Tax Filing Deadline Templates

Are you feeling overwhelmed by the upcoming tax filing deadline? You're not alone! It can be a stressful time for individuals and businesses alike. But fear not, we're here to help. Our comprehensive collection of tax filing deadline resources and information will ensure that you stay ahead of the game and meet all your tax obligations on time.

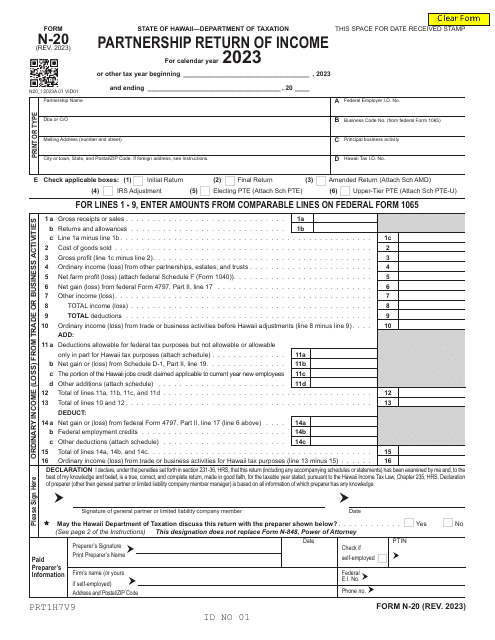

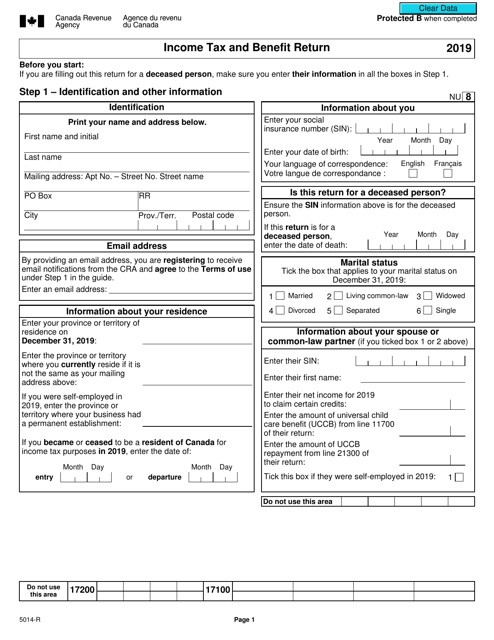

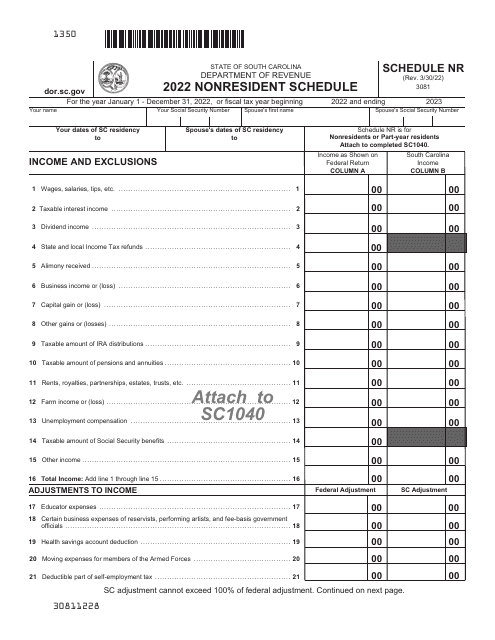

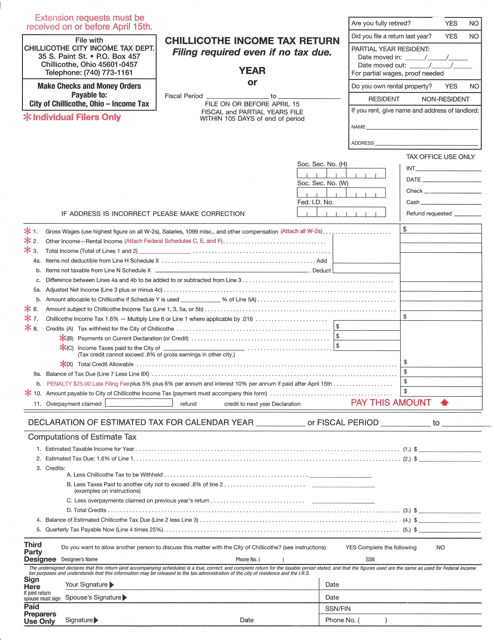

