Fiduciary Tax Templates

Are you looking for information and resources on fiduciary tax? Look no further! Our comprehensive collection of fiduciary tax documents will provide you with all the forms, instructions, and guidance you need to navigate the complex world of fiduciary tax filings.

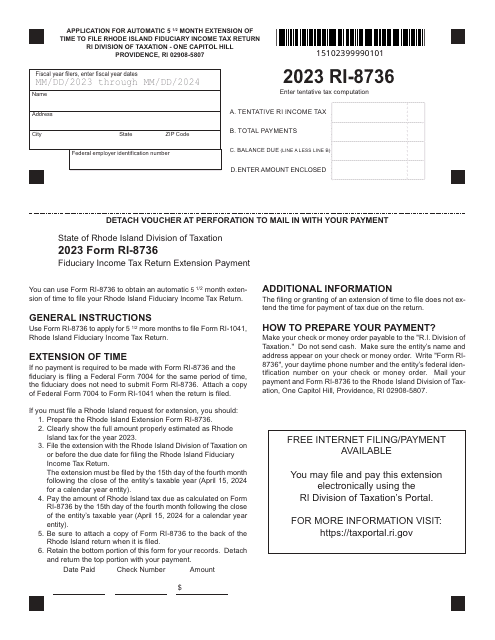

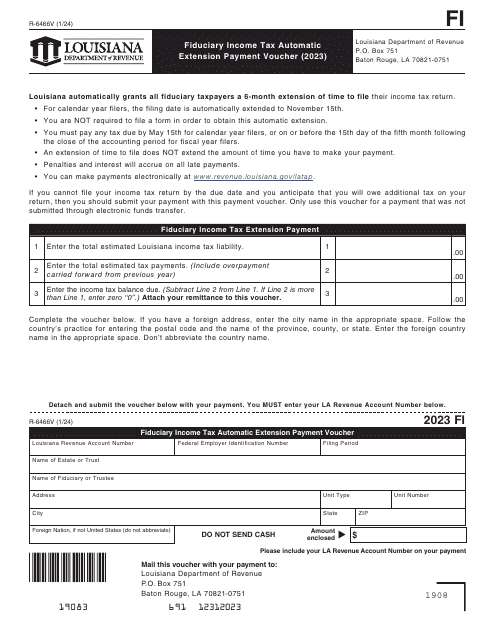

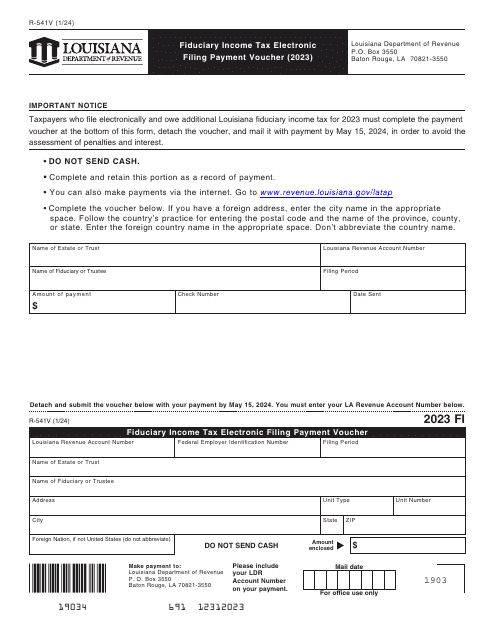

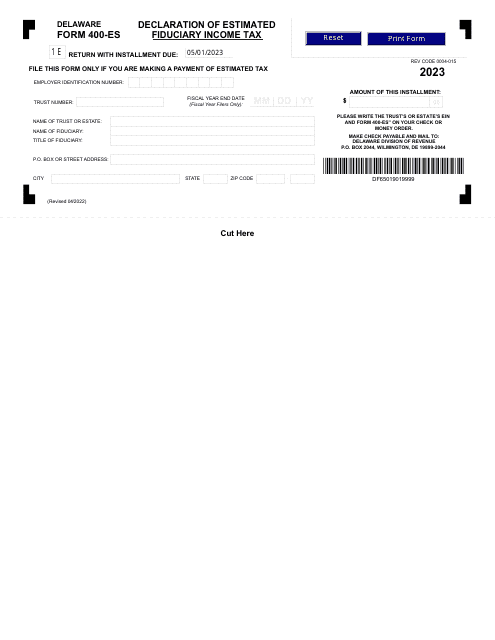

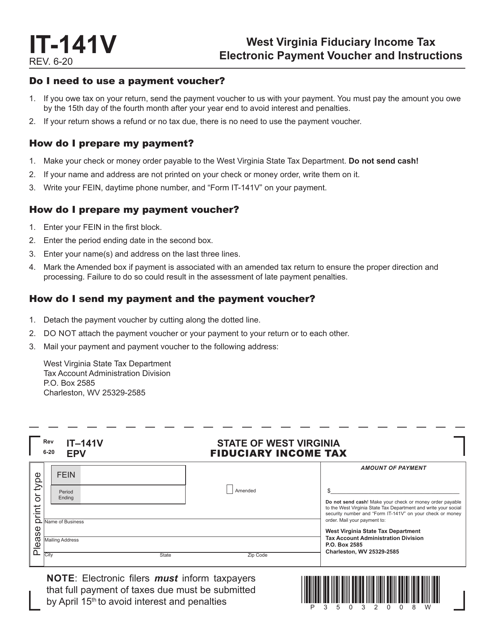

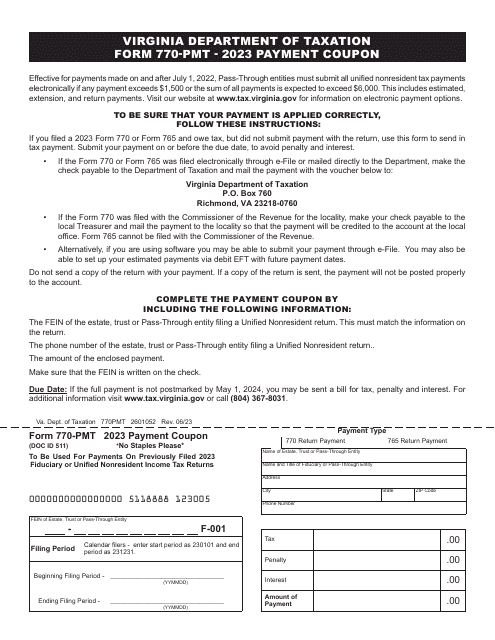

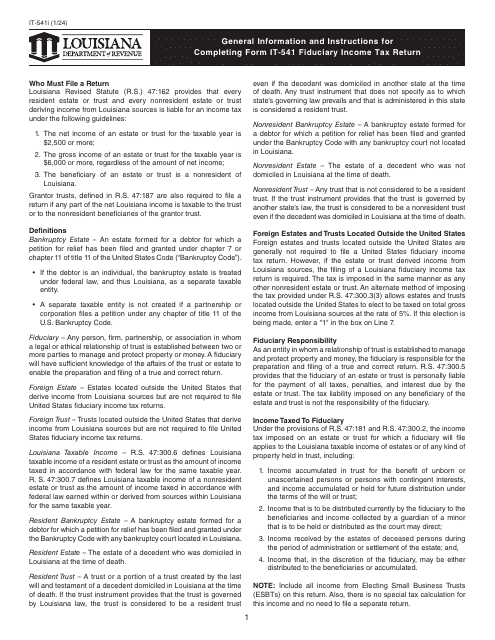

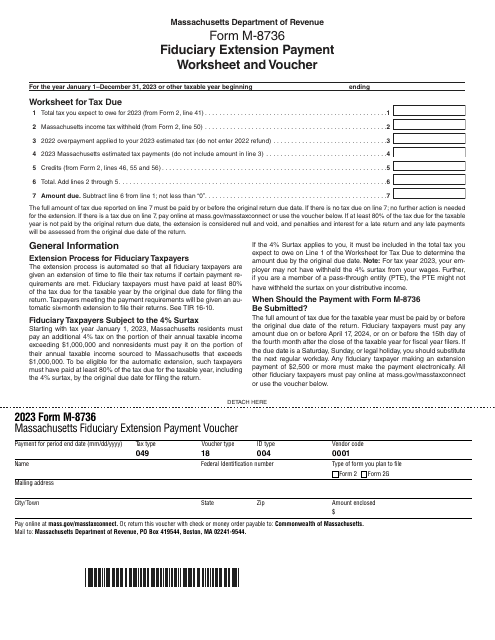

