Debt Collector Templates

Are you struggling with managing collections for your business? Look no further than our comprehensive collection of documents for debt collectors. Our carefully curated library includes a variety of resources to streamline your debt collection processes and ensure compliance with relevant regulations.

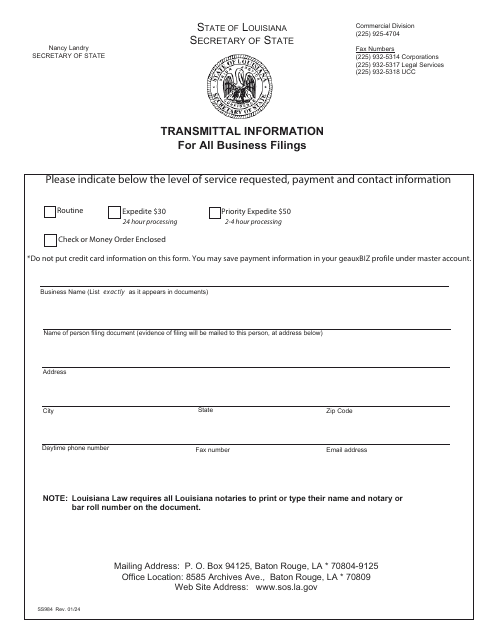

Whether you are a small business owner or an established collection agency, our collection of templates and forms will provide you with the necessary tools to effectively manage debt collection. From the Form SS I-1 Collection Agency/Debt Collector Registration Form in Louisiana to sample debt validation and dispute letters, we have you covered.

Our debt collector documents have been designed to simplify and expedite the debt collection process. These resources will not only help you stay organized, but also ensure that you are following legal requirements and protecting the rights of both your business and debtors.

So why spend valuable time creating your own debt collection documents from scratch when you can access our comprehensive library? Start using our debt collector resources today and experience the difference they can make in your debt collection efforts.

Documents:

12

This document helps you keep track of your debt collector interactions and payments. It is a useful tool for managing your debts and ensuring that you are staying on top of your financial obligations.

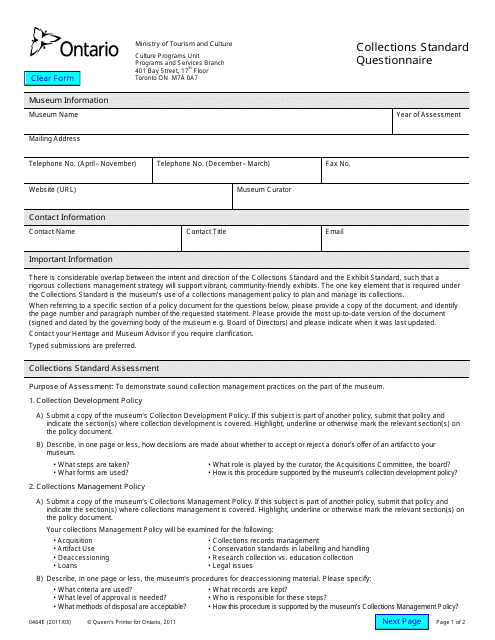

This Form is used for conducting collections standard questionnaires in Ontario, Canada. It is designed to gather information for assessing compliance with collections standards.

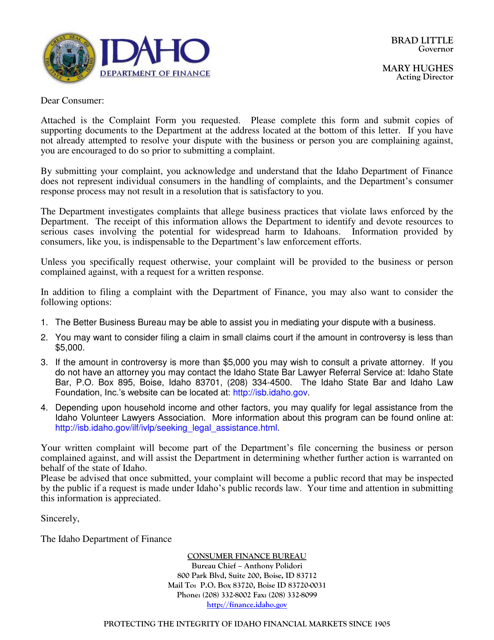

This Form is used for filing a complaint against a collection agency in Idaho.

This type of debt settlement letter is used by filers who want to decrease the debt on their credit card.