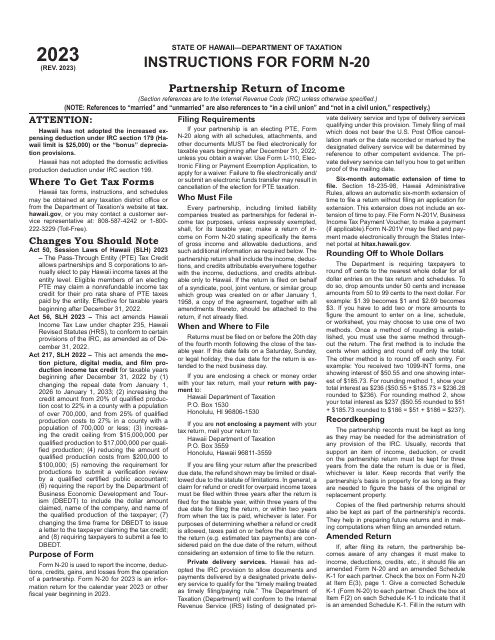

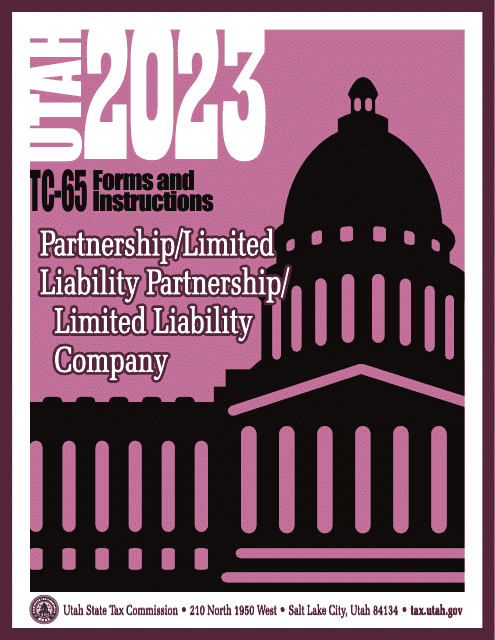

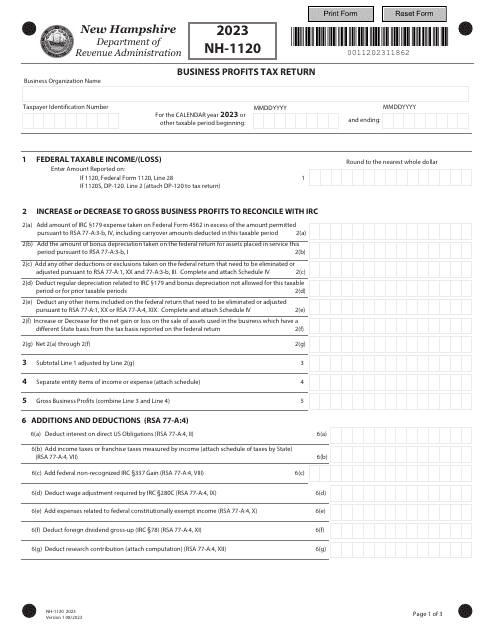

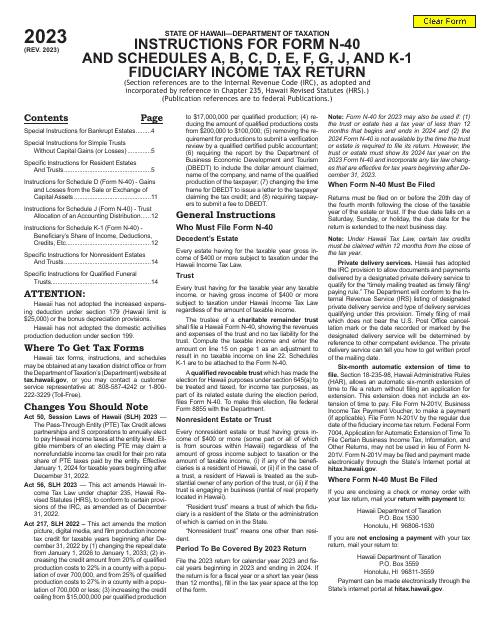

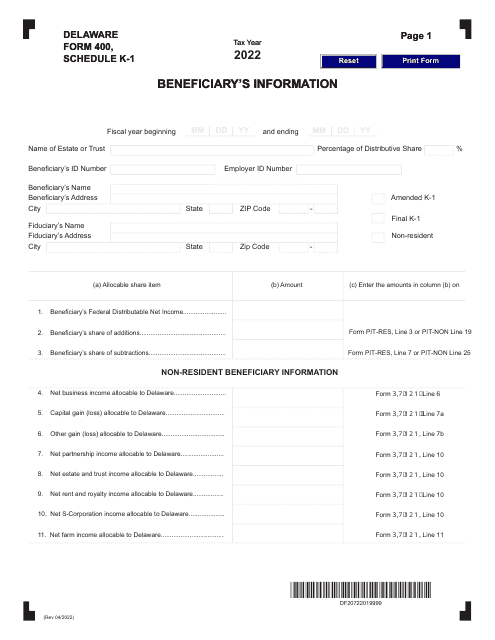

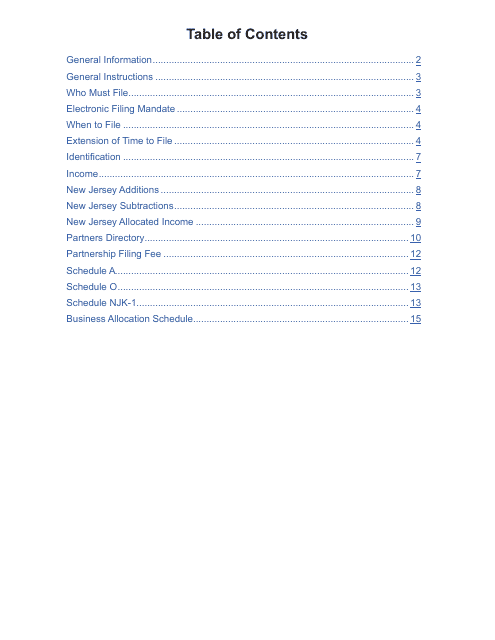

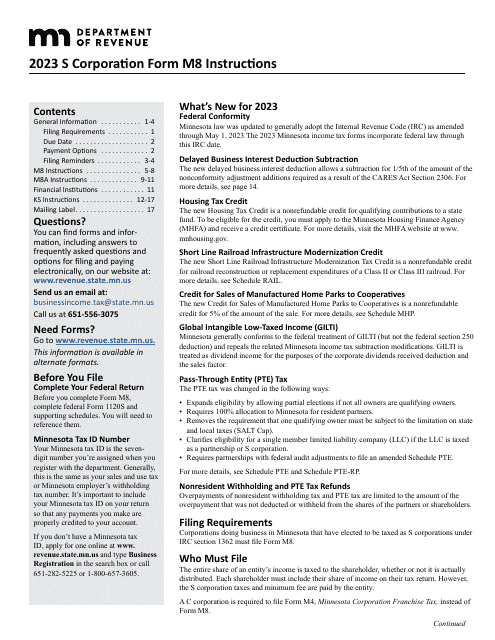

Whether you're a resident of Chillicothe, Ohio, or a business owner in New Hampshire, our database includes all the necessary forms and instructions to complete your tax returns accurately. Looking to file as a partnership or limited liability company in Utah? We've got you covered