Payroll Report Templates

Payroll Report Services

Looking for a reliable payroll report service? Look no further! We provide comprehensive payroll reporting solutions for businesses of all sizes. Our team of experts understands the importance of accurate and timely payroll reporting and is dedicated to helping you streamline your processes and save you time and resources.

Our payroll report service offers a wide range of benefits, including:

-

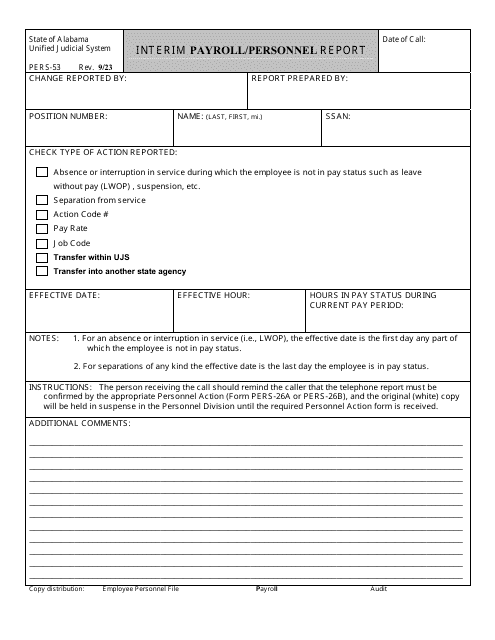

Timely and Accurate Reporting: We understand that payroll reporting is time-sensitive, which is why we ensure that all reports are prepared and submitted on time, every time. Our meticulous attention to detail ensures accurate calculations and data entry.

-

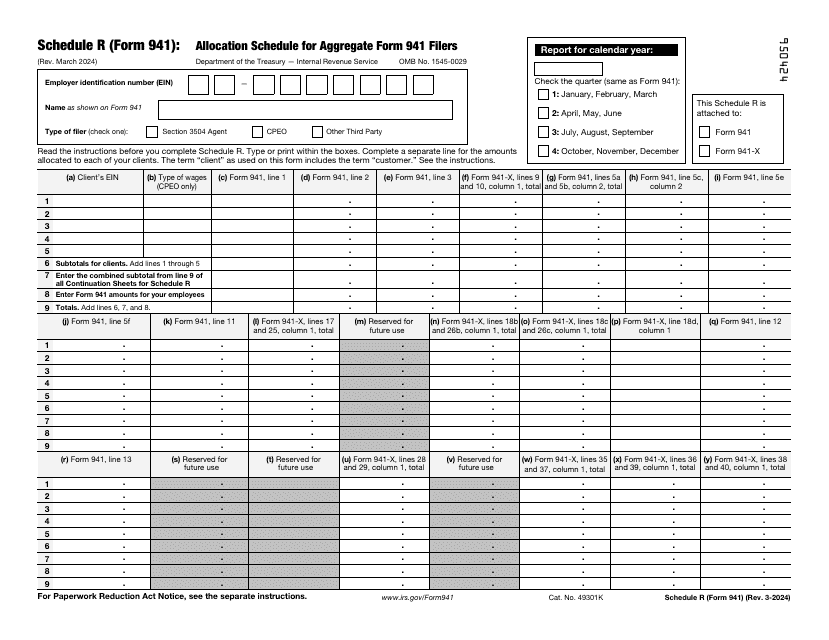

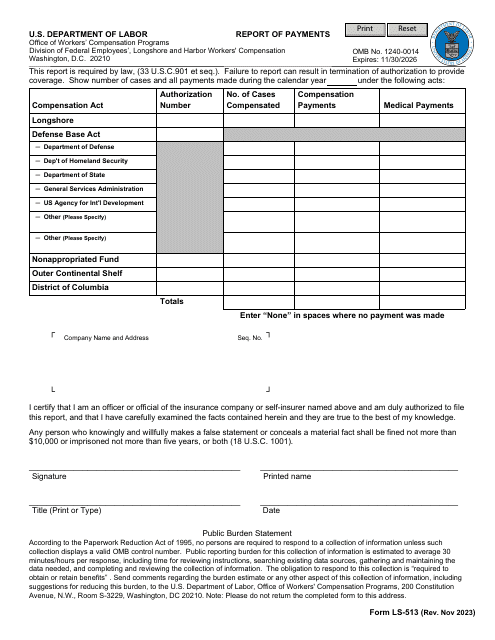

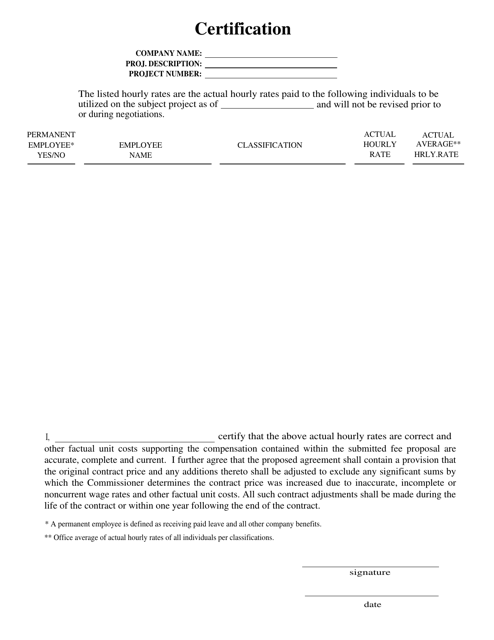

Compliance and Regulatory Support: Staying compliant with payroll regulations can be complex and overwhelming. Our team stays abreast of the latest regulatory changes and ensures that your payroll reports meet all necessary requirements. We will also assist you in completing any required tax forms accurately.

-

Customized Reporting Solutions: Every business has unique payroll reporting needs. We work closely with you to understand your specific requirements and tailor our services accordingly. Whether you need monthly, quarterly, or annual reports, we have the expertise to deliver.

-

Confidentiality and Data Security: We take the security of your payroll data seriously. Our systems are equipped with the latest cybersecurity measures to protect your sensitive information. You can trust us to handle your payroll reports with the utmost confidentiality.

-

Cost-Effective Solutions: Outsourcing your payroll reports can save you valuable time and resources. By entrusting us with your payroll reporting tasks, you can focus on core business activities and leave the complexities of payroll reporting to our experts.

