IRS Compliance Templates

Welcome to our IRS Compliance webpage, where we provide you with all the information you need to ensure your compliance with IRS regulations. We understand that navigating the complex world of tax laws and requirements can be overwhelming, but with our help, you can stay on top of your tax obligations and avoid any potential penalties or fines.

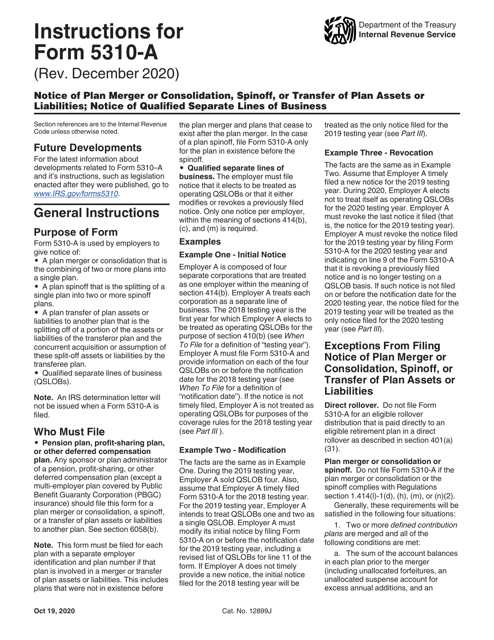

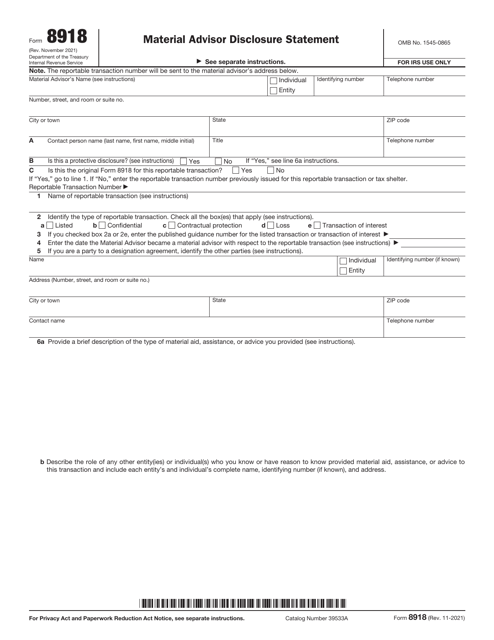

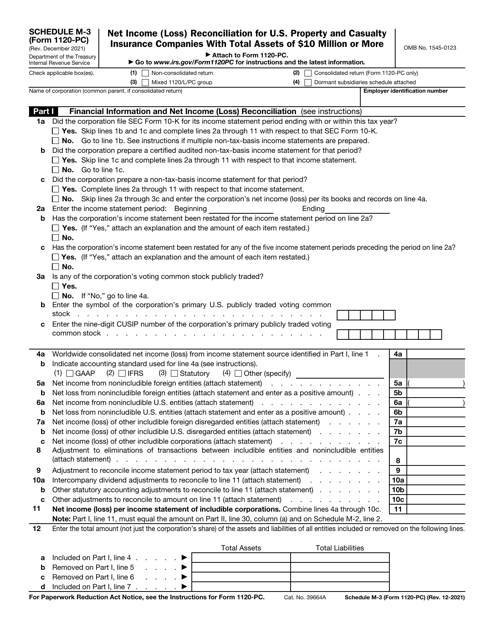

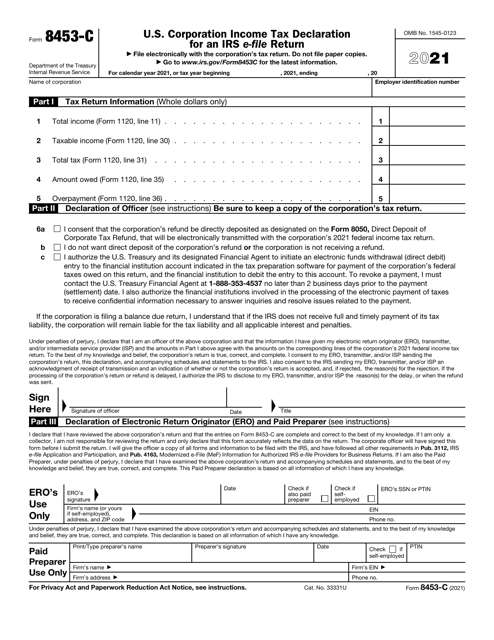

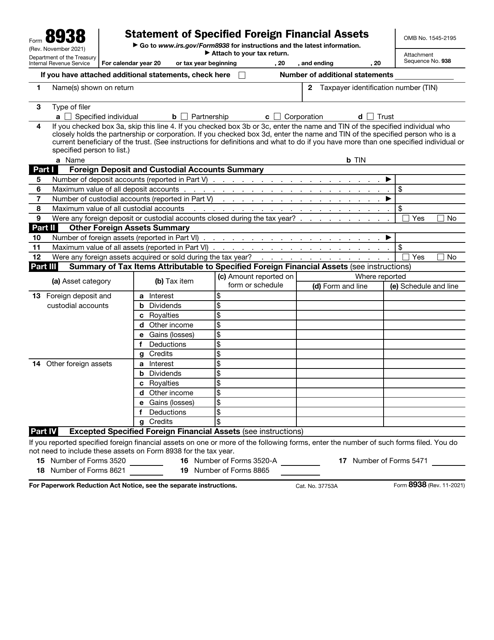

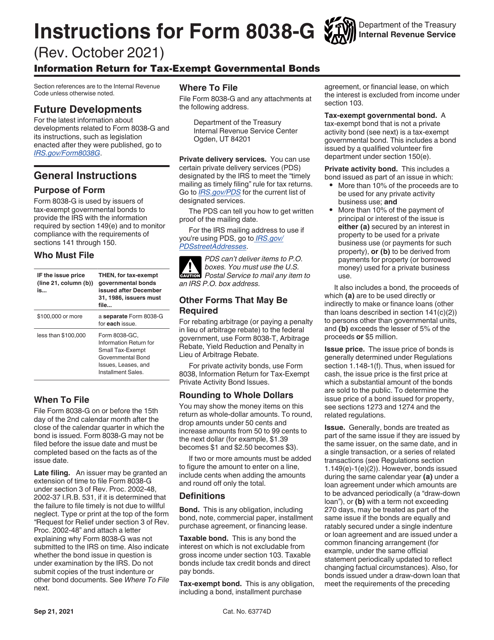

