Partial Exemption Templates

Partial Exemption (Partially Exempt) When it comes to various legal and financial matters, gaining a partial exemption can provide substantial benefits. This special status offers certain individuals and businesses relief from specific requirements or obligations, allowing them to save time and resources.

At USA, Canada, and other countries, we understand the importance of navigating the complex landscape of partial exemption. That's why we provide a comprehensive collection of documents to guide you through the process. Our extensive library includes forms, applications, and instructions tailored to specific jurisdictions and situations.

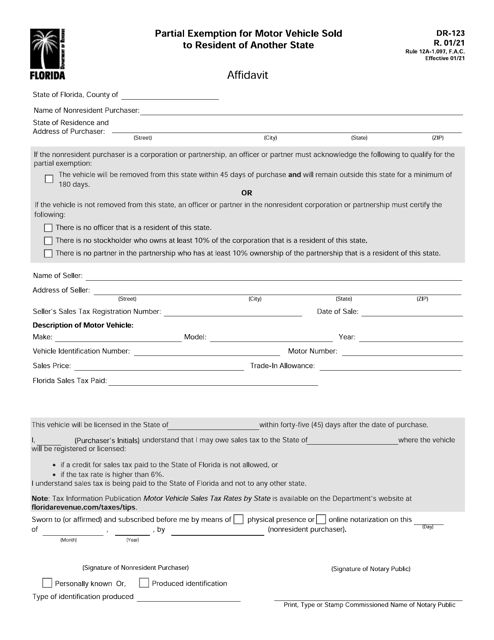

Whether you're a property owner seeking relief from architectural barrier compliance with the Americans With Disabilities Act of 1990, a physically disabled crime victim in need of assistance with real property exemptions, or even an aircraft common carrier looking to apply for a partial exemption from local taxes, our documents have got you covered.

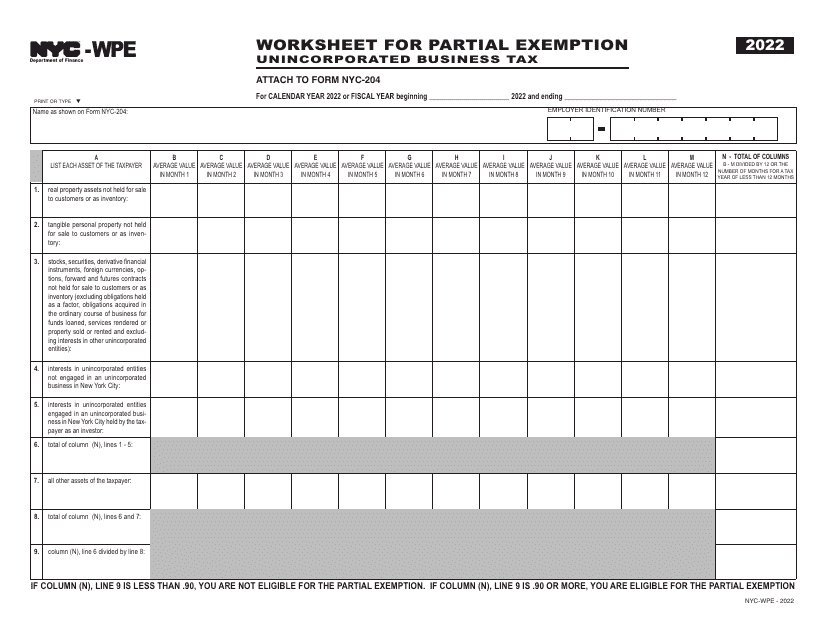

Additionally, we offer forms for requesting partial continuing education exemption, as well as worksheets designed to help businesses calculate their partial exemption for unincorporated business tax.

Don't let legal and financial complexities weigh you down. Explore our library of partial exemption documents today and take advantage of the benefits you deserve.