Don't let payroll reporting become a burden for your business. Let our professional payroll report service handle all your reporting needs, ensuring accuracy, compliance, and peace of mind. Contact us today to learn more about how we can help streamline your payroll reporting process.

Documents:

38

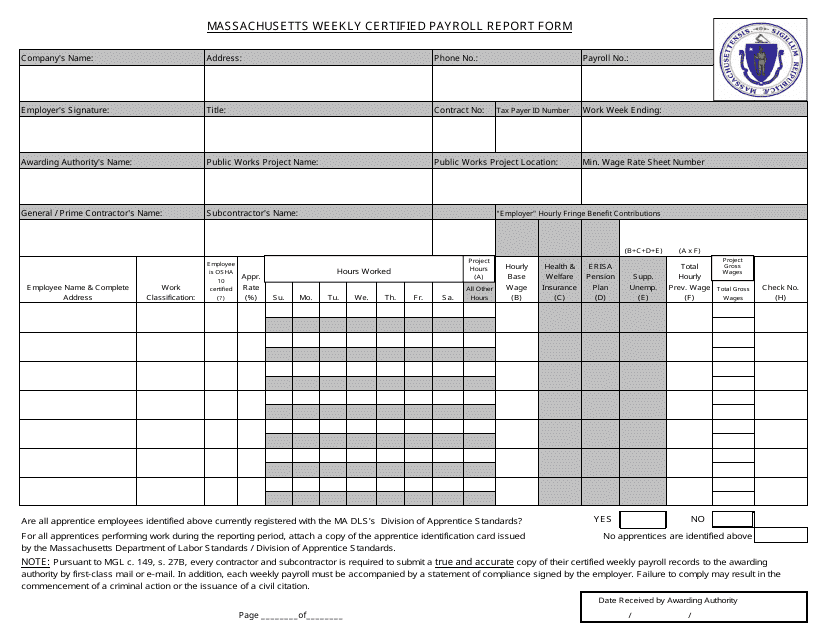

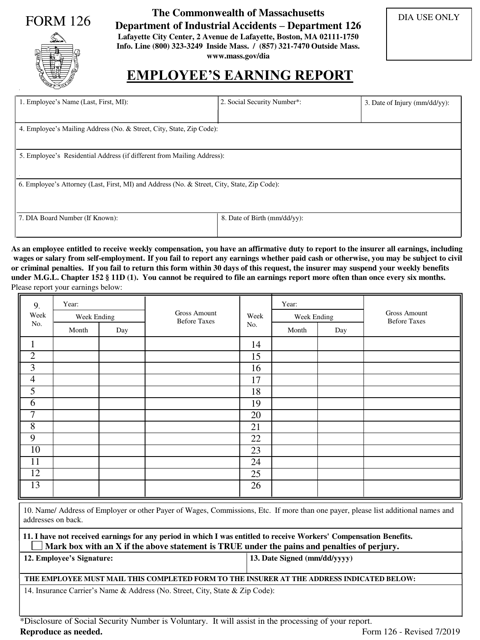

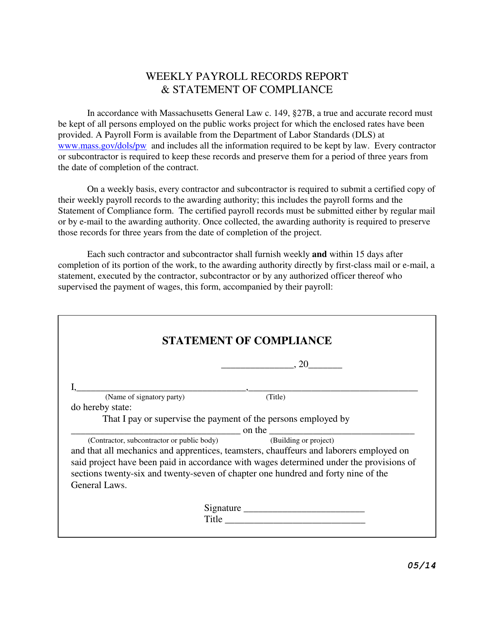

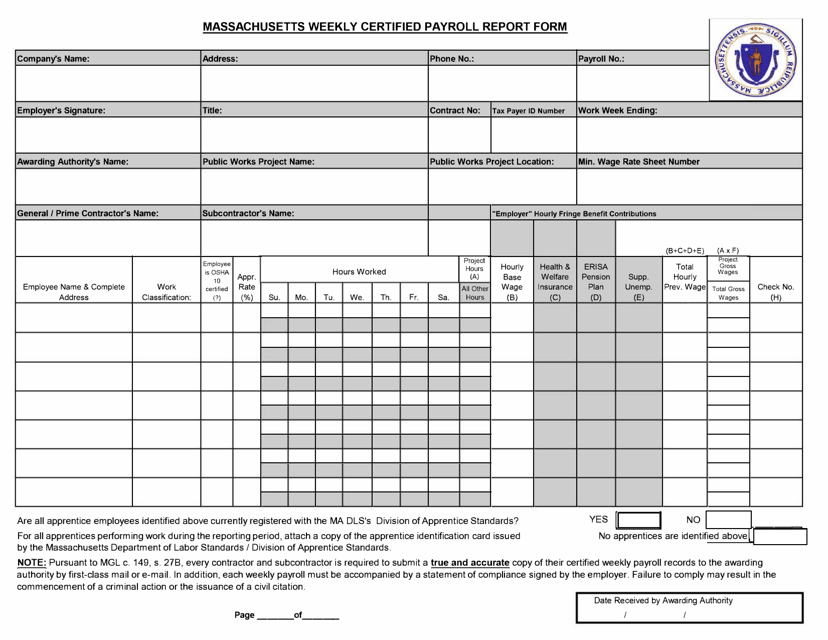

This form is used for reporting the weekly certified payroll in the state of Massachusetts. It is required for construction contractors to show details about the employees, wages, and hours worked on public works projects.

