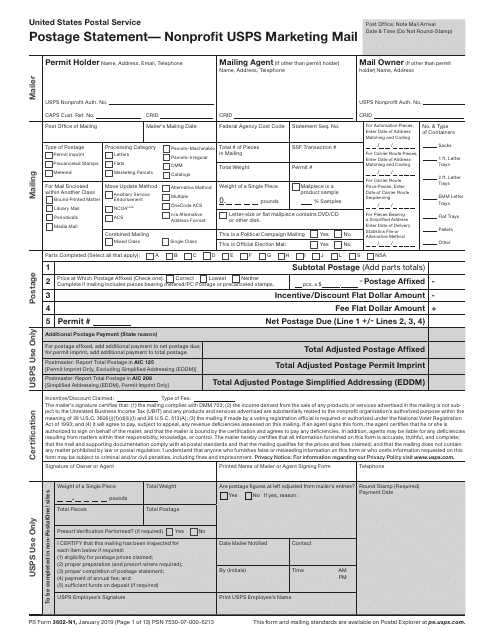

This form is used in the United States Postal Service (USPS) for sending USPS Marketing Mail postage at reduced prices, which are available for non-profit organizations authorized by the USPS.

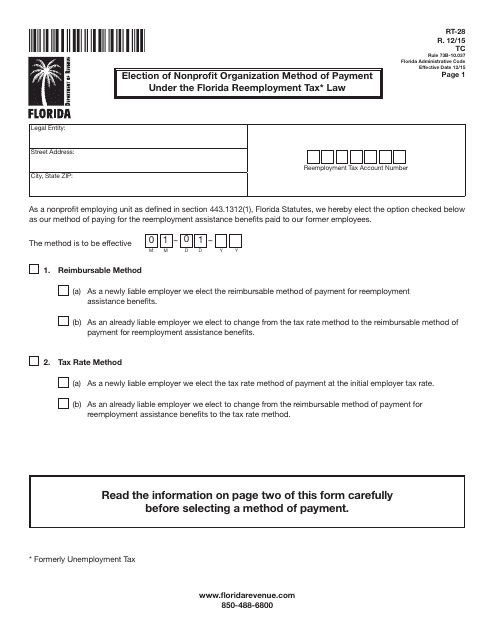

This Form is used for nonprofit organizations in Florida to choose a payment method for reemployment taxes under the Florida Reemployment Tax Law.

