Quarterly Taxes Templates

Are you a freelancer or self-employed worker? Do you need to pay taxes on a quarterly basis rather than annually? If so, you've come to the right place. We have all the information and resources you need to navigate the world of quarterly taxes.

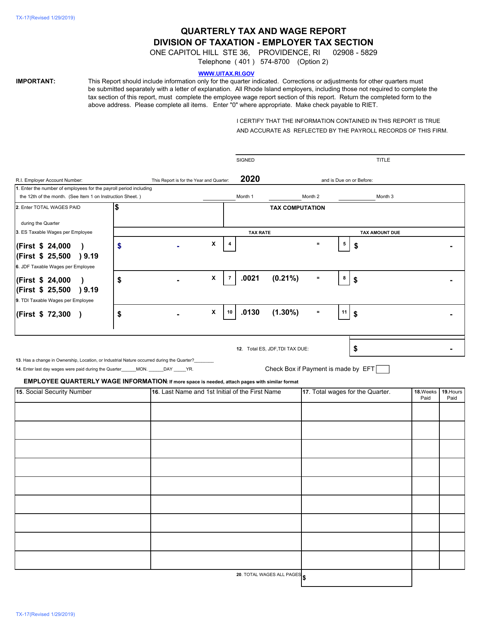

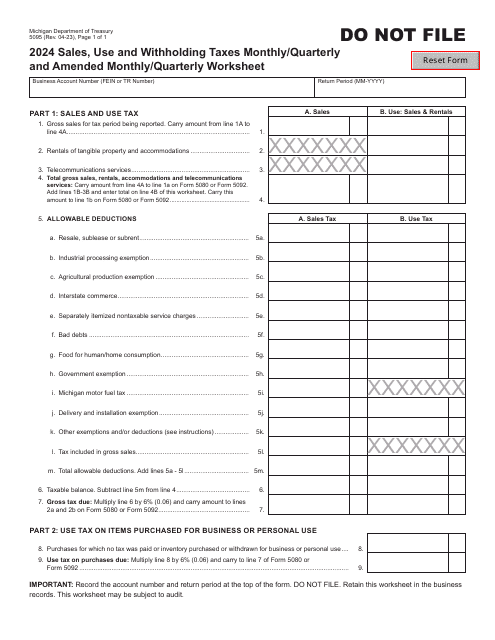

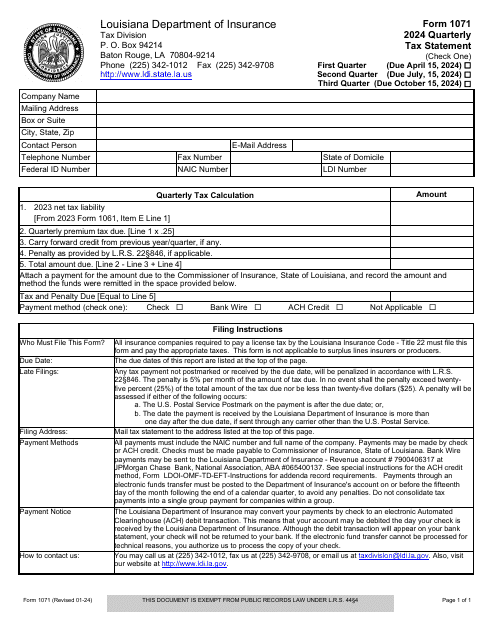

Quarterly taxes, also known as quarterly tax forms or quarterly tax payments, are a requirement for individuals and businesses who are not subject to traditional payroll withholding. These payments are made to the Internal Revenue Service (IRS) and other tax authorities on a quarterly basis throughout the year.

Filing quarterly taxes can be a complex process, but we're here to help simplify it for you. Whether you're an independent contractor, freelancer, or small business owner, understanding and managing your quarterly tax obligations is crucial to avoiding penalties and staying in compliance with tax laws.

