Delinquent Taxes Templates

Are you struggling with delinquent taxes? Do you owe back taxes to the IRS or your state government? If so, you're not alone. Many individuals and businesses find themselves in this difficult situation, facing the potential consequences of not paying their taxes on time.

Delinquent taxes refer to taxes that have not been paid by their due date. If you have delinquent taxes, it's crucial to take action and address the issue promptly to avoid further penalties and interest. Ignoring your tax obligations can lead to serious consequences, such as wage garnishment, tax liens, or even property seizure.

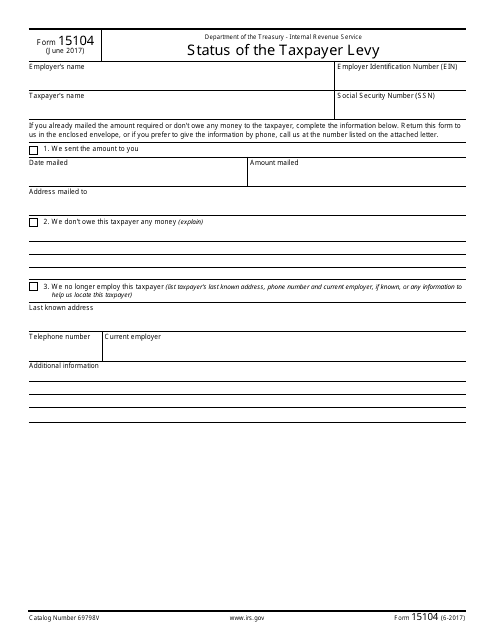

Fortunately, there are resources and processes in place to help individuals and businesses resolve their delinquent tax issues. The IRS and state governments offer various forms and programs to assist taxpayers in getting back on track. One such resource is the IRS Form 15104 Status of the Taxpayer Levy, which provides an overview of your tax status and whether a levy has been placed on your assets.