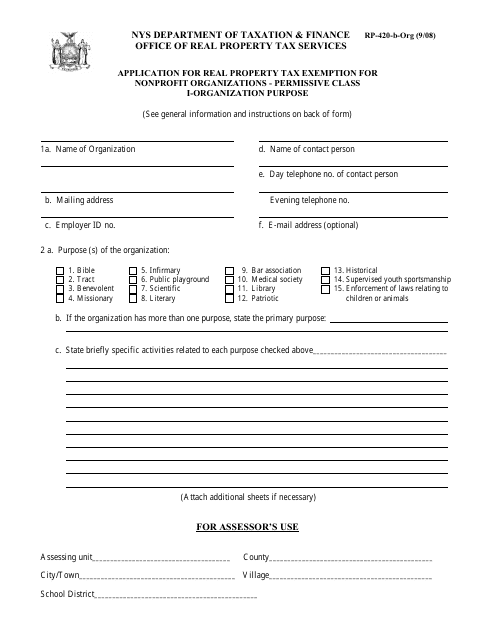

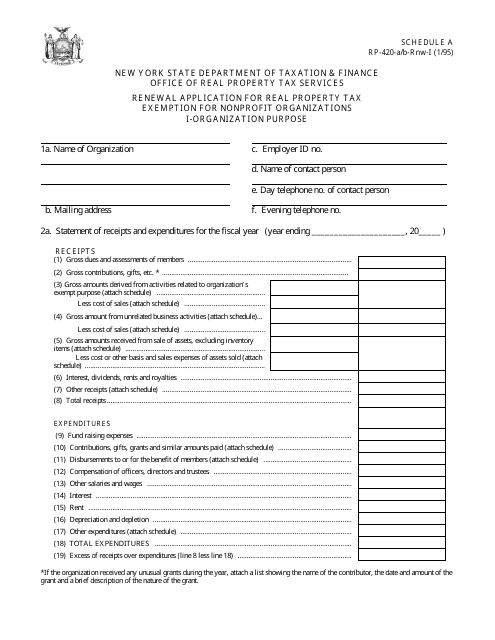

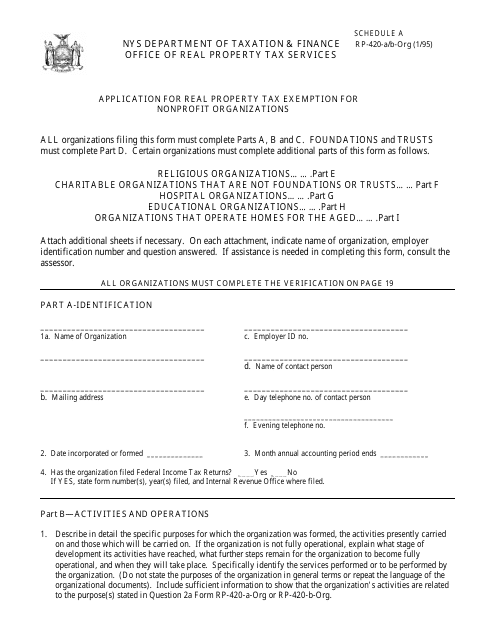

This form is used for applying for a real property tax exemption for nonprofit organizations in New York that fall under the Permissive Class I-Organization Purpose category.

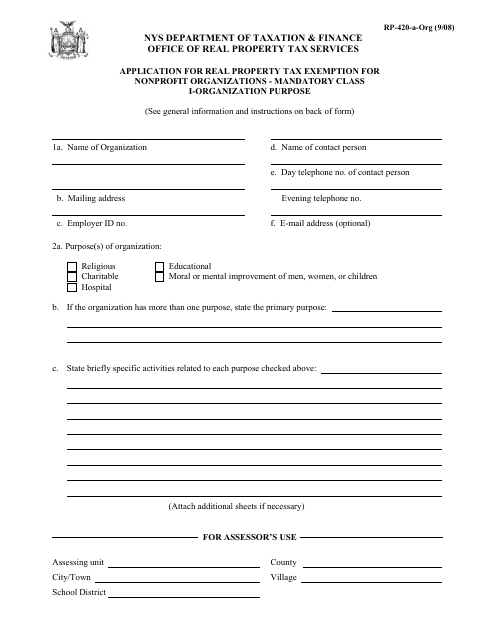

This form is used for applying for a real property tax exemption for nonprofit organizations in the state of New York. It is specifically for organizations categorized as Class I-Organization Purpose.

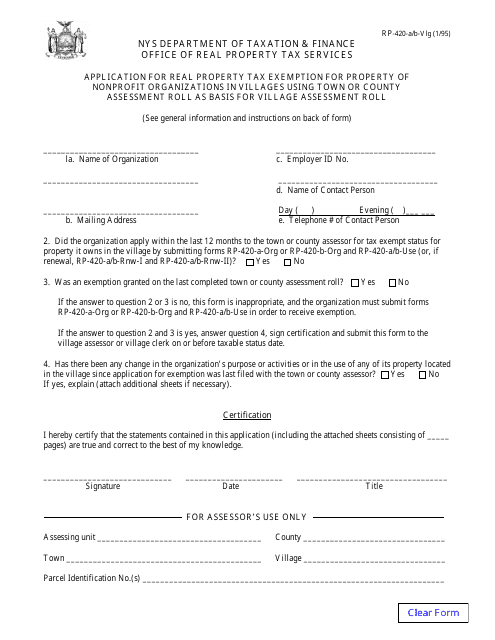

This document is used to apply for a real property tax exemption for nonprofit organizations in villages in New York. The exemption is based on the town or county assessment roll that is used for the village assessment roll.

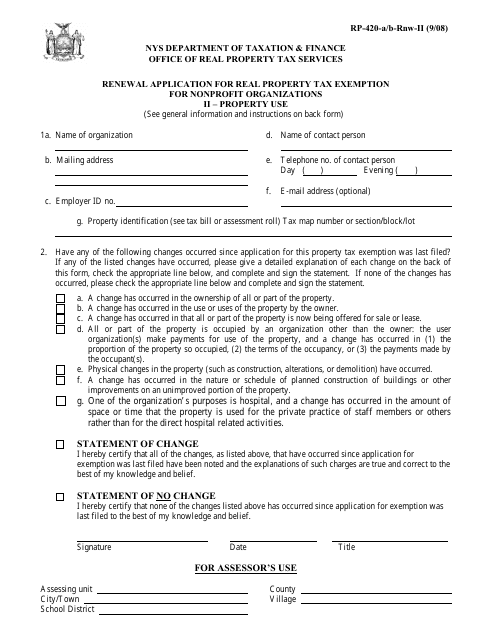

This form is used for renewing the real property tax exemption for nonprofit organizations in New York.