Documents:

21

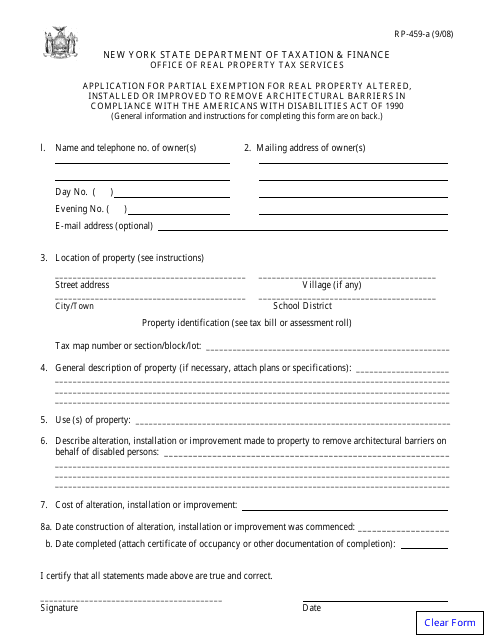

This type of document is used in New York to apply for a partial exemption for real property that has been altered or improved to remove architectural barriers in compliance with the Americans With Disabilities Act of 1990.

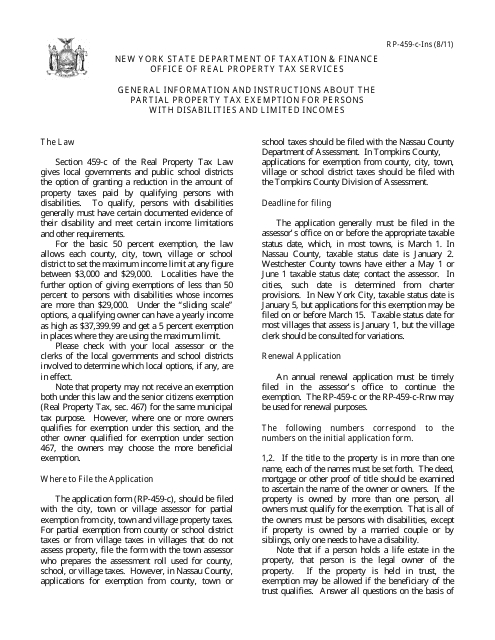

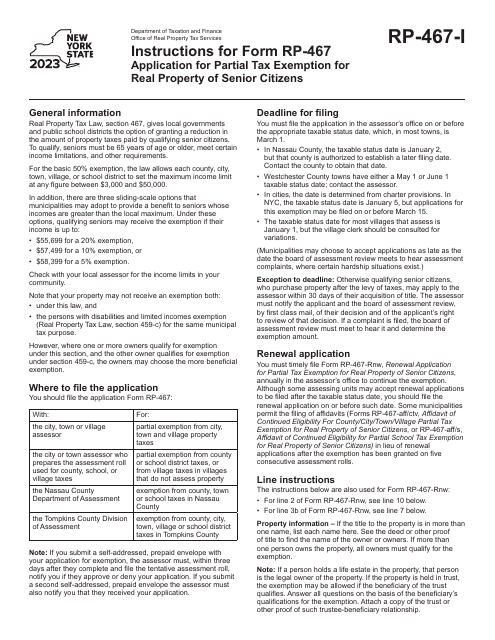

This Form is used for claiming a partial property tax exemption in New York for individuals with disabilities and limited incomes. It provides instructions on how to apply for the exemption and the documentation required.

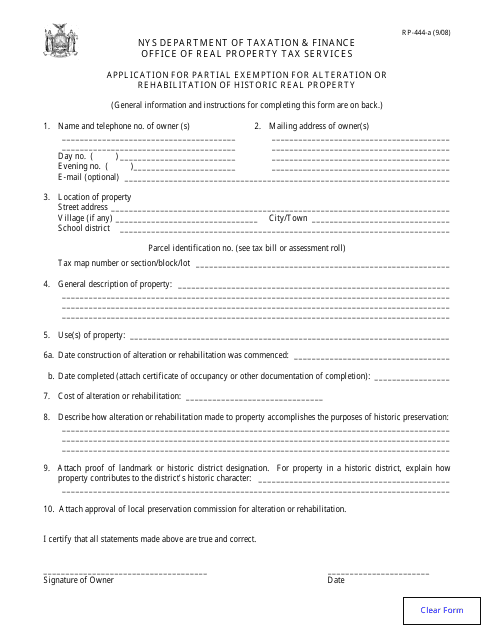

This form is used for applying for a partial exemption for the alteration or rehabilitation of historic real property in New York.

