Tax Elections Templates

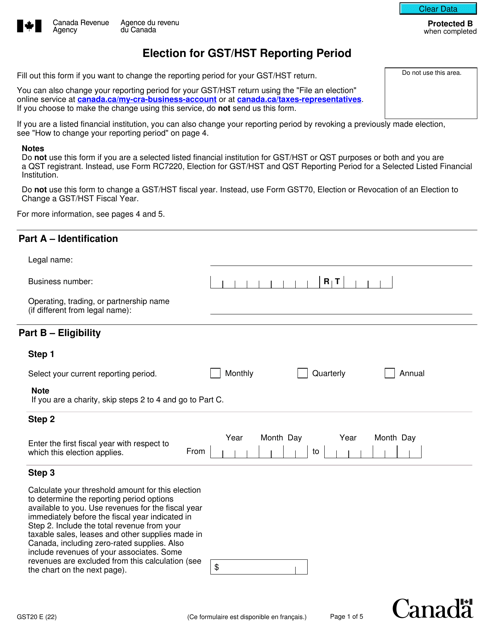

Are you looking for information about tax elections? Explore our comprehensive collection of tax election resources which include forms, instructions, and guides for various tax election procedures. Whether you are a non-resident selling real estate, a business owner making income elections, or a financial institution seeking tax recovery rate elections, we have the resources you need.

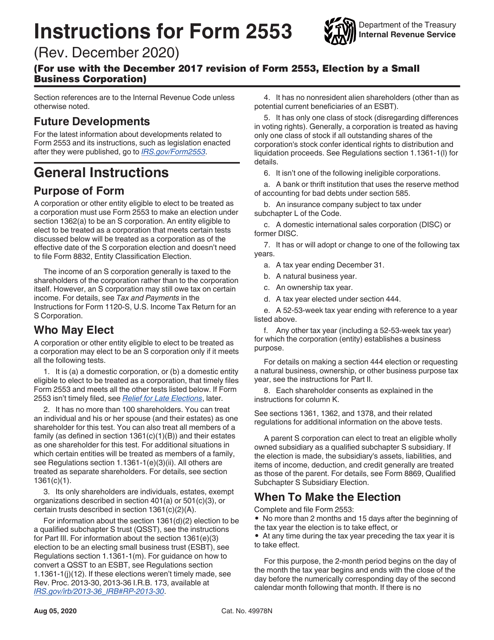

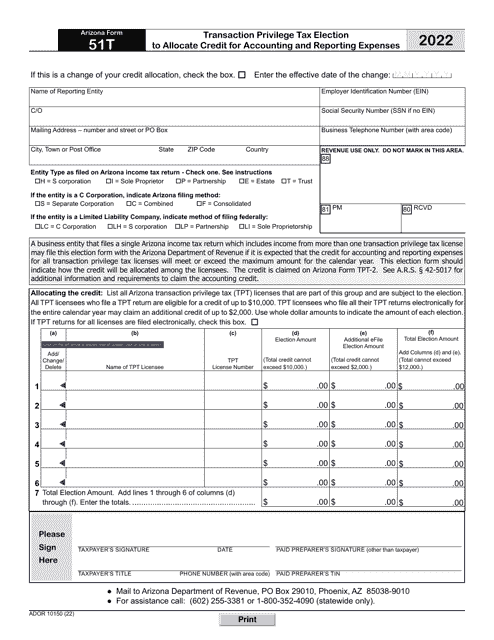

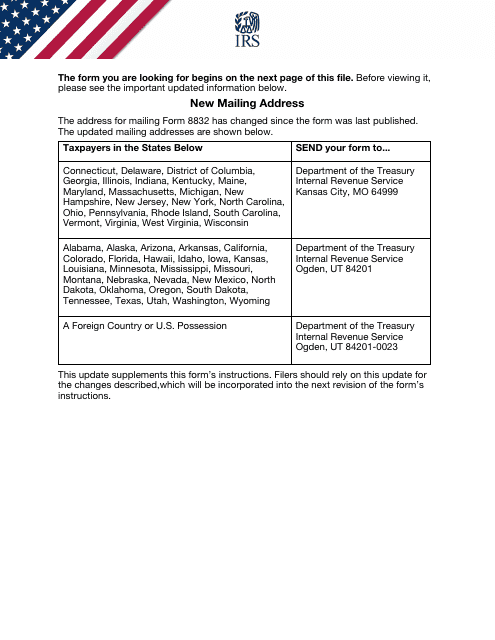

Our tax election resources provide step-by-step instructions and necessary forms to help you navigate the complex tax laws and make informed decisions. From the IRS Form 2553 for small business corporations to the Form K-120EL for Kansas business income elections, we cover a wide range of tax election scenarios.