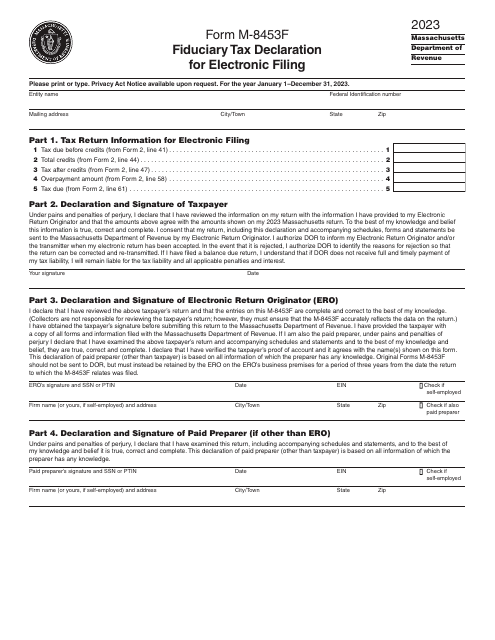

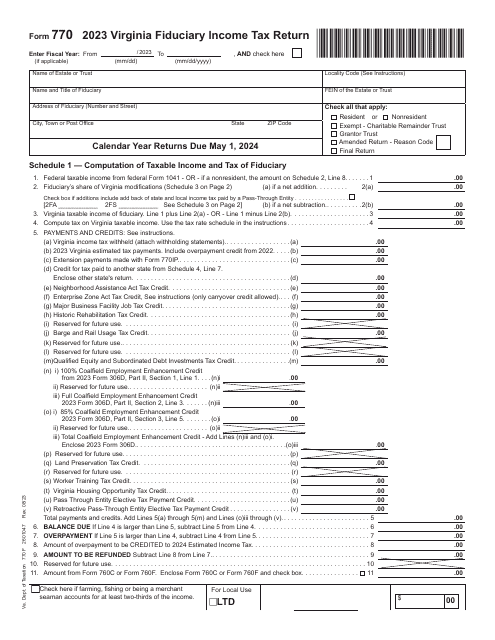

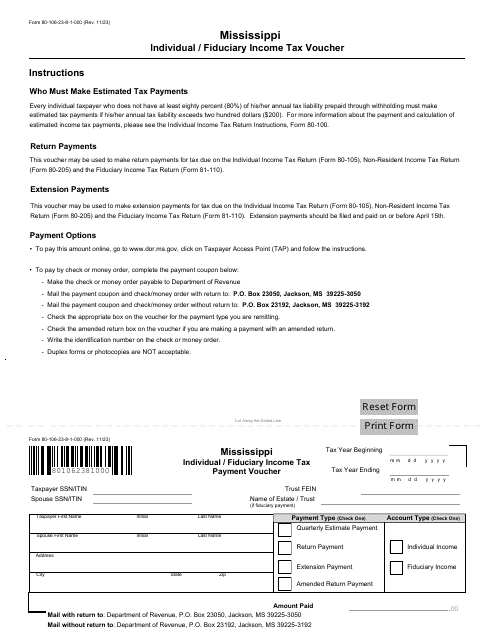

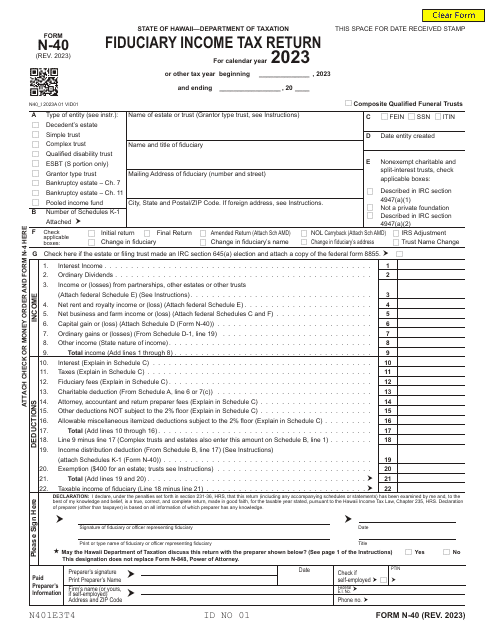

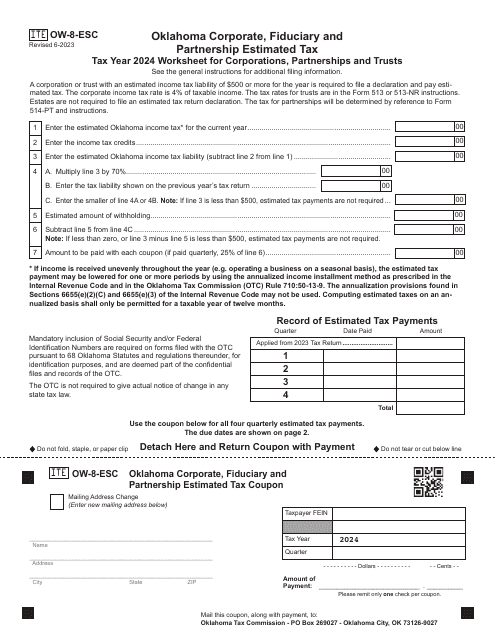

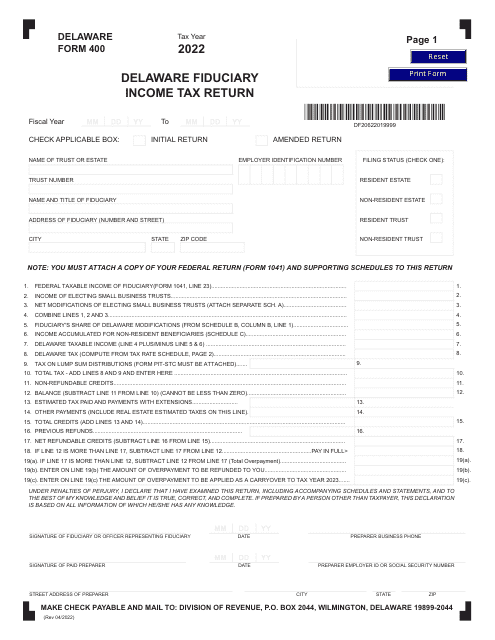

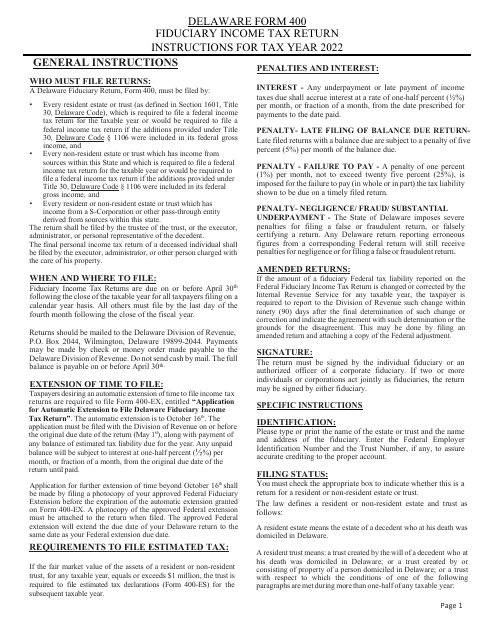

Whether you're looking for a fiduciary incometax return extension payment form in Rhode Island, a corporate, fiduciary, and partnership estimated tax worksheet for Oklahoma, a fiduciary income tax return in Delaware, or a fiduciary tax declaration for electronic filing in Massachusetts, we have you covered.