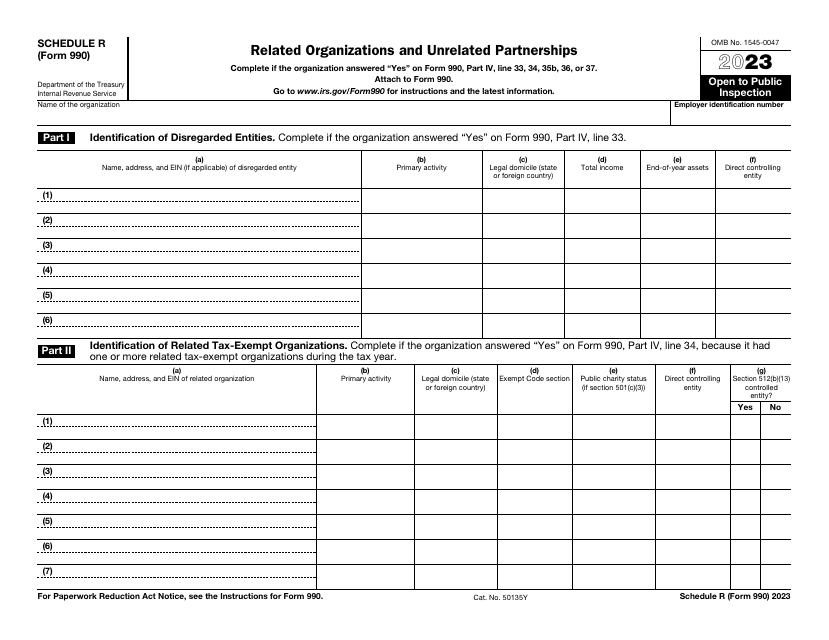

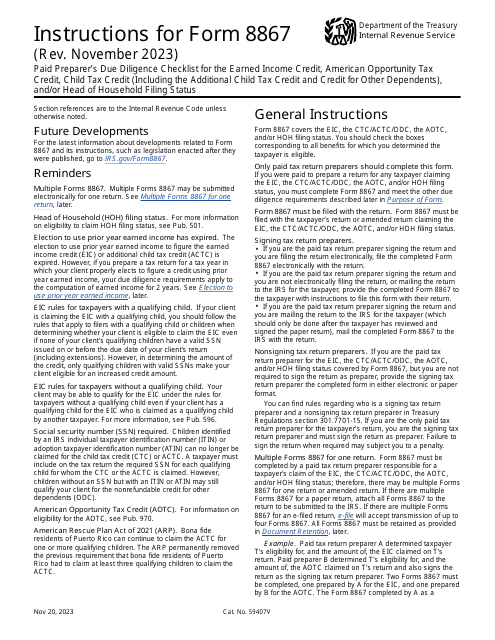

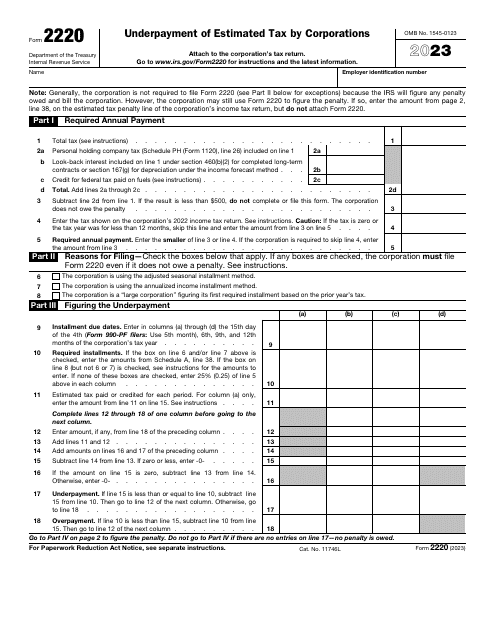

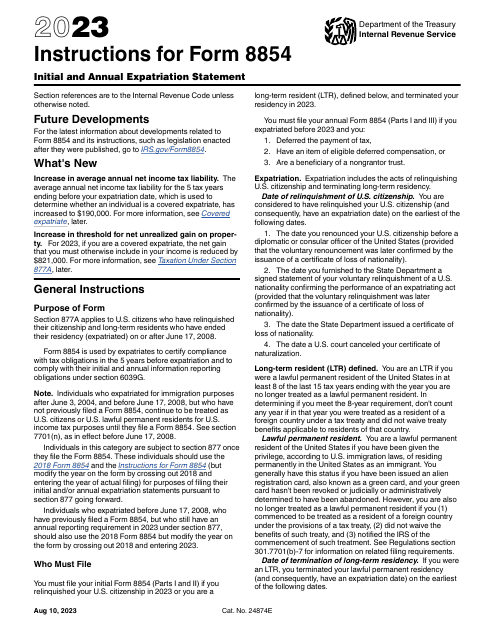

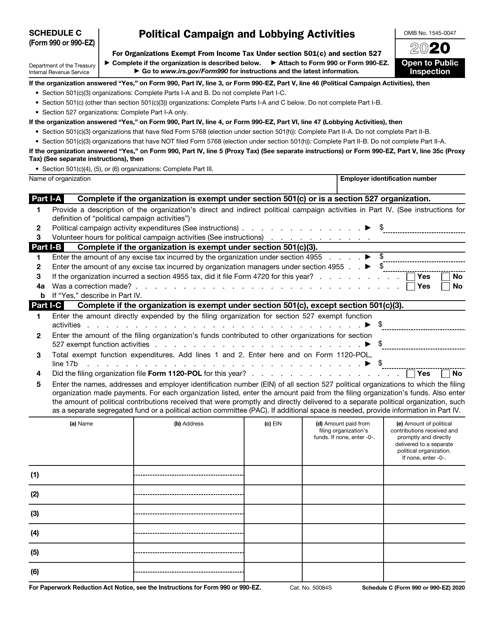

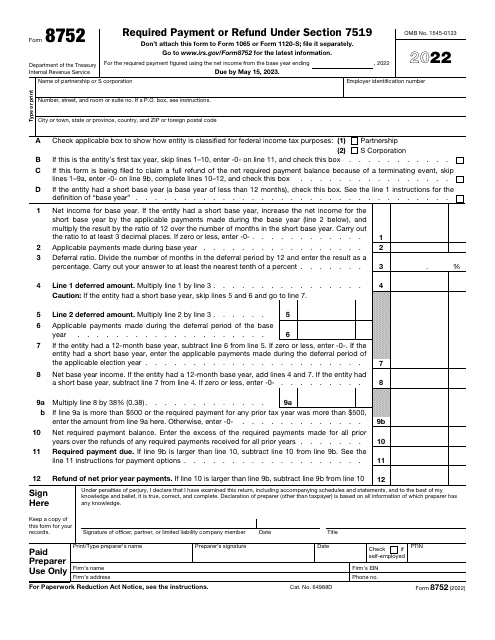

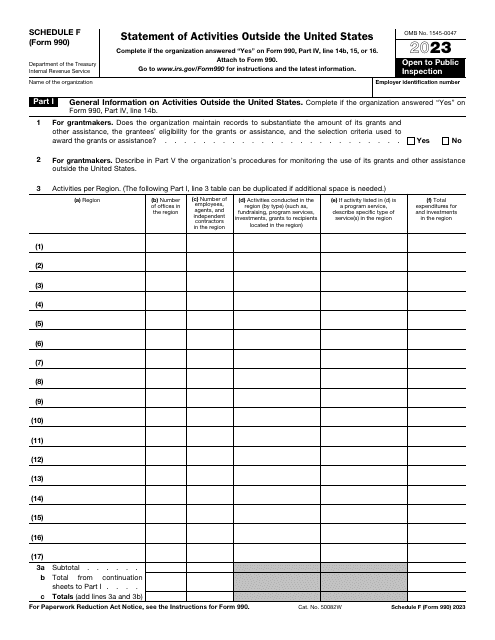

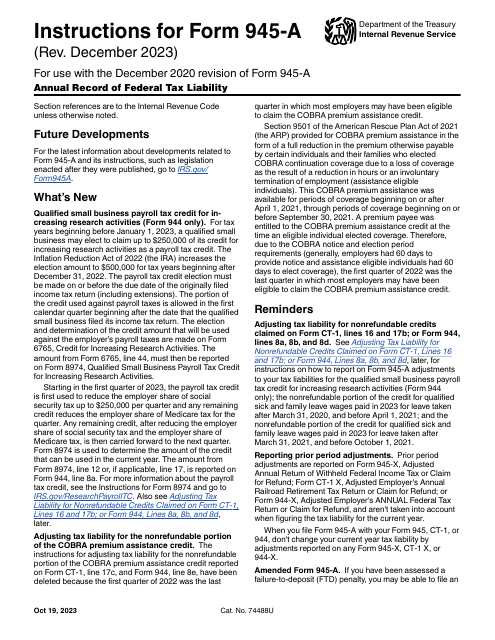

Our IRS Compliance section covers a wide range of topics, including reporting requirements for individuals and businesses, foreign financial assets, quarterly federal excise taxes, and expatriation statements. We offer detailed instructions and guidelines for filling out various IRS forms, such as Form 1120-PC Schedule M-3 for U.S. Property and Casualty Insurance Companies, Form 8938 for reporting specified foreign financial assets, Form 720 for quarterly federal excise taxes, Form 8854 for initial and annual expatriation statements, and Form 1042-S for foreign persons' U.S. source income subject to withholding.

We understand that staying compliant with IRS regulations is crucial for individuals and businesses alike. Failure to do so can result in monetary penalties, audits, and other legal consequences. That's why we've designed this webpage to provide you with all the resources you need to understand and fulfill your IRS compliance obligations.

Whether you're a U.S. property and casualtyinsurance company, an individual with specified foreign financial assets, or a business owner responsible for quarterly federal excise taxes, we've got you covered. Our comprehensive collection of resources and instructions will guide you through the process of meeting your IRS compliance requirements.

So, take the stress out of IRS compliance and let us be your trusted source for all your tax-related needs. Discover the information and guidance you need to stay compliant and avoid any unnecessary complications. Browse our IRS Compliance webpage today and ensure peace of mind in your tax affairs.