with our step-by-step instructions for Form TC-65. And if you're an S Corporation in Minnesota, you'll find all the guidance you need in our detailed instructions for Form M8.

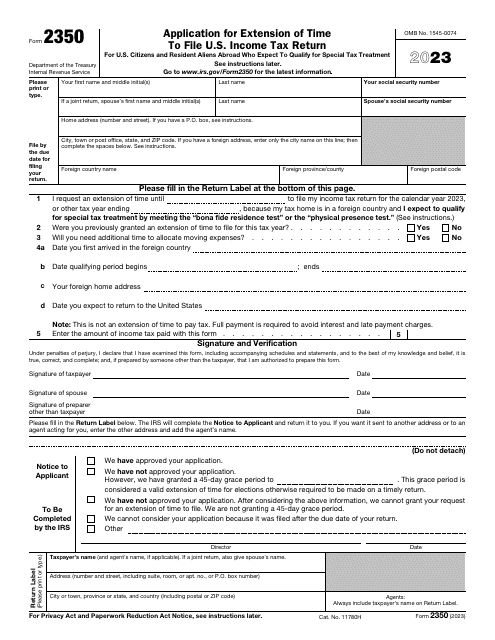

But what if you just need a little more time to gather your documents and complete your tax return? No worries! We also have resources for filing an extension. Our collection includes IRS Form 2350, the Application for Extension of Time to File U.S. Income Tax Return, which will grant you extra time to ensure your taxes are done right.