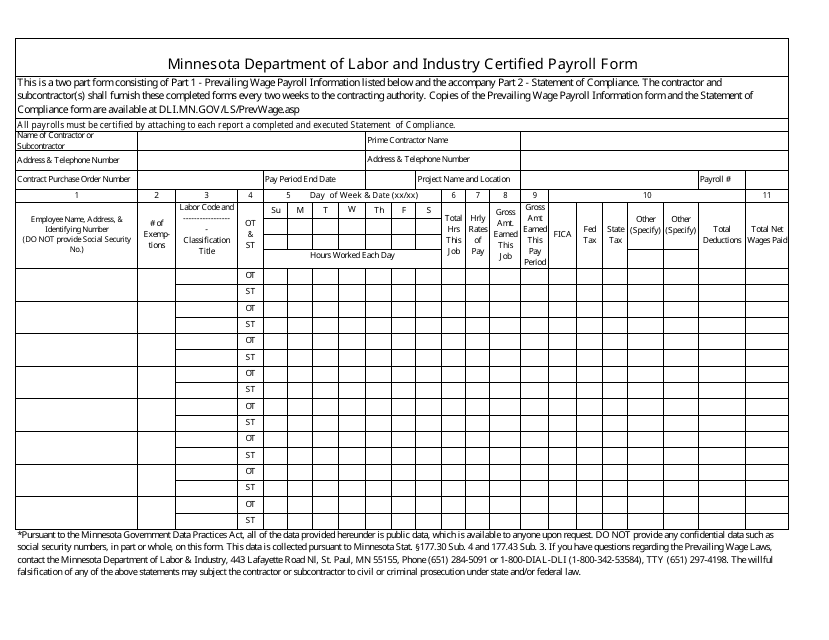

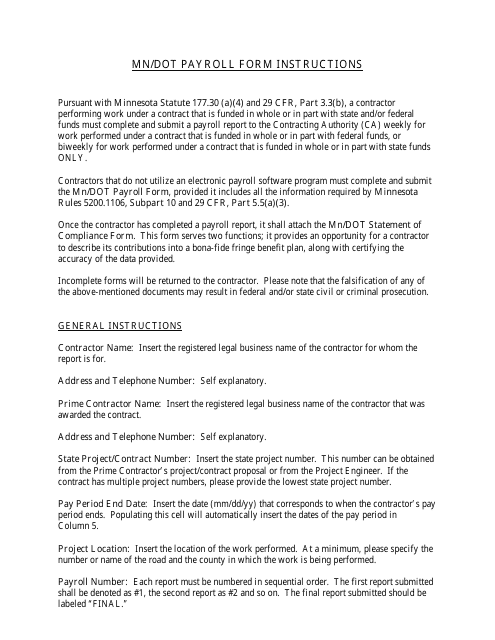

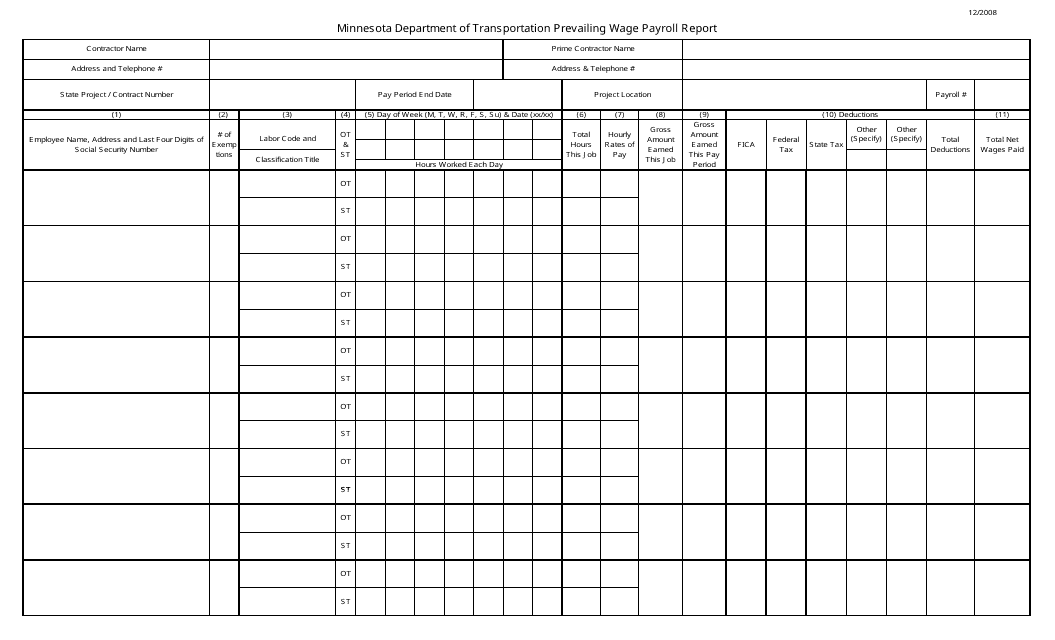

This Form is used for certified payroll reporting in the state of Minnesota. It helps ensure that contractors and subcontractors on public works projects comply with prevailing wage laws.

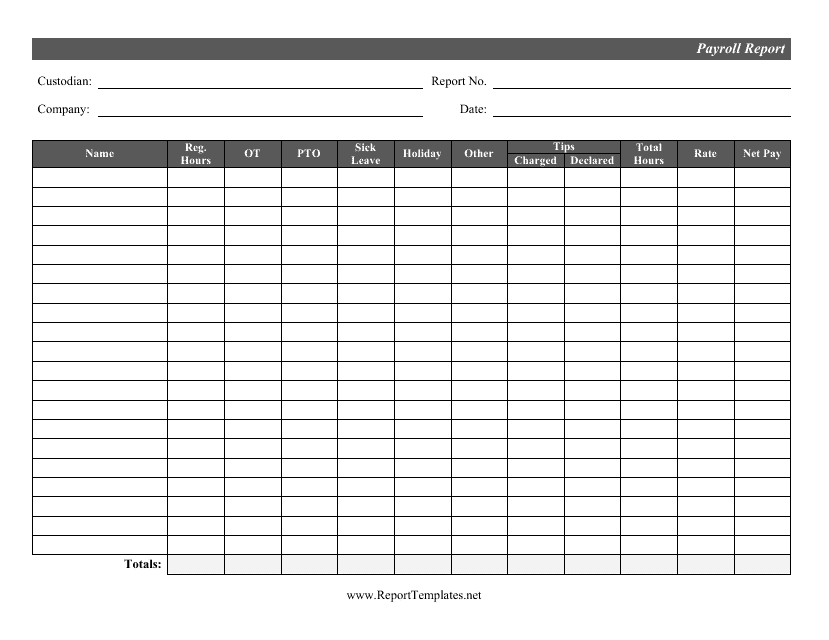

This template is used to create a report that summarizes employee wages, deductions, and net pay for a specific period of time. It helps businesses track and manage their payroll expenses.