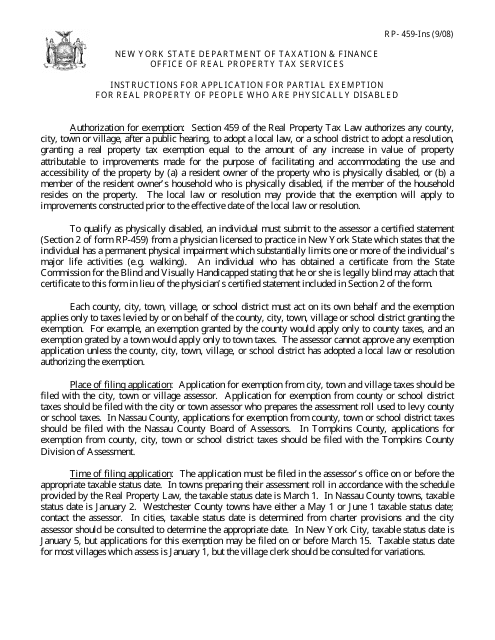

This Form is used for applying for a partial exemption for real property in New York for individuals who are physically disabled. It provides instructions on how to complete the application process.

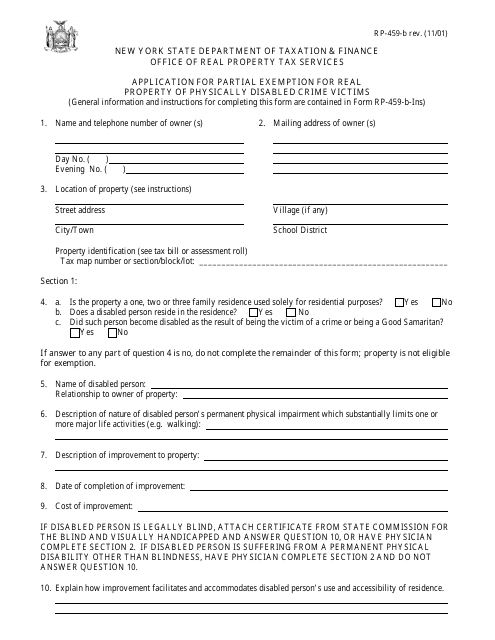

This form is used for applying for a partial exemption on real property taxes for physically disabled crime victims in New York.

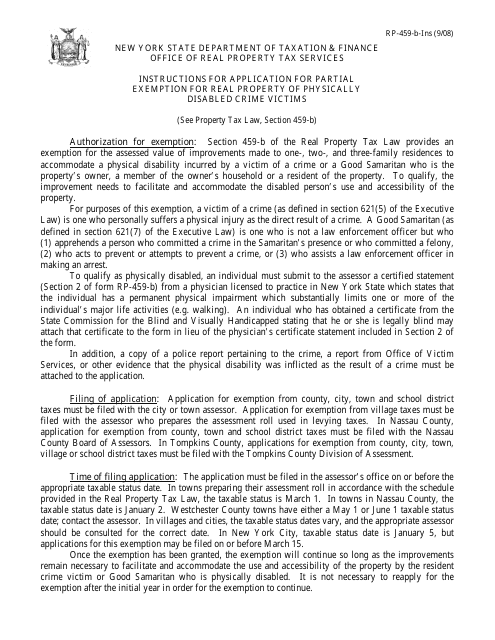

This form is used for applying for a partial exemption on real property tax for physically disabled crime victims in New York. It provides instructions on how to complete the form accurately.

