Life Insurance Contract Templates

Are you looking for information about life insurance contracts? Look no further! We have all the details you need to understand this important financial document. Whether you refer to it as a life insurance contract or life insurance contracts, we have you covered.

Life insurance contracts are legal agreements between an insurance company and an individual, providing valuable financial protection for loved ones in the event of the policyholder's death. These contracts ensure that beneficiaries receive a payout, known as a death benefit, upon the policyholder's passing.

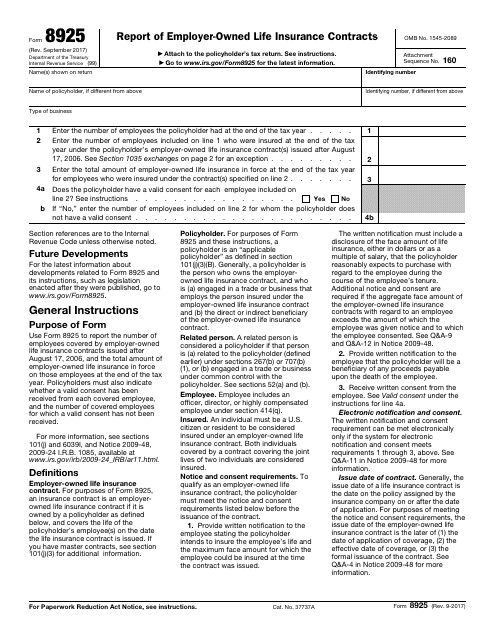

One commonly encountered document related to life insurance contracts is the IRS Form 8925 Report of Employer-Owned Life Insurance Contracts. This form is used to report certain information about employer-owned life insurance contracts and the beneficiaries of those contracts.

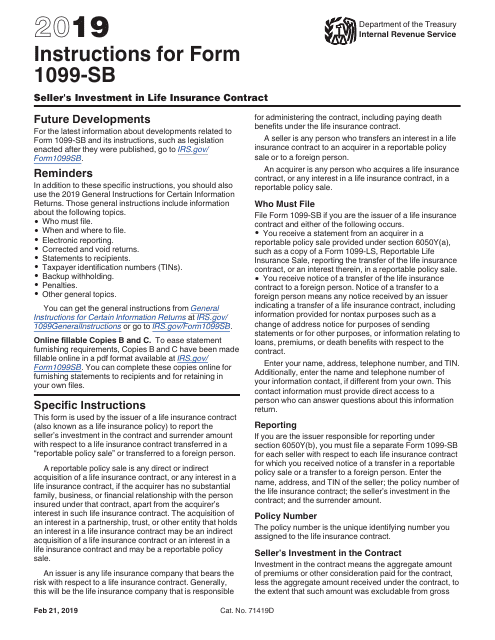

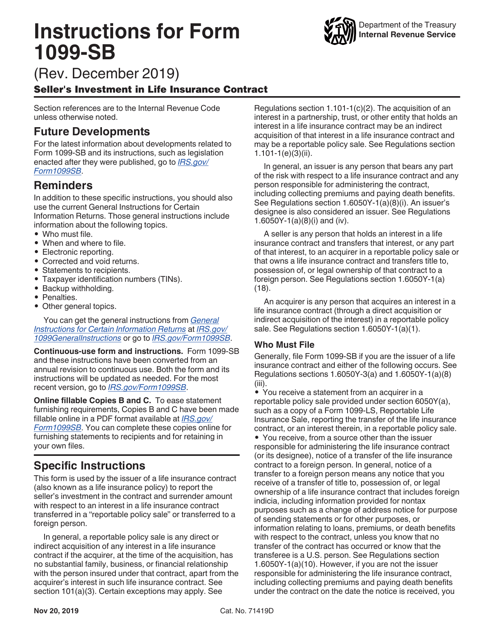

Another key document is the IRS Form 1099-SB Seller's Investment in Life Insurance Contract. This form is used to report income from a seller's investment in a life insurance contract, providing important information for tax purposes.

To help you navigate these forms, we also provide instructions for the IRS Form 1099-SB Seller's Investment in Life Insurance Contract. These instructions offer step-by-step guidance on completing the form accurately and efficiently.

Understanding life insurance contracts is crucial for protecting your loved ones' financial future. Whether you need information about IRS forms or need assistance with your policy, we have the resources you need. Let us guide you through the complex world of life insurance contracts.

Documents:

6