Income Tax Withholding Templates

Income Tax Withholding: Managing Your Tax Obligations Responsibly

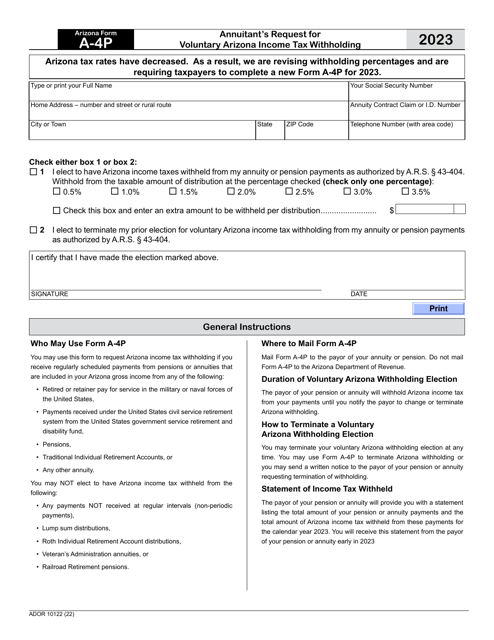

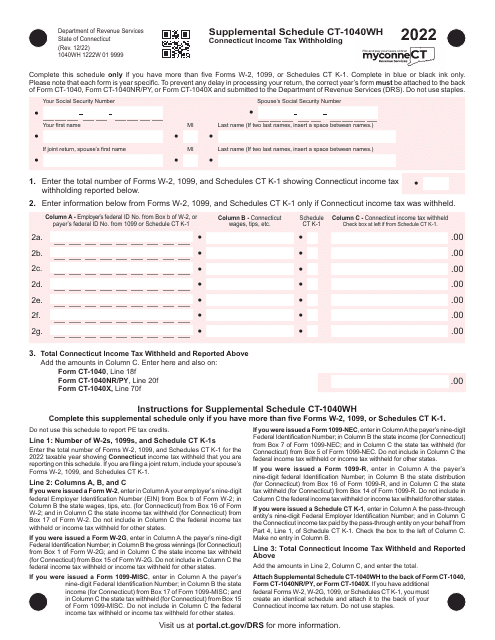

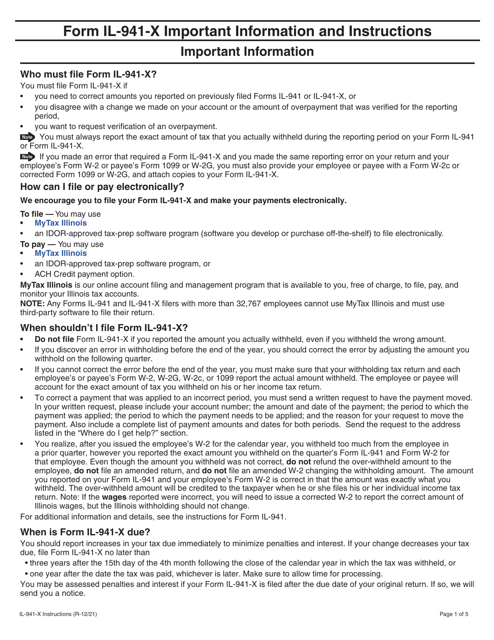

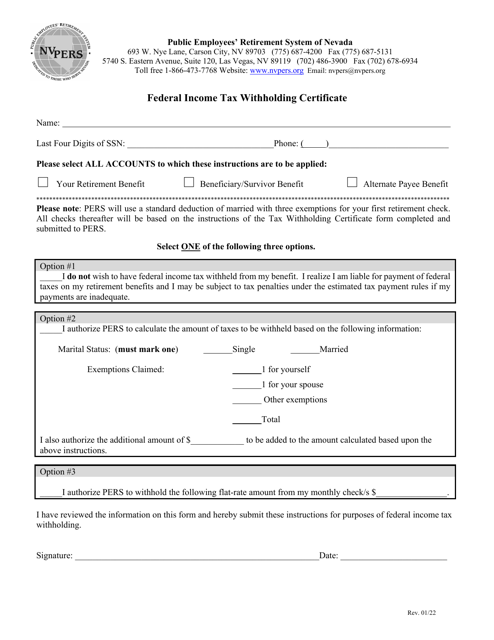

Ensure compliance with tax laws and avoid penalties by understanding and implementing proper income tax withholding. This crucial process involves deducting a portion of an employee's earnings to cover their federal, state, and local income tax liabilities.

At times referred to as income tax withholdings, withholding income tax, or income withholding tax, the practice of income tax withholding serves as a mechanism to satisfy tax obligations throughout the year, rather than waiting until the annual tax filing deadline. By deducting the appropriate amount from each paycheck, employers help individuals manage their tax liabilities and ensure a smooth experience come tax season.

