Fair Credit Reporting Act Templates

The Fair Credit Reporting Act (FCRA), also known as the fair credit reporting act, is a collection of documents designed to protect consumers' credit information and ensure fair practices by credit reporting agencies. These documents provide various forms and authorizations that allow individuals to access their credit reports, dispute any inaccuracies, and authorize the release of their credit information.

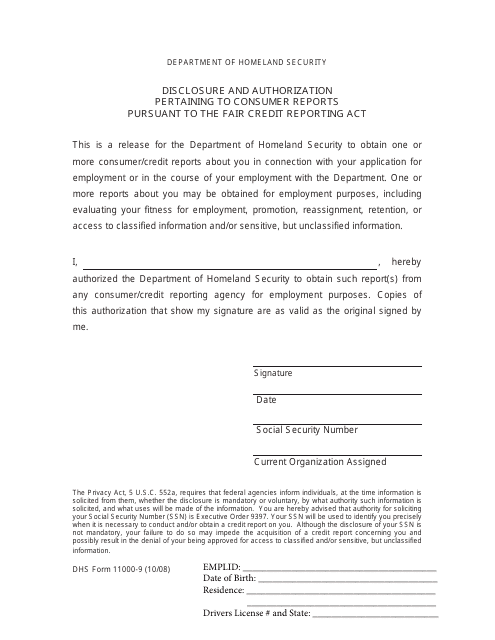

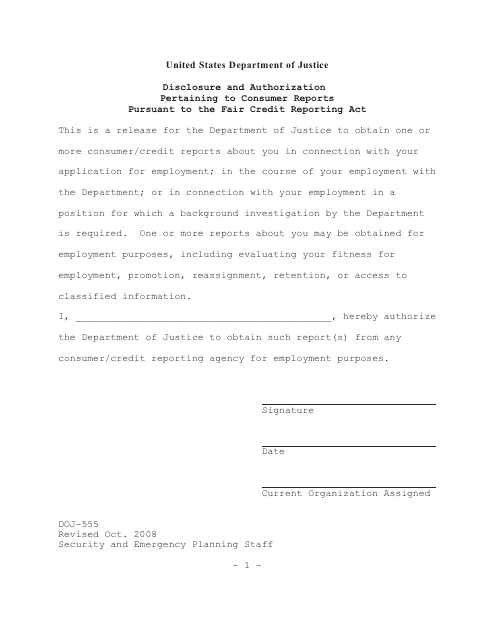

The FCRA documents include forms such as the DHS Form 11000-9 and Form DOJ-555, which pertain to the disclosure and authorization of consumer reports under the FCRA. These forms enable individuals to access their credit reports and request information regarding their credit history.

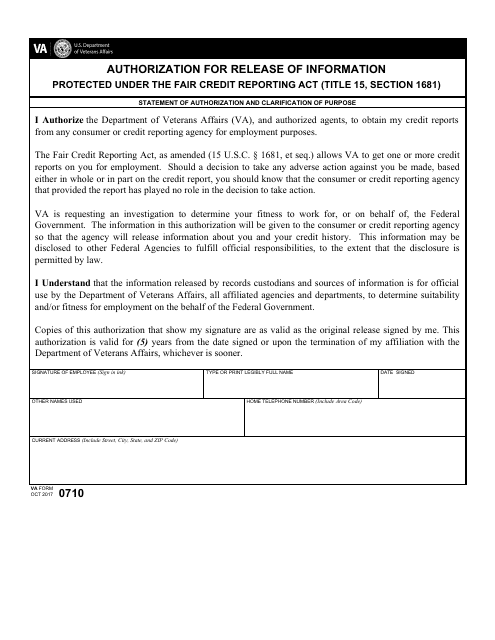

Another vital document under the FCRA is the VA Form 0710, which authorizes the release of information protected under the fair credit reporting act. This form allows individuals to grant permission for their credit information to be shared with certain entities, such as potential employers or landlords.

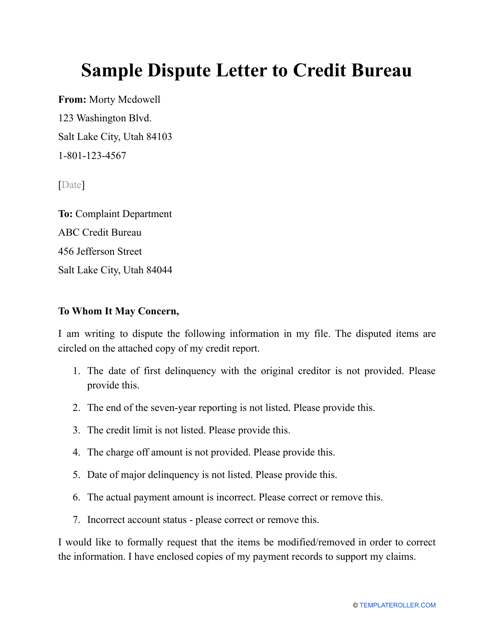

Additionally, the FCRA documents collection includes sample dispute letters to credit bureaus. These letters are invaluable tools for individuals who wish to dispute any inaccuracies or discrepancies on their credit reports.

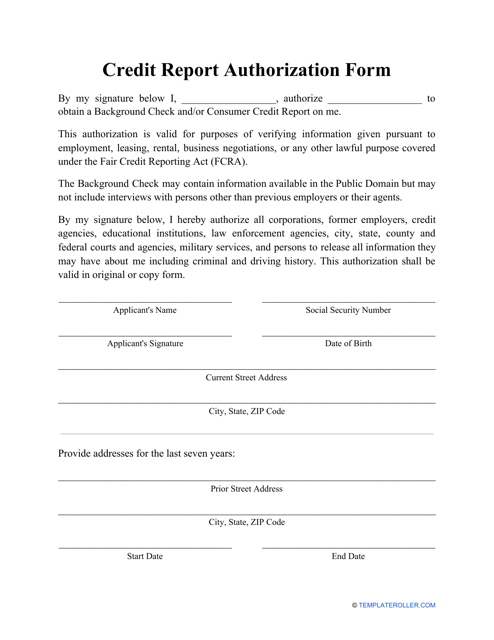

To ensure compliance with FCRA regulations, credit reporting agencies often require individuals to complete a credit report authorization form. This form serves as written consent for the agency to obtain and review the individual's credit information.

In summary, the Fair Credit Reporting Act (FCRA), or fair credit reporting act, encompasses a comprehensive set of documents that protect consumers and regulate credit reporting practices. These documents provide individuals with the necessary information and forms to access their credit reports, dispute inaccuracies, and authorize the release of their credit information. Ensure your rights are protected by familiarizing yourself with the FCRA and utilizing the documents it encompasses.

Documents:

5

This document is used for authorizing the disclosure of consumer reports under the Fair Credit Reporting Act.

This document is used for obtaining disclosure and authorization from individuals for conducting consumer reports, in accordance with the Fair Credit Reporting Act (FCRA).

This form is used for authorizing the release of information protected under the Fair Credit Reporting Act (Title 15, Section 1681). It is used by the VA (Department of Veterans Affairs) to obtain consent for accessing credit reports for various purposes.

If an individual notices an error in their credit report they can use this letter to have it corrected by the agency reporting the information.

Use this template to provide consent to a potential lender to learn more about the prospective borrower's credit history.