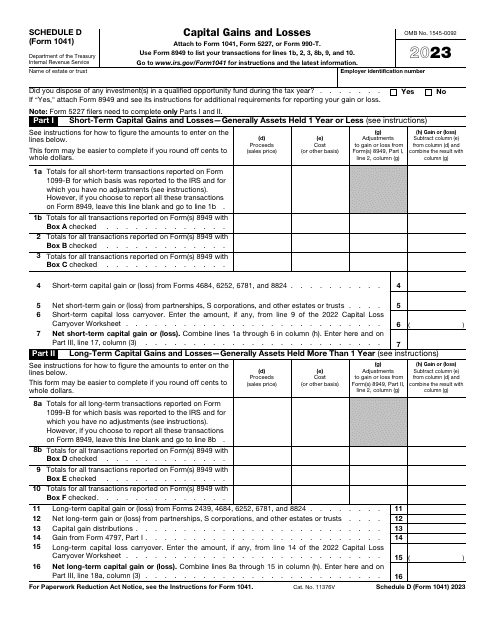

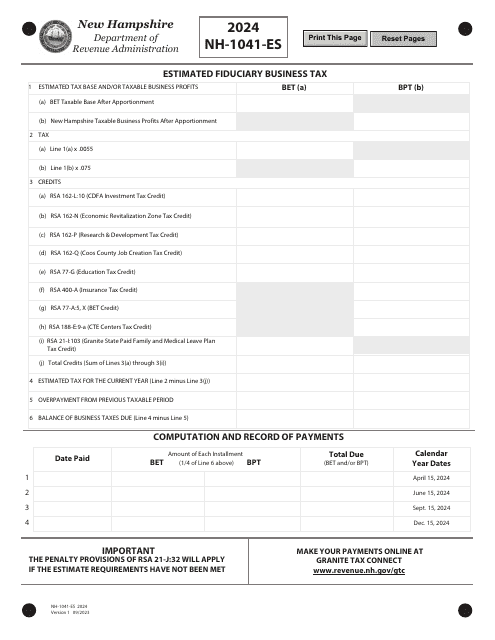

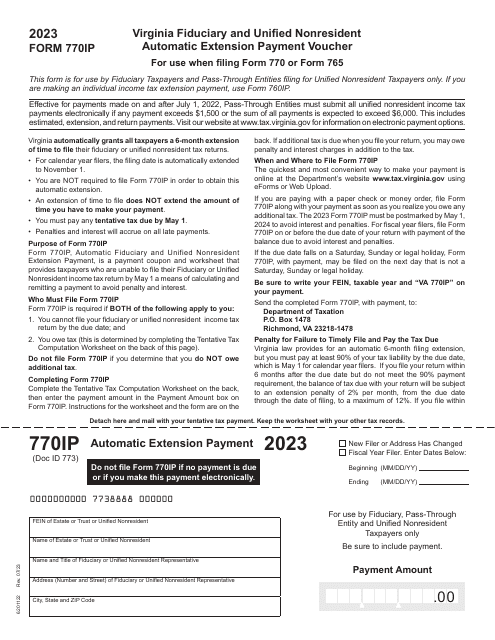

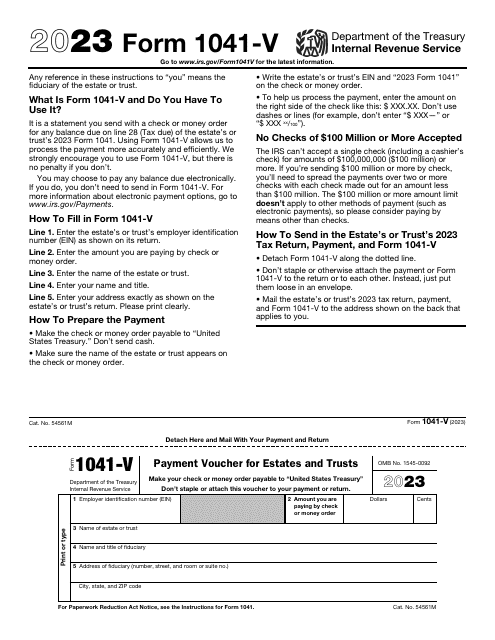

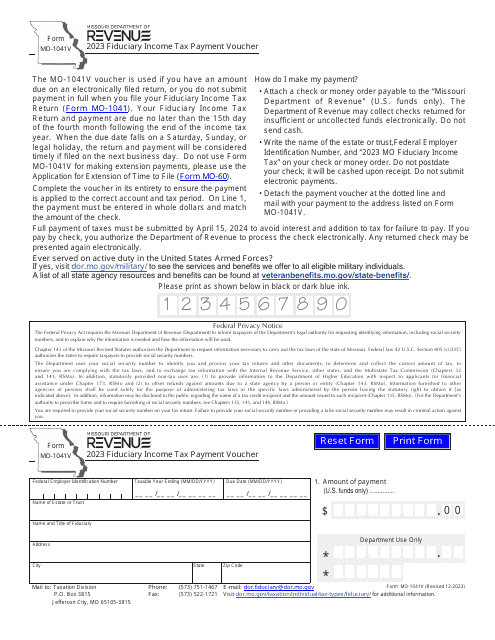

Our fiduciary tax document collection includes a wide range of forms, instructions, and resources from various states across the USA. No matter where you are located, you'll find the necessary documents to fulfill your fiduciary tax obligations.

Our alternate names for this documents group - fiduciary taxes, fiduciary tax documents, fiduciary tax forms - highlight the breadth and depth of resources available to help you successfully navigate the fiduciary tax landscape.