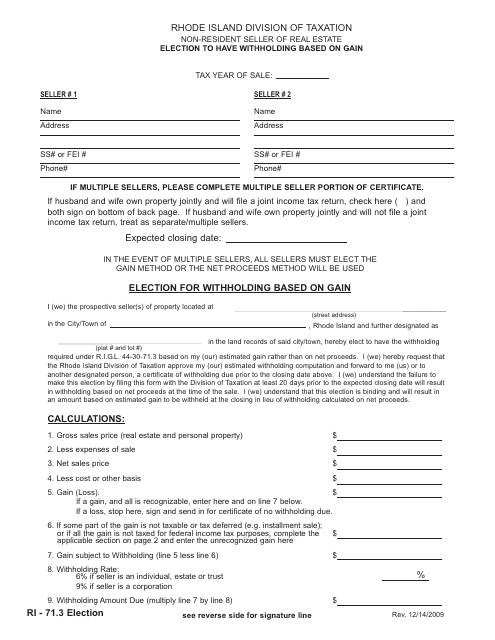

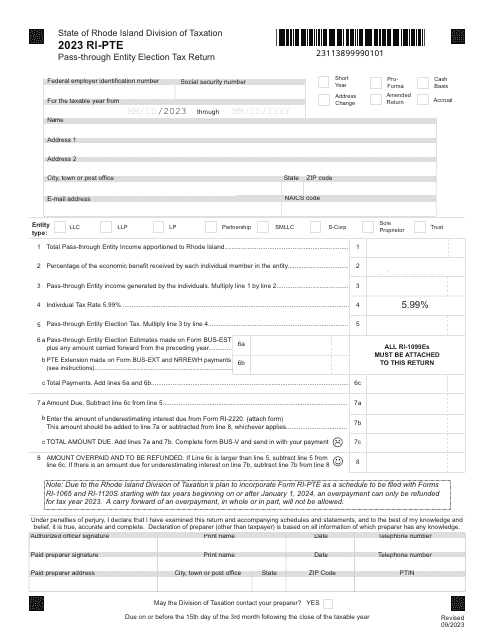

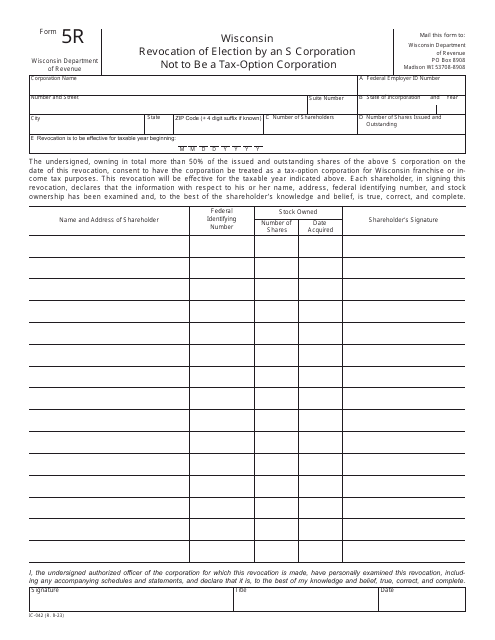

In addition to federal tax elections, we also offer resources for tax elections in specific states like Rhode Island and Wisconsin. From Form 71.3 for non-resident sellers of real estate in Rhode Island to the SPL-01 Model Form for Wisconsin legislators making Internal Revenue Code Section 162(H) elections, we have state-specific tax election forms and resources.

