Debt Reduction Templates

Are you struggling with overwhelming debt? Looking for ways to regain control of your finances? Our debt reduction resources are here to help you tackle your debt head-on and achieve financial freedom.

Whether it's credit card debt, business debt, or educational loans, our collection of documents and templates have been designed to assist you in your debt reduction journey. With a variety of resources available, you can choose the ones that best suit your needs and help you formulate a strategy to pay off your debts.

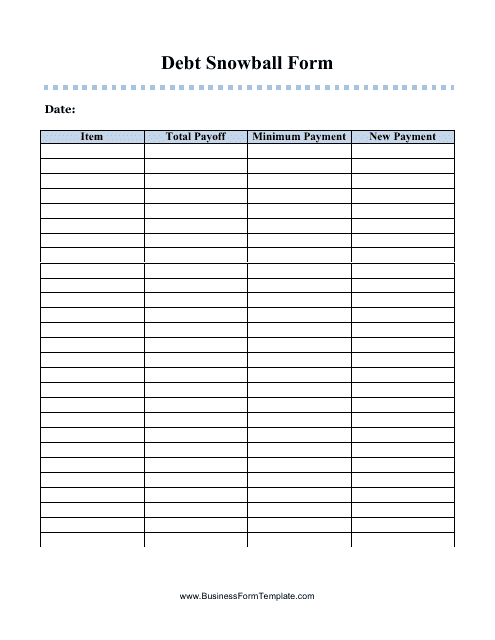

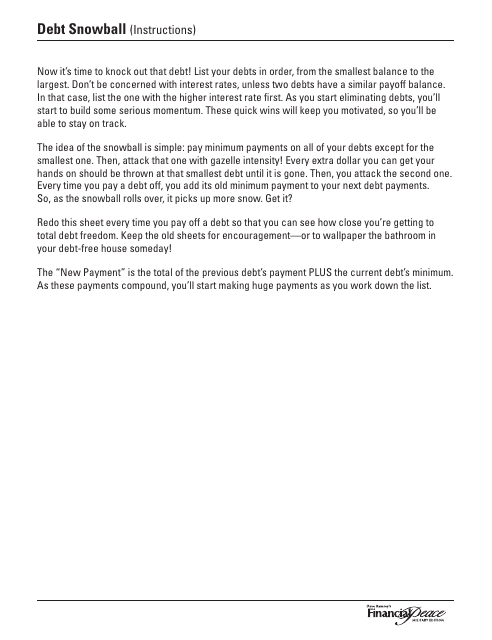

Our debt reduction resources include tools such as debt snowball spreadsheets, which follow the renowned financial guru Dave Ramsey's principles. These spreadsheets help you prioritize your debts and track your progress as you pay them off, giving you a clear roadmap to becoming debt-free.

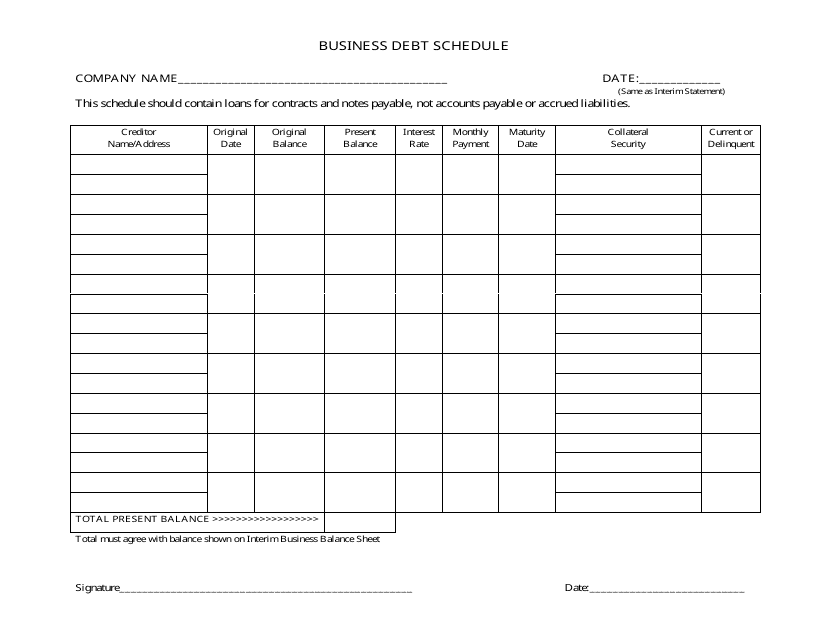

For those dealing with business debt, our business debt schedule template can assist you in keeping track of your outstanding obligations and outlining a repayment plan. By organizing your debts and establishing a payment schedule, you can take significant steps in reducing your company's financial burden.