Documents:

53

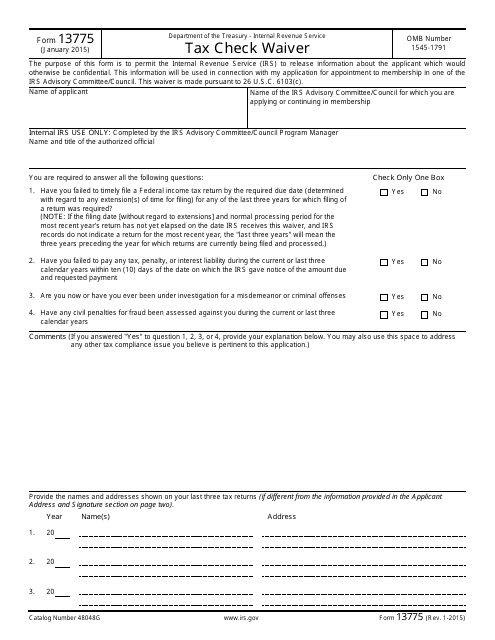

This form is used for requesting a waiver for tax checks from the IRS.

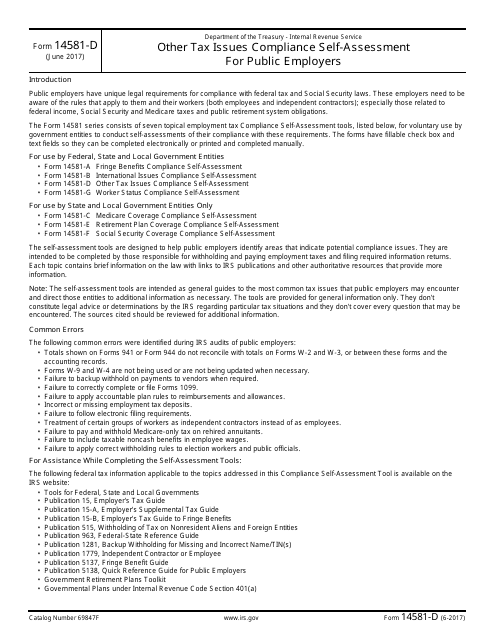

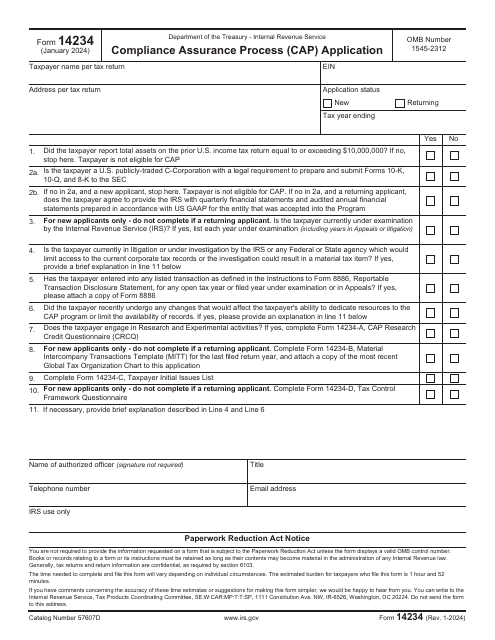

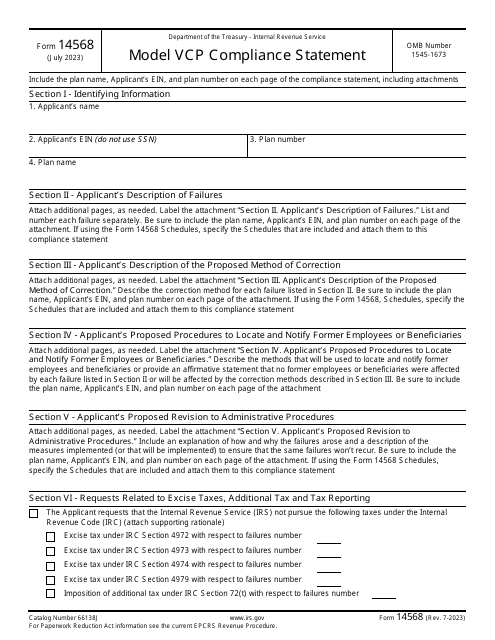

This Form is used for public employers to assess their compliance with other tax issues for the purpose of tax compliance.