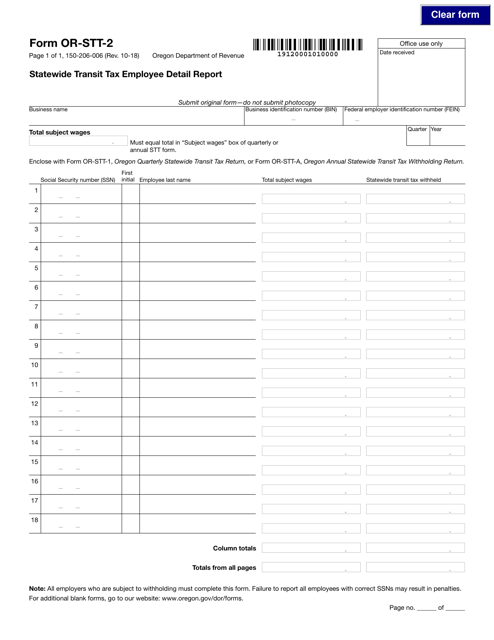

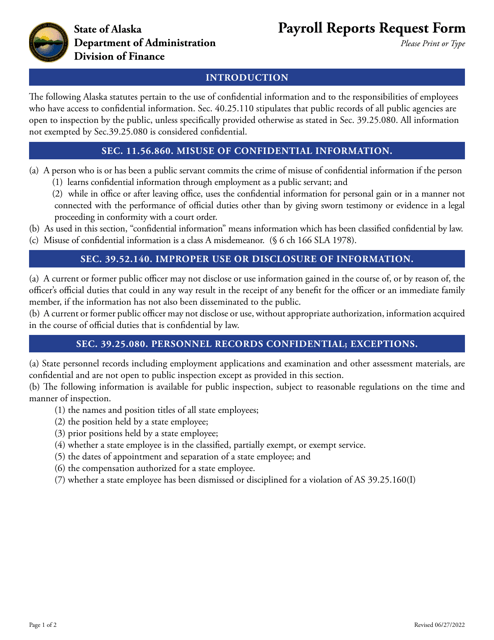

This form is used for reporting prevailing wages in the state of Minnesota. It provides instructions on how to accurately complete the Prevailing Wage Payroll Report.

This document is used to report the prevailing wage payroll information in Minnesota. It provides detailed information about the wages paid to employees working on public construction projects in the state.

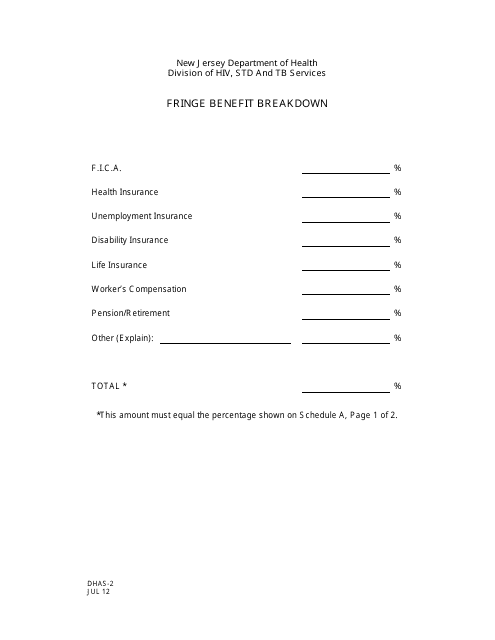

This form is used for reporting and providing a breakdown of fringe benefits in the state of New Jersey. It helps in understanding the various types of fringe benefits provided by an employer to their employees.

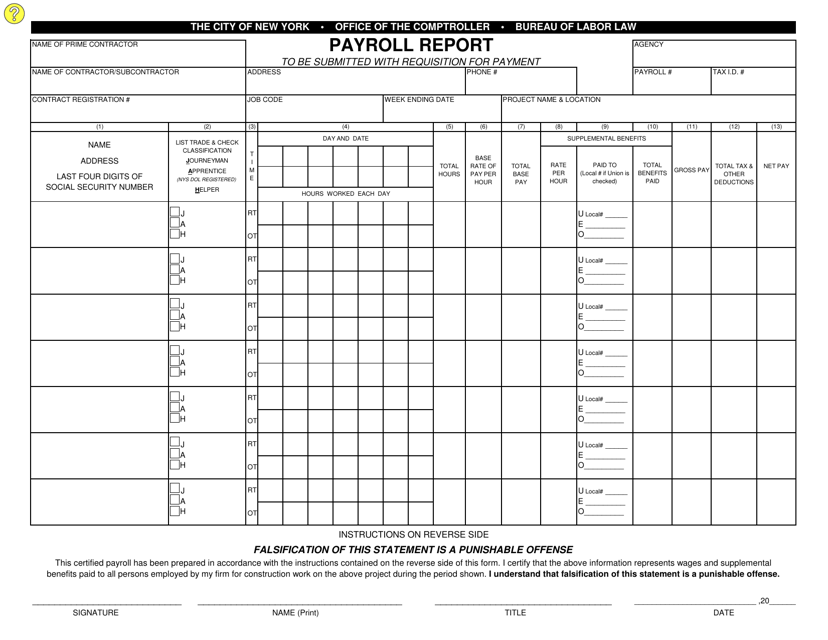

This Form is used for reporting payroll information for employees in New York City. It is required by employers to ensure compliance with local tax regulations and to calculate and pay the appropriate amount of taxes withheld from employee wages.