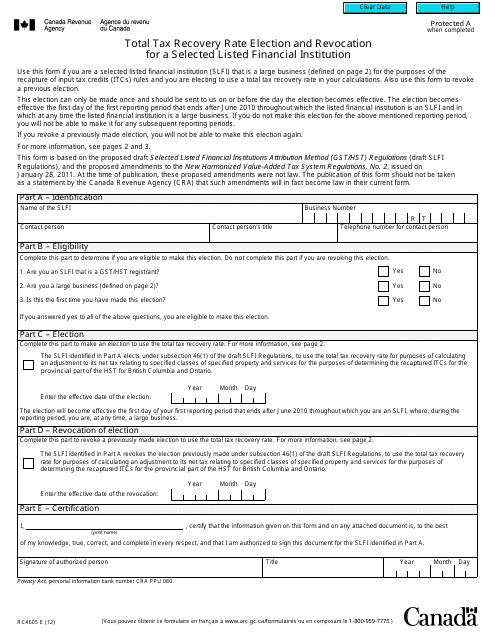

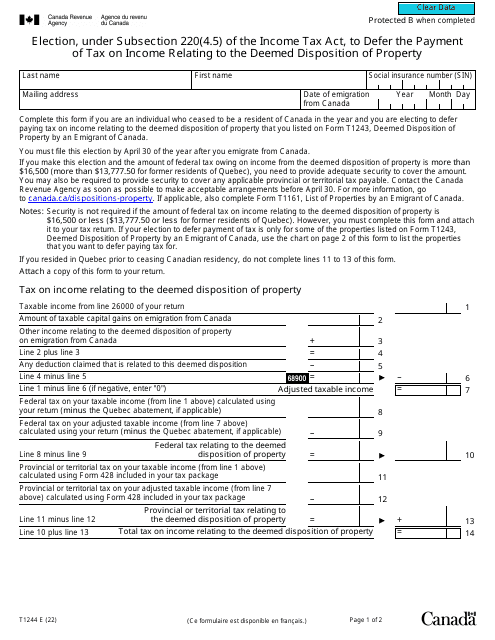

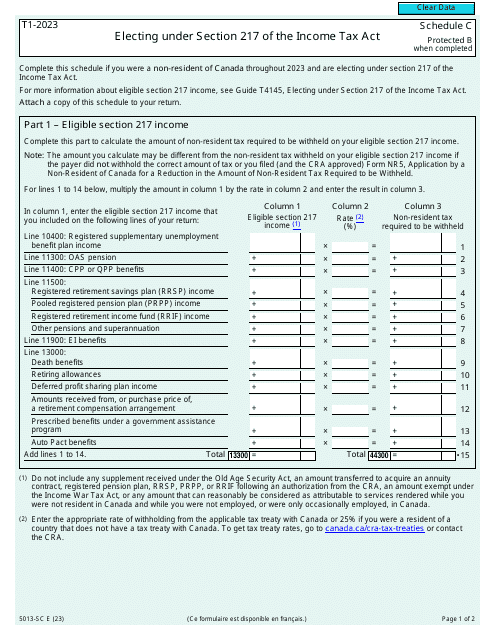

Our collection also includes resources for tax recovery rate elections for selected listed financial institutions in Canada. Whether you are looking to make an election or revoke an existing one, the Form RC4605 and accompanying instructions will guide you through the process.

No matter what type of tax election you need to make, our comprehensive resources will make the process easier. With our easy-to-follow instructions and up-to-date forms, you can ensure compliance and maximize your tax benefits. Explore our tax election resources today and make well-informed decisions for your tax planning needs.

Documents:

52

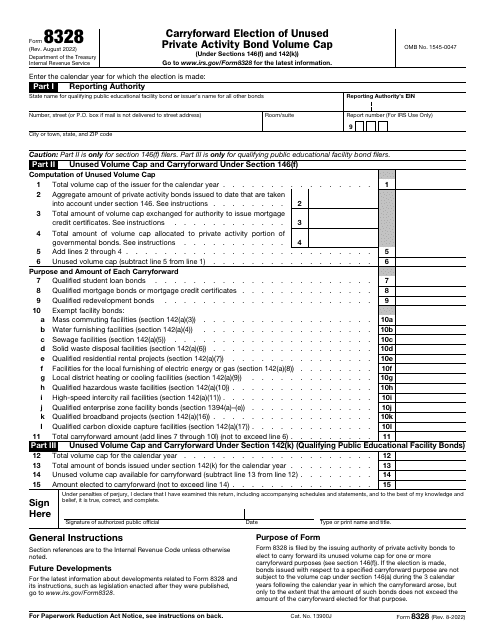

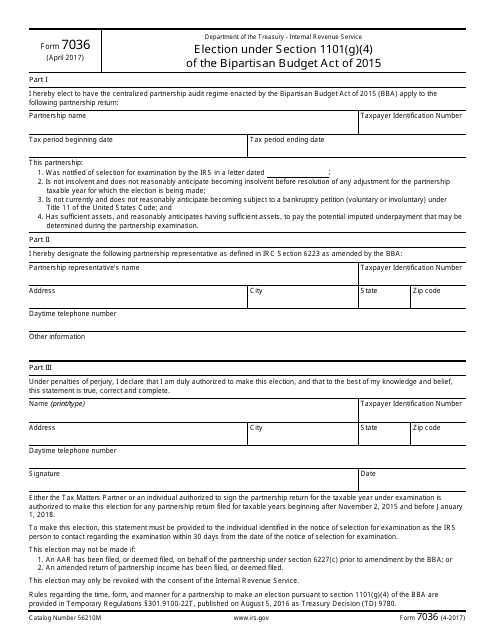

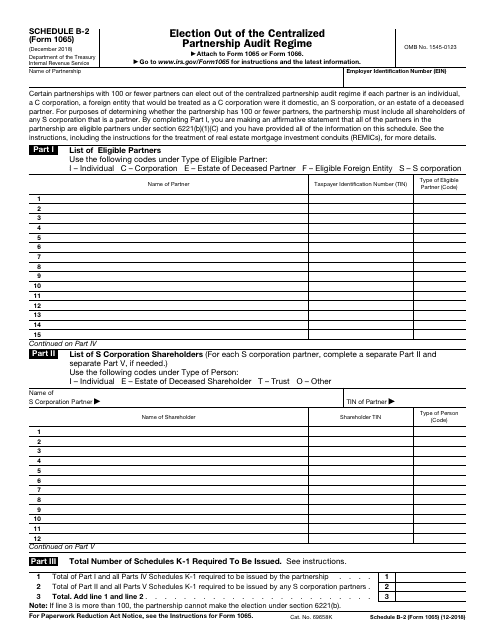

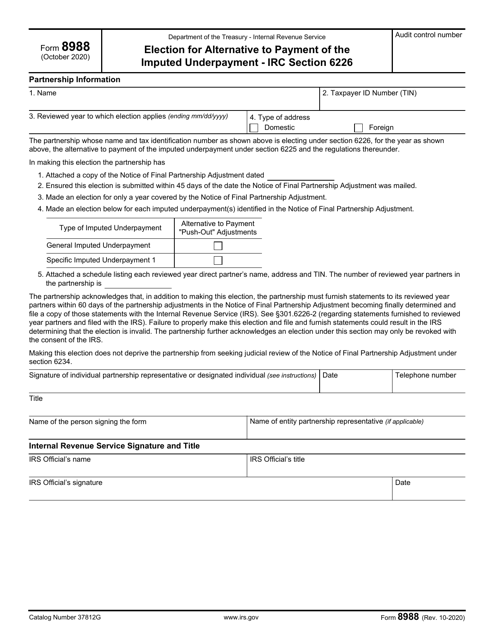

This form is used for making an election under Section 1101(G)(4) of the Bipartisan Budget Act of 2015.

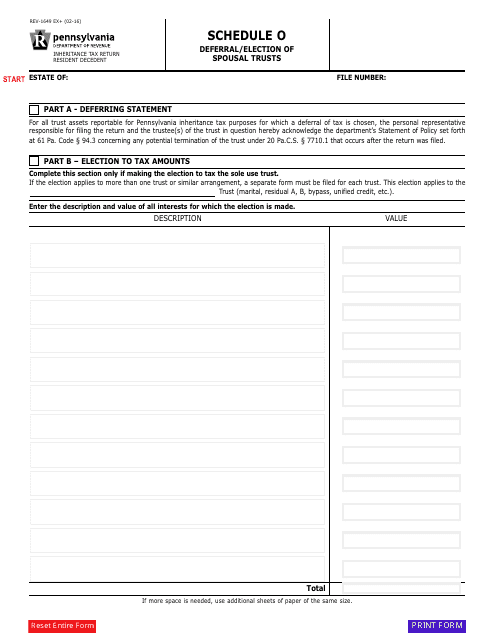

This form is used for deferral or election of spousal trusts in Pennsylvania.

This form is used for non-resident sellers of real estate in Rhode Island to elect withholding based on gain.

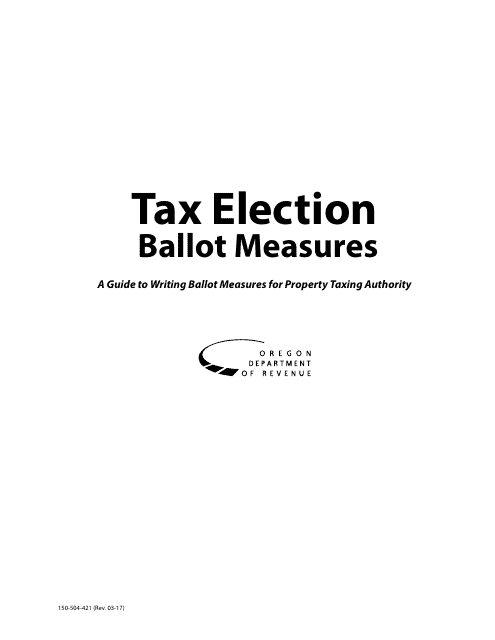

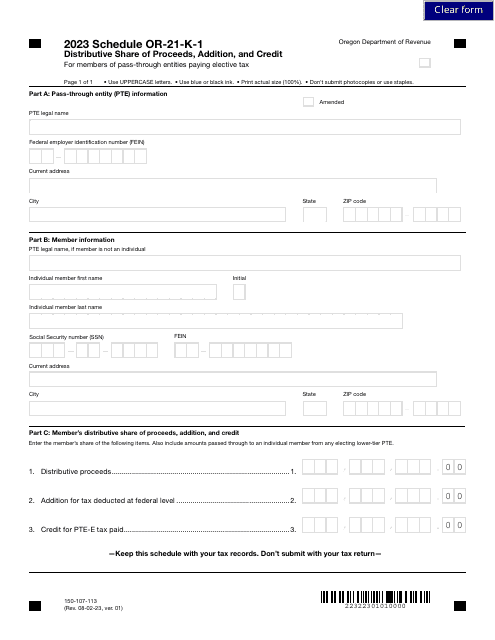

This form is used for voting on tax election ballot measures in the state of Oregon.