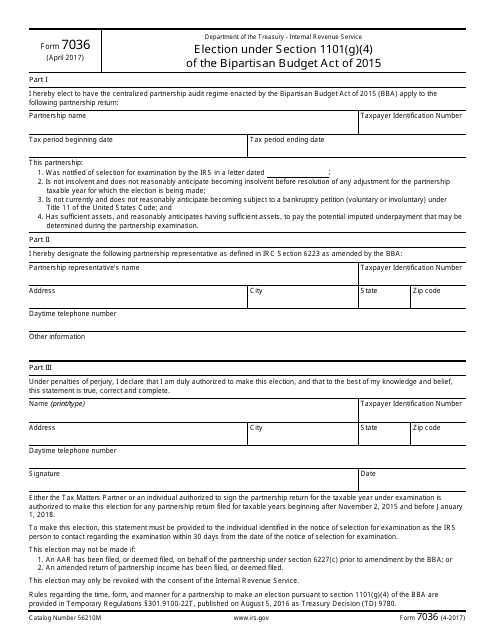

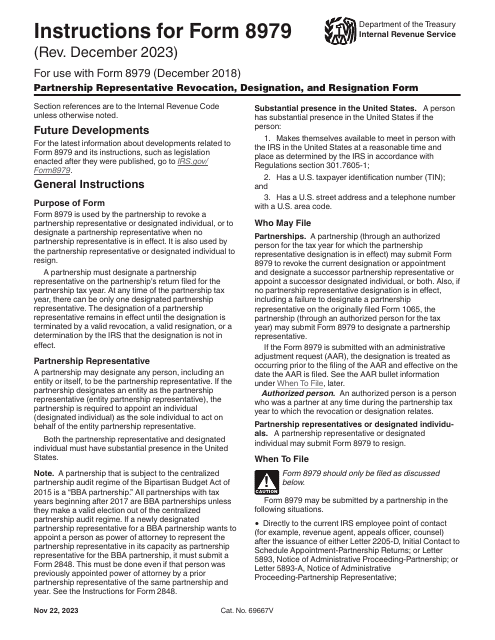

This form is used for making an election under Section 1101(G)(4) of the Bipartisan Budget Act of 2015.

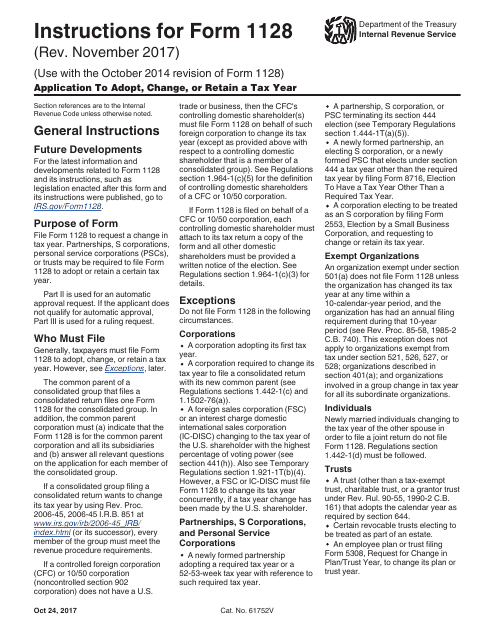

These are instructions for IRS Form 1128, Application to Adopt, Change, or Retain a Tax Year.

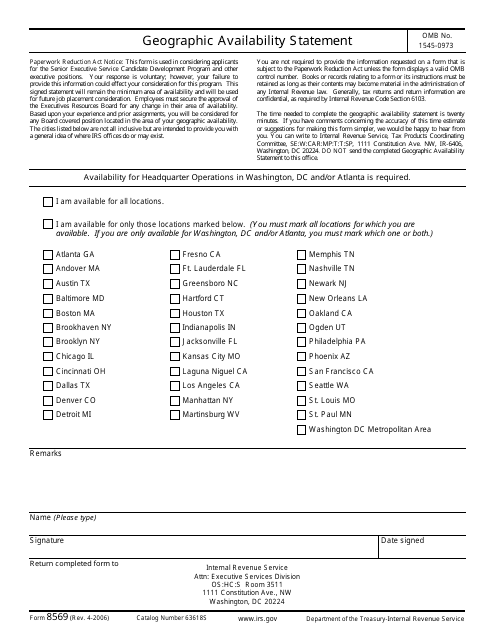

This form is used for providing information about the geographic availability of services provided by an organization to the Internal Revenue Service (IRS).