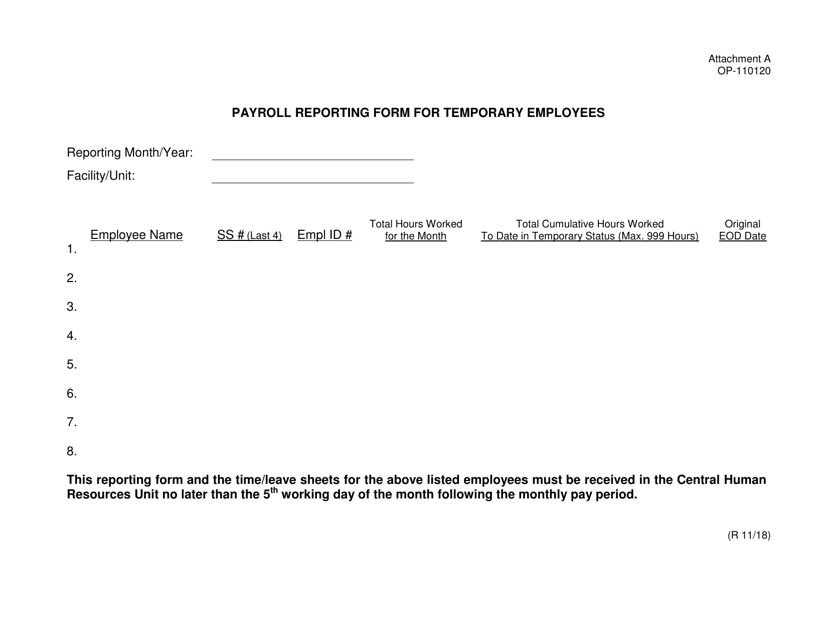

This Form is used for reporting payroll information for temporary employees in Oklahoma.

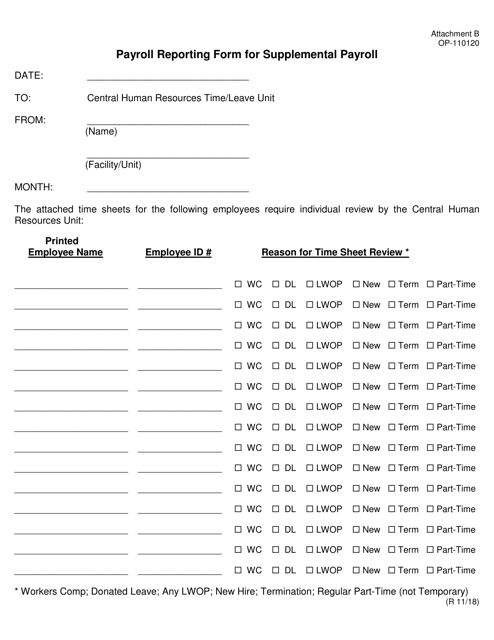

This Form is used for reporting supplemental payroll in Oklahoma.

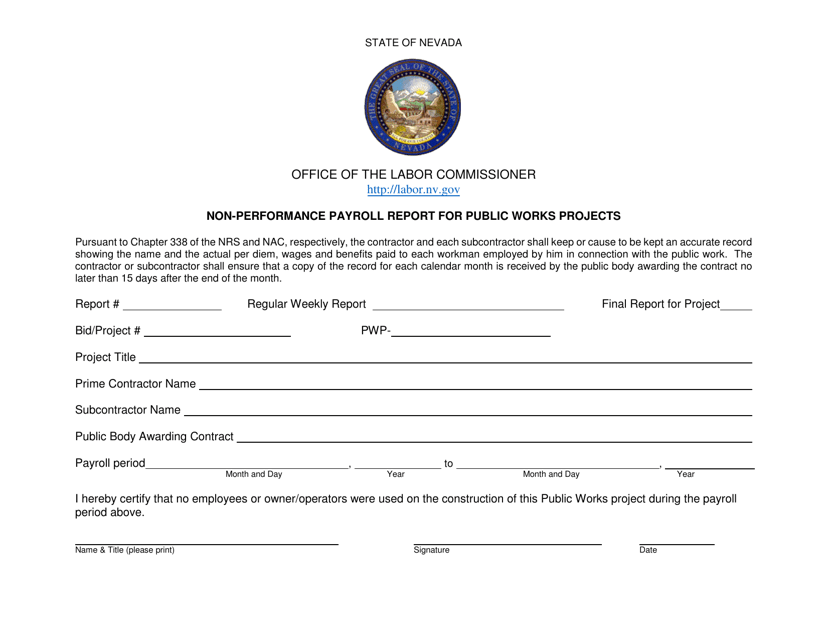

This document provides a report on the payroll of non-performance workers involved in public works projects in Nevada. It includes information about wages and hours worked.

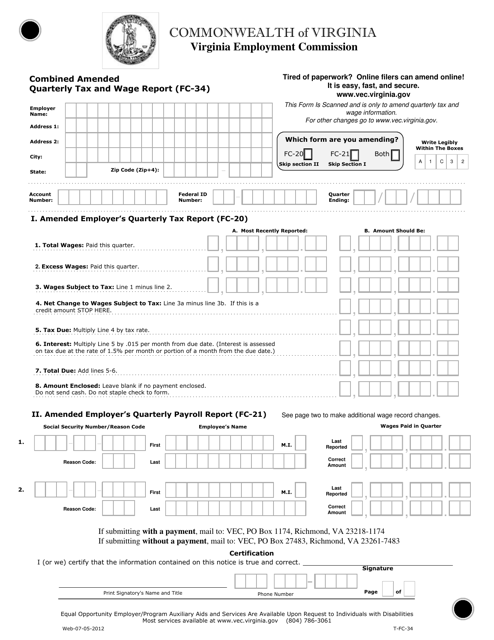

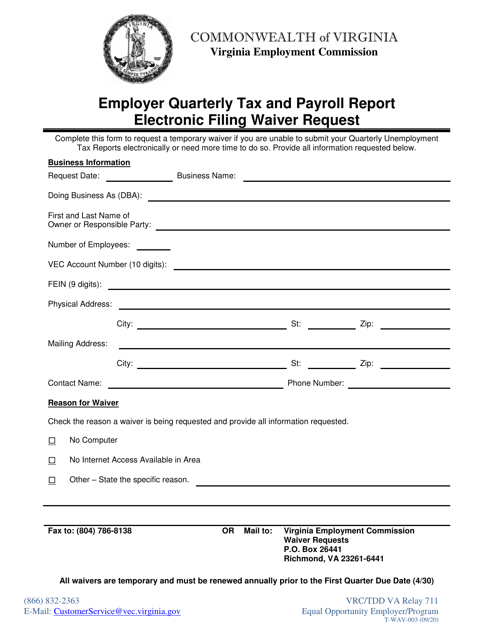

Form T-WAV-003 Employer Quarterly Tax and Payroll Report Electronic Filing Waiver Request - Virginia