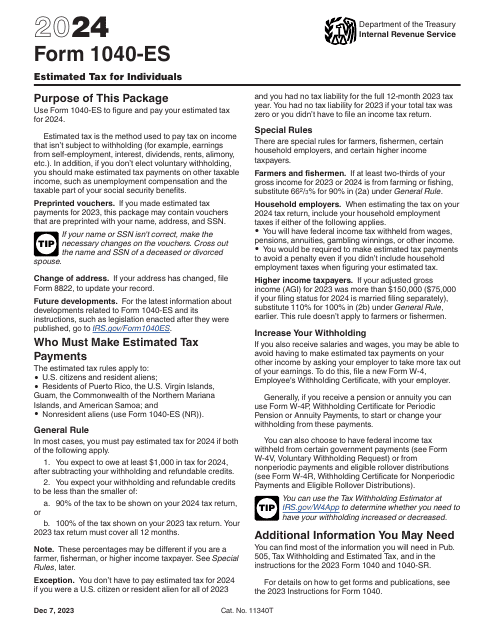

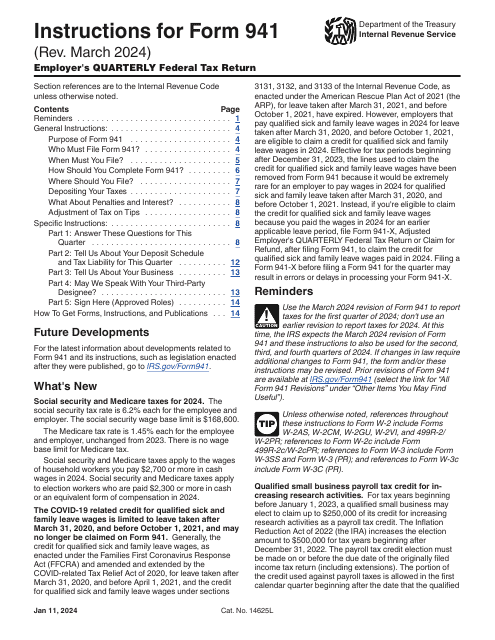

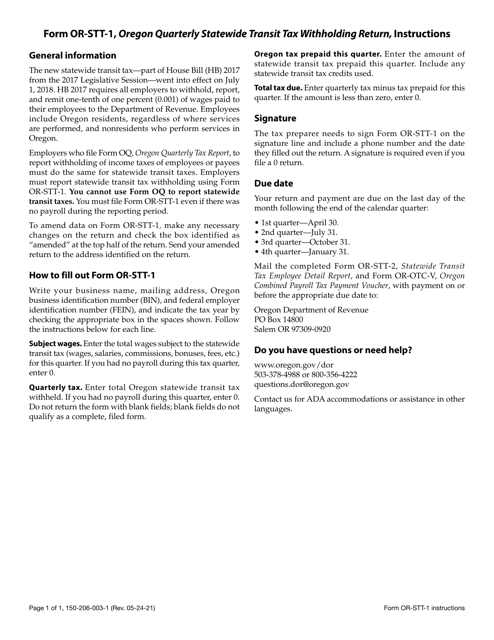

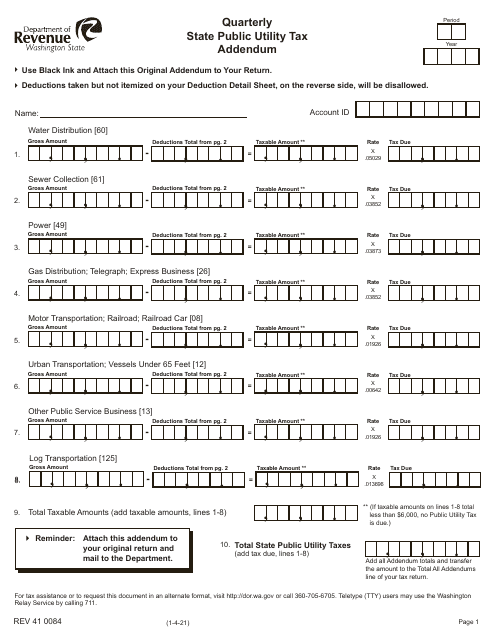

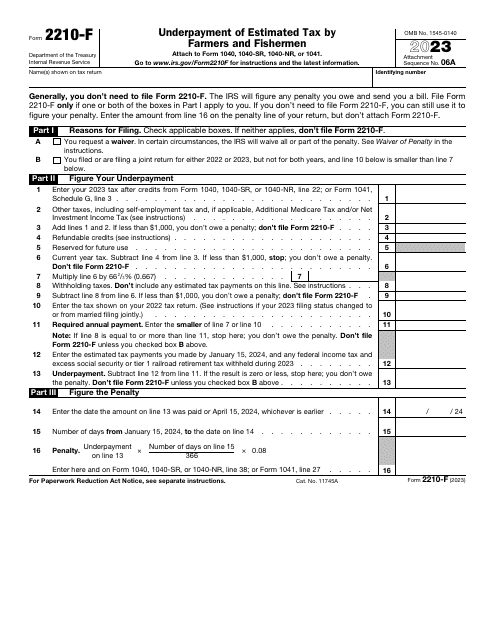

Our website provides a comprehensive collection of resources to assist you in calculating and paying your quarterly taxes. We have detailed instructions and forms for various types of quarterly tax returns, including the IRS Form 1040-ES for individuals and state-specific forms for businesses.

Additionally, we offer guidance on estimating your tax liability, determining the appropriate quarterly tax payment amounts, and keeping accurate records of your income and