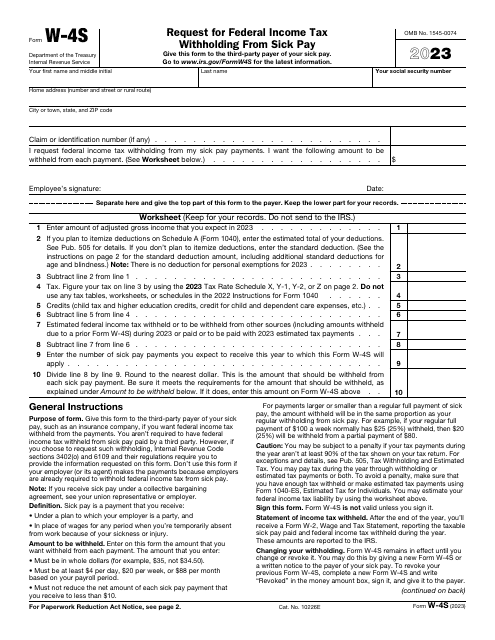

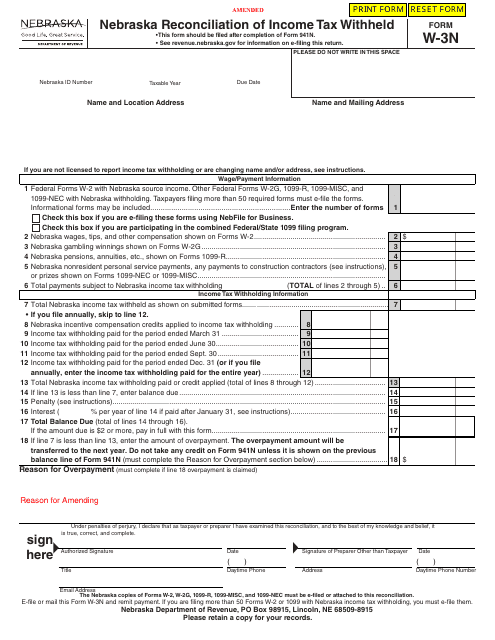

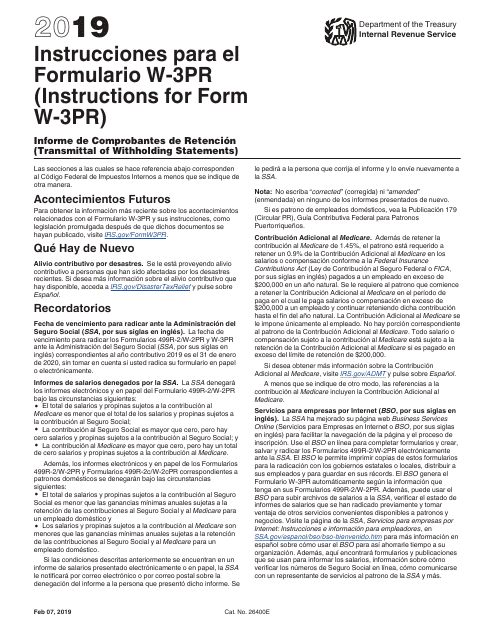

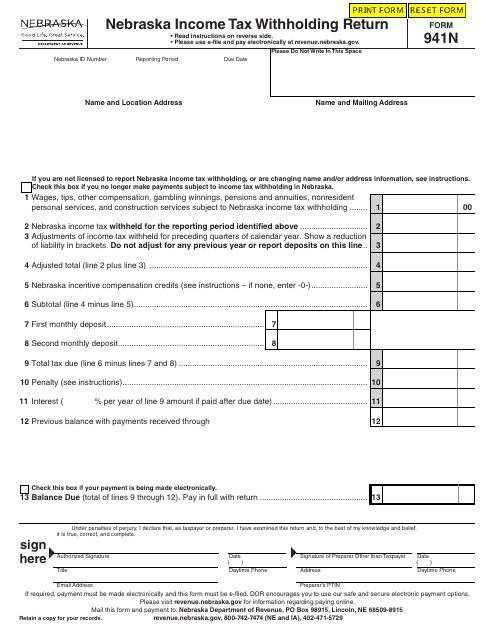

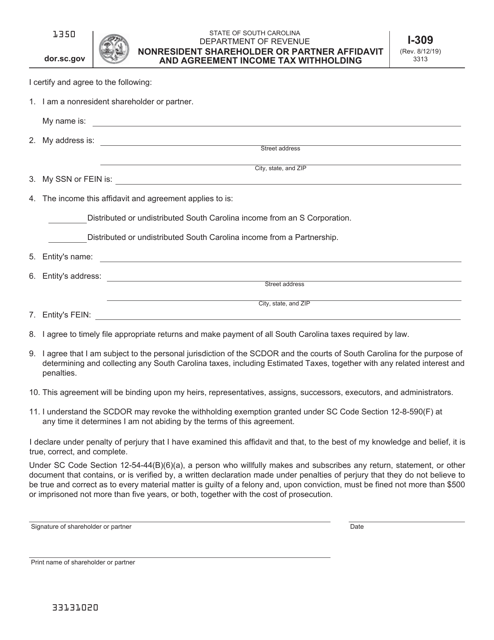

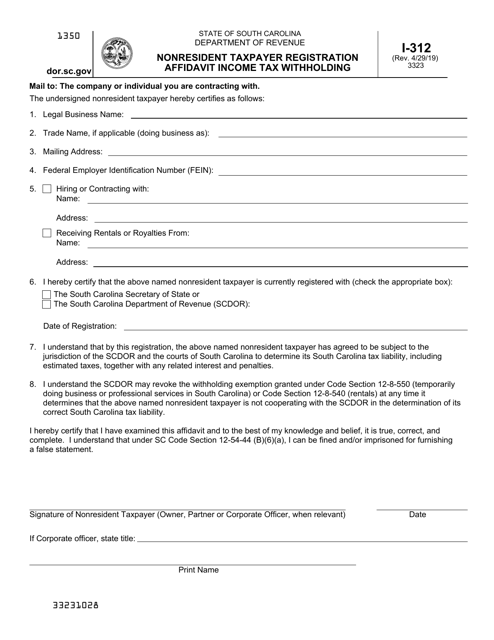

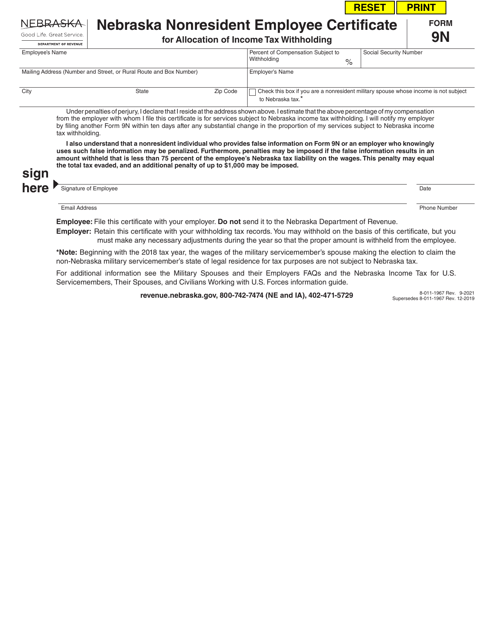