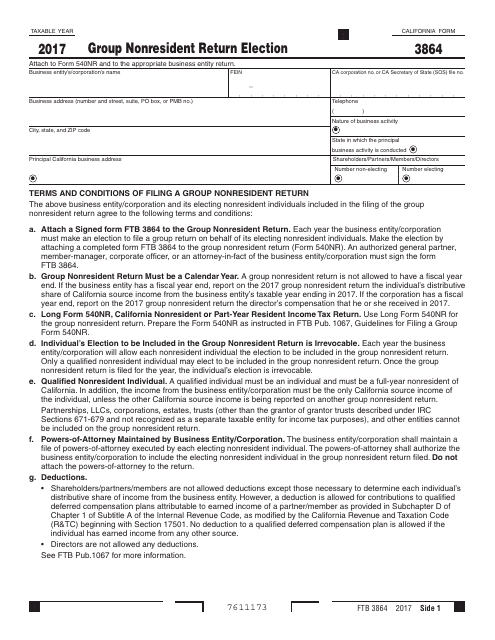

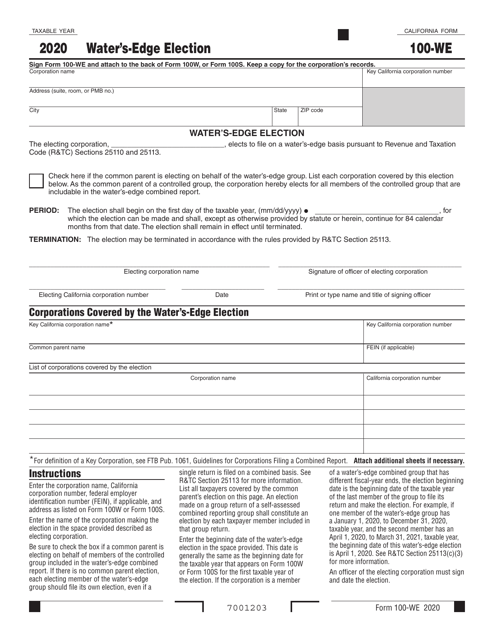

This form is used for electing to file a group nonresident return in the state of California.

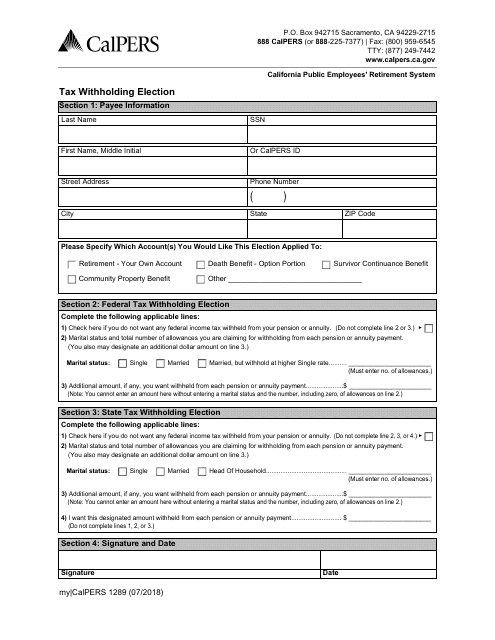

This document is used for making tax withholding elections in the state of California.

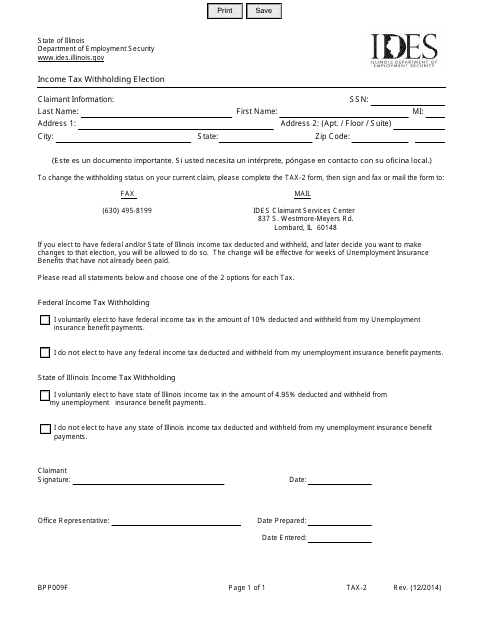

This Form is used for making an income tax withholding election in the state of Illinois.

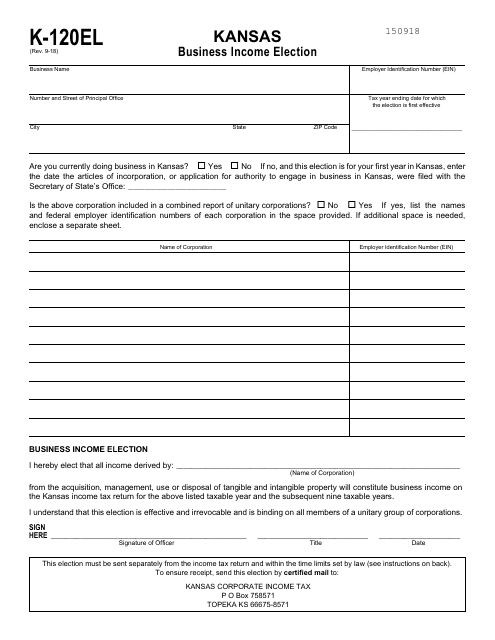

This form is used for electing Kansas business income tax treatment.

