Disbursement Schedule Templates

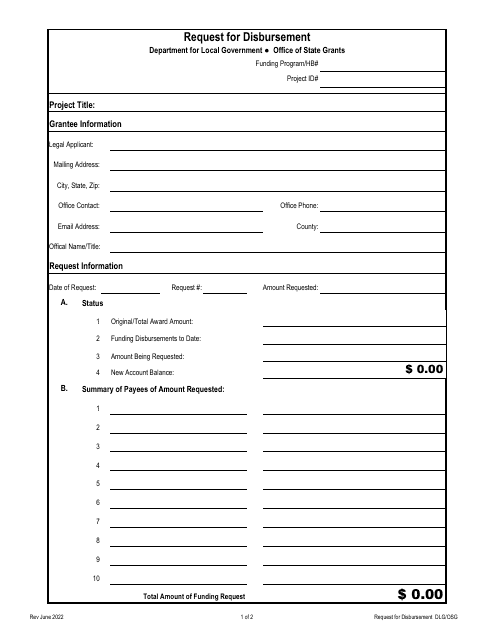

A disbursement schedule, also known as a disbursement schedule template or a disbursements schedule, is a document that outlines the timing and distribution of funds. It provides a clear breakdown of when and how funds will be disbursed for a specific purpose or project. This schedule serves as a valuable tool for maintaining financial organization and accountability.

Whether you are a business owner, project manager, or individual handling finances, having a disbursement schedule can greatly streamline the disbursement process. It helps ensure that funds are allocated appropriately and that all parties involved are aware of the disbursement timeline.

