Agreed Upon Procedure Templates

Agreed Upon Procedure

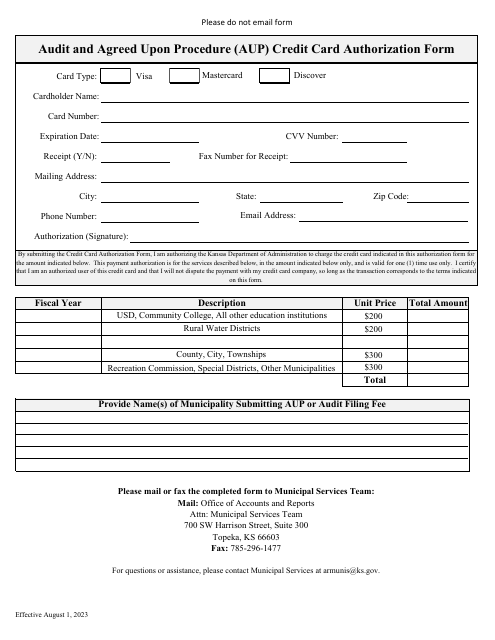

When it comes to ensuring transparency and accountability, organizations often seek to validate specific financial, operational, or compliance processes. To achieve this, they employ the use of Agreed Upon Procedure

s (AUPs) or Agreed Upon Procedure engagements.Agreed Upon Procedure

s engagements involve a range of independent examinations conducted by certified public accountants (CPAs) or other qualified professionals. These engagements are tailored to address specific areas or aspects that require scrutiny, giving organizations the assurance they need to make informed decisions.During an Agreed Upon Procedure

engagement, a CPA or a qualified professional will meticulously design and execute a set of procedures. These procedures are agreed upon by the engaged parties, which could include management, auditors, regulators, or other stakeholders. The results are then documented in a comprehensive report that highlights any findings, observations, or exceptions discovered during the examination.The purpose of these engagements is to provide an unbiased and professional assessment of specific processes, controls, or transactions. This can include reviewing financial records, conducting data analysis, or assessing compliance with regulatory requirements. The flexibility of Agreed Upon Procedure

s engagements allows organizations to target their needs and focus on areas they deem critical.Why Choose Agreed Upon Procedure

s?Agreed Upon Procedure

s engagements offer several advantages for organizations seeking assurance in specific areas. The ability to tailor the procedures and scope of the engagement ensures that organizations can address their unique concerns. This approach allows for a cost-effective alternative to traditional audit engagements, as it allows organizations to focus on specific risks or processes without the need for a full-scale audit.Furthermore, Agreed Upon Procedure

s engagements can be performed on a regular or ad-hoc basis. Regular engagements provide organizations with a consistent and ongoing assessment of the effectiveness of their chosen procedures or controls. Ad-hoc engagements, on the other hand, can be employed to address specific concerns or incidents as they arise, providing timely insights and recommendations to mitigate risks.By engaging in Agreed Upon Procedure

s, organizations gain valuable assurance and insights that enable them to enhance their financial integrity, operational efficiency, and regulatory compliance. Whether it is validating the accuracy of financial statements, assessing the effectiveness of internal controls, or ensuring compliance with industry standards, Agreed Upon Procedures engagements offer a flexible and transparent approach to scrutiny.Discover the Power of Agreed Upon Procedure

sAt Templateroller.com, we specialize in providing comprehensive Agreed Upon Procedure

engagements tailored to meet the unique needs of our clients. Our team of qualified professionals boasts extensive experience in conducting independent examinations for organizations across various industries.Whether you are a real estate brokerage, a professional employer organization (PEO), or any other entity seeking objective validation, our Agreed Upon Procedure

s engagements can help you navigate the complexities of compliance, risk management, and financial transparency.Contact Templateroller.com today to discuss your specific requirements and explore the benefits of Agreed Upon Procedure

s engagements. Our dedicated team is ready to assist you in achieving greater transparency, efficiency, and peace of mind.Documents:

6

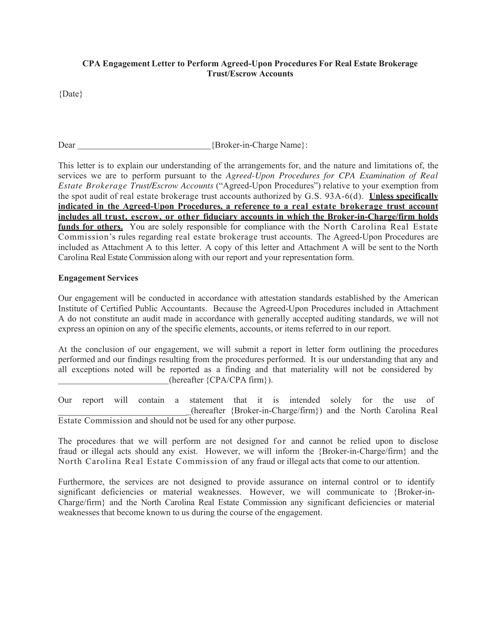

This document is an engagement letter for Certified Public Accountants (CPAs) to perform agreed-upon procedures for real estate brokerage trust/escrow accounts in North Carolina. It outlines the scope of services and responsibilities of the CPA firm and the client.