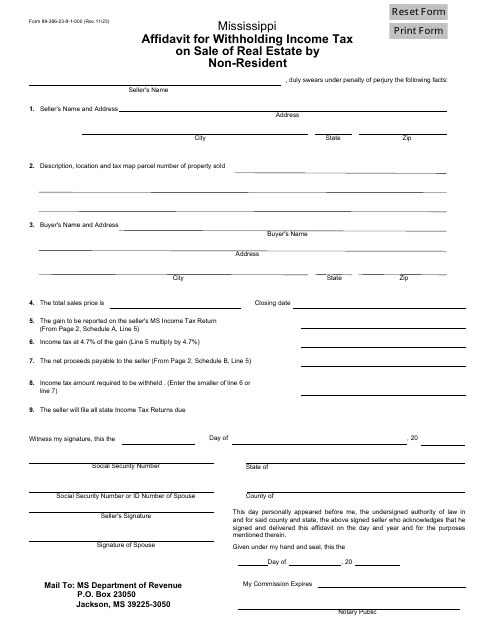

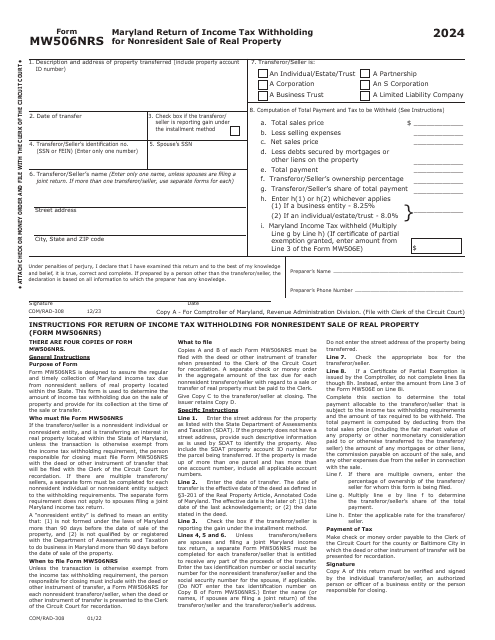

Our extensive collection of documents related to income tax withholding provides valuable information and guidance to both employers and employees. These documents cover a wide range of topics, including guidelines for completing crucial forms like IRS Form W-3PR Transmittal of Withholding Statements (English/Spanish) and state-specific forms such as Form 941N Nebraska Income Tax Withholding Return - Nebraska and Form I-312 Nonresident Taxpayer Registration Affidavit Income Tax Withholding - South Carolina.