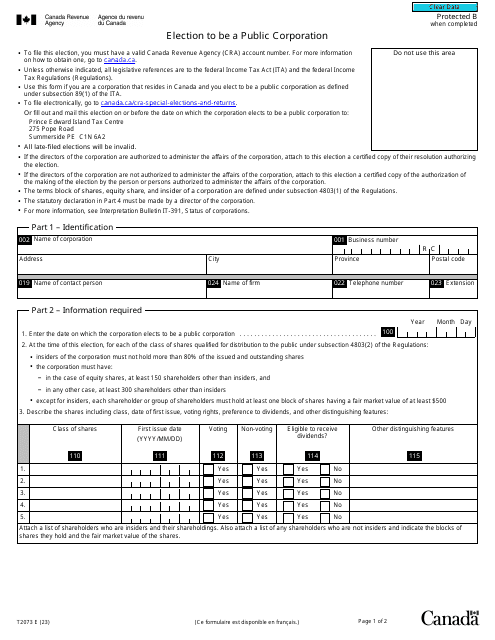

This is form is used by partnerships to inform the tax authorities they choose not to be subject to a partnership audit regime prescribed by current fiscal legislation.

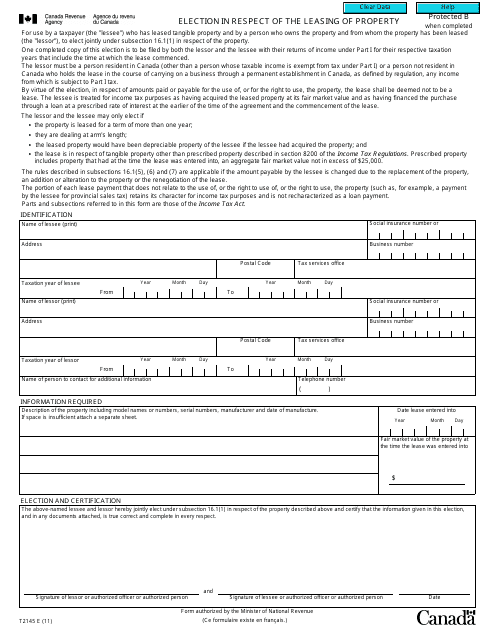

This form is used for making an election related to the leasing of property in Canada. It is used for tax purposes and allows individuals and businesses to choose how they want to report their rental income and expenses.

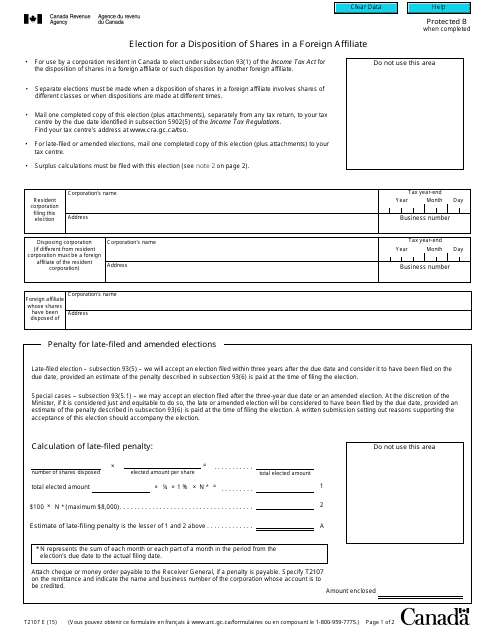

This form is used for electing how to dispose of shares in a foreign affiliate for taxpayers in Canada.

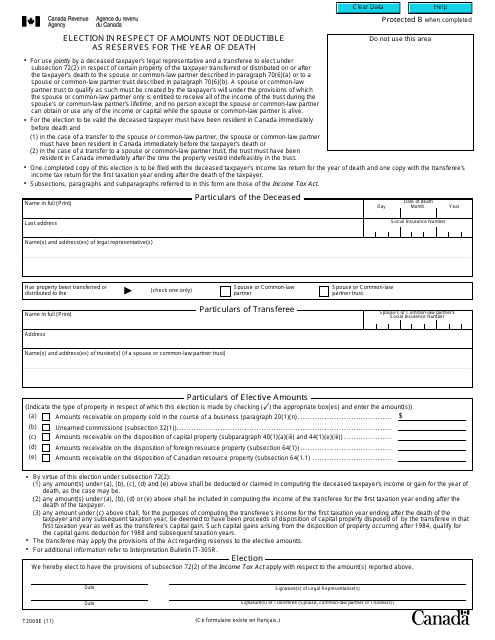

This form is used for making an election in Canada for amounts that are not deductible as reserves in the year of death.

This form is used for making an election or revocation for the total tax recovery rate for a listed financial institution in Canada.