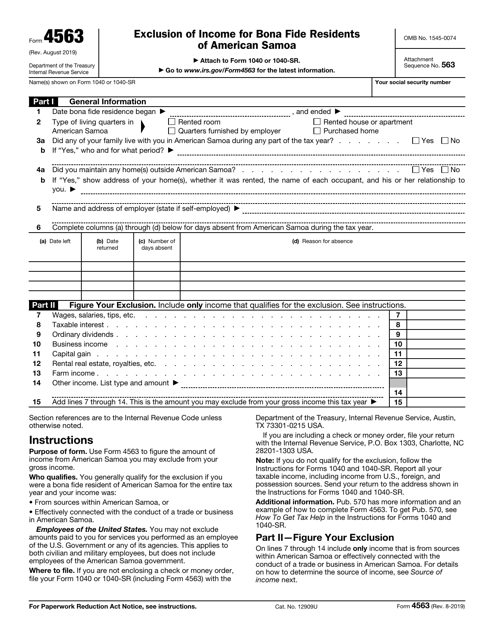

This is a tax form people permanently residing in American Samoa can use to exclude certain income from their gross income.

This is a formal IRS document that outlines the details of a property foreclosure.

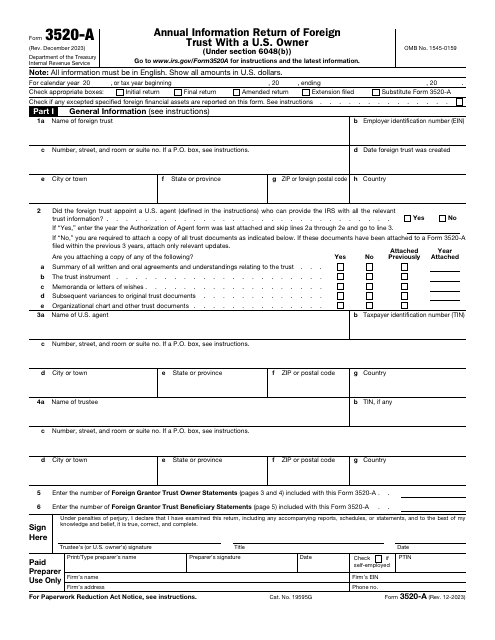

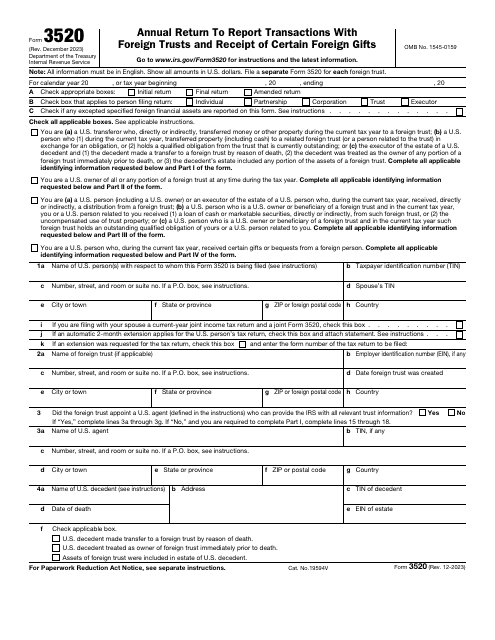

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.