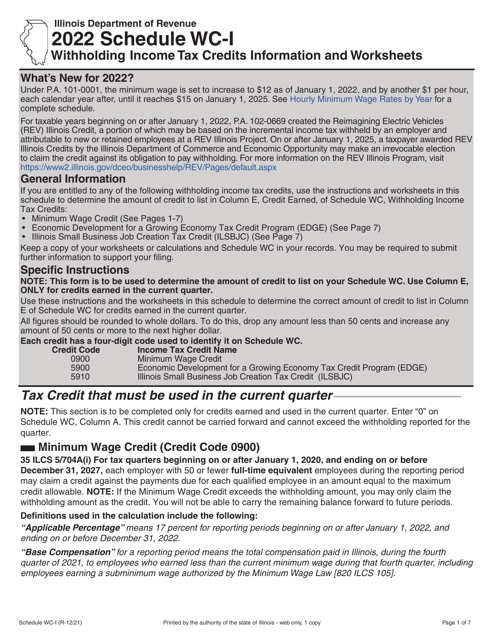

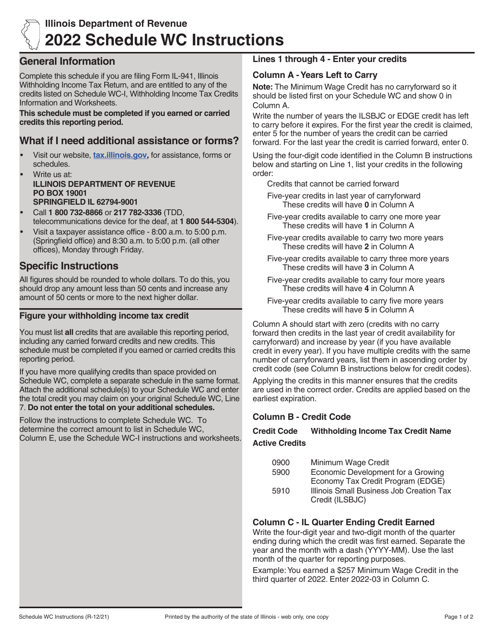

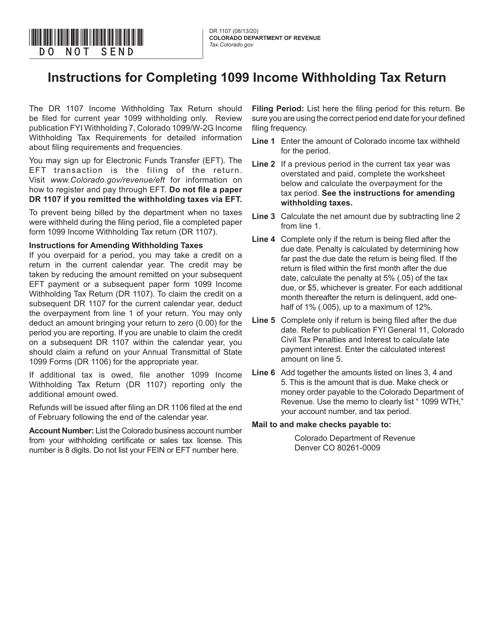

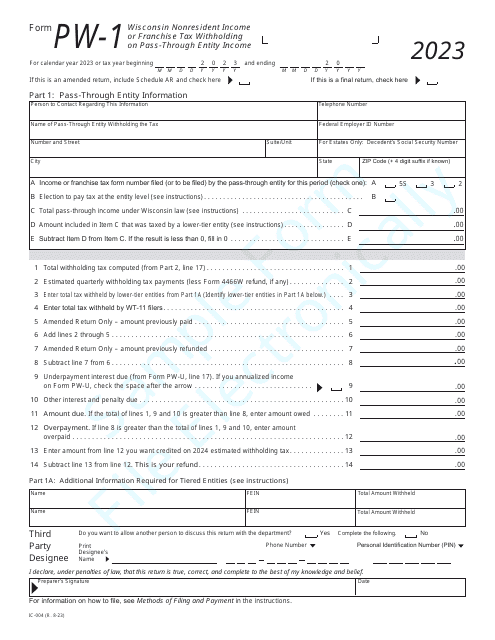

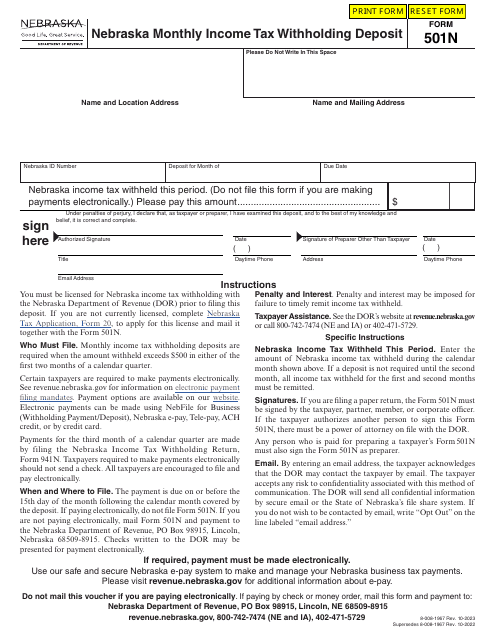

Our comprehensive resources also include documents like Schedule WC-I Withholding Income Tax Credits Information and Worksheets - Illinois and Form 501N Nebraska Monthly Income Tax Withholding Deposit - Nebraska. These resources offer detailed instructions and insights, ensuring that employers and employees understand their obligations and can navigate the income tax withholding process effectively.

Trust our thorough and reliable collection of income tax withholding documents to stay informed and compliant. Take the