This Form is used for requesting a waiver to electronically file the Employer Quarterly Tax and Payroll Report in Virginia.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

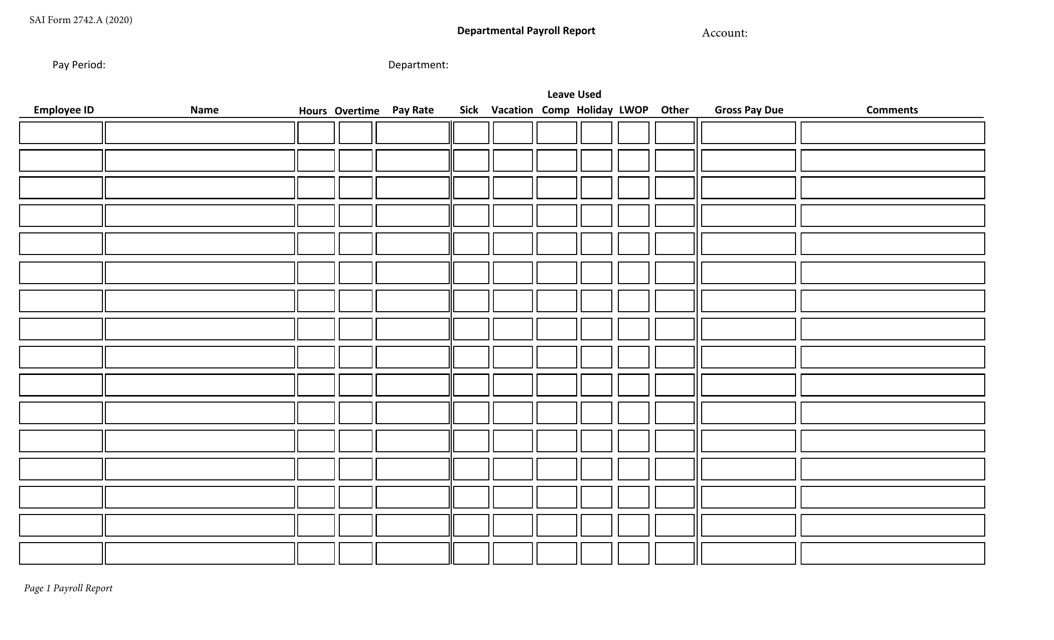

This form is used for reporting departmental payroll in the state of Oklahoma.

This form is used for reporting the wages and hours worked by employees on public works projects in Connecticut. It ensures that workers are paid the prevailing wage rates as required by law.

This form is used for submitting weekly certified payroll reports in the state of Massachusetts. It ensures that employees on public construction projects are paid the correct prevailing wages.

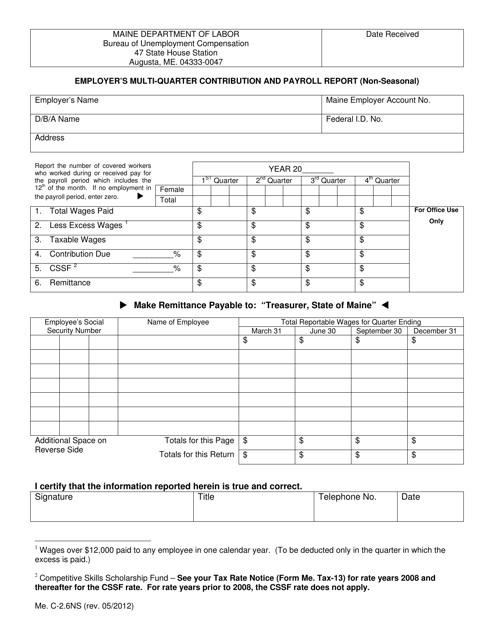

This Form is used for employers in Maine to report multi-quarter contributions and payroll for non-seasonal workers.

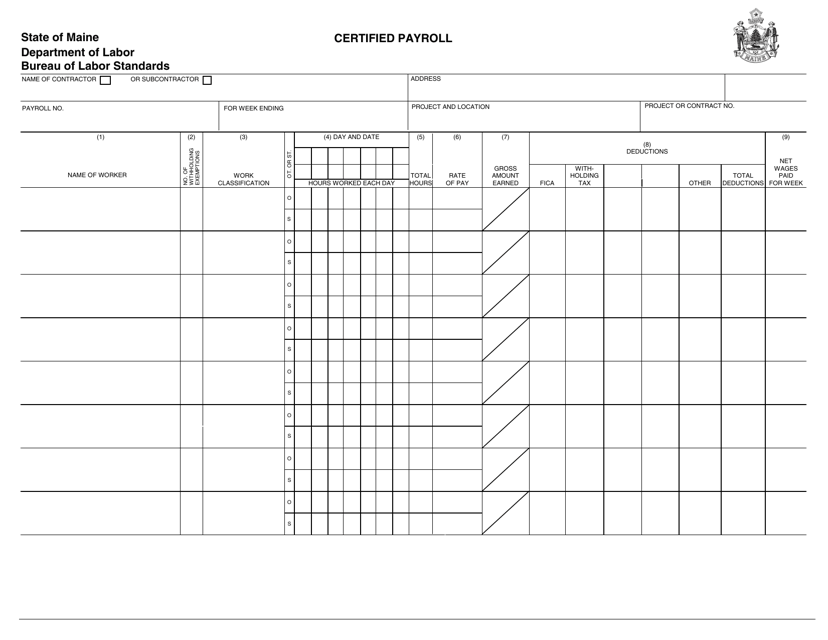

This document is used for certified payroll in the state of Maine. It provides a record of wages and benefits paid to employees on a specific project, ensuring compliance with prevailing wage laws.