Don't let fiduciary tax filings overwhelm you. With our comprehensive collection of fiduciary tax documents, you'll have the information and resources you need at your fingertips. Start exploring today and ensure compliance with fiduciary tax requirements.

Documents:

60

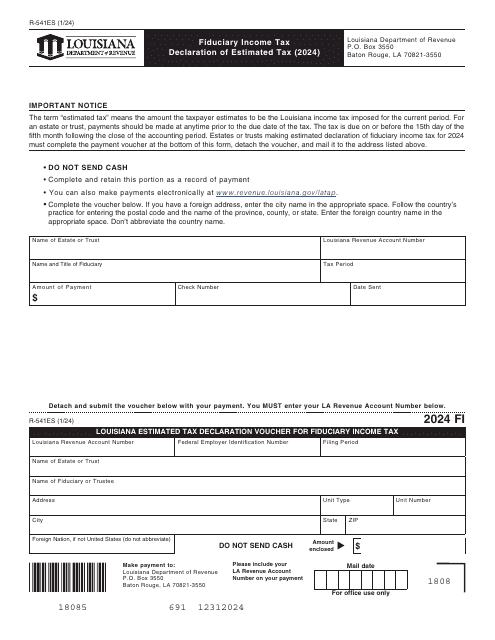

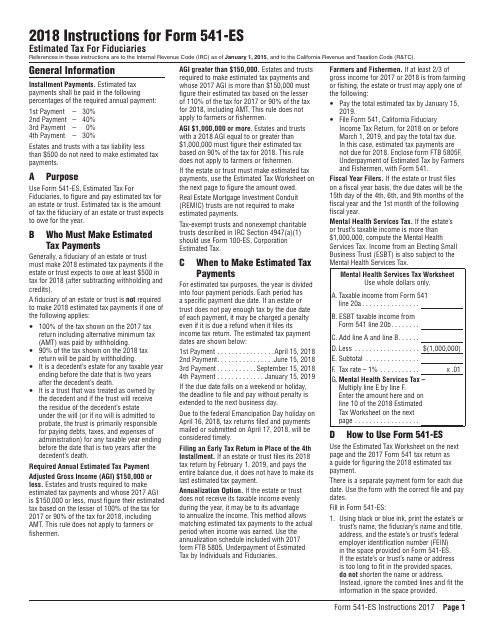

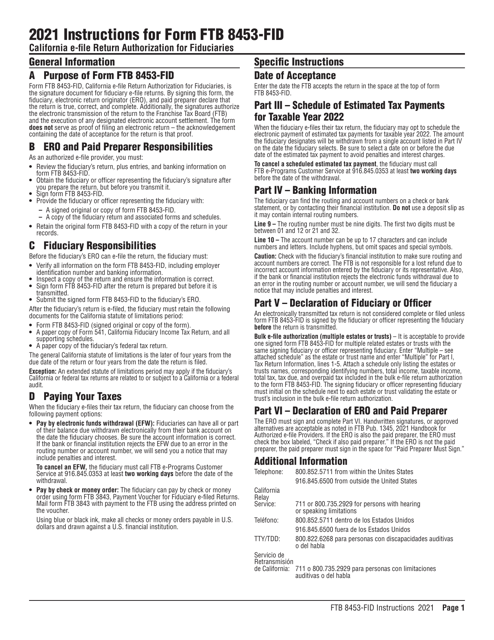

This Form is used for filing estimated tax payments for fiduciaries in California. It provides instructions on how to calculate and pay estimated taxes for trusts and estates.