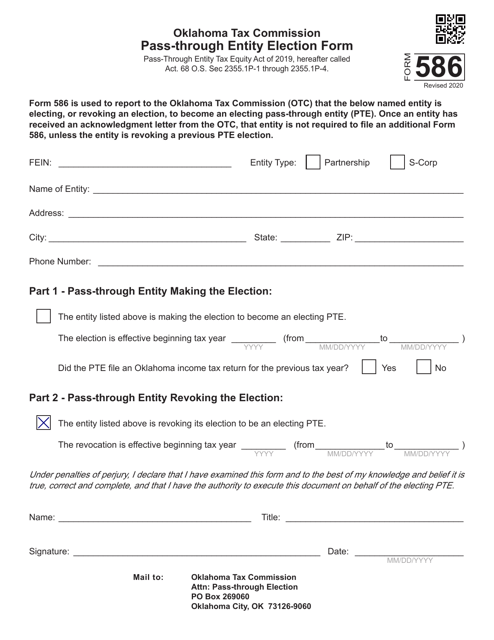

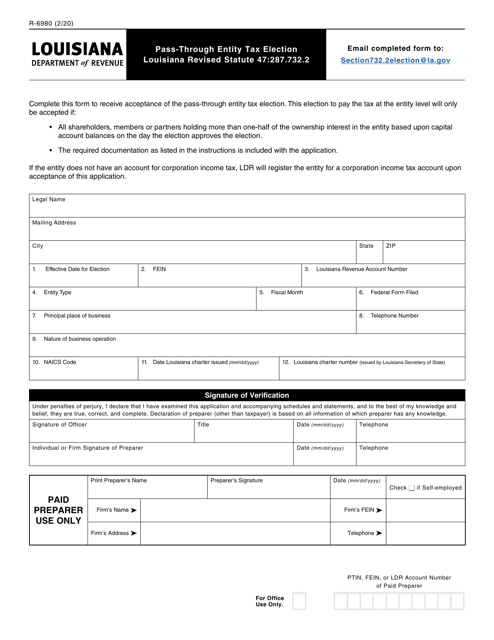

This form is used for electing pass-through entity tax in the state of Louisiana.

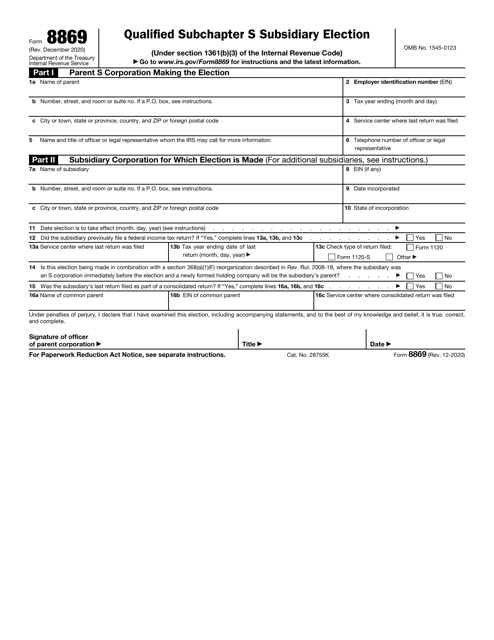

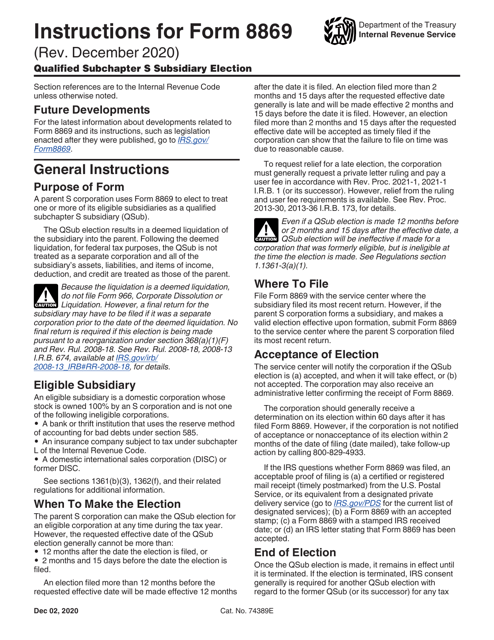

This Form is used for electing to treat a domestic corporation as a Qualified Subchapter S Subsidiary (QSub).