Don't let the tax filing deadline sneak up on you. Visit our website today and take advantage of our comprehensive tax filing deadline resources. With our assistance, you'll have all the necessary tools and information to meet your tax obligations with confidence and ease.

Documents:

24

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

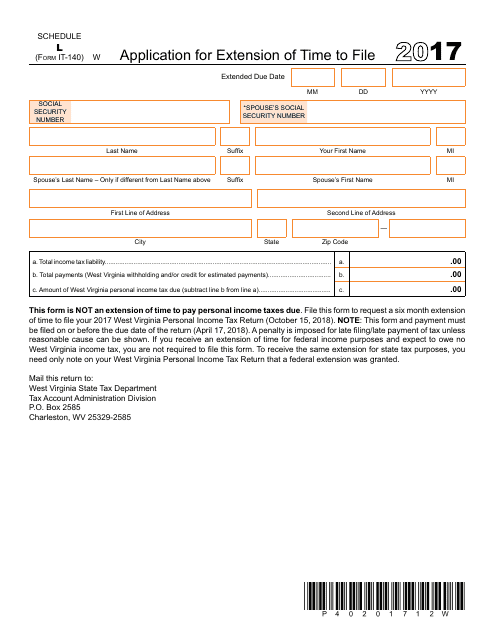

This form is used for applying for an extension of time to file your West Virginia state income tax return, Form IT-140.

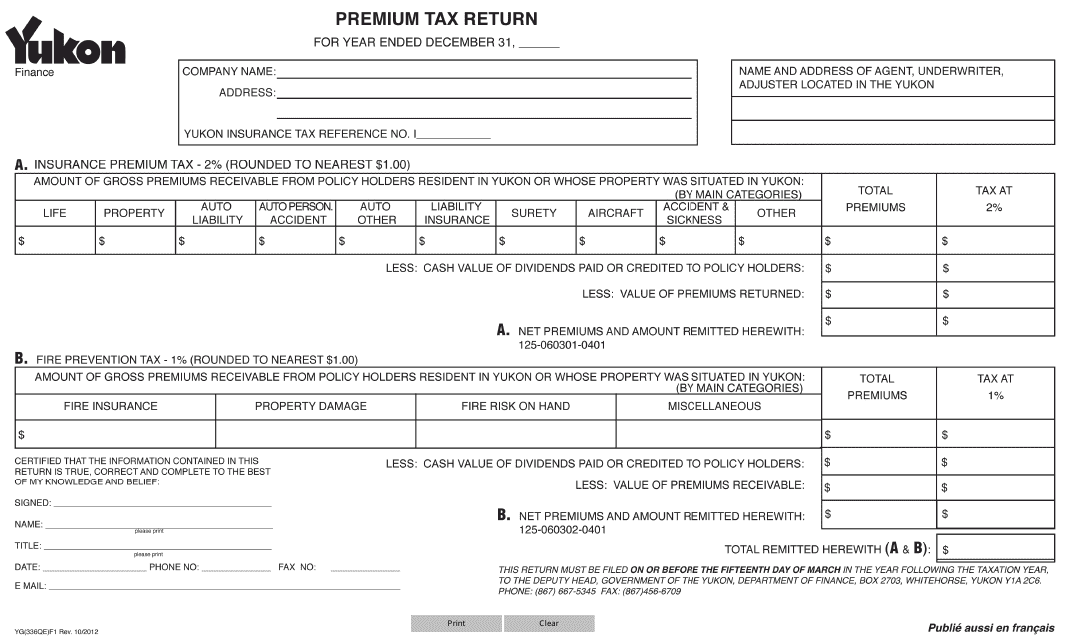

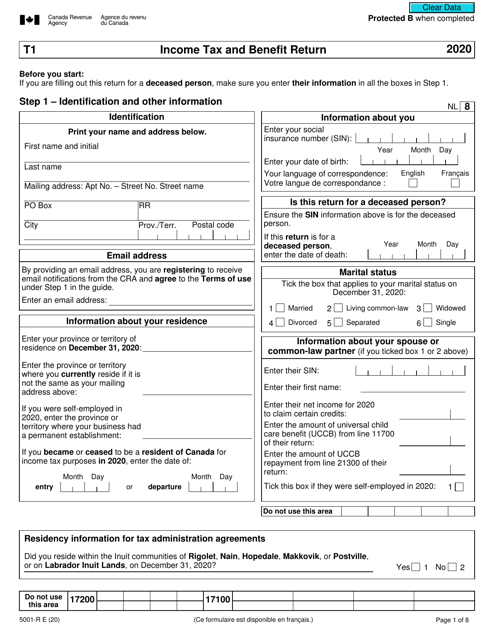

This form is used for filing premium tax returns in Yukon, Canada.

