Capital Structure Templates

Capital Structure: Maximizing Financial Efficiency and Stability

Achieving optimal capital structure is crucial for businesses of all sizes. It involves finding the right balance between debt and equity financing to maximize financial efficiency and stability. In this comprehensive collection of documents, we provide valuable information and resources to help you navigate the complexities of capital structure.

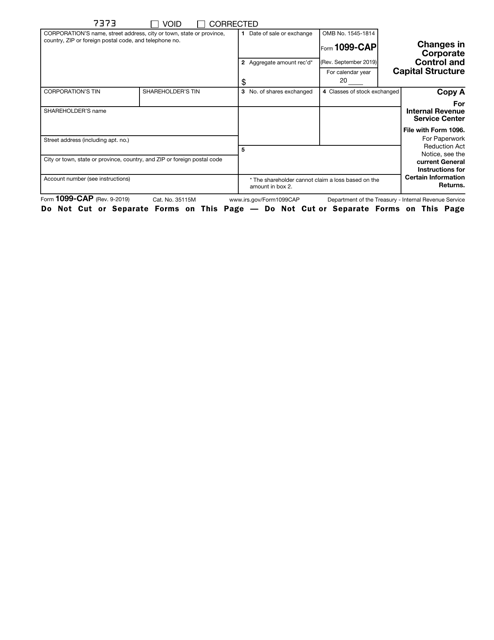

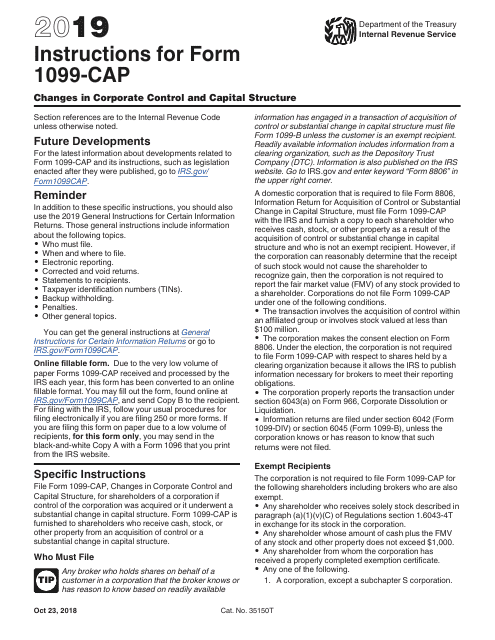

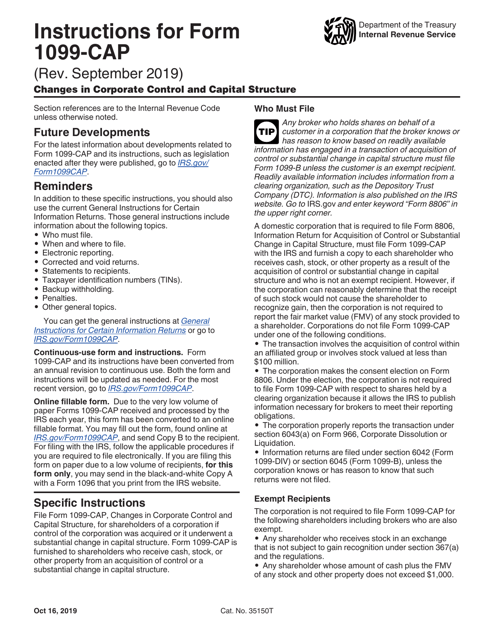

Our collection includes essential guidance and forms such as the IRS Form 1099-CAP. This form, also known as "Changes in Corporate Control and Capital Structure," is used to report significant changes in a company's ownership and capital structure. Understanding and correctly filling out this form is essential for compliance with IRS regulations.

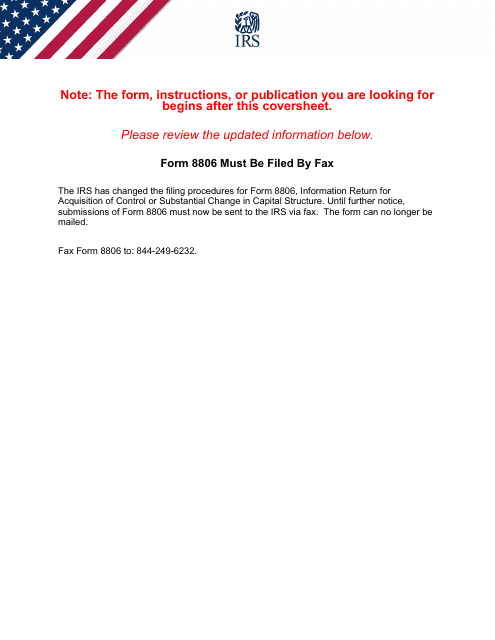

Another valuable resource we offer is the IRS Form 8806, also known as the "Information Return for Acquisition of Control or Substantial Change in Capital Structure." This form is used to report the acquisition of control or substantial changes in a company's ownership or capital structure. Compliance with this form is vital for accurate reporting and meeting tax obligations.

In addition to these specific forms, our collection includes comprehensive instructions and guidance on capital structure and its importance. Whether you are a business owner, financial professional, or individual seeking to understand capital structure better, our documents provide valuable insights and resources.

By leveraging the knowledge and resources available in our comprehensive collection, you can make informed decisions about your company's capital structure. Achieving the right balance between debt and equity financing can provide stability, flexibility, and ultimately drive financial success.

Discover the key principles, regulations, and best practices surrounding capital structure with our extensive collection. Explore the alternate names such as "Optimizing Financial Efficiency and Stability" or "Navigating Changes in Corporate Control and Capital Structure" to gain a deeper understanding of this essential aspect of business finance.

Documents:

6

This type of document provides instructions for filling out IRS Form 1099-CAP, which is used to report changes in corporate control and capital structure.

This form is used for reporting changes in corporate control and capital structure to the IRS. It is important for businesses to accurately complete this form to comply with tax regulations.