Charitable Trust Templates

A charitable trust, also known as charitable trusts or a trust for a charitable purpose, is a legal entity that is created to support a specific charitable cause or organization. These trusts are established with the intention of benefiting the public or a particular community, and their purpose typically includes activities such as providing financial support for education, healthcare, poverty alleviation, or other charitable initiatives.

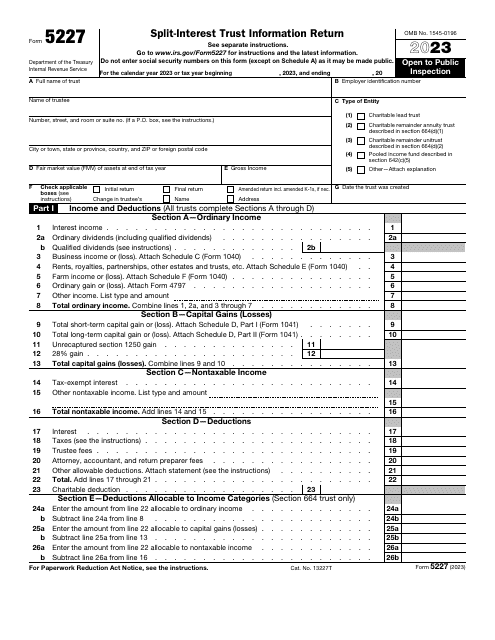

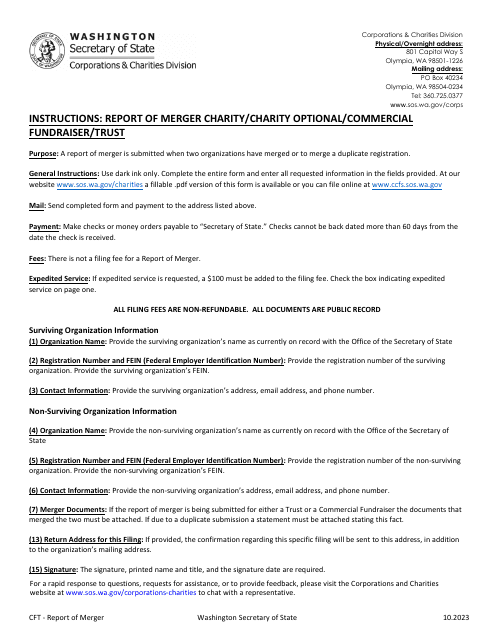

If you are interested in establishing a charitable trust or want to learn more about existing charitable trust structures, our webpage is here to guide you through the process. Our comprehensive collection of documents includes the Form NHCT-1 Register of Charitable Trusts Application for Registration from New Hampshire, IRS Form 5227 Split-Interest Trust Information Return, Form T1 Charitable Trust Initial Registration Form from Minnesota, Charitable Trust Amendment from Washington, and Charitable Trust Initial Registration from Washington, among others.

Whether you are a philanthropist looking to start a charitable trust or a trustee seeking guidance on administrative tasks and compliance, our webpage provides all the essential resources to help you navigate the complexities of charitable trust management. From registration forms and amendment documents to expert advice and best practices, we have compiled the necessary tools to ensure a smooth and successful charitable trust experience.

Explore our webpage today and discover valuable insights, practical tips, and the necessary documentation to establish, manage, and fulfill the noble goals of your charitable trust. Start making a positive impact on the causes that matter to you and contribute to the betterment of society through the power of charitable trusts.

