Tuition Deduction Templates

Are you a student or a parent looking for ways to save on your education expenses? Look no further than the tuition deduction, also known as the tuition deductions. This is a valuable tax benefit offered by both the United States and Canada, allowing eligible individuals to deduct their tuition expenses when filing their income taxes.

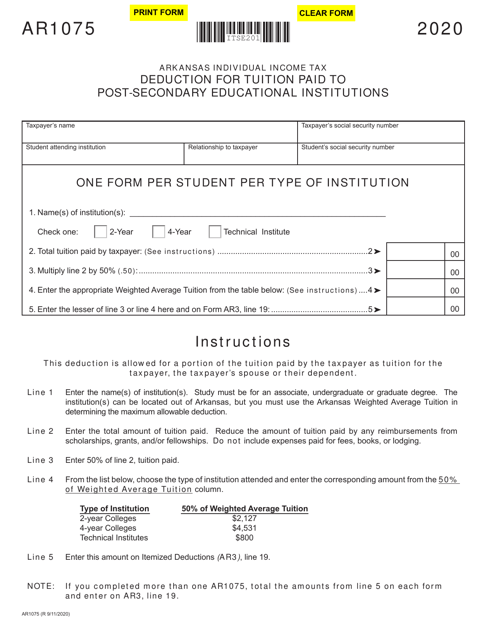

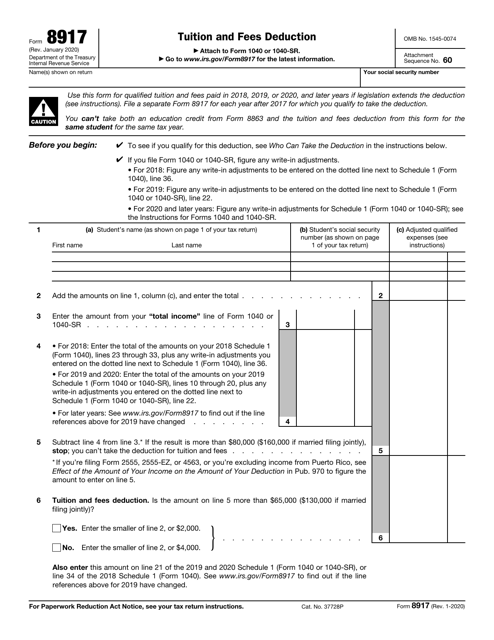

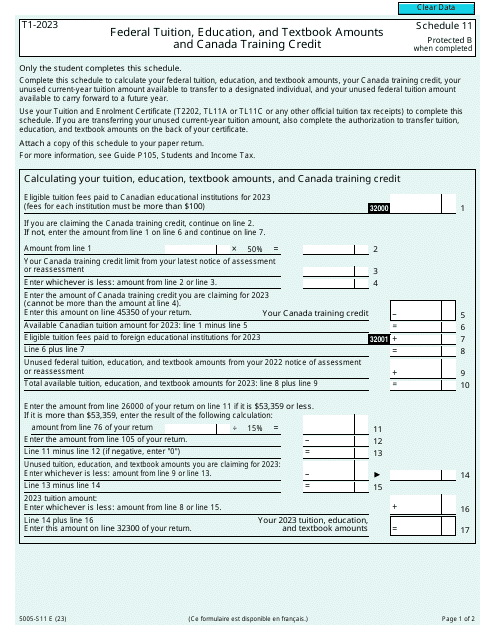

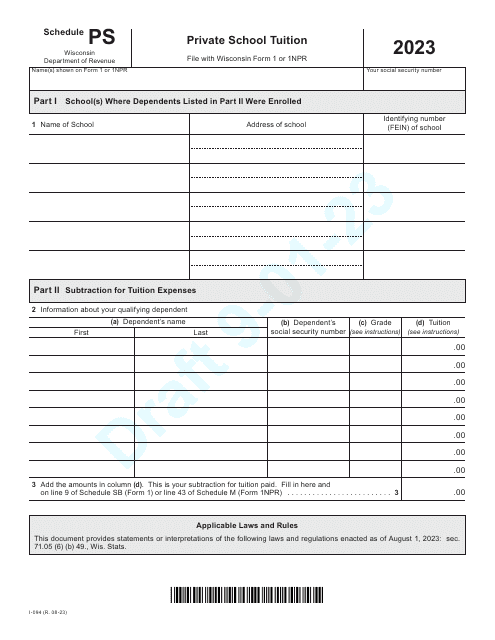

In the United States, the tuition deduction is available through various forms such as Form AR1075 Deduction for Tuition Paid to Post-secondary Educational Institutions for residents of Arkansas. This form specifically caters to individuals who have paid tuition fees to post-secondary educational institutions in Arkansas. Similarly, Form 5005-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts is a popular option for Canadian residents looking to claim their federal tuition, education, and textbook amounts.

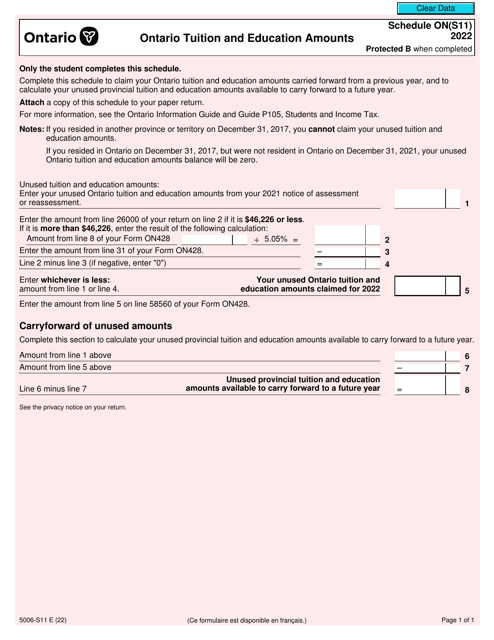

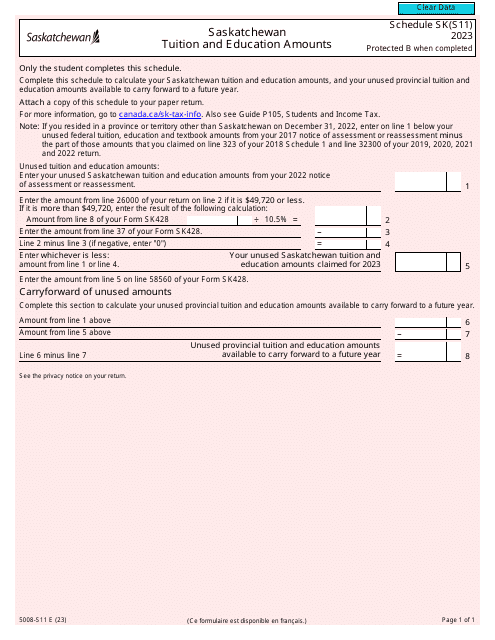

For residents of Ontario, Canada, there is Form 5006-S11 Schedule ON(S11) Ontario Tuition and Education Amounts, which allows students to claim their provincial tuition and education amounts. Likewise, residents of Saskatchewan can utilize Form 5008-S11 Schedule SK(S11) Saskatchewan Tuition and Education Amounts to claim their provincial tuition and education amounts.

By taking advantage of the tuition deduction, you can potentially reduce your taxable income, resulting in a lower tax liability or even a tax refund. This can make a significant difference in your overall financial situation, especially considering the rising costs of education.

Whether you're a student pursuing higher education or a parent supporting your child's educational journey, it's essential to explore every available opportunity to save on expenses. The tuition deduction, also known as the tuition deductions, can provide you with much-needed financial relief. So don't miss out on claiming your rightful deductions when it's time to file your income taxes.

Remember to consult with a tax professional or refer to the official tax forms provided by the respective tax authorities for detailed instructions and eligibility requirements. Start maximizing your education savings today with the tuition deduction!

Documents:

8