expenses. We understand that tax laws and regulations can be overwhelming, so we strive to present the information in a clear and concise manner.

Don't let quarterly taxes become a burden. Let us be your go-to resource for everything you need to know about quarterly tax payments. Stay on top of your tax obligations and avoid any surprises by utilizing our expert guidance and resources. Start exploring our website today to gain confidence and control over your quarterly tax responsibilities.

Documents:

35

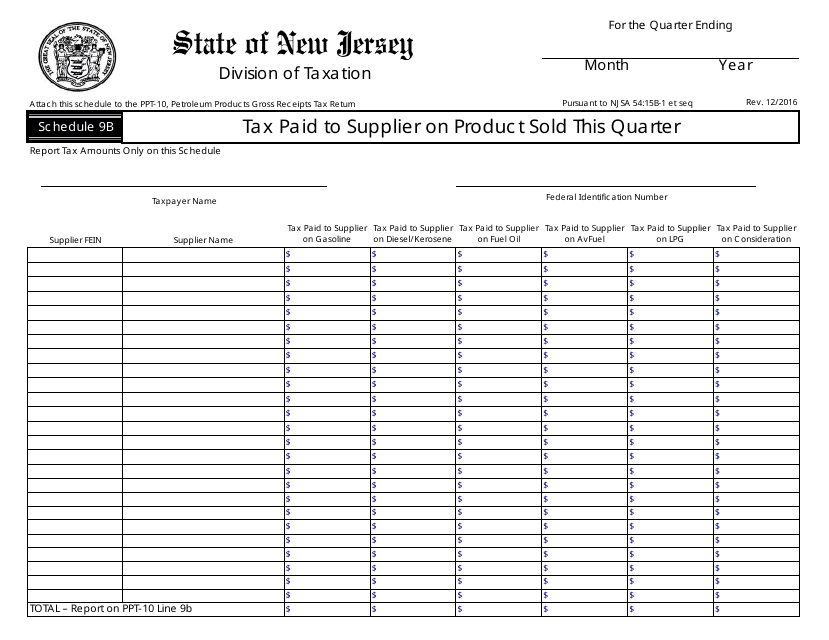

This Form is used for reporting tax paid to suppliers on products sold in the current quarter in the state of New Jersey.