Documents:

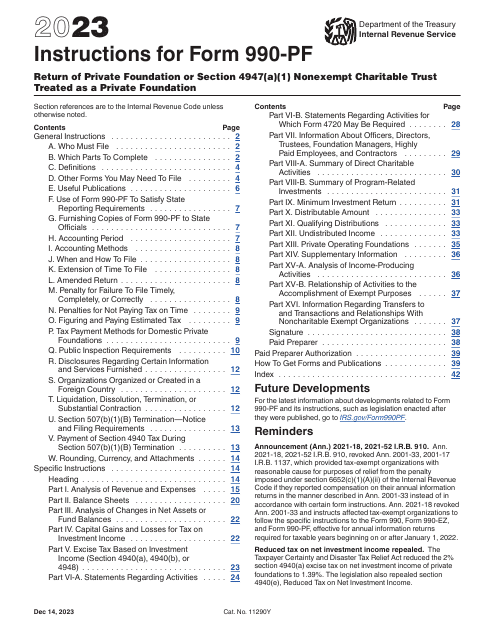

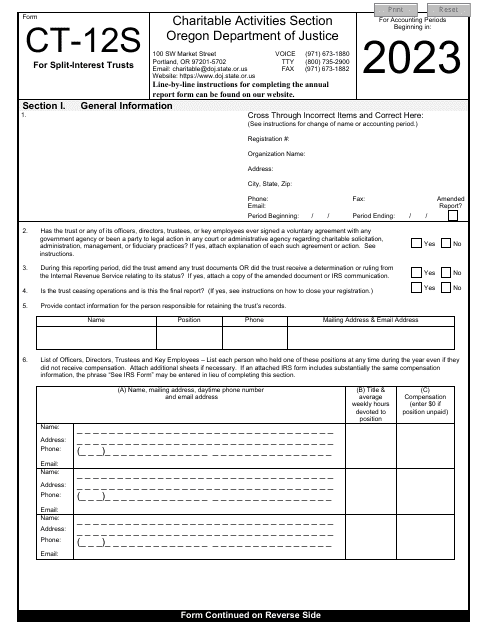

23

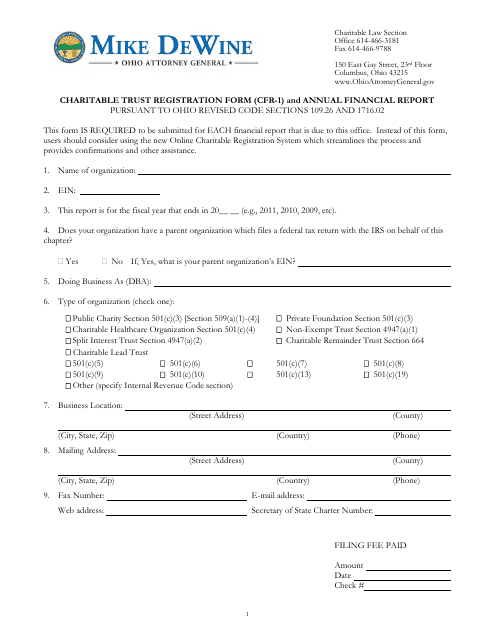

This form is used for registering and reporting financial information for charitable trusts in Ohio.