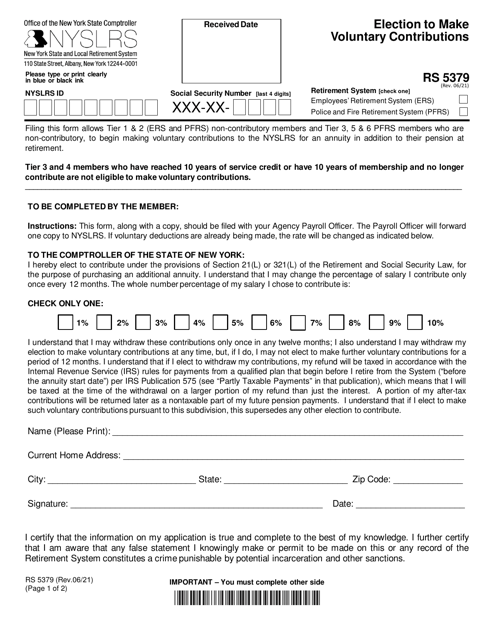

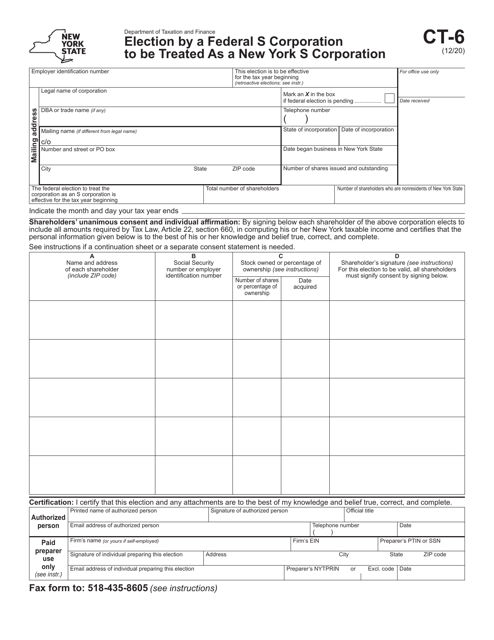

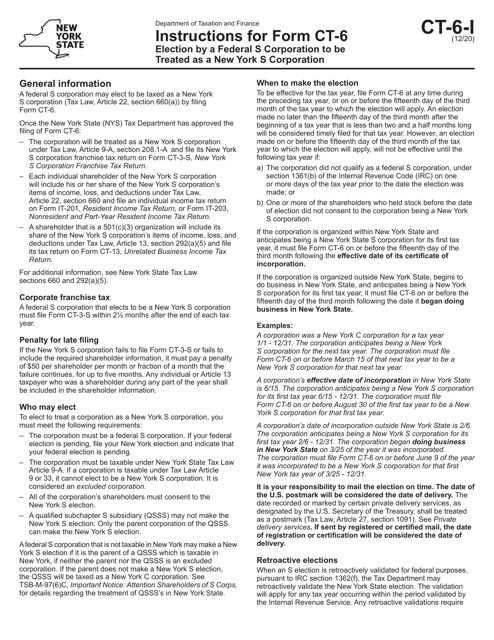

This Form is used for a Federal S Corporation to elect to be treated as a New York S Corporation. It is required for tax purposes in the state of New York.

This form is used for a federal S Corporation to elect to be treated as a New York S Corporation for tax purposes in the state of New York. It provides instructions on how to make this election.

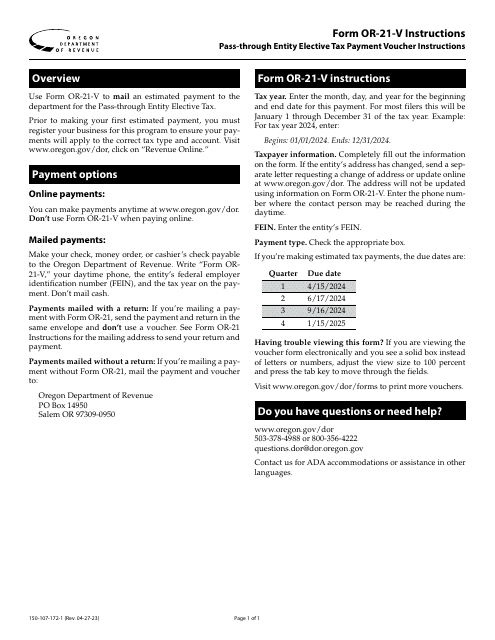

Instructions for Form OR-21-V, 150-107-172 Pass-Through Entity Elective Tax Payment Voucher - Oregon

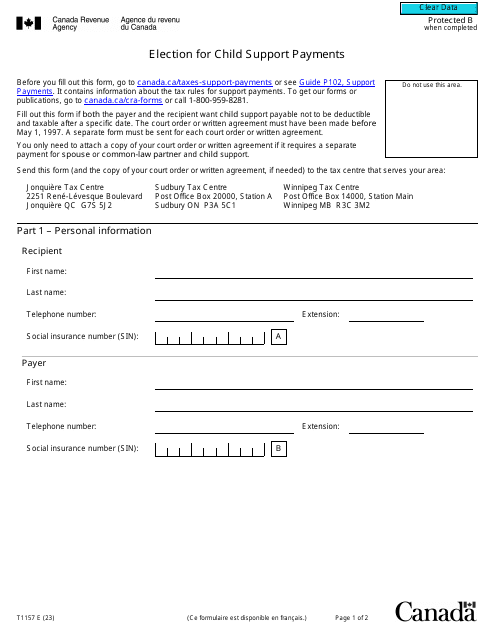

This is a legal document that needs to be completed to register an election for child support payments in Canada.