Commercial Insurance Templates

Commercial Insurance: Protect Your Business with Confidence

Safeguarding your business against unexpected risks is crucial for its long-term success. Commercial insurance provides the financial protection and peace of mind that every business owner needs. Whether you are a small start-up or a large corporation, having the right commercial insurance coverage ensures that you are prepared for potential losses or liabilities that may arise.

At Commercial Insurance, we understand that every business has unique needs and risks. That is why we offer a wide range of insurance options tailored to suit your specific requirements. Our team of experienced professionals will work closely with you to assess your business's risks and develop a comprehensive insurance plan that provides the coverage you need, at a price you can afford.

Our commercial insurance policies cover a variety of areas including property damage, general liability, workers' compensation, and business interruption. With our flexible options, you can customize your coverage to protect your assets, employees, and customers. Whether you need coverage for your physical assets, such as buildings, equipment, or inventory, or you require liability insurance to protect against lawsuits and claims, our commercial insurance policies have got you covered.

We understand that navigating the world of commercial insurance can be overwhelming, with complex forms and terminology. That is why we have simplified the process for you. Our streamlined application process ensures that you can get a quote and purchase your policy quickly and easily. We also offer dedicated customer support to answer any questions or concerns you may have throughout the process.

So why wait? Protect your business today with the commercial insurance coverage it deserves. Our team is ready to assist you in finding the perfect insurance solution that meets your specific needs. Contact us now to learn more about our comprehensive commercial insurance options.

Alternate: Secure Your Business's Future with Commercial Insurers Alternate: Commercial Insurance Forms Made Easy - Protect Your Business Today

Documents:

11

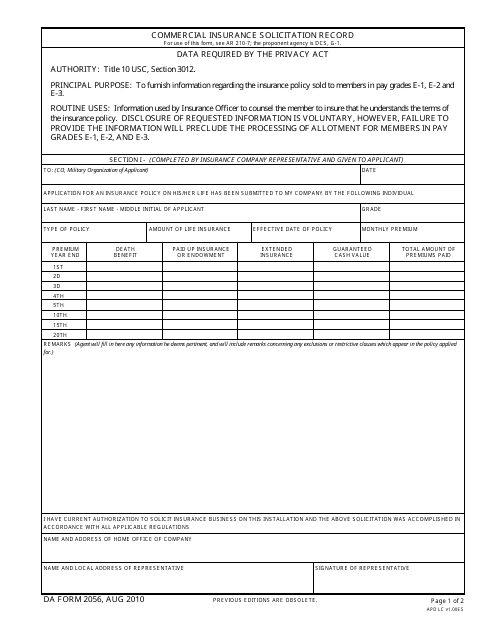

This form is used for documenting commercial insurance solicitations. It helps record details of the solicitation process for future reference.

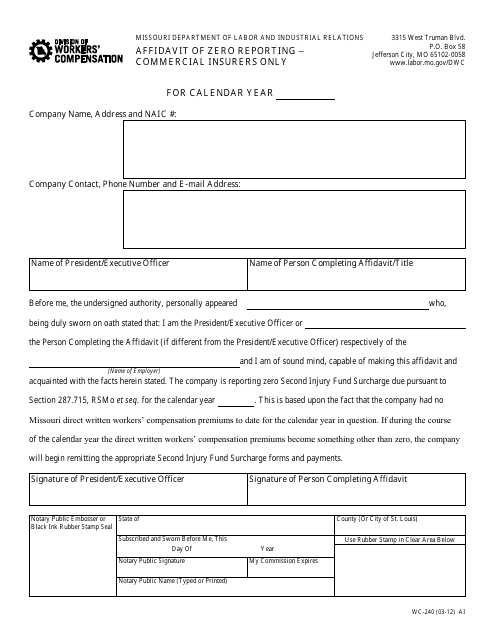

This form is used for commercial insurers in Missouri to provide an affidavit of zero reporting. It is a requirement to report zero activity for certain insurance lines.