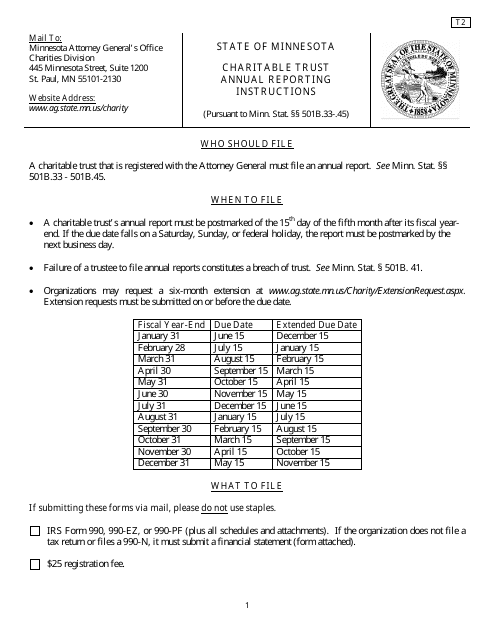

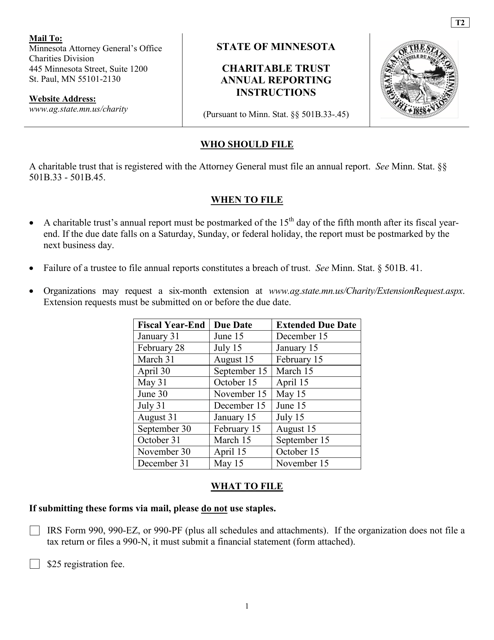

This form is used for submitting financial statements for charitable trusts in Minnesota.

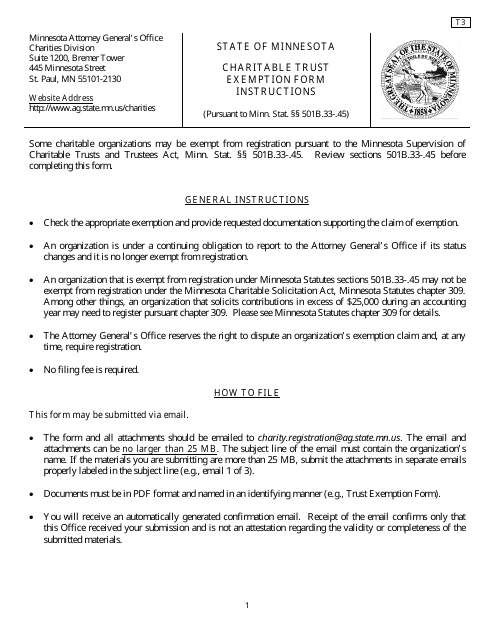

This form is used for applying for charitable trust exemption in the state of Minnesota.

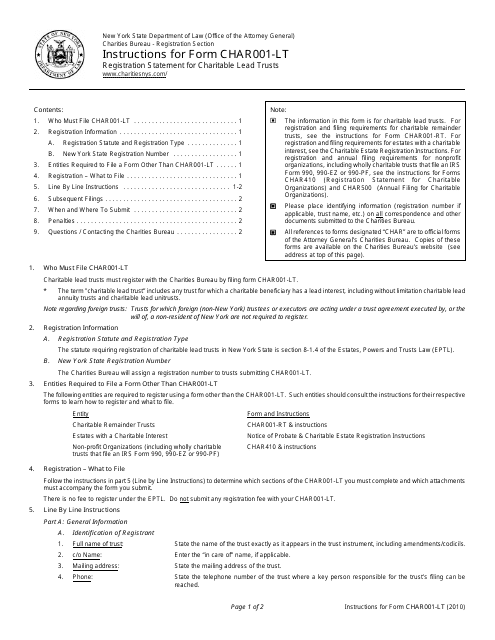

This Form is used for registering a Charitable Lead Trust in the state of New York. It provides instructions for completing the registration statement for the trust.

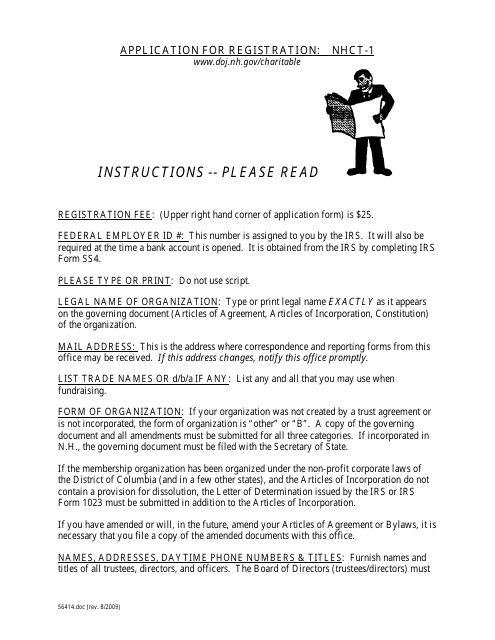

This form is used to apply for registration of a charitable trust in the state of New Hampshire.