necessary steps to fulfill your tax obligations accurately, benefiting both your employees and your organization. Access our valuable resources today to simplify your income tax withholding processes and ensure a financially stable future.

Note: Unfortunately, the provided document examples did not allow for the creation of a specific text using them.

Documents:

37

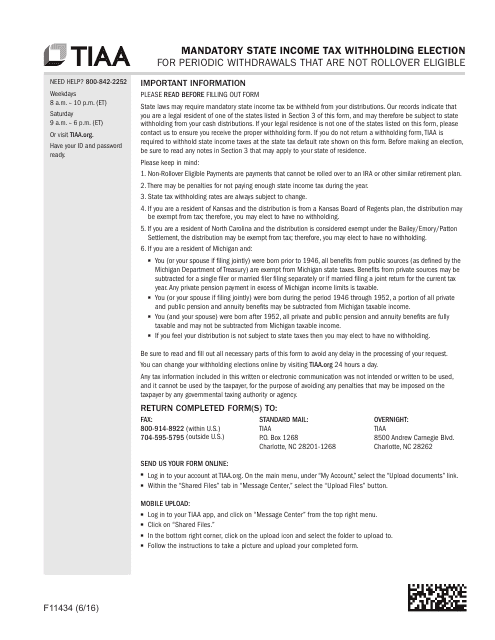

This form is used for making a mandatory state income tax withholding election for periodic withdrawals that are not rollover eligible with TIAA.

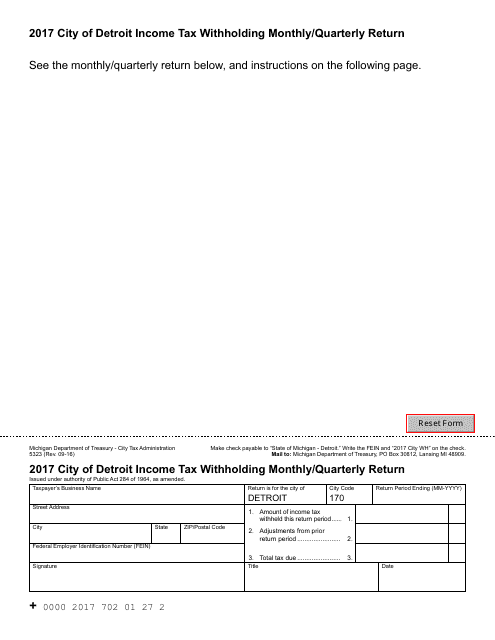

This form is used by businesses in the City of Detroit to report their monthly or quarterly income tax withholdings for employees.