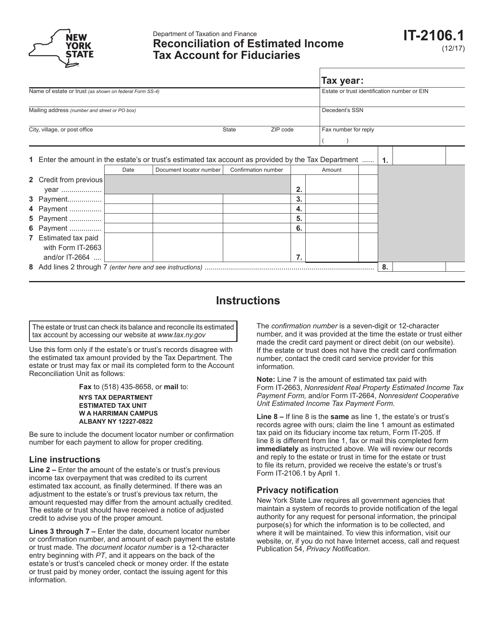

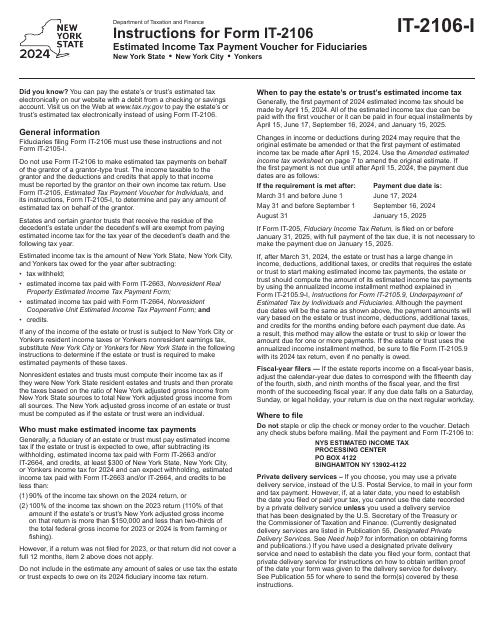

This form is used for reconciling the estimated income tax account for fiduciaries in the state of New York.

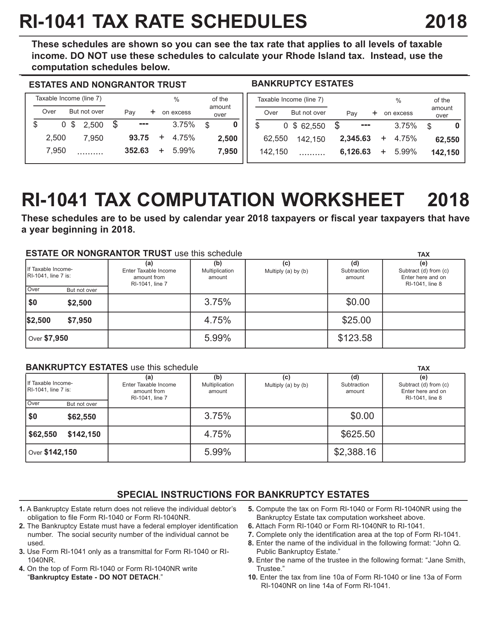

This form is used for calculating the tax rates and liabilities for fiduciaries in Rhode Island.