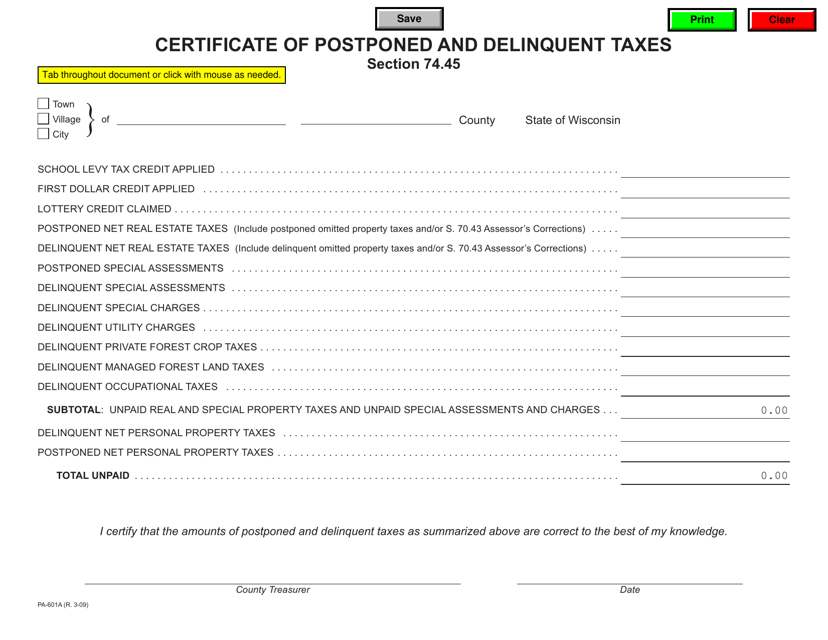

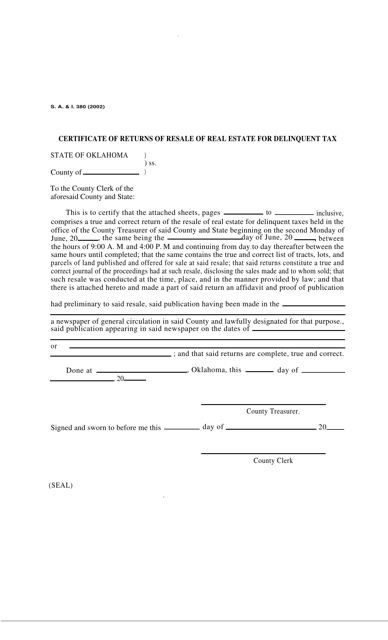

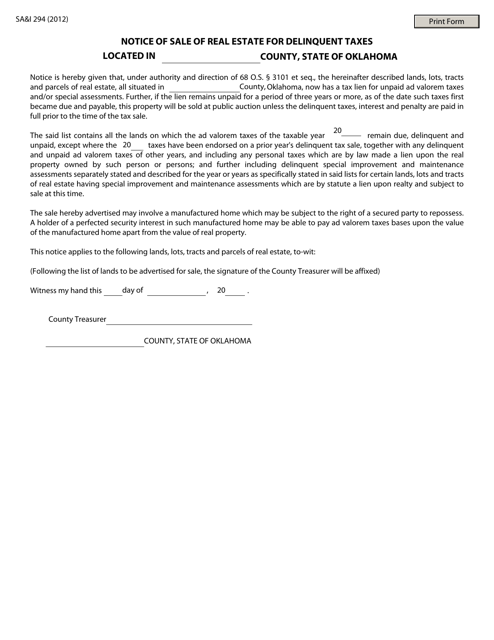

States like Wisconsin offer the Form PA-601A Certificate of Postponed and Delinquent Taxes to help individuals delay payment or request an installment plan. Similarly, the Form S.A.& I.380 Certificate of Returns of Resale of Real Estate for Delinquent Tax in Oklahoma allows for the sale of properties with delinquent taxes.

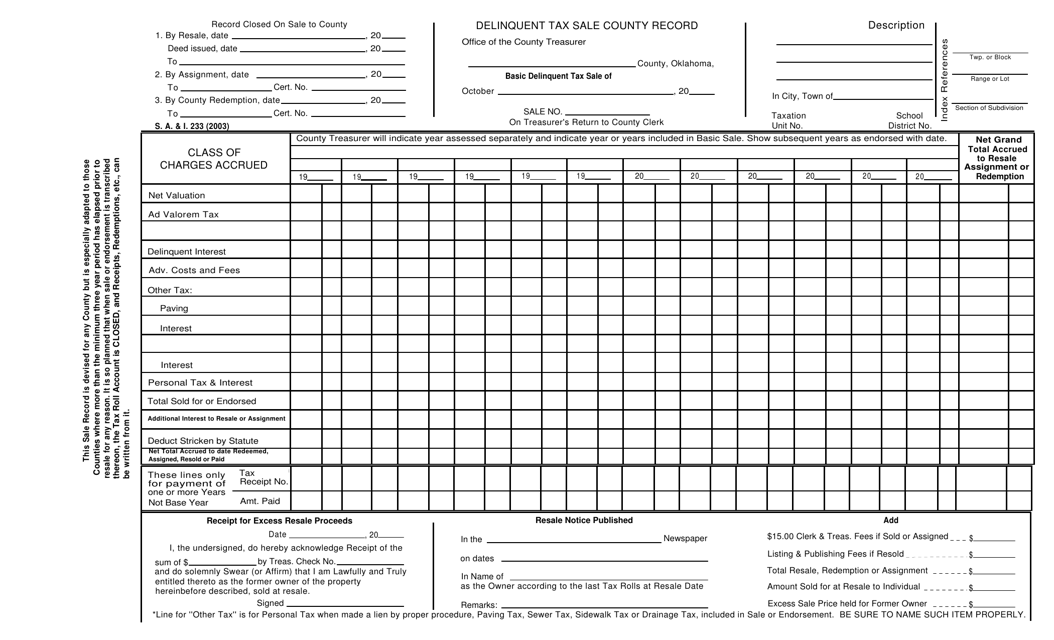

Another important document is the Form S.A.& I.233 Delinquent Tax Sale County Record in Oklahoma, which provides information about properties sold due to tax delinquency. This document can help individuals understand the status of their properties and take necessary actions.