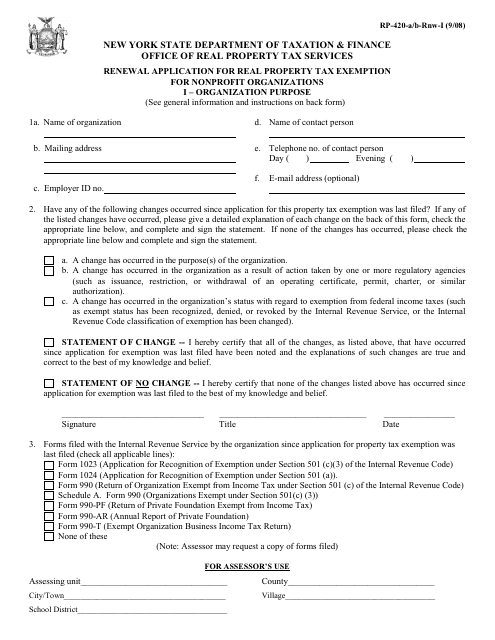

This Form is used for applying for the renewal of a real property tax exemption for nonprofit organizations in New York. It involves providing information about the organization's purpose.

This form is used for renewing the real property tax exemption for nonprofit organizations in New York. It is specifically for organizations that have a new purpose.

This Form is used for nonprofit organizations in New York to apply for a real property tax exemption.

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

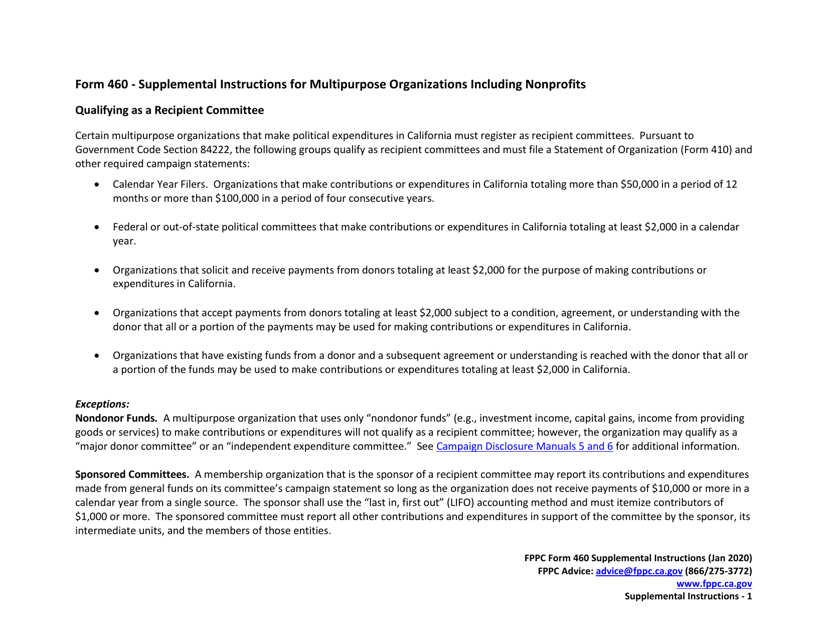

This form is used for reporting information about multipurpose organizations, including nonprofits, in California.