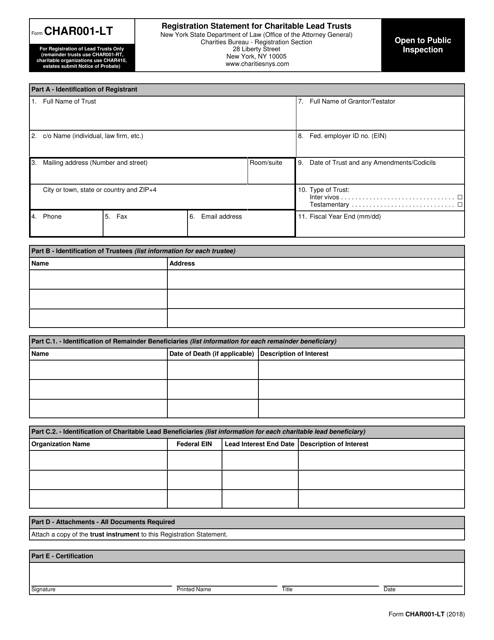

This Form is used for registering a Charitable Lead Trust in the state of New York. It is necessary to comply with the state's requirements for charitable trusts.

This document provides the financial statement information of a charitable trust located in Minnesota. It includes details of the trust's income, expenses, and overall financial health.

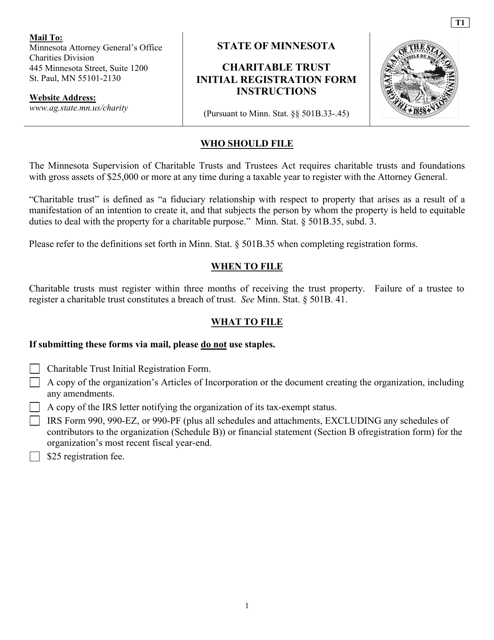

This form is used for the initial registration of a charitable trust in the state of Minnesota.

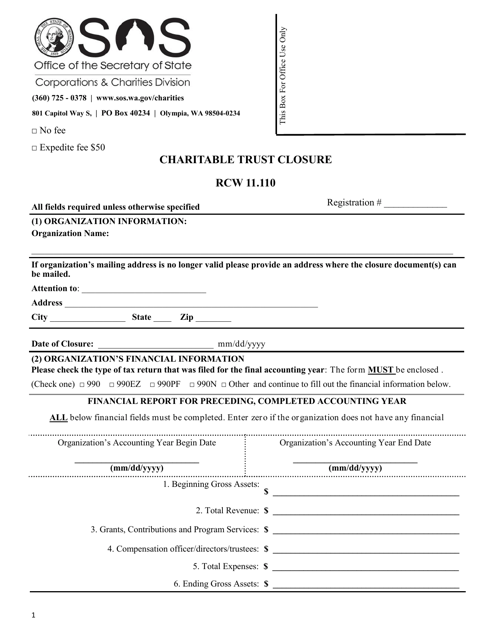

This document is for closing a charitable trust in Washington. It provides the necessary forms and instructions for properly terminating the trust.