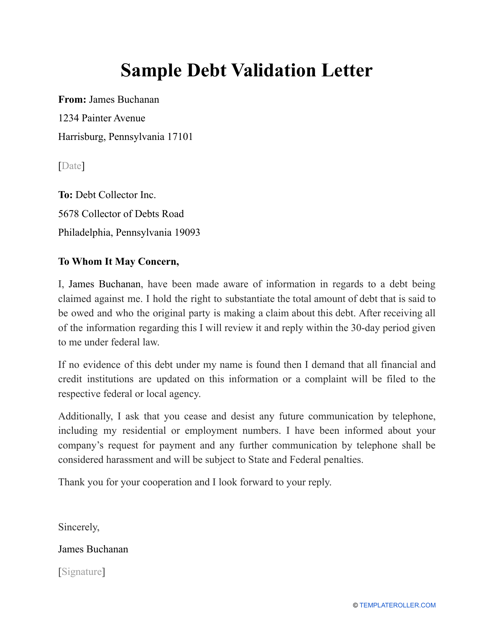

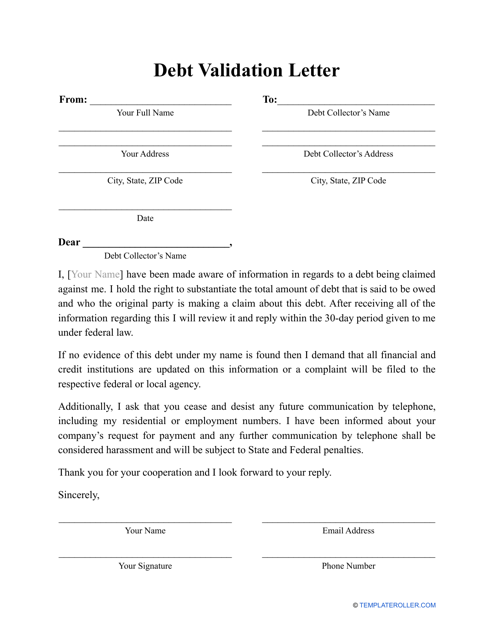

An individual or entity may prepare this type of letter and send it to a financial institution that has notified them about a debt to find out whether this debt is legitimate.

Use this letter to request information about your credit history and any particular debts you may have.

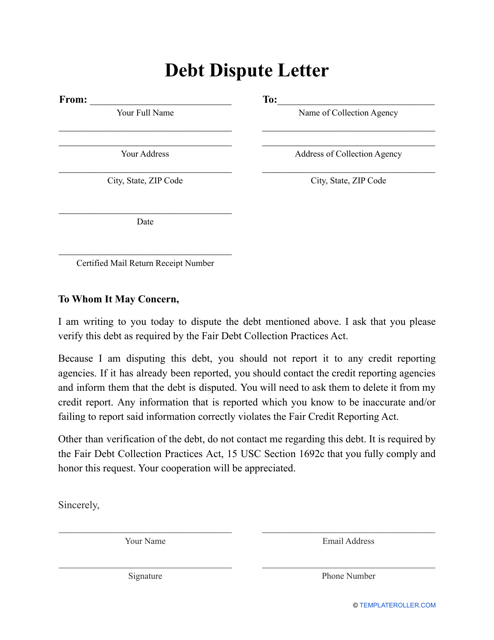

This letter serves as a refusal to accept debt and is written in response to a collector's notice.

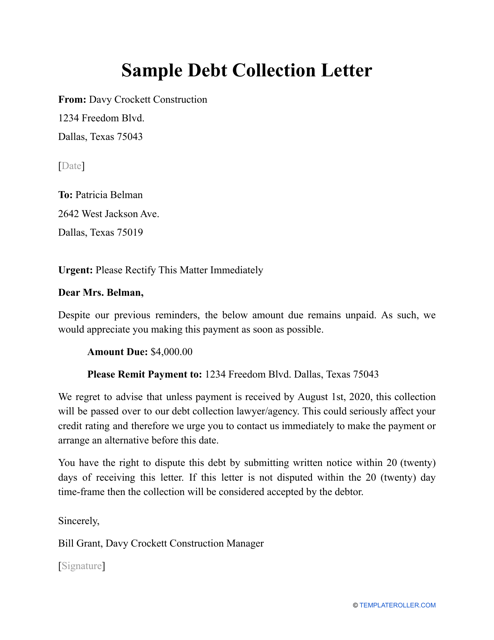

A lender can preparer this financial statement and send it to a borrower with the request for them to handle an unpaid debt.

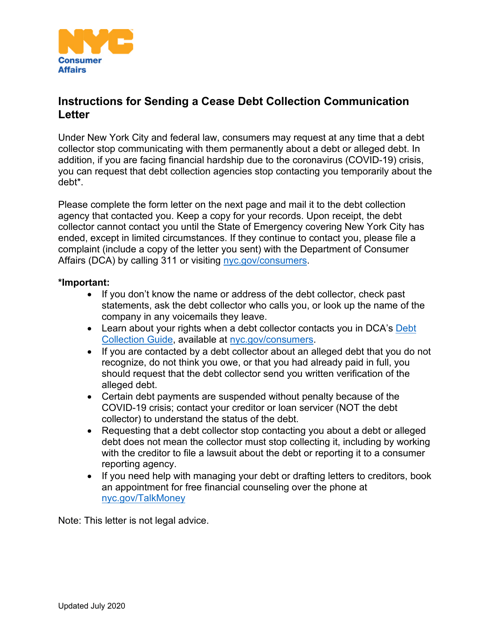

This document is used to stop debt collectors from contacting you in New York City.

This type of document is a Cease Debt Collection Communication Letter specifically for residents of New York City. It is available in both English and Korean languages.

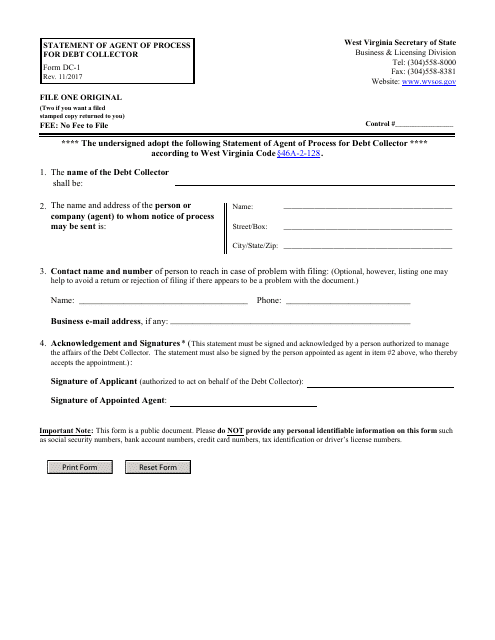

This form is used for appointing an agent of process for a debt collector in West Virginia.