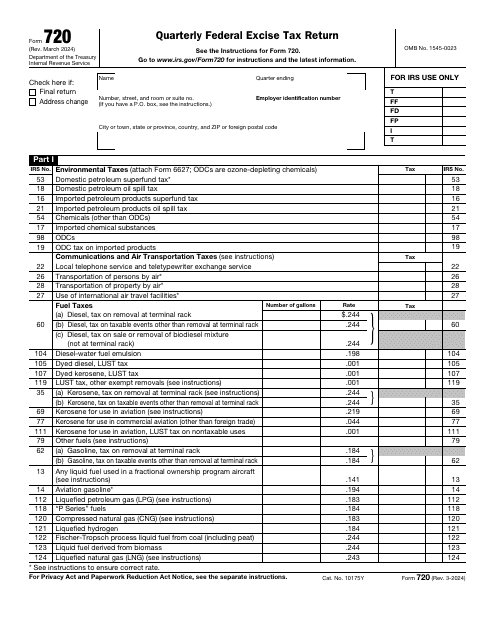

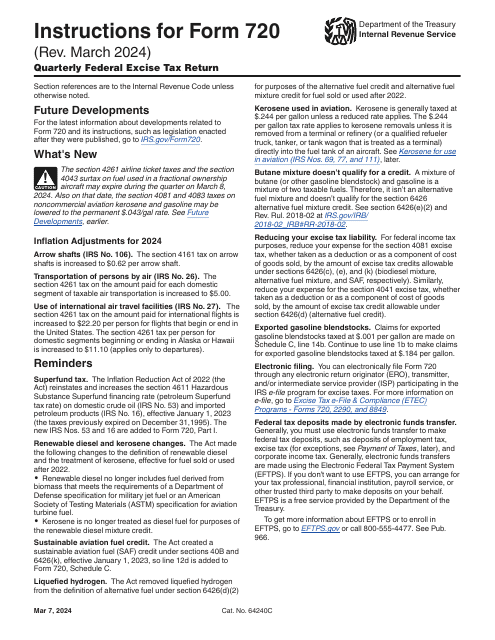

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

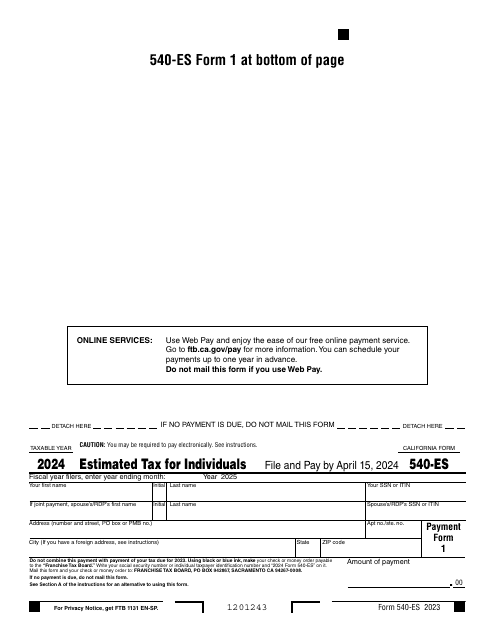

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

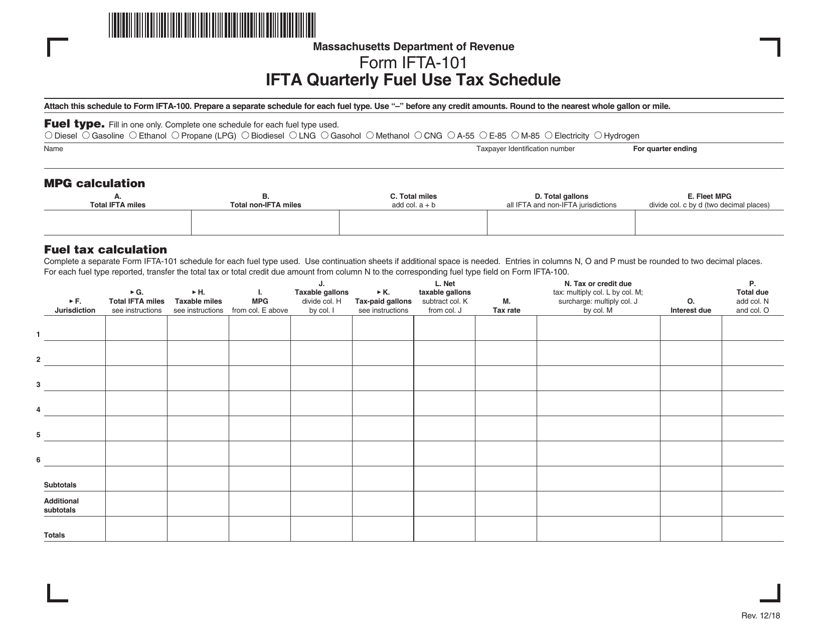

This Form is used for filing the IFTA Quarterly Fuel Use Tax Schedule in the state of Massachusetts.

