Beneficios Fiscales Templates

Welcome to our webpage dedicated to "Beneficios Fiscales" or tax benefits. This comprehensive collection of documents provides invaluable information and resources for individuals and businesses seeking to take advantage of various tax benefits available to them.

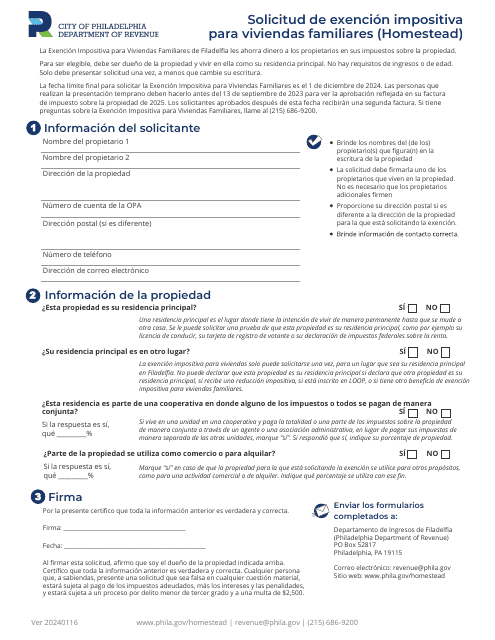

Navigating the complex world of taxes can be overwhelming, but our "Beneficios Fiscales" documents are here to simplify the process and help you maximize your tax savings. Whether you're looking for guidance on IRS forms related to tax credits during the Covid-19 pandemic or seeking information on property tax exemptions for disabled homeowners, our documents cover a wide range of topics.

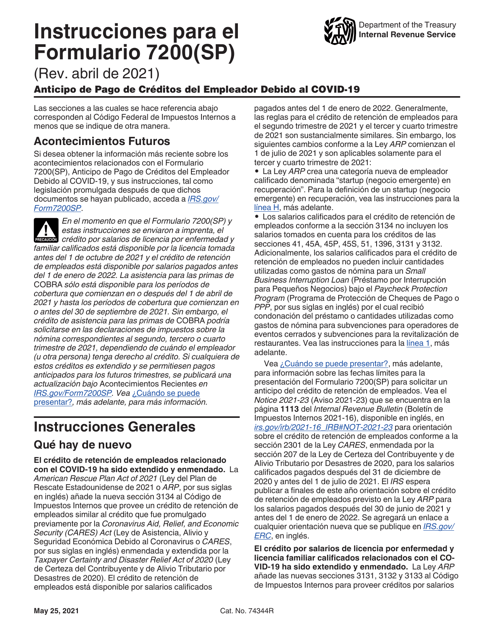

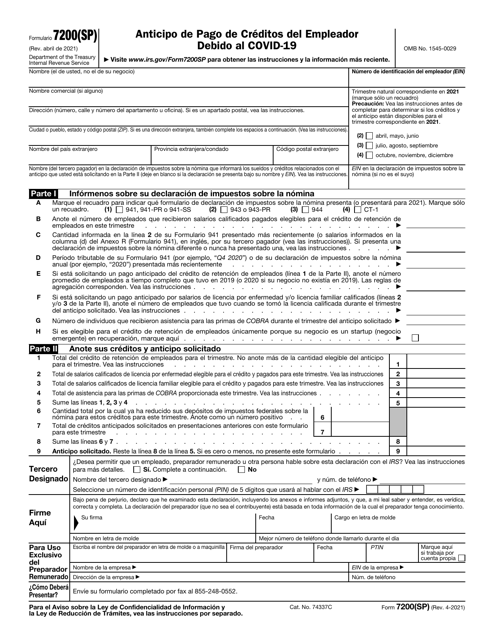

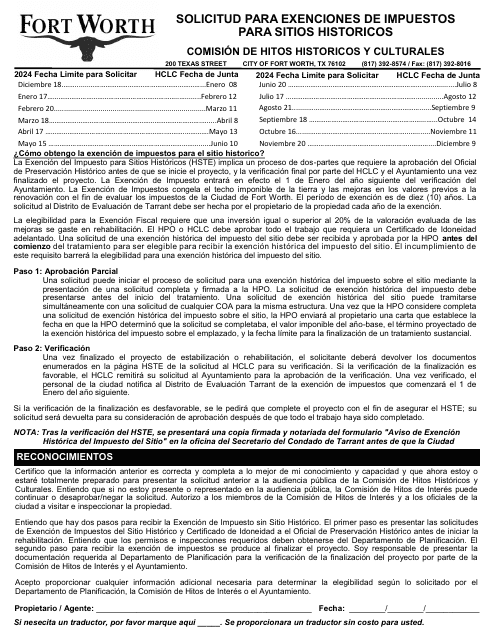

Our collection includes resources such as instructions for IRS Formulario 7200(SP) Anticipo De Pago De Creditos Del Empleador Debido Al Covid-19 (Spanish), which provides step-by-step guidance on how to claim employer tax credits related to Covid-19. We also offer a comprehensive guide on how to apply for Solicitud Para Exenciones De Impuestos Para Sitios Historicos - City of Fort Worth, Texas (Spanish), helping property owners unlock tax benefits for historic sites.