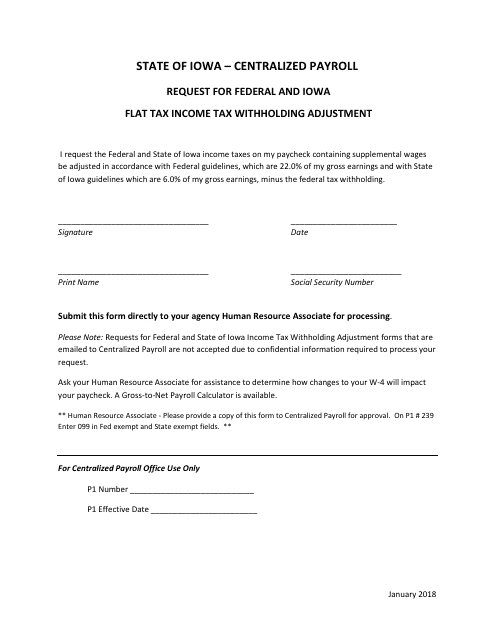

This Form is used for requesting adjustments to federal and Iowa flat tax income tax withholding in the state of Iowa.

This document provides instructions for completing the IRS Form W-3PR, which is used to transmit withholding statements. The instructions are available in both English and Spanish.

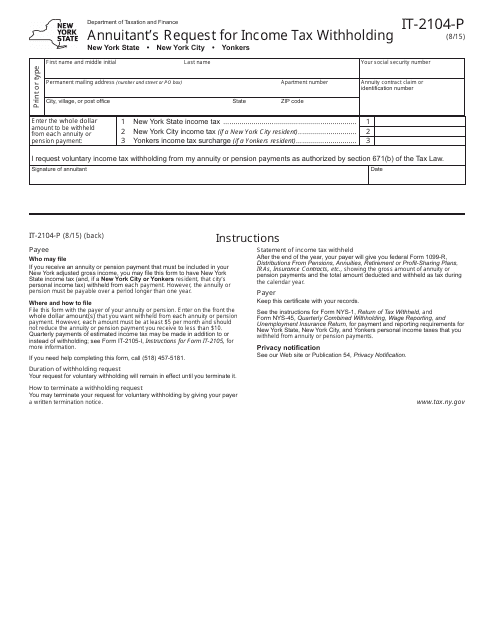

This form is used for annuitants in New York to request income tax withholding.

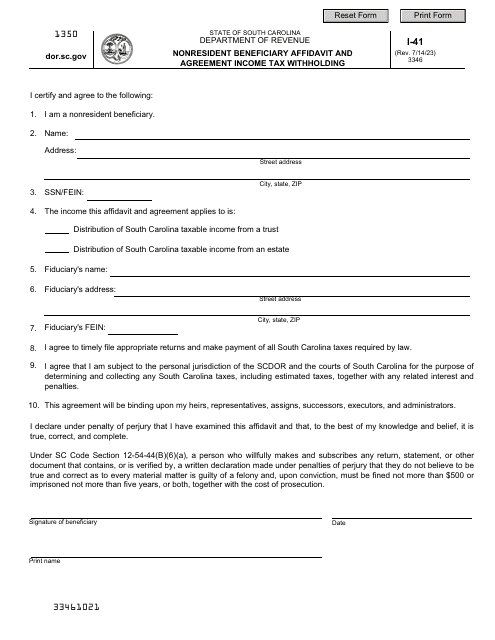

This form is used for nonresident shareholders or partners in South Carolina who need to provide an affidavit and agreement for income tax withholding.

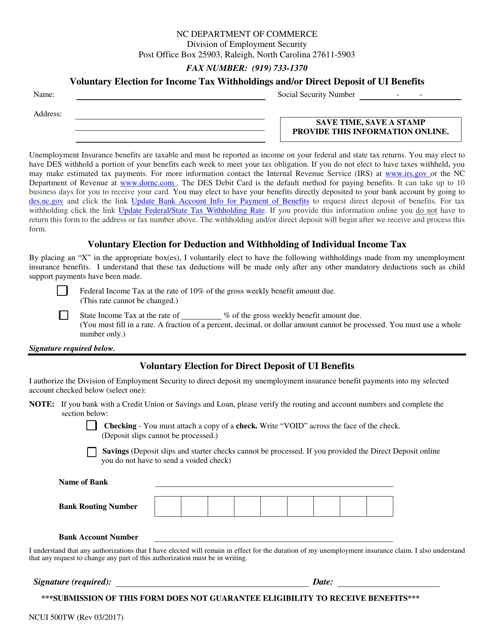

This form is used for voluntary election of income tax withholdings and/or direct deposit of UI benefits in North Carolina.