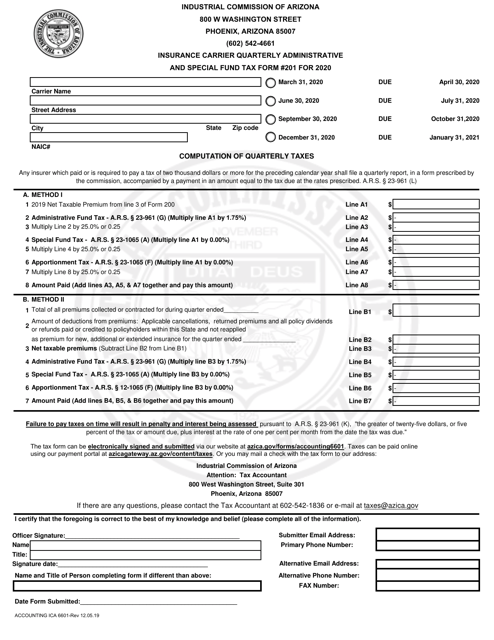

This Form is used for accounting purposes by insurance carriers to file quarterly tax information in the state of Arizona.

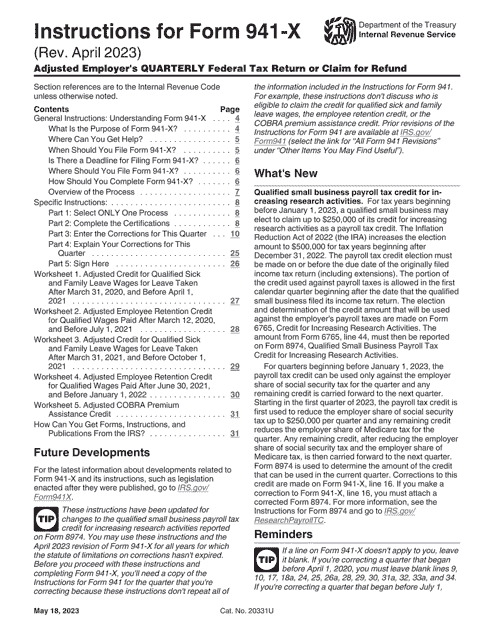

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

Fill out this form over the course of a year to pay your taxes in the state of California.

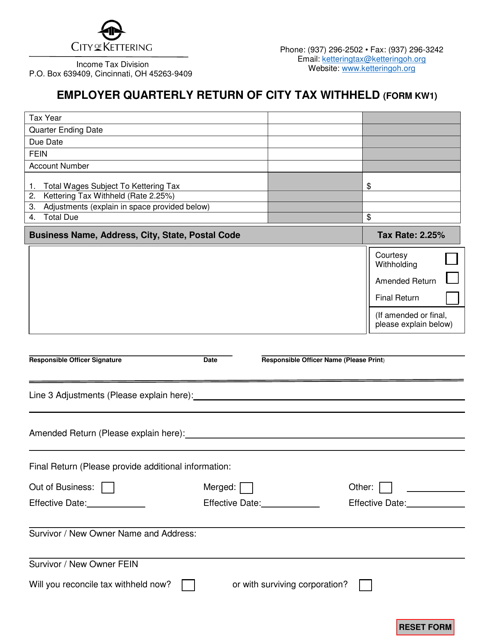

This form is used for employers in Kettering, Ohio to report the amount of city tax withheld from employee wages on a quarterly basis.