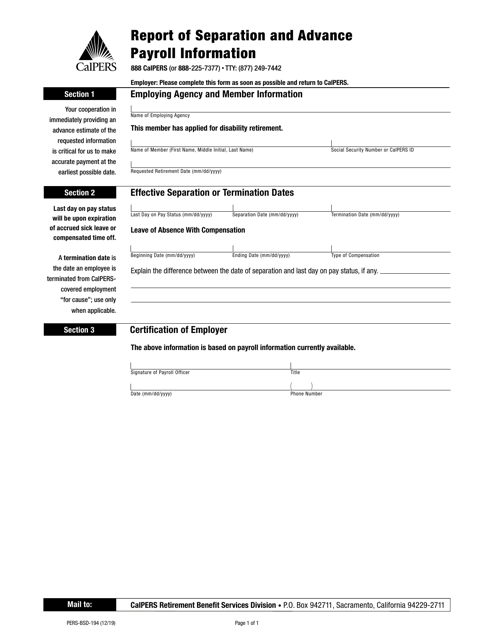

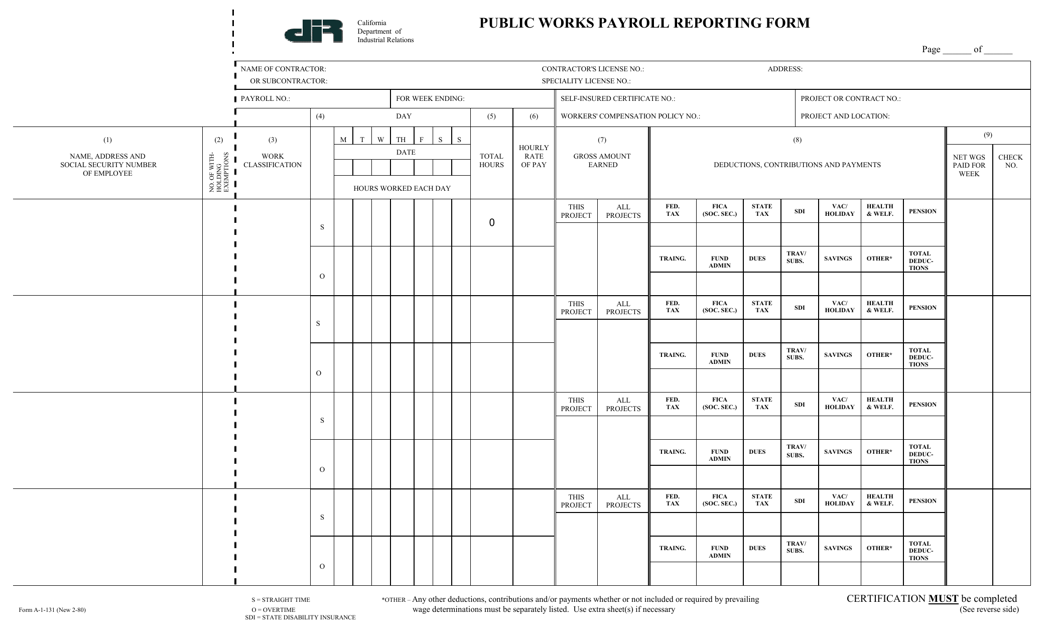

This form is used for reporting payroll information related to public works projects in the state of California. It is required by the California Department of Industrial Relations to ensure proper payment of wages on these projects.

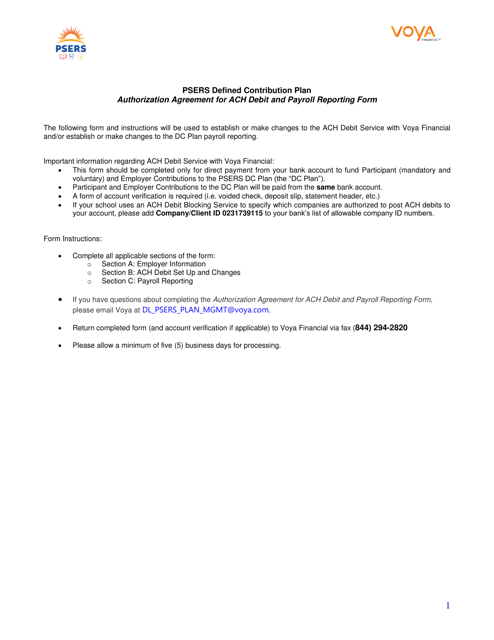

This form is used for authorizing ACH debits and payroll reporting with Voya in Pennsylvania.

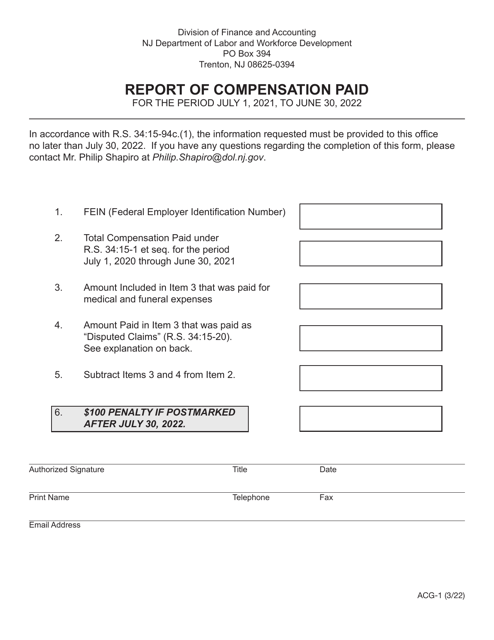

This form is used for reporting compensation paid in the state of New Jersey.

