Reconciliation Process Templates

Reconciliation Process: Ensuring Accuracy and Transparency

In any organization, the reconciliation process plays a vital role in maintaining accurate financial records, detecting discrepancies, and promoting transparency. It involves comparing different sets of data to identify and resolve any inconsistencies or discrepancies. This essential process helps businesses, governments, and institutions maintain integrity and ensures that financial statements and reports are reliable.

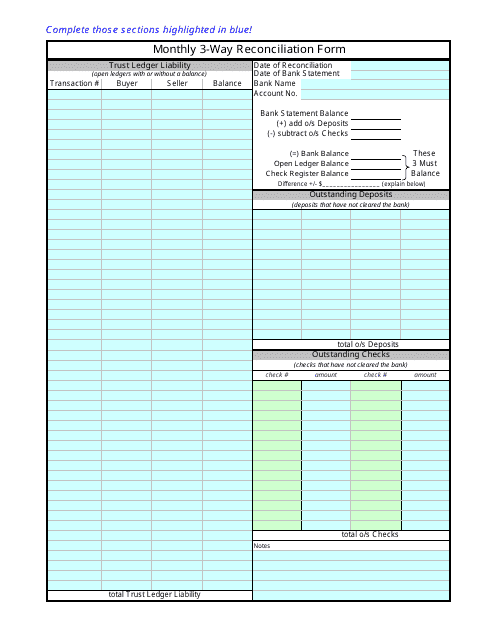

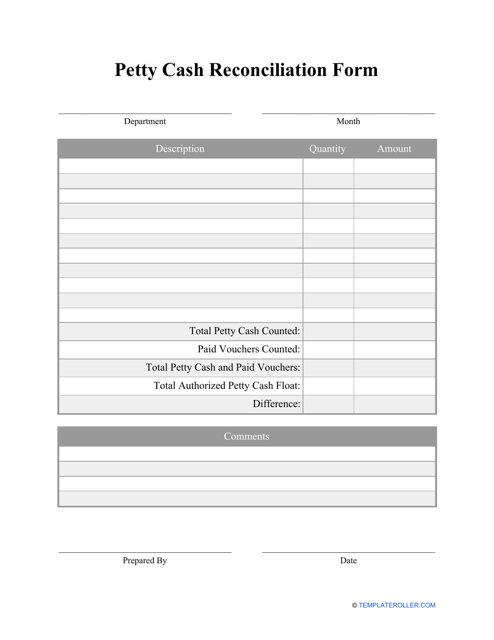

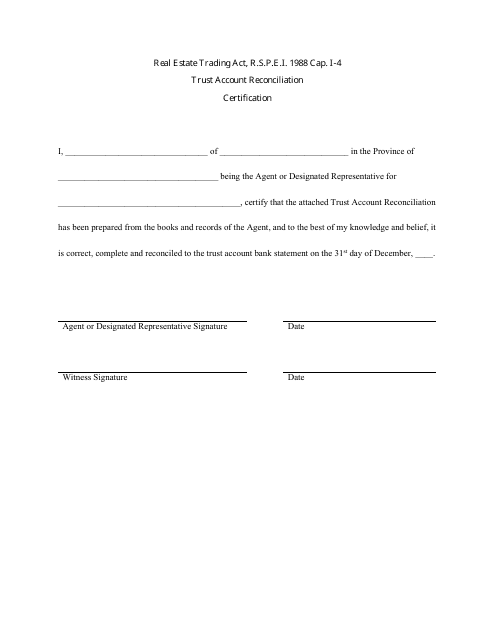

Whether it's a company's monthly 3-way reconciliation form, a petty cash reconciliation form, or a trust account reconciliation certification in Prince Edward Island, Canada, the reconciliation process is a critical aspect of financial management. It helps identify errors, fraud, or misappropriation of funds, enabling swift corrective action and preventing future issues.

By adopting a robust reconciliation process, businesses and organizations can effectively track and monitor their financial transactions, ensuring that revenues and expenses are accurately recorded. Financial institutions rely on reconciliation procedures to verify deposits, withdrawals, and account balances, preventing errors and maintaining customer trust.