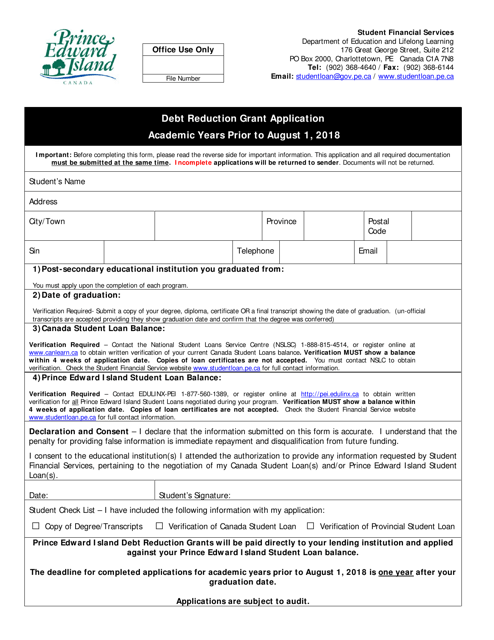

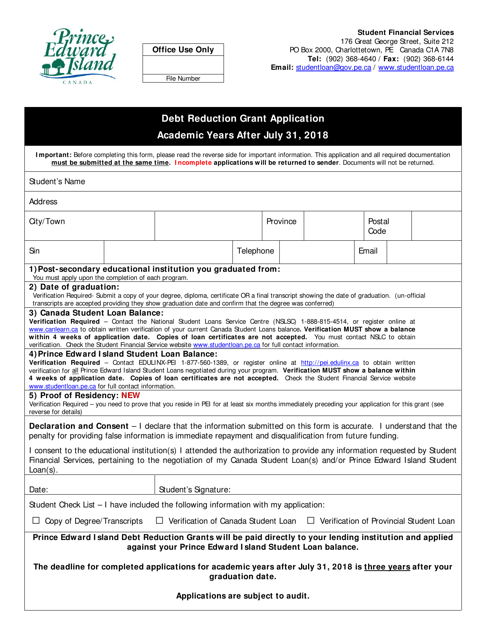

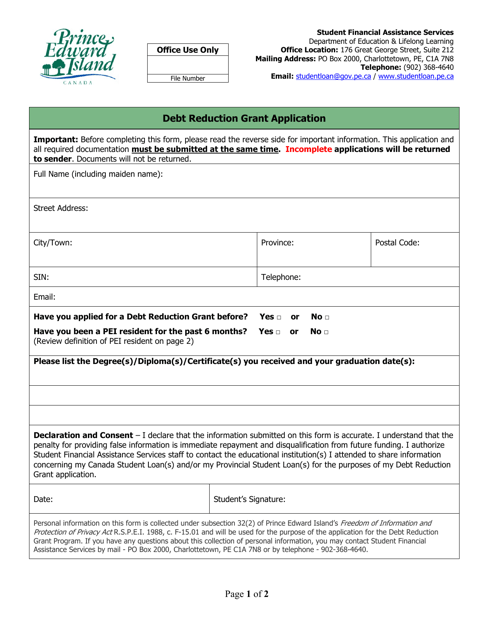

In addition to these resources, we also offer debt reduction grant applications for eligible individuals. These grants, available in Prince Edward Island, Canada, provide financial assistance to those striving to overcome their debt. Whether you're a student seeking relief from educational loans or an individual looking to reduce your debt load, these applications can guide you through the process and help you access the support you need.