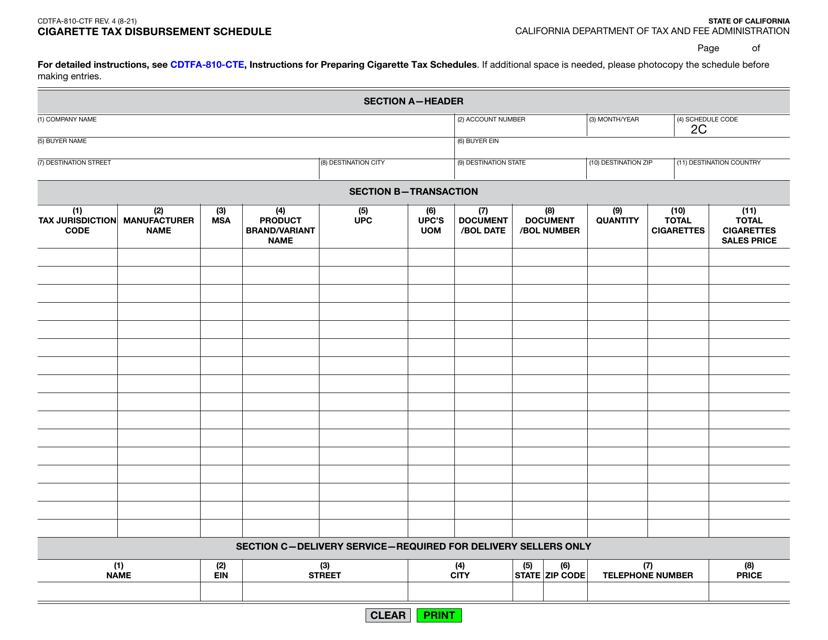

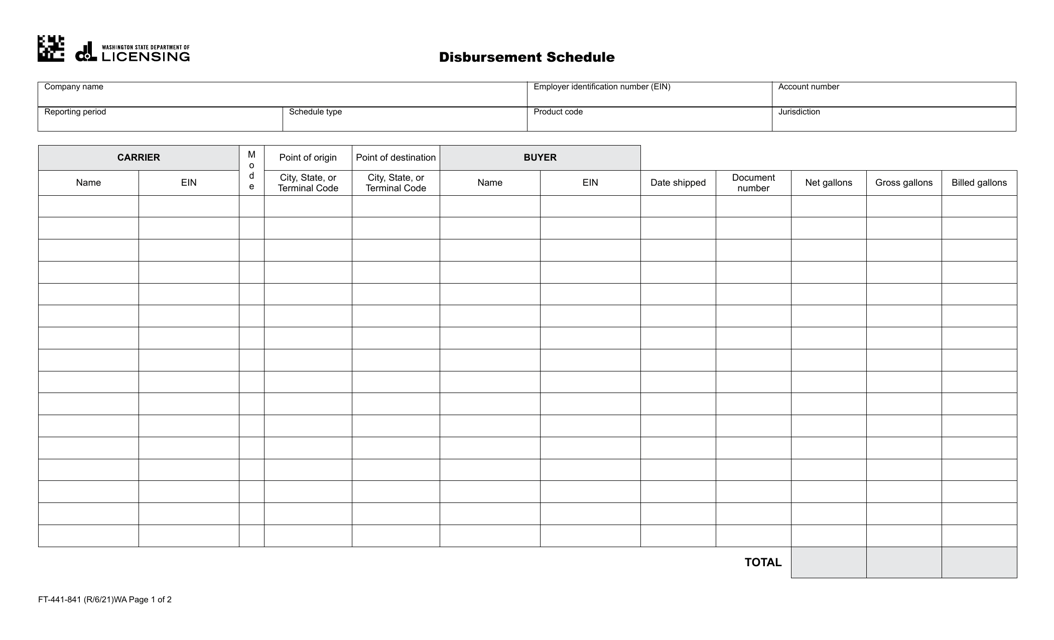

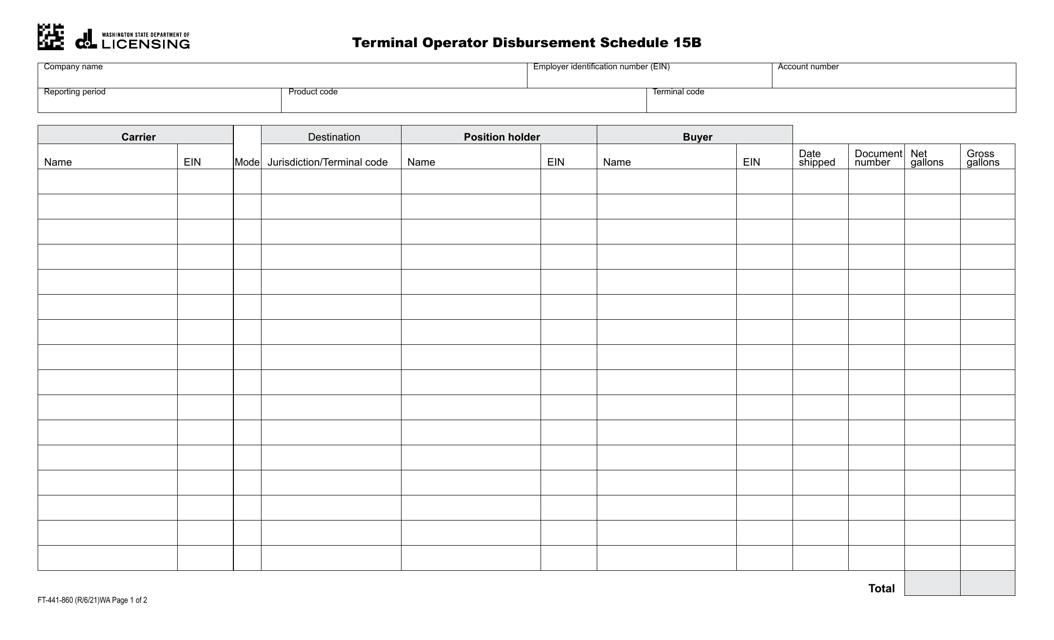

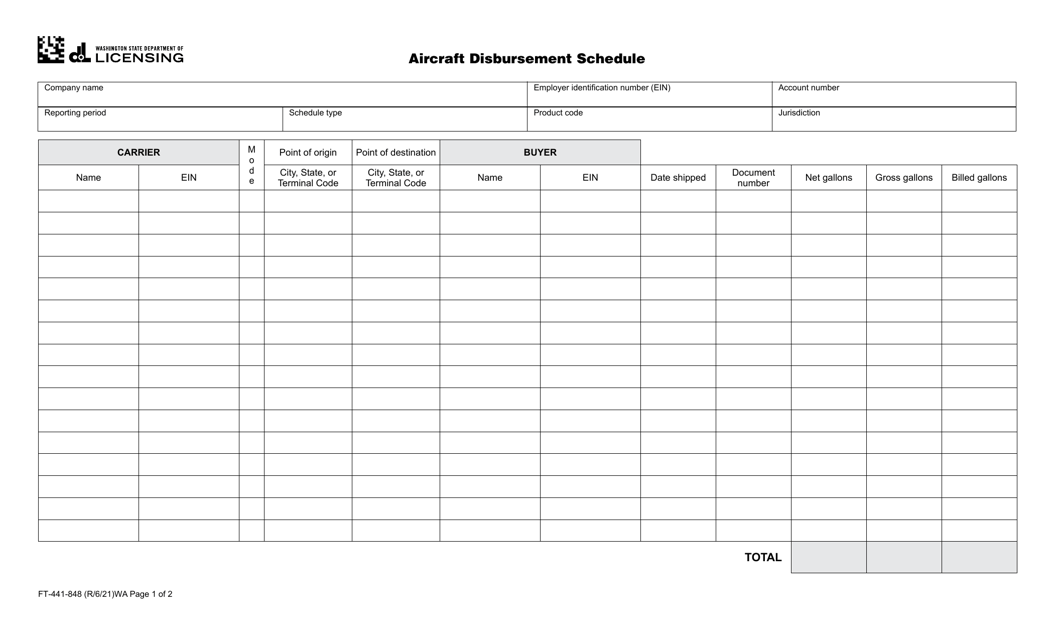

In some cases, a disbursement schedule may be required by regulatory bodies or government agencies. For instance, the CDTFA-810-CTF Cigarette Tax Disbursement Schedule in California is an official form used by businesses involved in the distribution of cigarettes to report and schedule the disbursement of taxes. Similarly, the Form FT-441-848 and Form FT-441-860 in Washington are used to outline the disbursement schedule for specific industries.

Accessing a free disbursement schedule template can save you time and effort in creating your own. These templates are readily available and