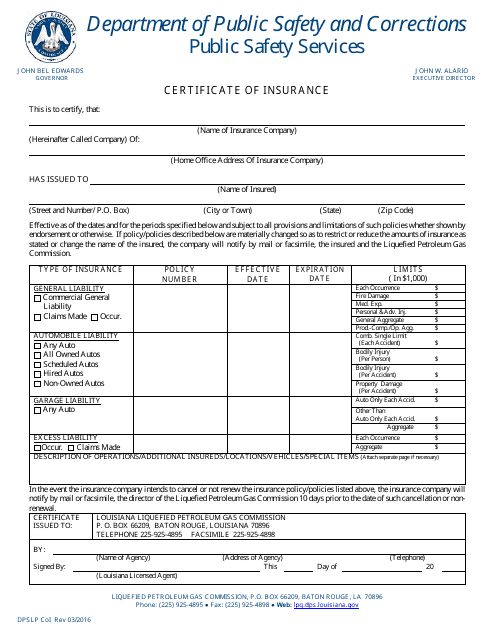

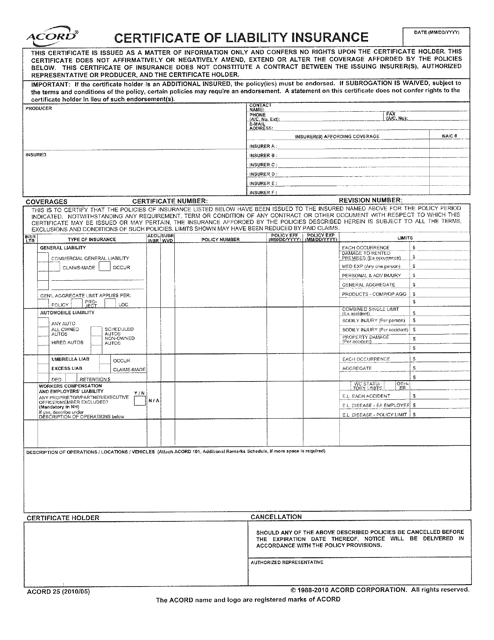

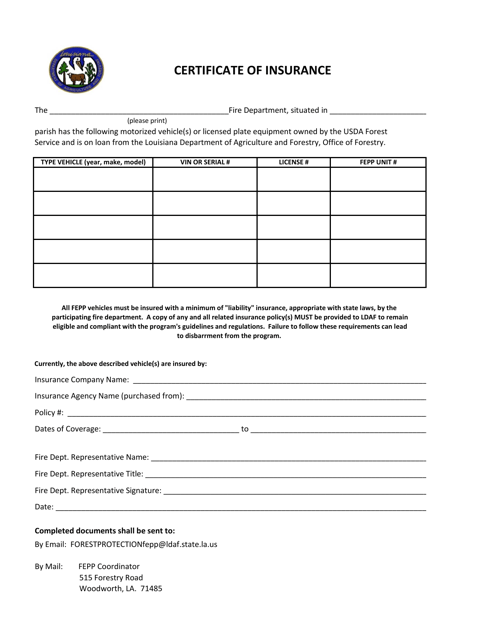

This form is used for obtaining a Certificate of Insurance (COI) in the state of Louisiana. It serves as proof of insurance coverage for certain purposes.

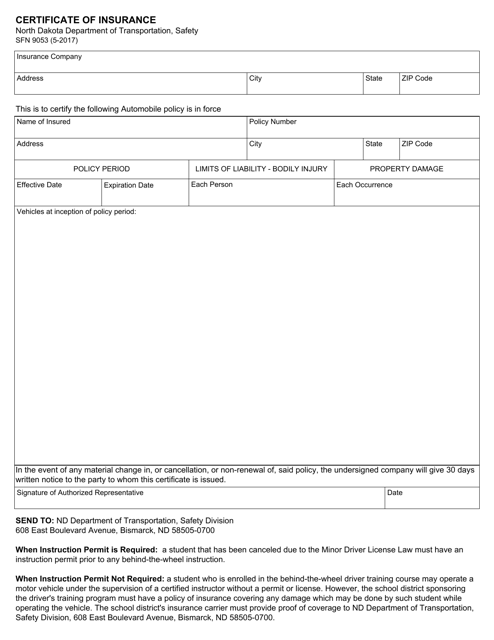

This form is used for obtaining a Certificate of Insurance in North Dakota. It provides documentation that proves the existence of insurance coverage for a particular individual or entity.

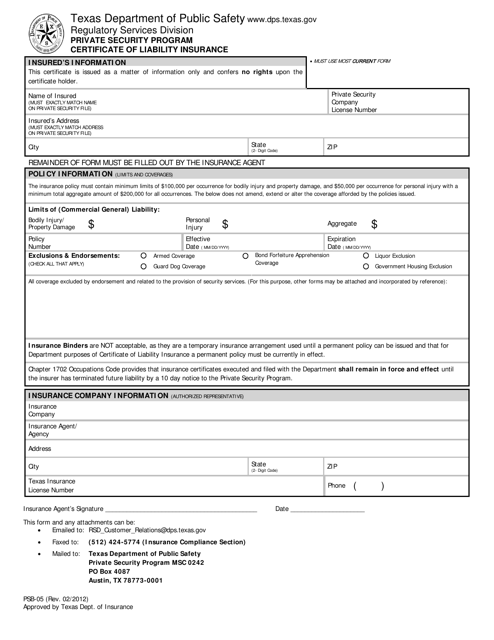

This form is used to certify that an individual or business has liability insurance coverage in Texas. It is required in certain situations, such as when applying for a professional license or bidding on a government contract.

