Taxable Supplies Templates

Are you looking for information on taxable supplies? Look no further! Here, you can find all the details you need about taxable supplies, also referred to as taxable supply.

Taxable supplies are goods or services that are subject to taxation. These supplies are subject to sales tax or value-added tax (VAT), depending on the country or region. Understanding taxable supplies is essential for individuals and businesses alike to ensure compliance with tax regulations.

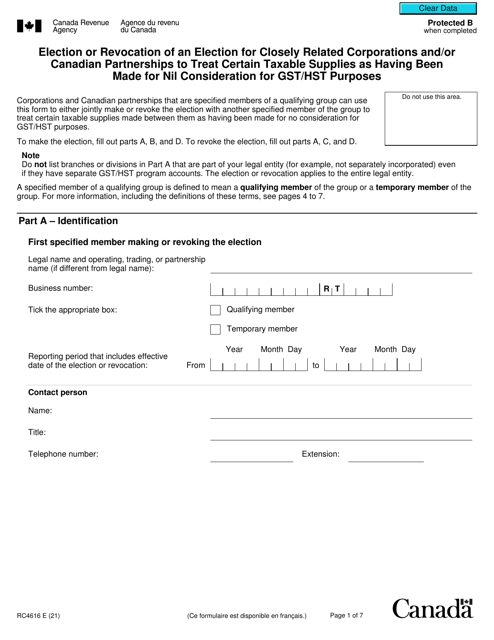

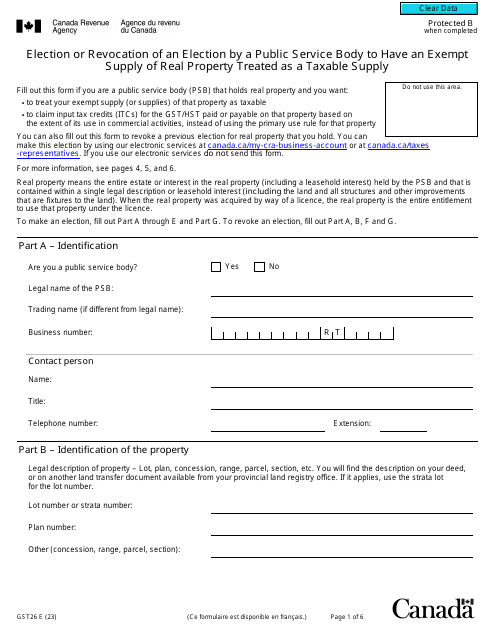

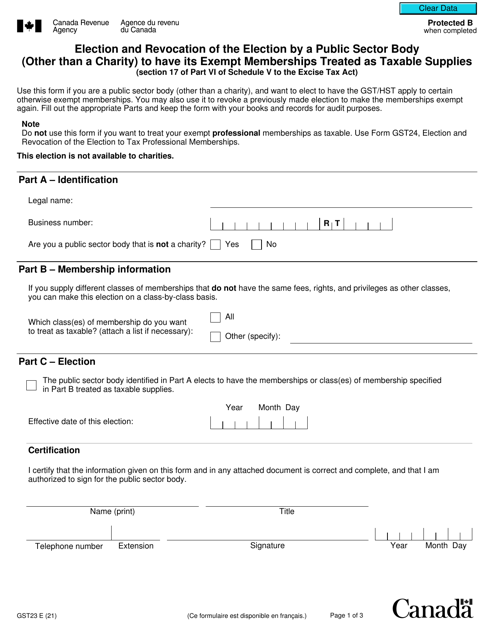

In Canada, there are various forms and elections related to taxable supplies. For instance, the Form GST23 enables public sector bodies, excluding charities, to elect or revoke the election to have their exempt memberships treated as taxable supplies. Another form, the Form RC4616, is used for closely related corporations and/or Canadian partnerships to treat certain taxable supplies as having been made for nil consideration for GST/HST purposes.

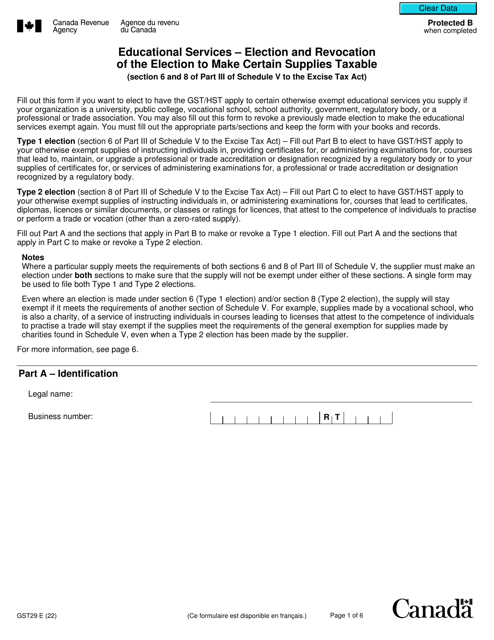

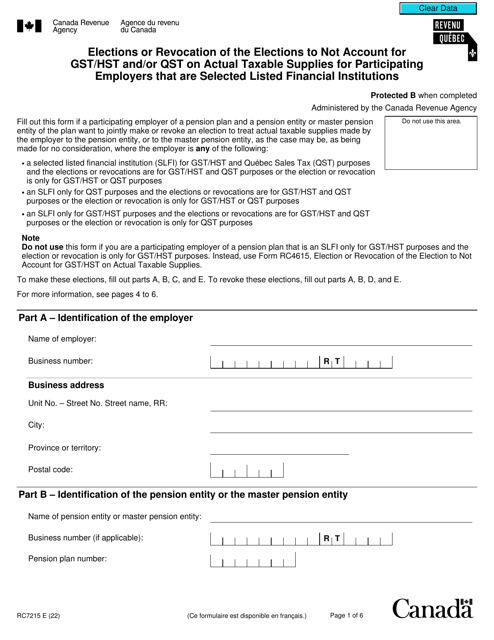

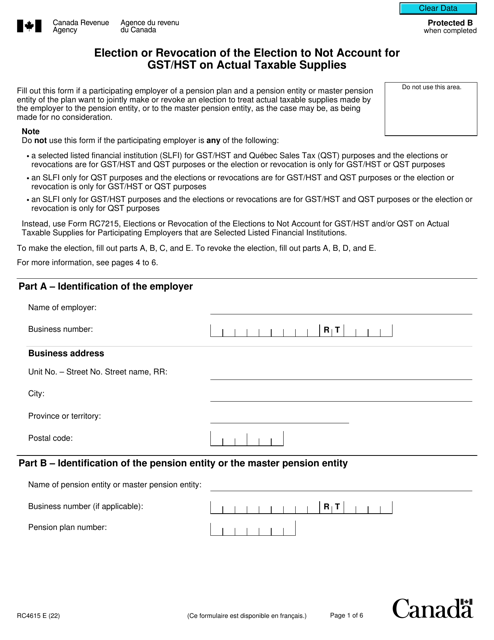

If you're a participating employer who is a selected listed financial institution, the Form RC7215 allows you to make elections or revoke elections to not account for GST/HST and QST on actual taxable supplies. Additionally, educational service providers can use Form GST29 to make elections or revoke elections to make certain supplies taxable.

These examples show the importance of understanding taxable supplies and the various elections and forms associated with them. Ensuring compliance and accurate reporting of taxable supplies is crucial for businesses and individuals to avoid penalties or legal issues.

If you need more information about taxable supplies or related forms and elections, explore our website to find all the resources you need. Our goal is to provide you with accurate and reliable information to help you navigate the world of taxable supplies with ease.

Documents:

13