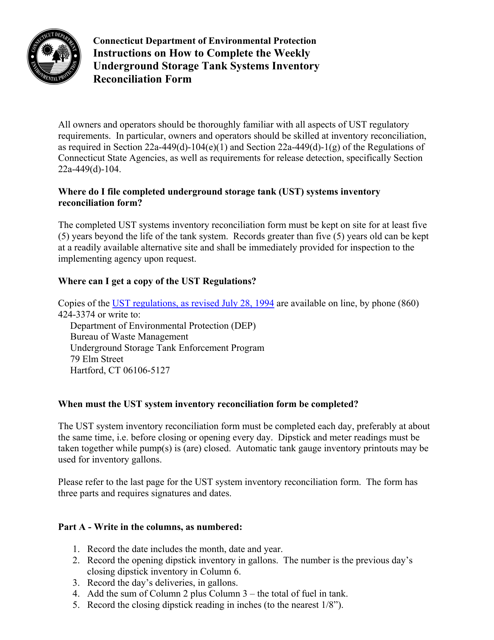

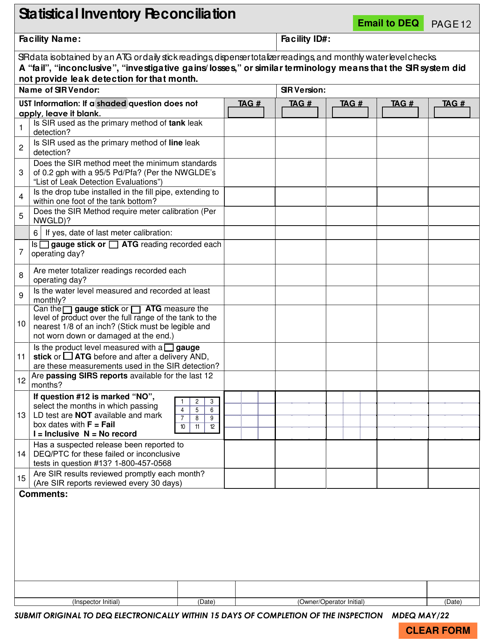

The reconciliation process spans across various industries and sectors, adapting to their unique requirements and regulations. For example, the Page 12 Statistical Inventory Reconciliation in Montana aids in tracking and reconciling inventory numbers, allowing businesses to optimize their supply chain management.

Ensuring accuracy and transparency in financial records is crucial not only for internal stakeholders but also for external entities such as investors, auditors, and regulatory bodies. Implementing a comprehensive reconciliation process helps build trust and establishes credibility with stakeholders, paving the way for long-term success.

With the proper utilization of reconciliation tools and techniques, organizations can streamline their financial operations, identify potential risks, and enhance overall efficiency. By regularly reviewing and reconciling financial records, businesses and institutions can easily identify trends, address discrepancies promptly, and make informed decisions based on accurate data.

Embracing a proactive approach to the reconciliation process is vital for any organization striving to maintain financial integrity and compliance. By implementing sound reconciliation practices, businesses and institutions can identify and resolve discrepancies, safeguard against potential risks, and ensure transparency in their financial reporting.

Documents:

6

This form is used for monthly financial reconciliation between three different accounts or entities.

This document is used for weekly inventory reconciliation of underground storage tank systems in Connecticut.

This form compiles and manages all business-related expenses in order to avoid any irregularities in a company's records.

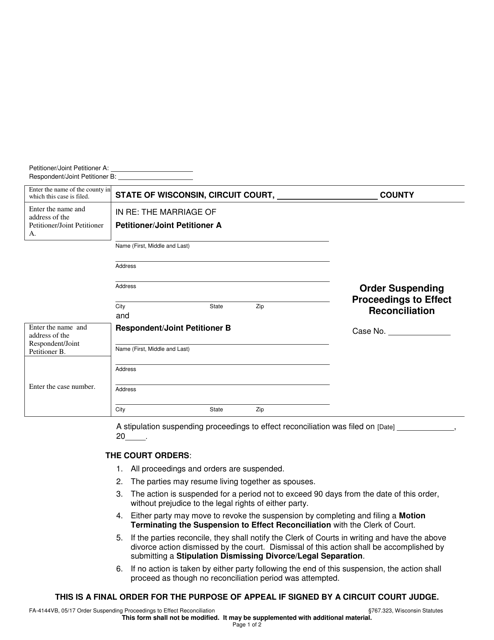

This form is used for requesting an order to suspend proceedings in Wisconsin in order to attempt reconciliation with the other party involved.

This type of document is used for performing statistical inventory reconciliation in the state of Montana.

This document certifies the reconciliation of a trust account in Prince Edward Island, Canada.