It's worth noting that navigating the world of delinquent taxes can be complex, especially if you're unfamiliar with the tax laws and procedures. Seeking professional assistance from a tax attorney or accountant experienced in delinquent taxes can greatly assist in resolving your tax issues.

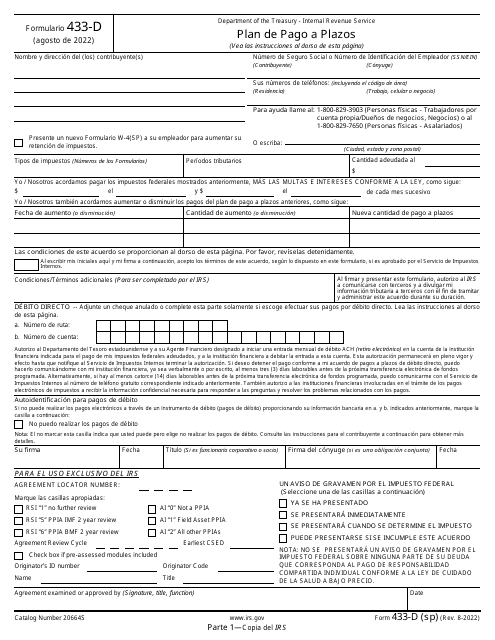

If you're a Spanish-speaking taxpayer, the IRS also offers the IRS Formulario 433-D Plan De Pago a Plazos, a Spanish version of the installment agreement form, allowing you to set up a payment plan in your native language.

If you find yourself facing delinquent taxes, it's important to understand that there are options available to help you resolve these issues. Taking the necessary steps to address your delinquent taxes can provide you with peace of mind and prevent further financial hardships. Don't let your delinquent taxes continue to cause you stress or impact your financial well-being.

To learn more about delinquent taxes, explore our website or speak with a tax professional who specializes in delinquent tax matters. Remember, facing your delinquent taxes head-on is the first step towards regaining control over your financial situation.

Documents:

19

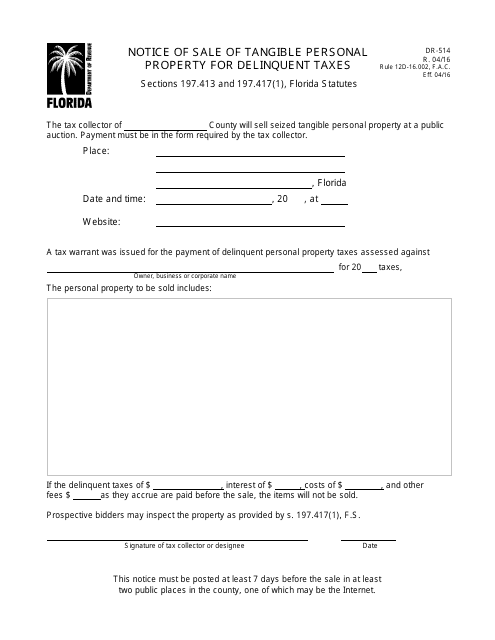

This form is used for notifying the sale of tangible personal property for delinquent taxes in the state of Florida.

This form is used to check the status of a taxpayer levy with the IRS.