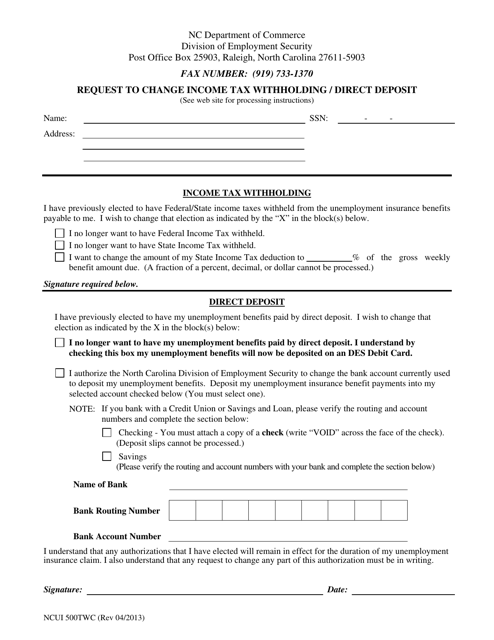

This form is used for residents of North Carolina to request a change in their income tax withholding or direct deposit information.

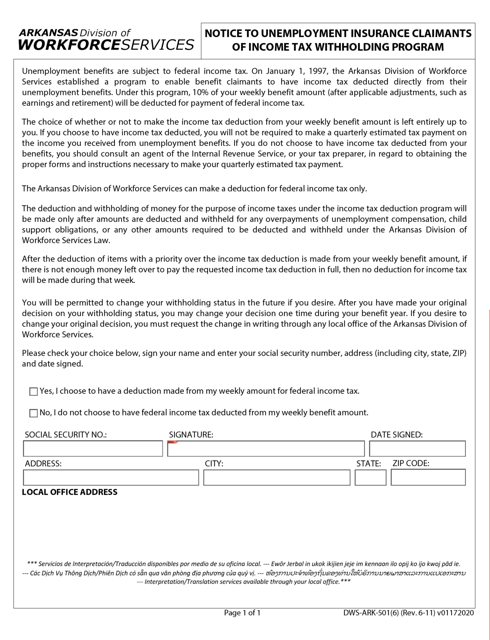

This form is used for notifying unemployment insurance claimants in Arkansas about the Income Tax Withholding Program.

This form is used for nonresident taxpayers in South Carolina to register and declare their income tax withholding status.

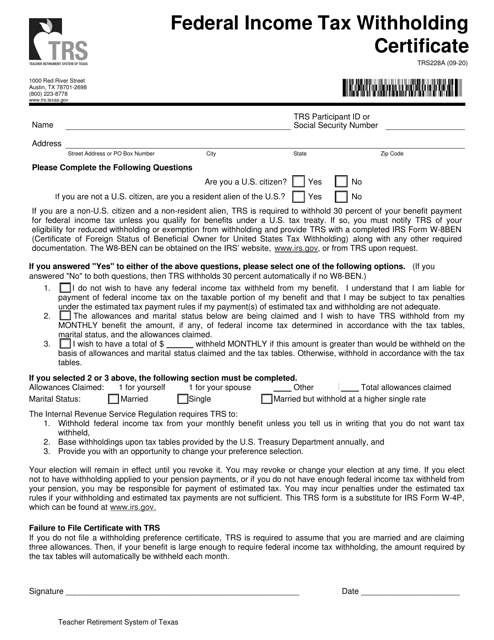

This form is used for the federal income tax withholding in Texas. It helps individuals to determine the correct amount of federal tax to be withheld from their paychecks.