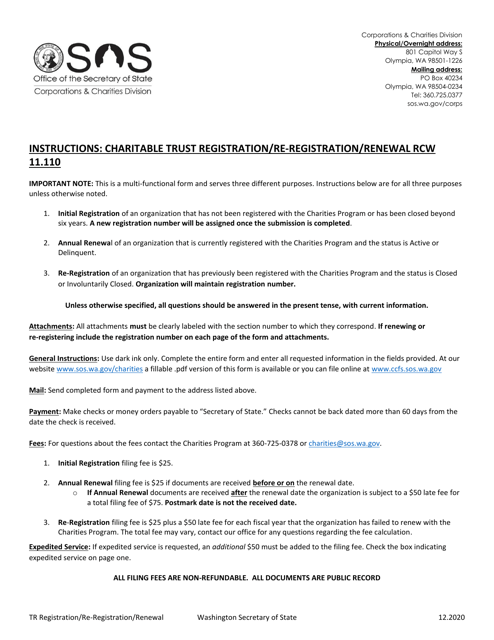

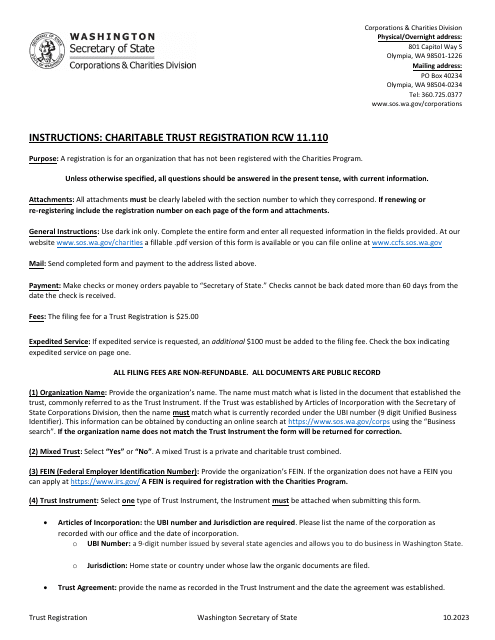

This form is used for the initial registration, re-registration, or annual renewal of a charitable trust in the state of Washington.

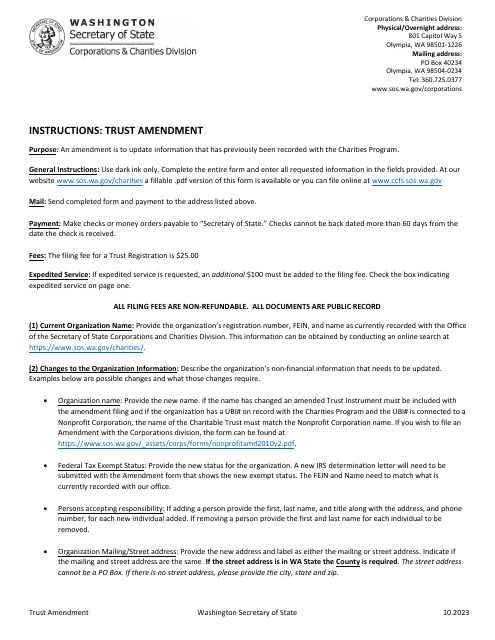

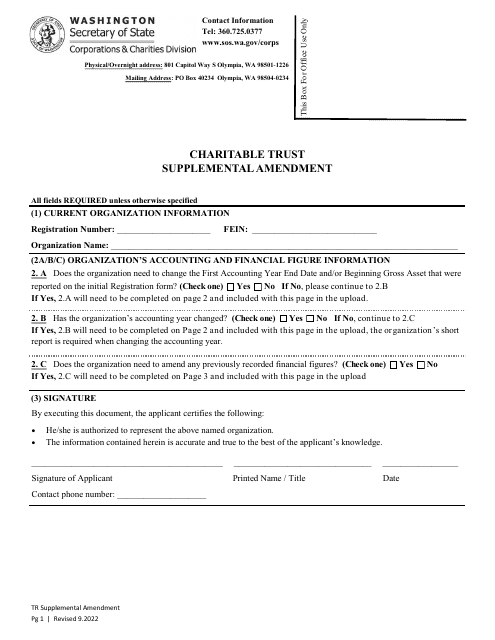

This document is used to make additional changes to a charitable trust in the state of Washington. It allows for modifications or updates to the trust's provisions or terms.