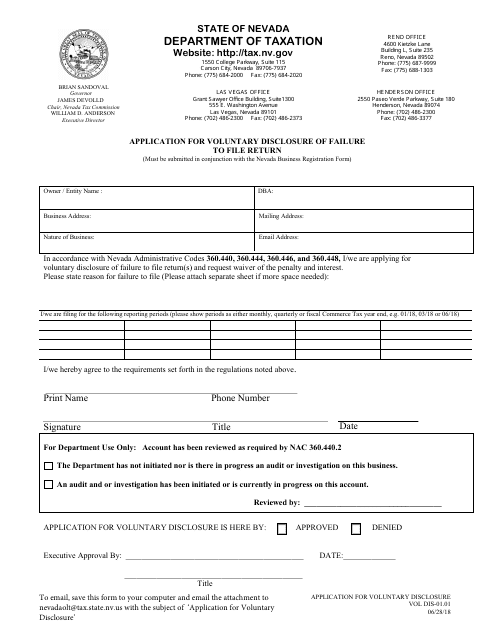

This form is used for individuals or businesses in Nevada who have failed to file a tax return and want to voluntarily disclose their mistake to the state. By filling out this application, you can avoid penalties and potential legal consequences.

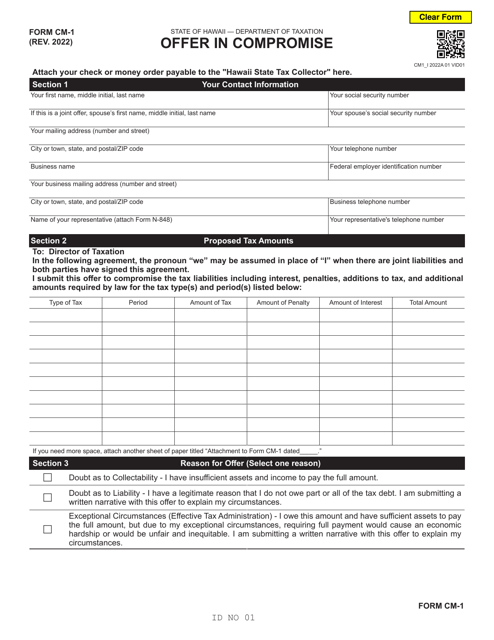

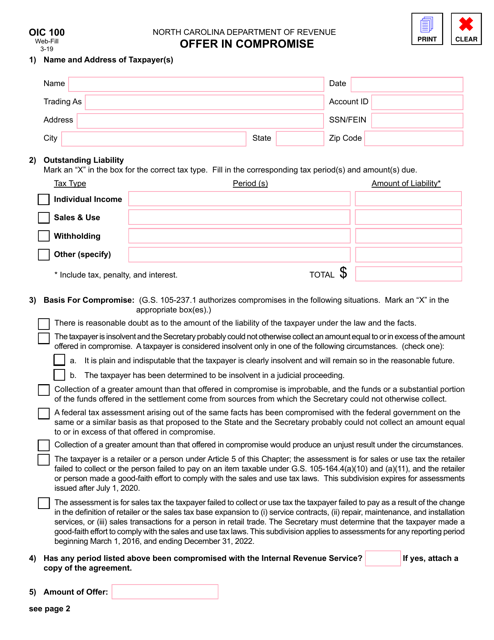

This document is used for submitting an Offer in Compromise to the state of North Carolina. It is a request to settle a tax liability for less than the full amount owed.

This form is used for certifying postponed and delinquent taxes in Wisconsin.

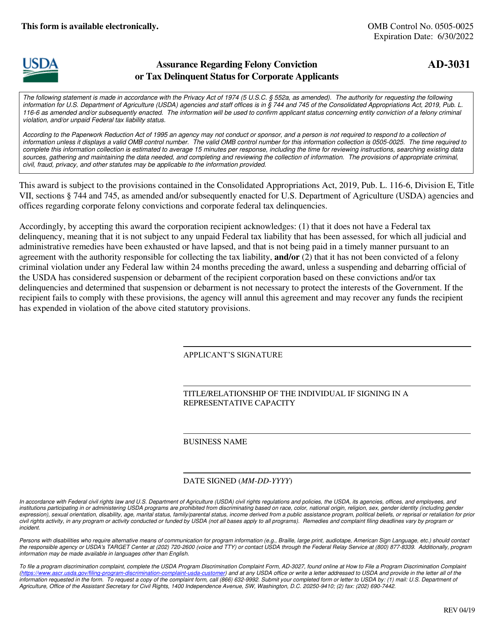

Form AD-3031 Assurance Regarding Felony Conviction or Tax Delinquent Status for Corporate Applicants

This form is used for corporate applicants to provide assurance regarding their felony conviction or tax delinquent status.