This form is used for providing proof of liability insurance coverage in the state of Texas. It is commonly used by businesses to demonstrate that they have adequate insurance protection in place.

This document serves as proof that an individual or organization in Louisiana has a valid insurance policy. It outlines the coverage and terms of the insurance.

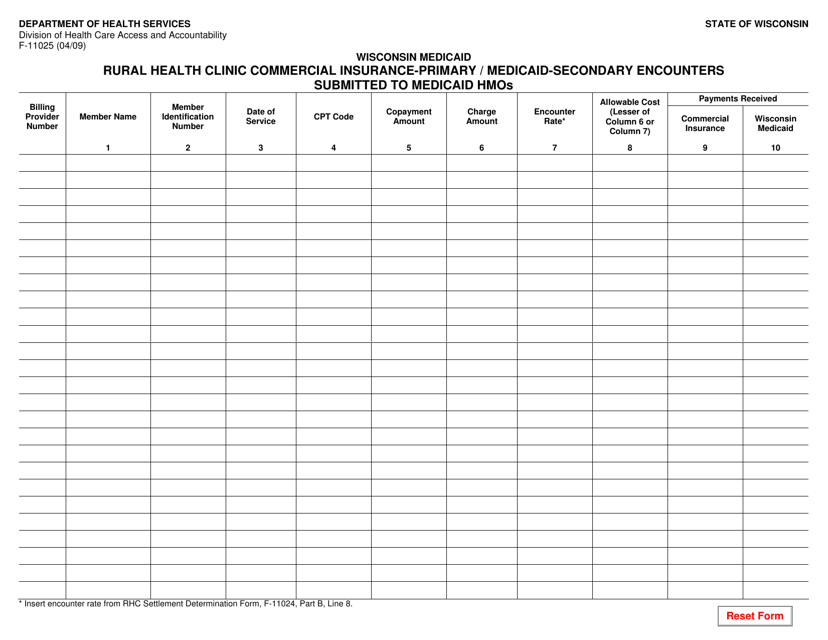

This type of document is used for submitting encounters from rural health clinics to Medicaid HMOs in Wisconsin.

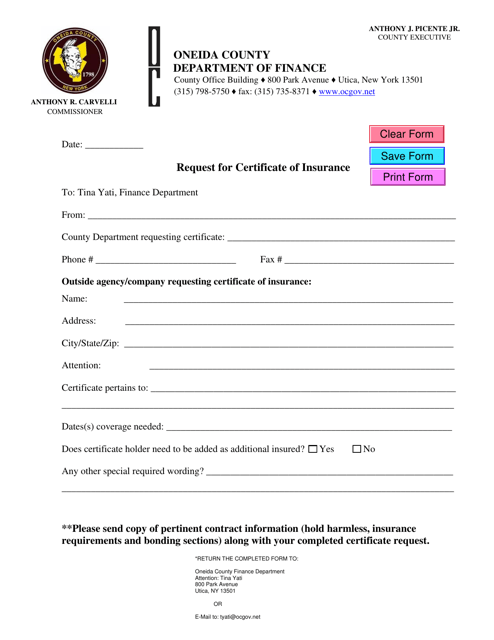

This type of document is a request for a certificate of insurance specific to Oneida County, New York. It is used to formally ask for proof of insurance coverage.

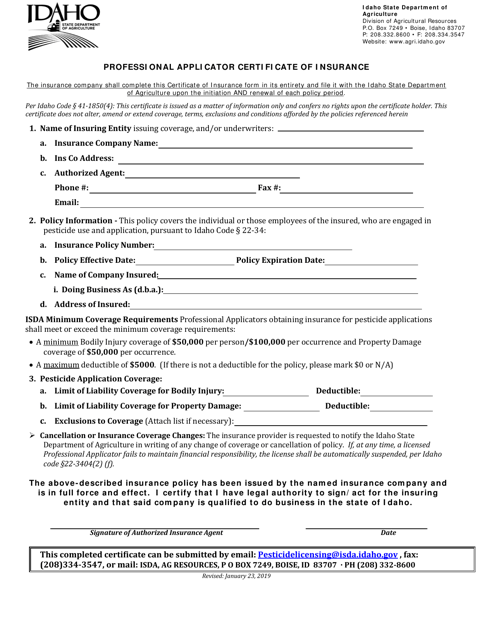

This document is used to verify that a professional applicator in Idaho has the necessary insurance coverage.

This document outlines the insurance requirements that must be met when applying for Small Business Administration (SBA) loans. It details the types of insurance coverage that businesses must have in order to qualify for an SBA loan and protect their assets.