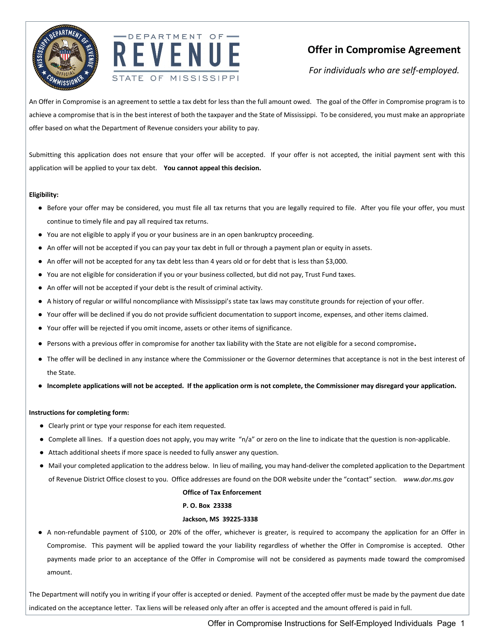

For self-employed individuals in Mississippi, our instructions for the offer in compromise application can be a valuable resource. This document provides guidance on how to apply for a compromised settlement with the state tax authorities, giving you an opportunity to reduce your tax debt and find relief from financial strain.

With our collection of debt reduction resources, you no longer have to feel burdened by excessive debt. Take charge of your finances and start your journey towards financial freedom today. Explore our tools and applications, and discover the path to a debt-free life.

Documents:

10

This form is used for organizing and managing your debt repayment strategy using the debt snowball method.

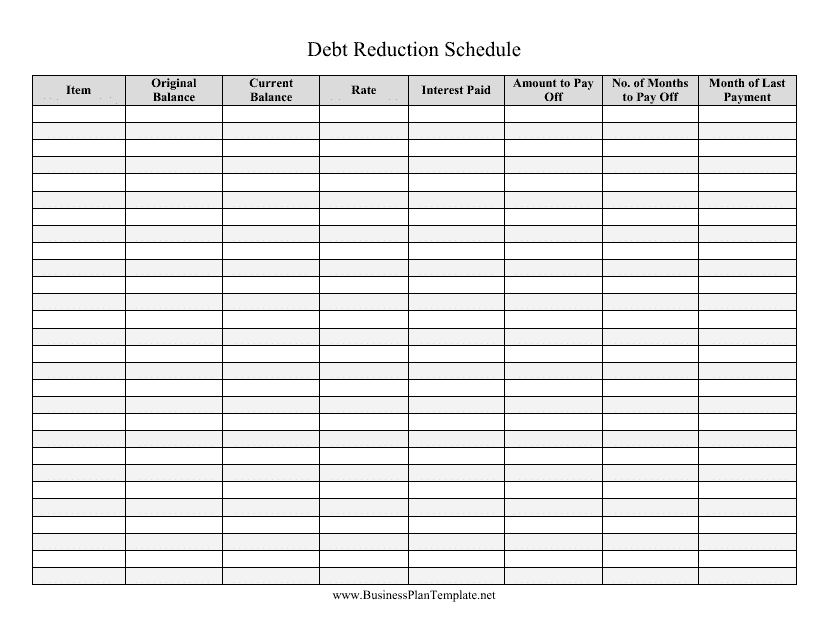

This document is a template that helps in creating a schedule for reducing debt. It can be customized to fit individual financial situations and goals.

This type of document is a template that helps you manage and track your debts. It provides a structured format for organizing your debt information, including balances, interest rates, and payment schedules. Using a debt worksheet template can help you create a repayment plan and keep track of your progress towards becoming debt-free.

This document is a debt snowball spreadsheet designed specifically for military personnel using Dave Ramsey's Financial Peace method. It helps individuals manage and pay off their debts systematically.

This document helps businesses organize and track their debts. It provides a template for listing the details of each debt, such as the amount owed, interest rate, and repayment terms. By using this template, businesses can better manage their debt obligations and make informed financial decisions.

This document is an application form for a debt reduction grant in Prince Edward Island, Canada. It is specifically for the academic year prior to August 1, 2018.

This type of document is a debt reduction grant application for academic years starting after July 31, 2018 in Prince Edward Island, Canada. It is designed for individuals seeking financial assistance to reduce their debt burden.

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

This document is for applying for a debt reduction grant in Prince Edward Island, Canada. It provides the necessary information and forms to apply for financial assistance to reduce or eliminate debt.