can be tailored to suit your specific needs. Using a template ensures that you include all the necessary information and formatting, allowing for a professional and organized disbursement schedule.

Having a well-structured disbursement schedule is essential for maintaining financial transparency, tracking expenses, and ensuring timely payments. It helps prevent confusion or disputes regarding the allocation of funds and provides a clear record of financial transactions. With the right disbursement schedule in place, you can streamline your financial processes and stay on top of your disbursement obligations.

Documents:

12

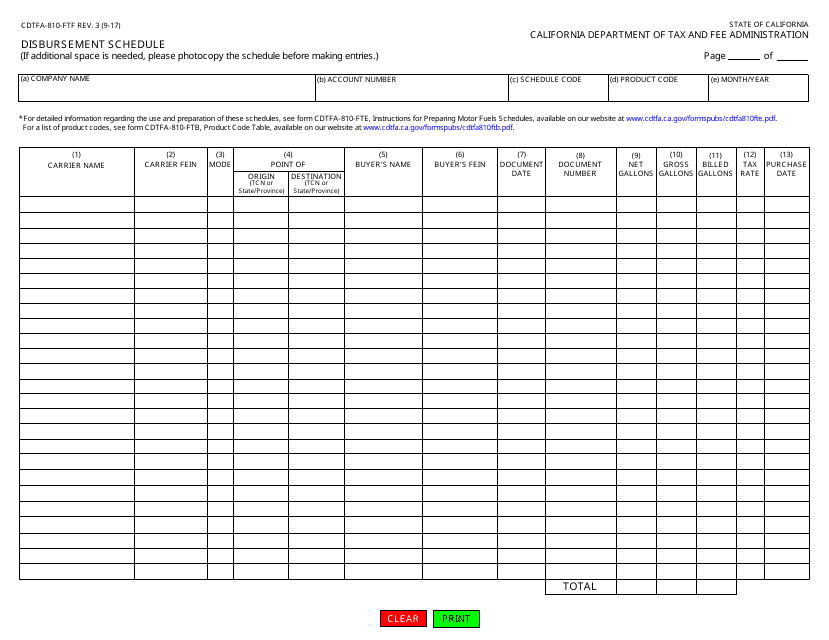

This form is used for the disbursement schedule in California by the CDTFA-810-FTF.