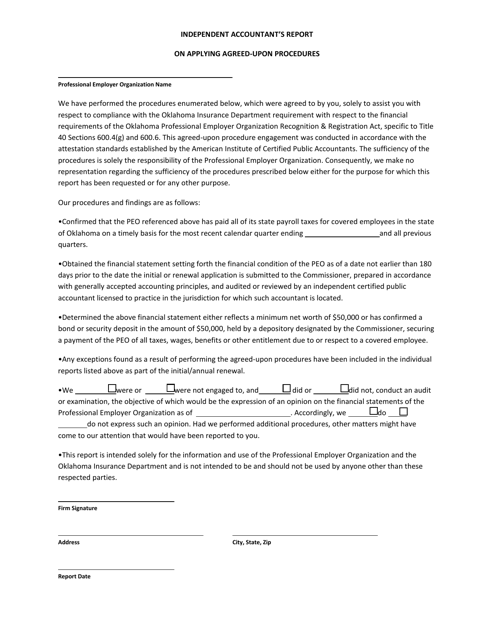

This document is a report prepared by an independent accountant in Oklahoma. It details the agreed-upon procedures that were applied to a full PEO (Professional Employer Organization).

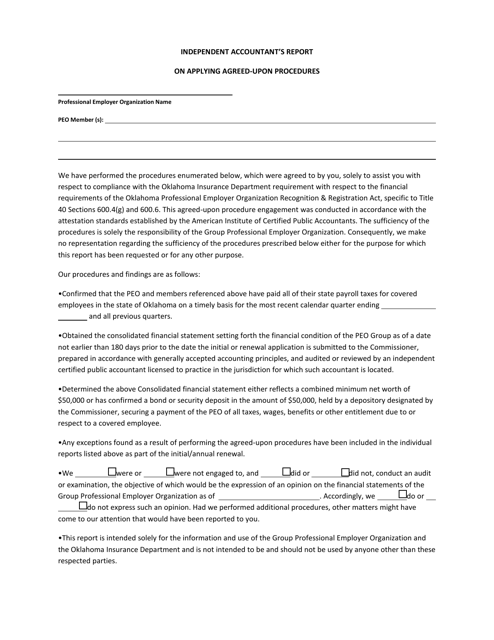

This document is an independent accountant's report that applies agreed-upon procedures to the group PEO in Oklahoma.

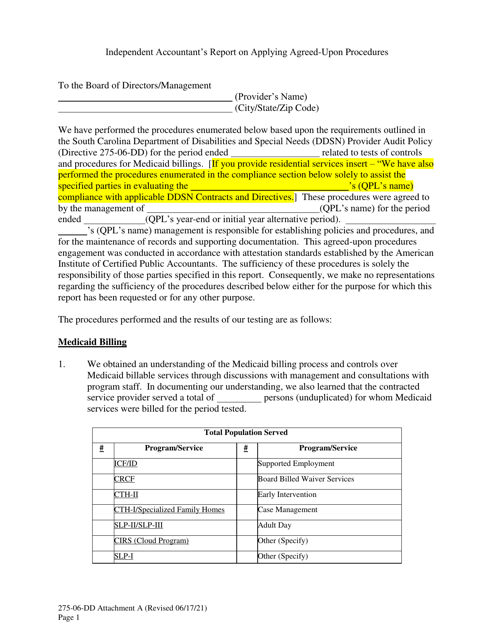

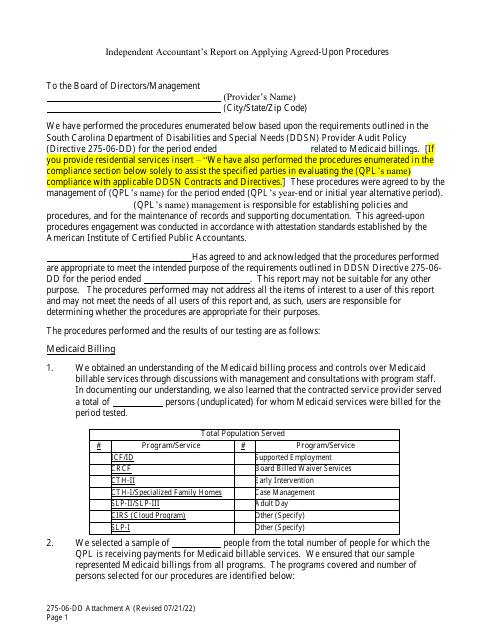

This document is an independent accountant's report that applies agreed-upon procedures specific to South Carolina.

This form is used for an Independent Accountant's Report on Applying Agreed-Upon Procedures in South Carolina. It is a document that outlines the procedures performed by an independent accountant to assess the accuracy and reliability of financial statements or specific financial data.