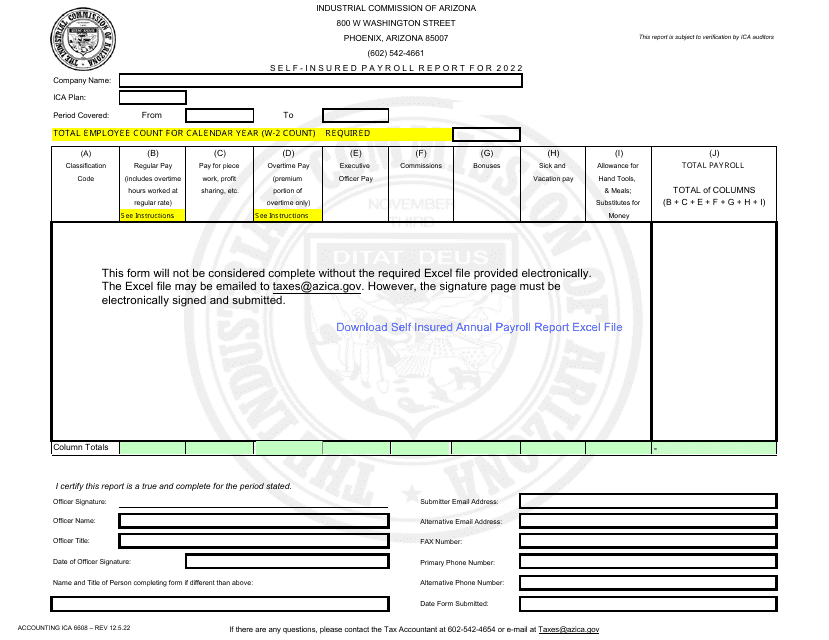

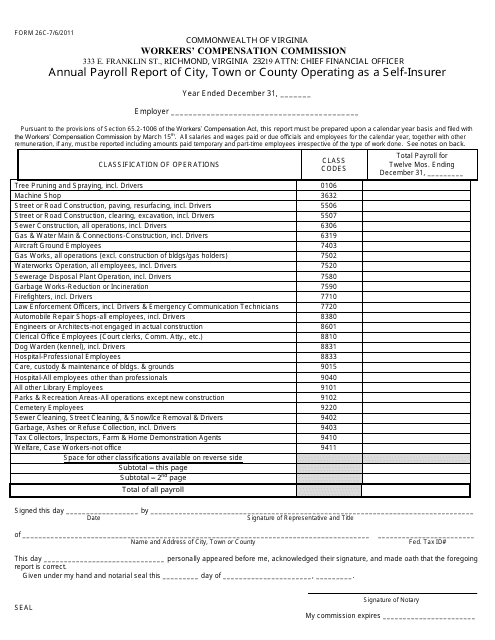

This form is used for reporting the annual payroll of a city, town, or county that operates as a self-insurer in Virginia. It provides information on the wages paid to employees and helps in determining insurance premiums.

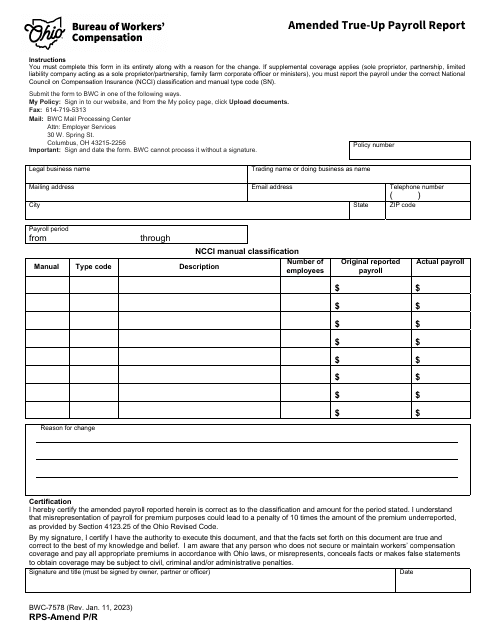

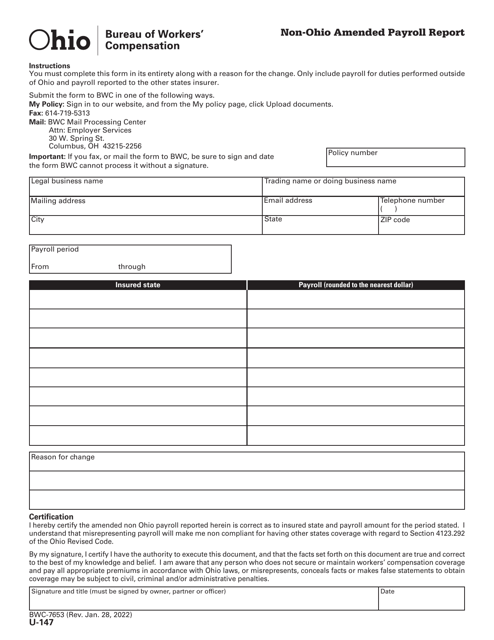

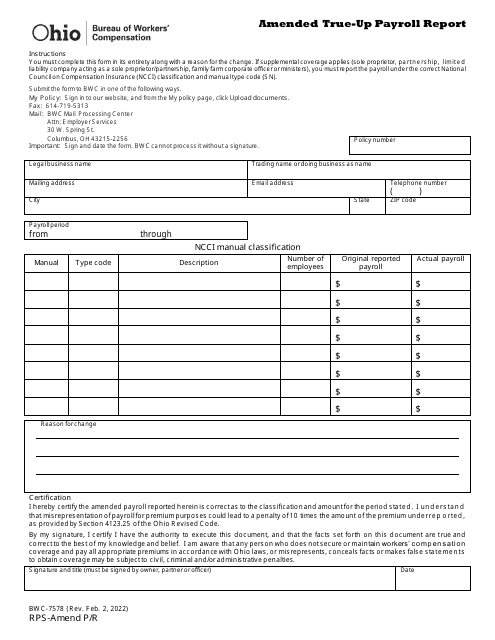

This Form is used for submitting an amended true-up payroll report for Ohio. It is used to correct any errors or omissions in the original report.

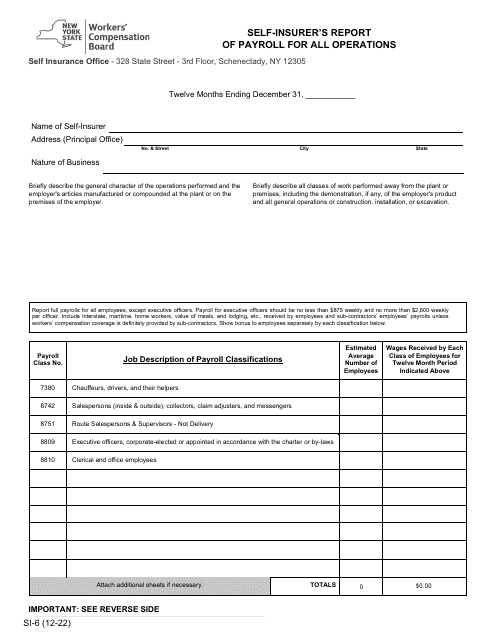

This Form is used for self-insurers in New York to report their payroll for all operations.