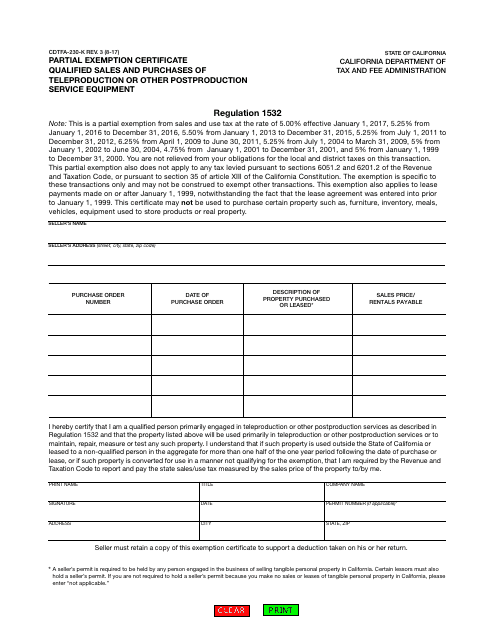

This form is used for claiming a partial exemption on sales and purchases of teleproduction or other postproduction service equipment in California.

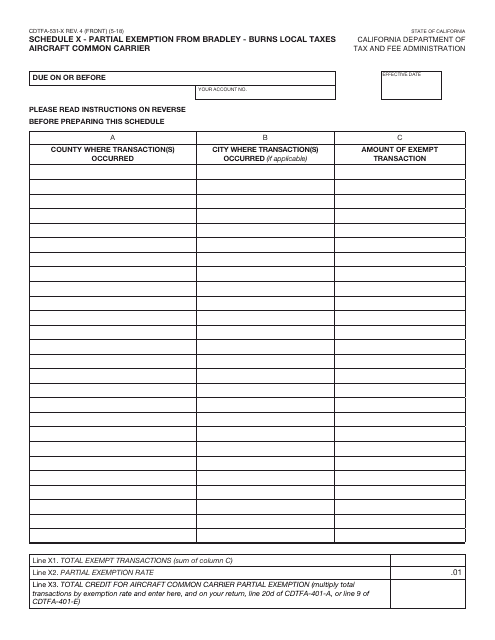

This form is used for claiming a partial exemption from Bradley-Burns local taxes for aircraft common carriers in California.

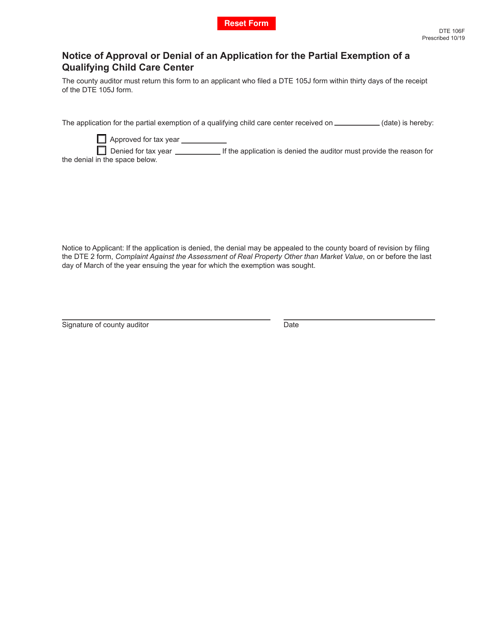

This form is used for notifying the applicant of the approval or denial of their application for the partial exemption of a qualifying child care center in Ohio.

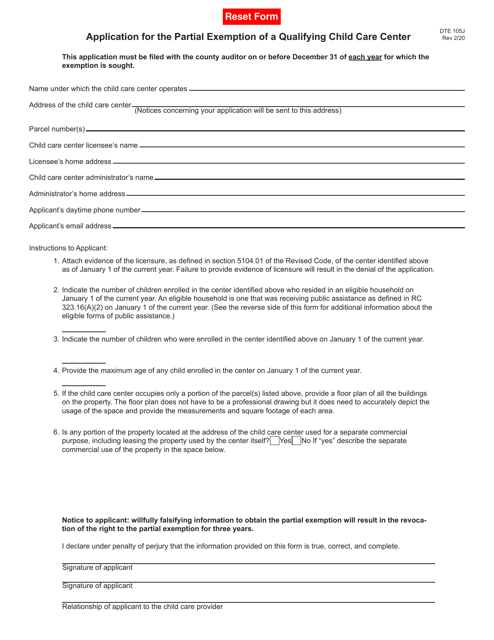

This form is used to apply for a partial exemption for a qualifying child care center in Ohio.