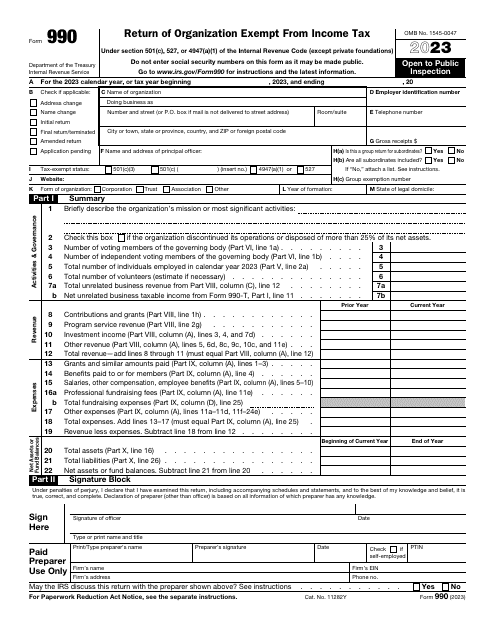

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

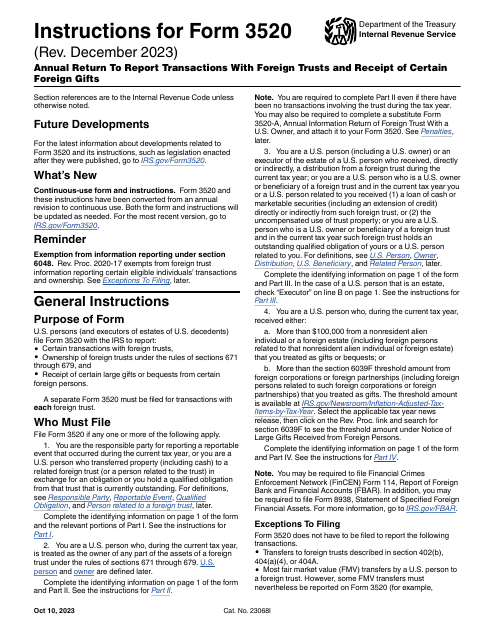

This form is a formal statement used by people and entities obliged to tell the fiscal authorities about the transactions they have had with foreign trusts throughout the year.

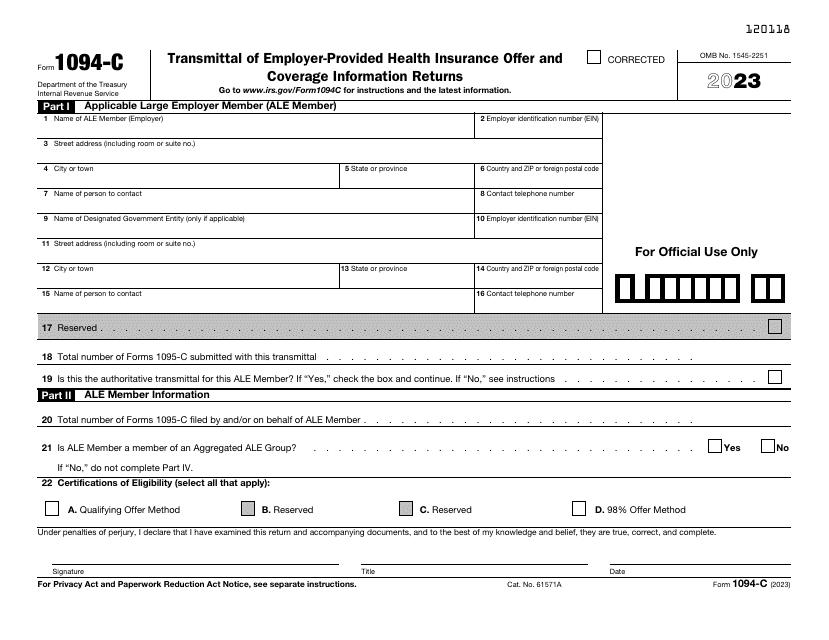

Download these cover sheets in order to report a summary about the Applicable Large Employer (ALE) and to transmit Form 1095-C, Employer-Provided Health Insurance Offer and Coverage to the Internal Revenue Service (IRS).

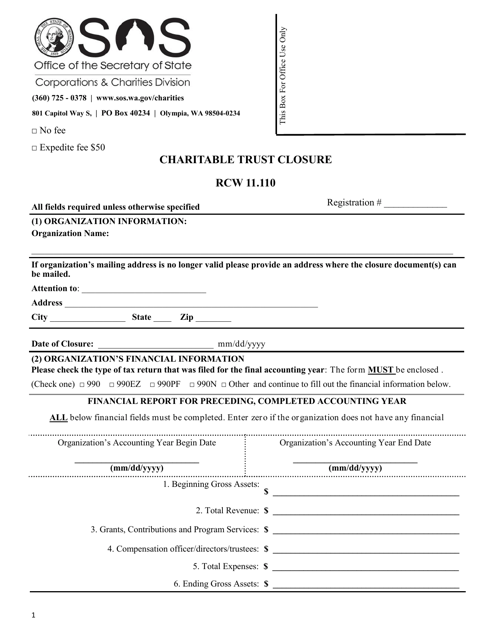

This document is for closing a charitable trust in Washington. It provides the necessary forms and instructions for properly terminating the trust.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.