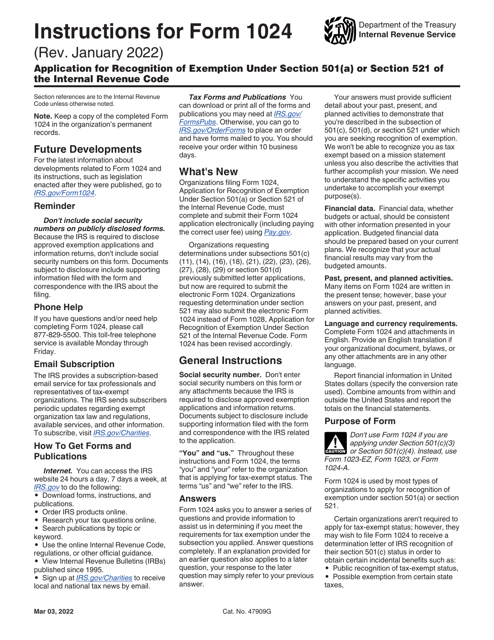

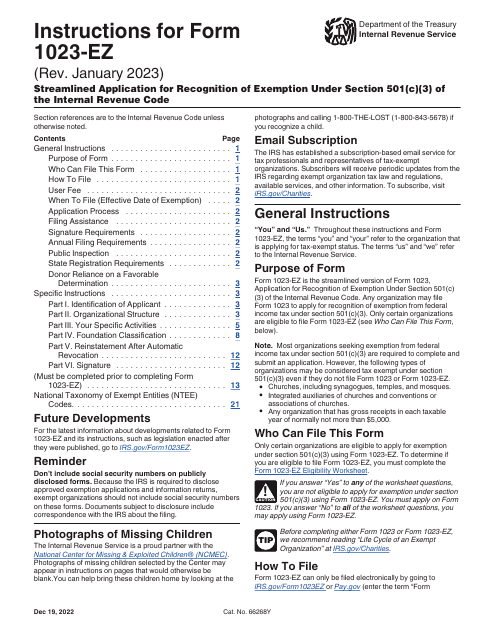

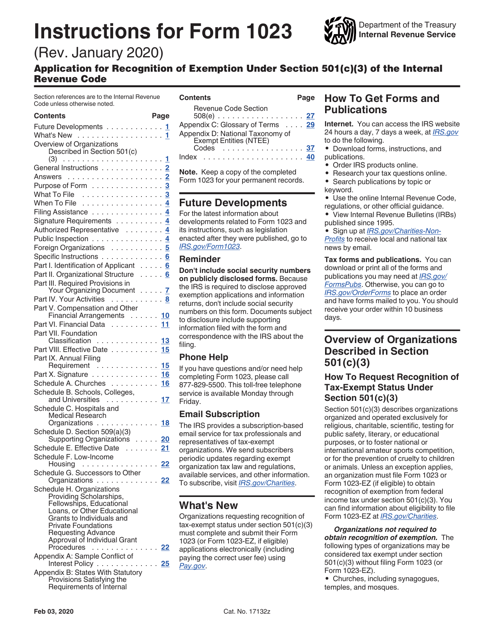

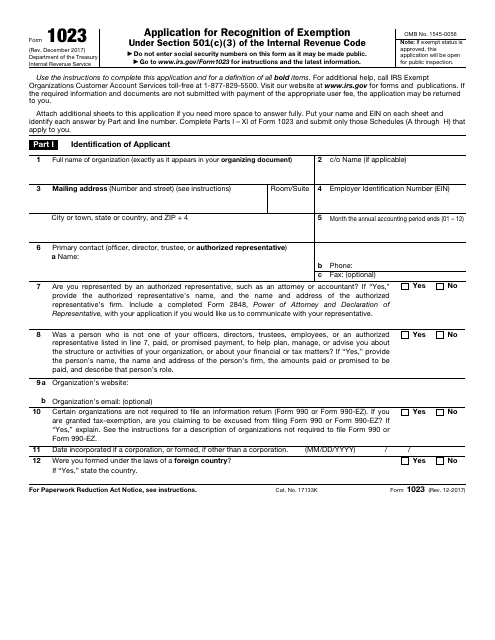

This Form is used for applying for tax-exempt status for charitable organizations with the IRS.

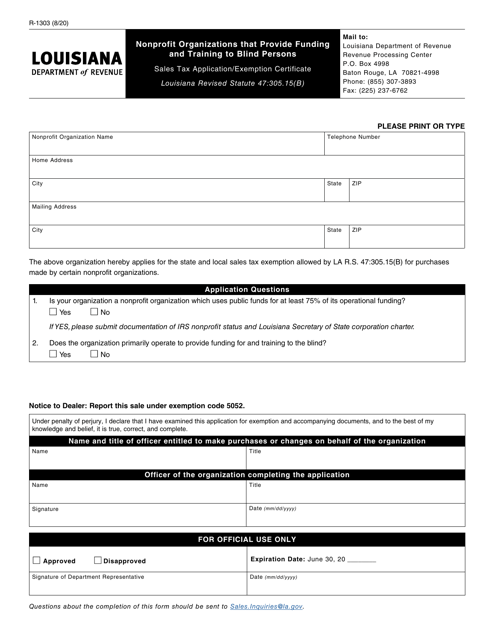

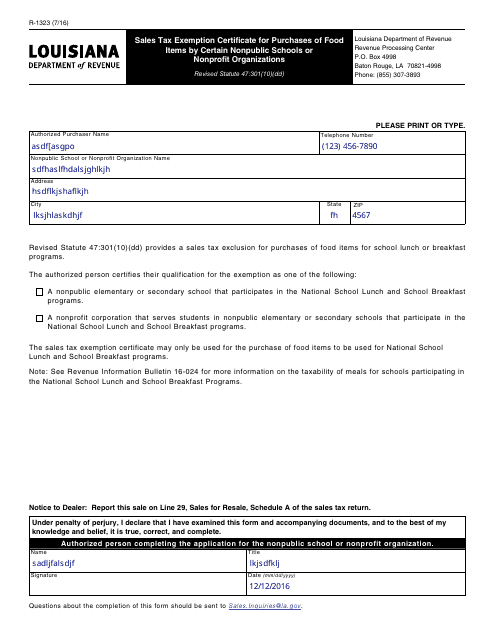

This form is used for obtaining a sales tax exemption certificate in Louisiana for the purchase of food items by certain nonpublic schools or nonprofit organizations.