This document is used for filing your income tax return with the City of Chillicothe, Ohio.

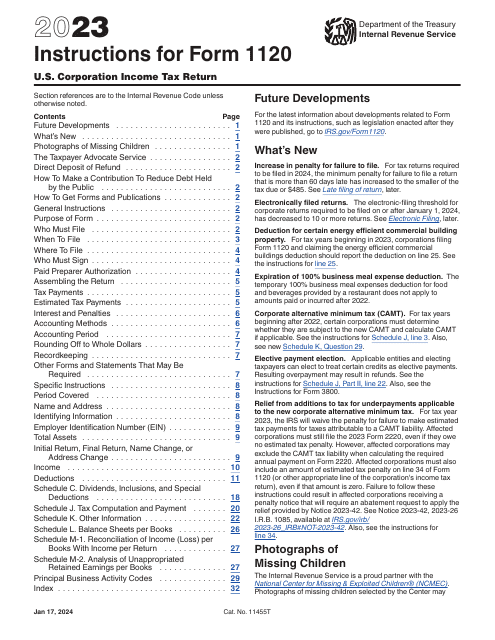

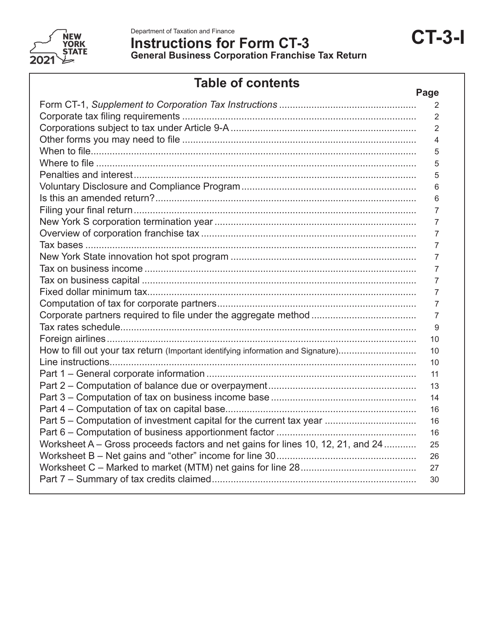

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

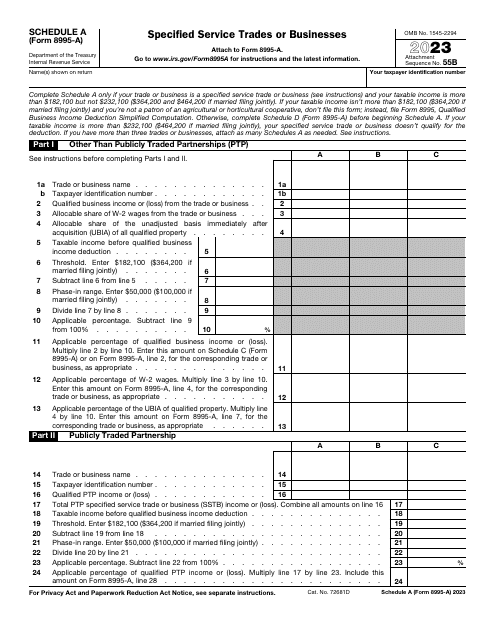

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

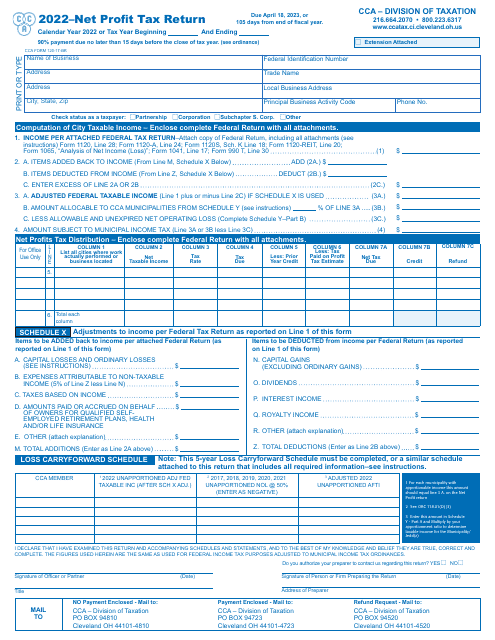

This form is used for filing the net profit tax return with the City of Cleveland, Ohio.