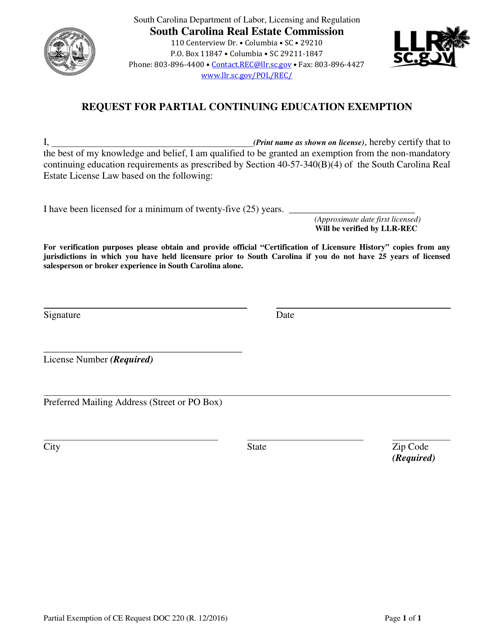

This Form is used for requesting a partial continuing education exemption in South Carolina.

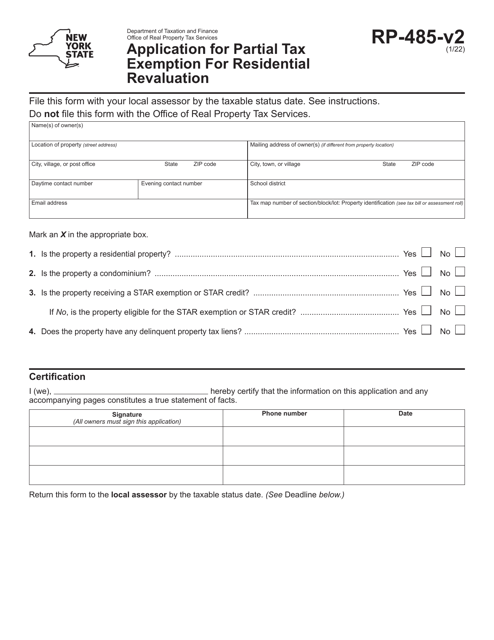

This form is used to apply for a partial tax exemption for residential revaluation in New York. It allows homeowners to potentially reduce their property taxes based on the changes in market value of their residential property.

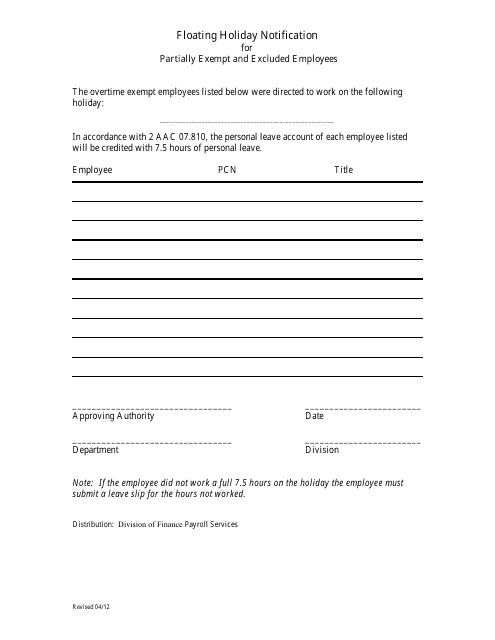

This document provides a notification regarding floating holidays for partially exempt and excluded employees in Alaska. It outlines the details and guidelines for observing these special holidays.