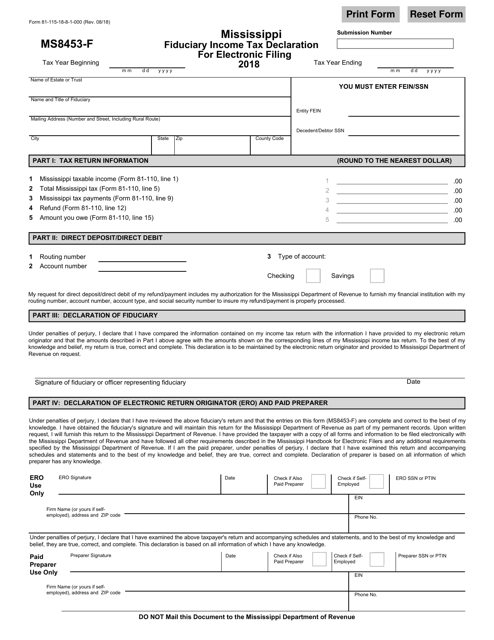

This Form is used for filing the fiduciary income tax declaration electronically in the state of Mississippi. It is also known as form 81-115-18-8-1-000 (MS8453-F).

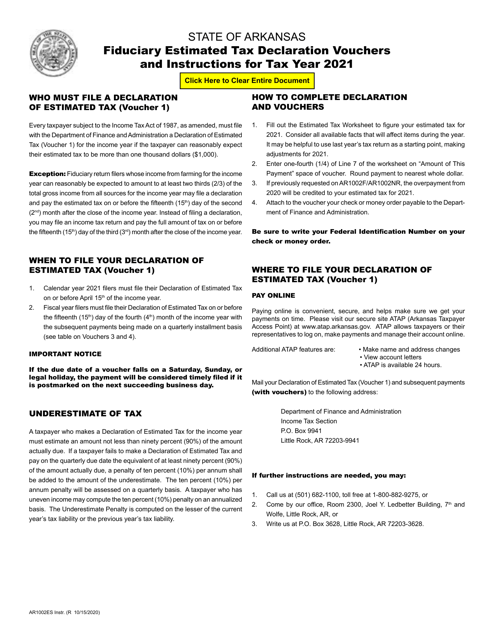

This form is used for filing estimated tax declarations by fiduciaries in Arkansas.

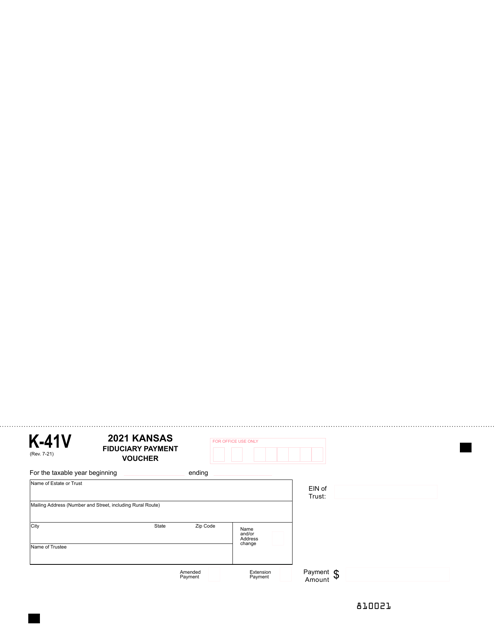

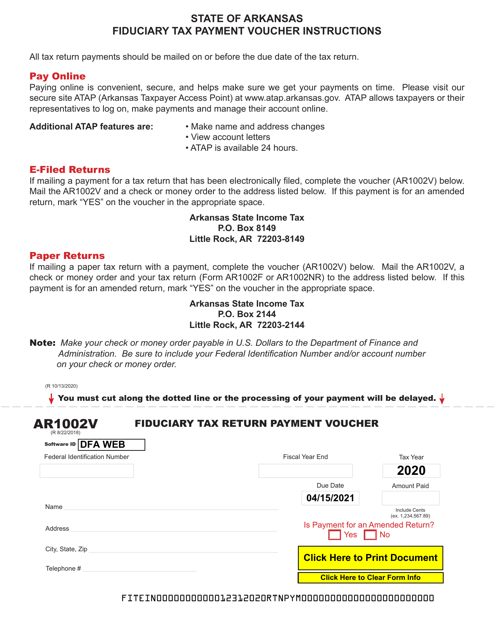

This form is used for making tax payments for a Fiduciary Tax Return in the state of Arkansas.