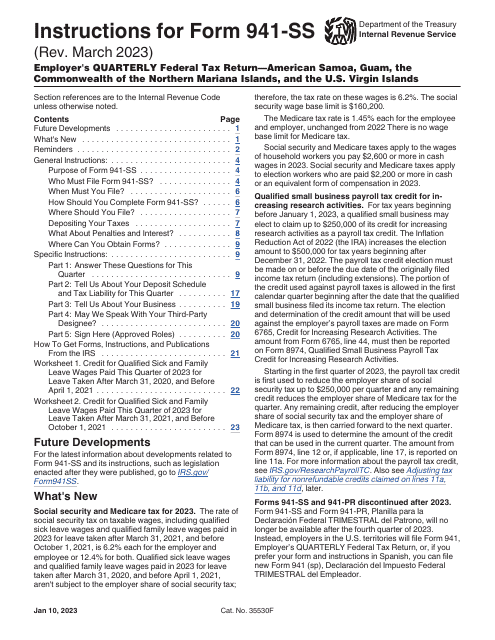

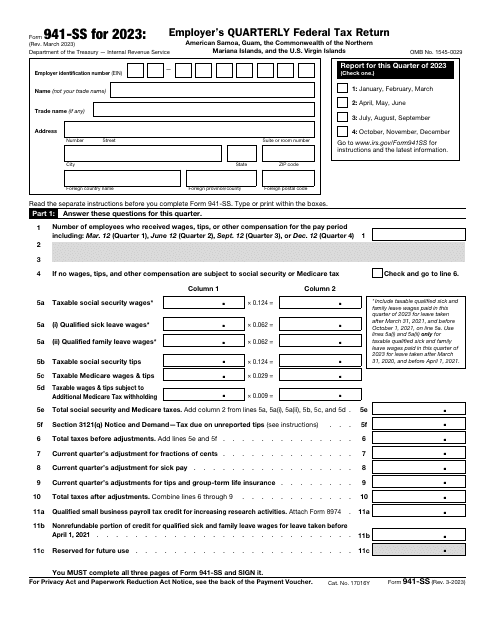

This document, otherwise known as the Employer's Quarterly Federal Tax Return, is a form downloaded to report about your social security and Medicare taxes. This form is used only if the official place of business is located within the specified territories.

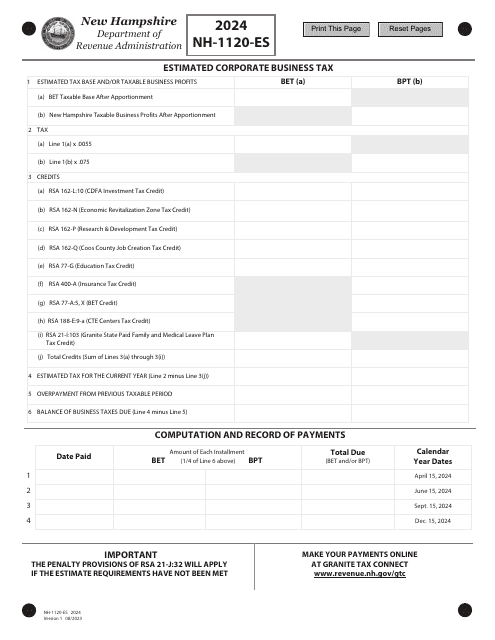

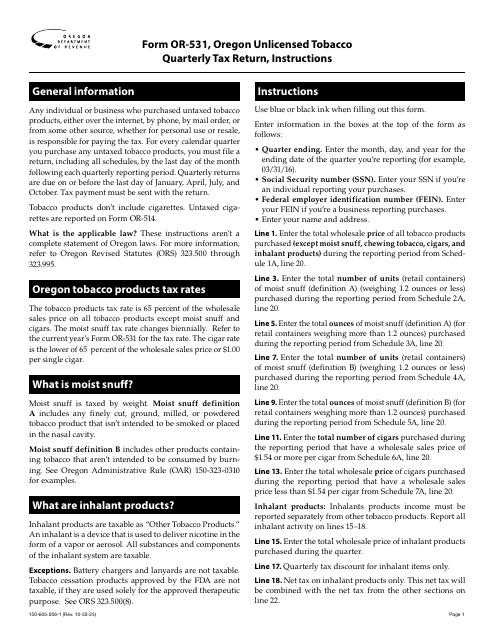

This Form is used for reporting quarterly state public utility tax in the state of Washington.

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.