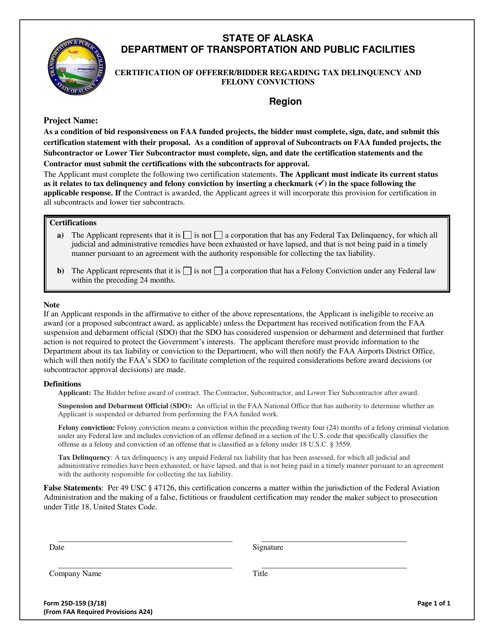

This form is used for certifying that an individual or organization involved in an offer or bid does not have any tax delinquency or felony convictions in Alaska.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

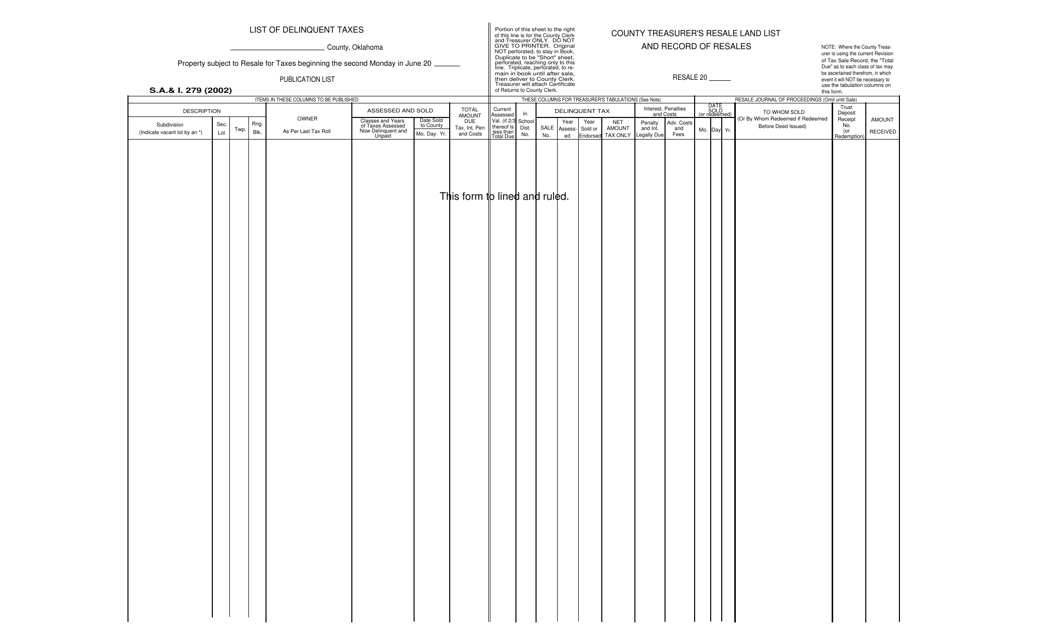

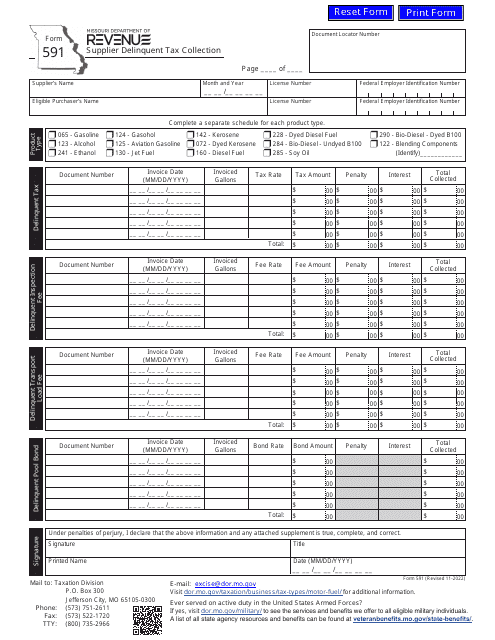

This form is used to list delinquent taxes in the state of Oklahoma. It provides information on individuals or businesses who haven't paid their taxes on time.

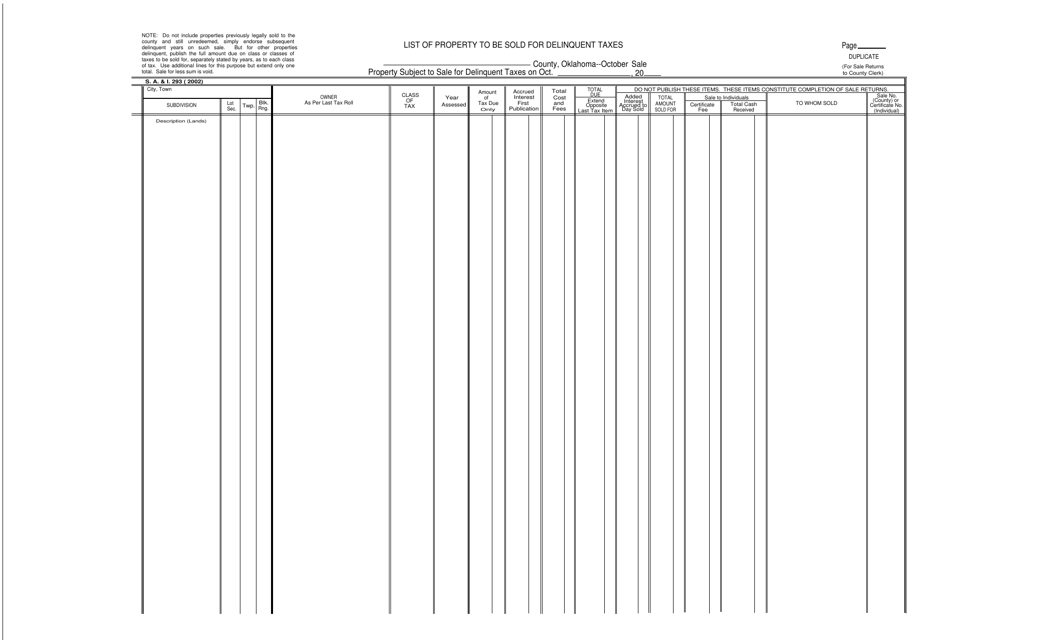

This form is used for listing the properties that are to be sold due to delinquent taxes in the state of Oklahoma.

This form is used for reporting the resale of real estate for which the taxes were previously delinquent in Oklahoma. It is a certificate of return that provides information on the sale and the amount of tax owed.

This form is used for notifying the public of the sale of real estate in Oklahoma that has become delinquent on taxes.

This Form is used for recording delinquent tax sales in Oklahoma county.

This Spanish document is used for setting up a installment payment plan with the IRS. It is known as IRS Form 433-D.