Statewide Transit Tax Templates

Are you looking for information about the statewide transit tax in USA, Canada, and other countries? This tax, also known as the statewide transit tax, is an important topic for both individuals and businesses. Whether you are an employer responsible for withholding this tax from your employees' wages or an employee wanting to understand how this tax affects your paycheck, it is essential to be well-informed.

Under the statewide transit tax system, employers are required to withhold a certain percentage from their employees' wages to fund public transportation services in their state. This tax helps support the development and maintenance of transit systems, ensuring that people have access to reliable and efficient modes of transportation.

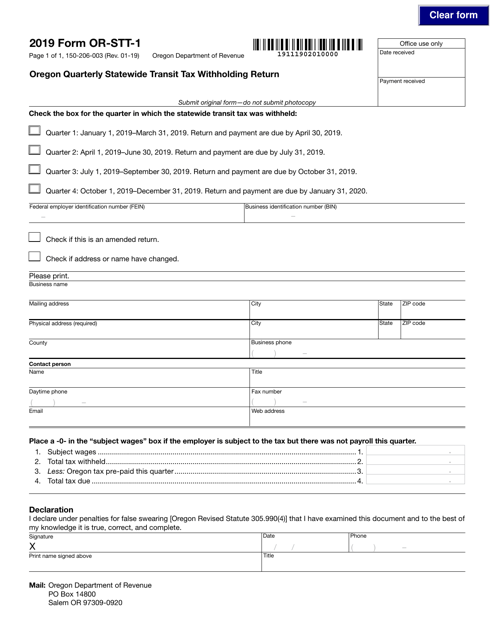

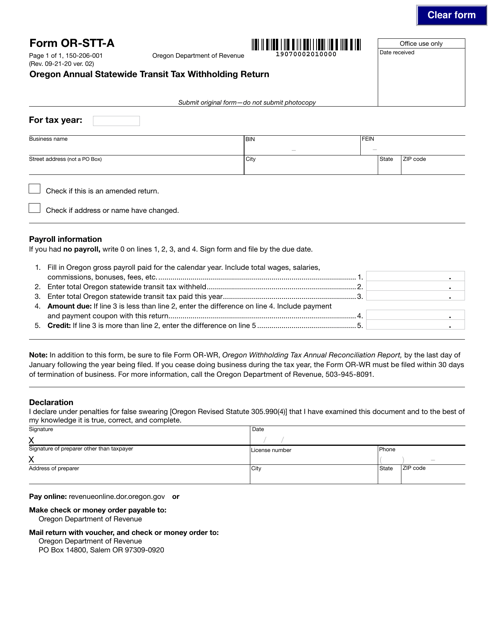

To comply with the statewide transit tax regulations, employers must fill out various forms and reports. The Oregon Quarterly Statewide Transit Tax Withholding Return (Form 150-206-003, also known as OR-STT-1) and the Oregon Annual Statewide Transit Tax Withholding Return (Form OR-STT-A, 150-206-001) are examples of the forms that employers need to complete. These forms provide a breakdown of the tax withheld from employees' wages and report the total amount withheld for each period.

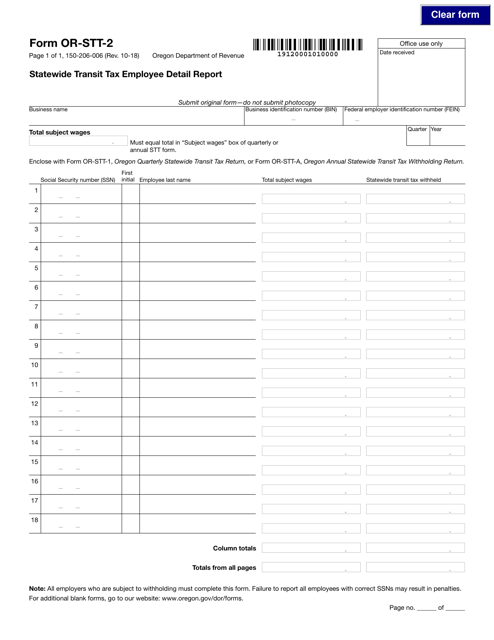

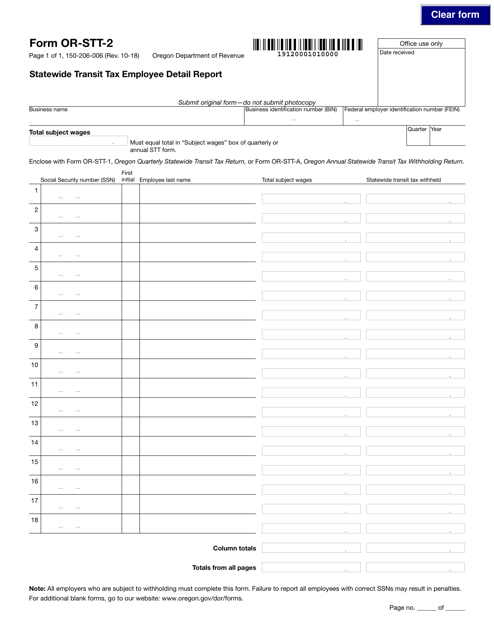

Additionally, there is the Statewide Transit Tax Employee Detail Report (Form OR-STT-2, 150-206-006), which provides detailed information about each employee's tax withholding. Employers can use this report to reconcile the tax withheld from employees' wages with their payroll records.

If you need guidance on how to complete these forms correctly, you can refer to the Instructions for Form OR-STT-A (150-206-001) and the Instructions for Form OR-STT-1 (150-206-003). These instructions provide step-by-step guidance on how to fill out the forms accurately and efficiently.

It is essential to stay up-to-date with the statewide transit tax regulations in your jurisdiction, as they may change over time. Being aware of your responsibilities as an employer or understanding how this tax affects your paycheck will help ensure compliance and avoid any unnecessary penalties or issues.

If you have any further questions or need more information about the statewide transit tax, consult with a tax professional or visit the official government website of your state or jurisdiction for the most accurate and up-to-date information.

Documents:

9

Form 150-206-003 (OR-STT-1) Oregon Quarterly Statewide Transit Tax Withholding Return - Oregon, 2019

This form is used for reporting quarterly statewide transit tax withholdings in Oregon.

This form is used for reporting employee details to the Statewide Transit Tax in Oregon.

This document provides instructions for completing Form OR-STT-2, which is the Statewide Transit Tax Employee Detail Report used in Oregon. It outlines how to report employee information related to the Statewide Transit Tax.

This Form is used for filing the Oregon Annual Statewide Transit Tax Withholding Return to report and pay the transit tax withheld from employees' wages in Oregon.