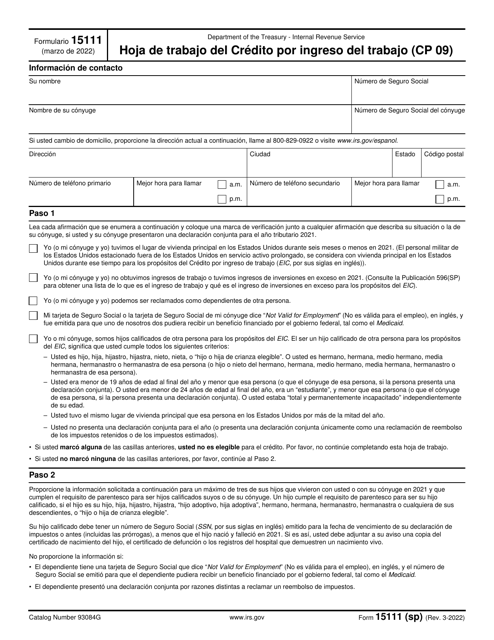

Furthermore, our collection includes important documents like Instrucciones para IRS Formulario 7200(SP) Anticipo De Pago De Creditos Del Empleador Debido Al Covid-19 (Spanish), which offers valuable information on how to request an advance payment of employer credits due to the Covid-19 pandemic. Additionally, we provide helpful resources like IRS Formulario 15111 Hoja De Trabajo Del Credito Por Ingreso Del Trabajo (CP 09) (Spanish), assisting individuals in understanding and calculating the Earned Income Tax Credit.

Whether you're an individual looking to maximize your tax savings or a business owner seeking to take advantage of tax benefits provided by different jurisdictions, our "Beneficios Fiscales" documents are an essential resource. Let us help you navigate the complexities of tax benefits and ensure you're making the most of the opportunities available to you.

Documents:

11

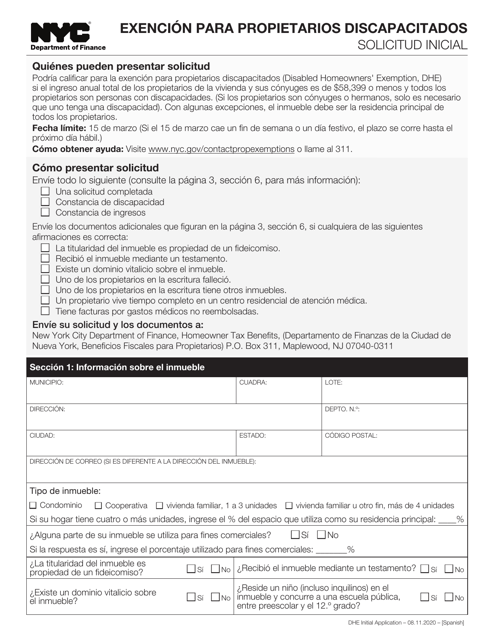

This document is for disabled property owners in New York City who want to apply for an initial exemption.

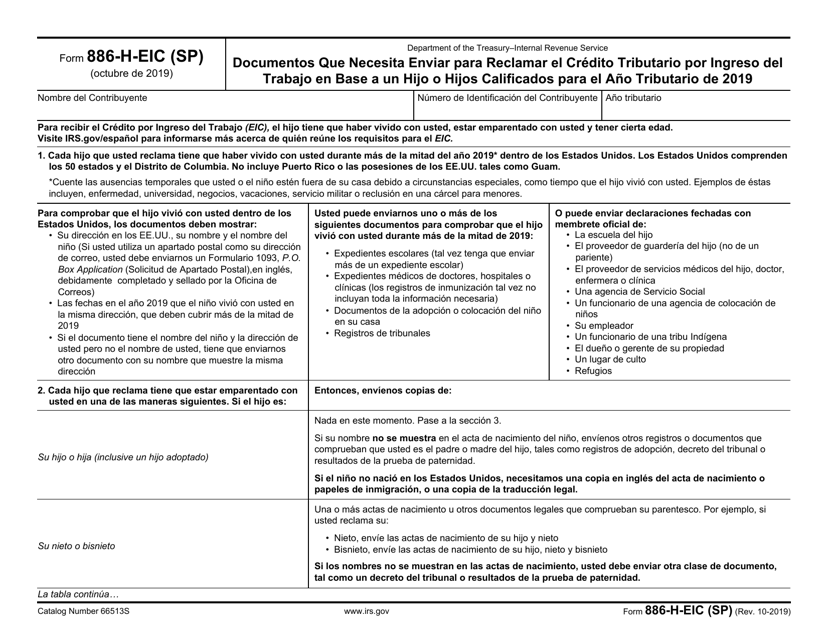

This document is for Spanish-speaking individuals who need to submit documents to claim the Earned Income Tax Credit based on a qualified child or children.

This Form is used for claiming the Earned Income Tax Credit (EITC) on your tax return. It is available in Spanish and is used to calculate the amount of the credit you may be eligible for.

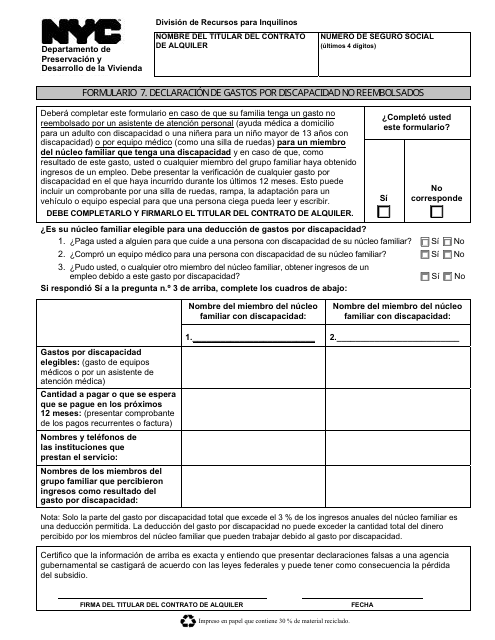

This form is used for declaring unreimbursed disability expenses in New York City.