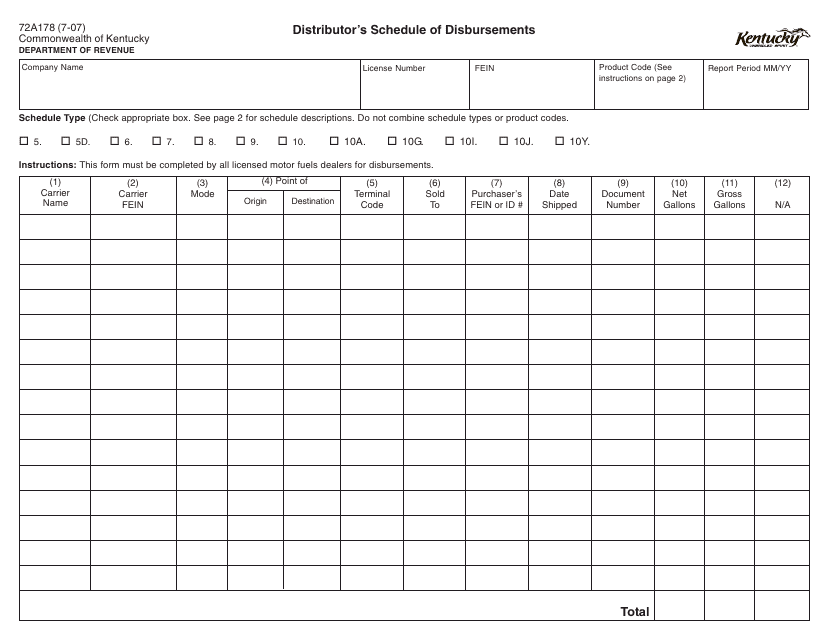

This form is used for distributors in Kentucky to report their disbursements. It helps track the distribution of funds for tax purposes.

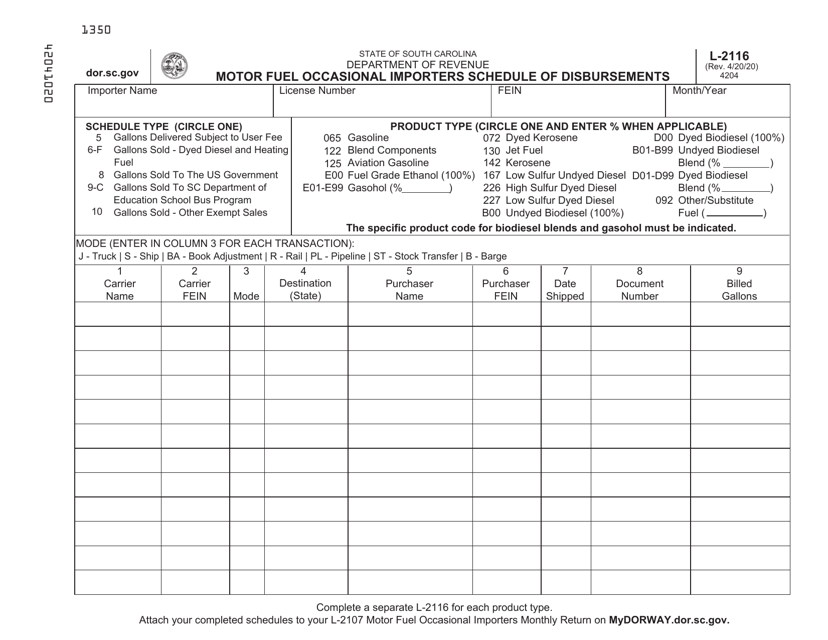

This form is used for recording the schedule of disbursements for occasional importers of motor fuel in South Carolina.