Historic Rehabilitation Templates

Are you looking to restore and preserve historic buildings? Do you want to take advantage of tax credits to offset the cost of these rehabilitation projects? Look no further than our collection of documents on historic rehabilitation, also known as historic rehabilitation forms.

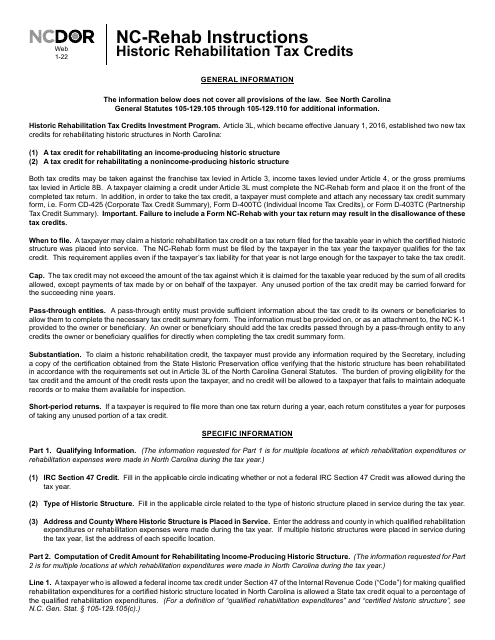

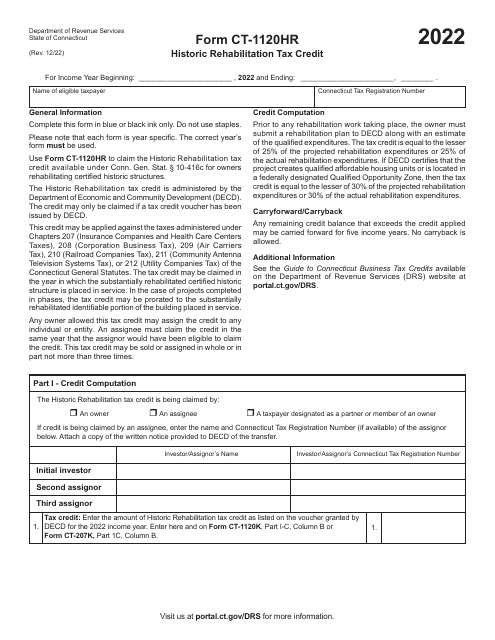

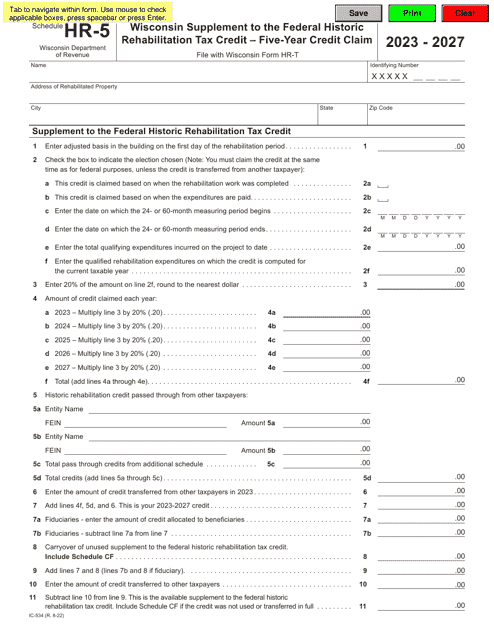

From instructions for specific state tax credit programs like the North Carolina Historic Rehabilitation Tax Credits, to federal supplemental forms such as the Wisconsin Supplement to the Federal Historic Rehabilitation Tax Credit, our comprehensive collection has got you covered.

Whether you're in Alabama and need the Continuation Sheet for the Alabama Historic Rehabilitation Tax Credit Program or in Wisconsin and require the Form IC-034 Schedule HR Wisconsin Historic Rehabilitation Credits, you'll find all the necessary documents here.

Historic rehabilitation is not just about preserving the past; it's about injecting new life into historic properties while benefiting from tax incentives. Explore our extensive documents collection on historic rehabilitation to ensure a smooth and successful restoration project. Trust us to provide you with the essential resources you need to navigate the complexities of obtaining tax credits for historic rehabilitation.

Documents:

11

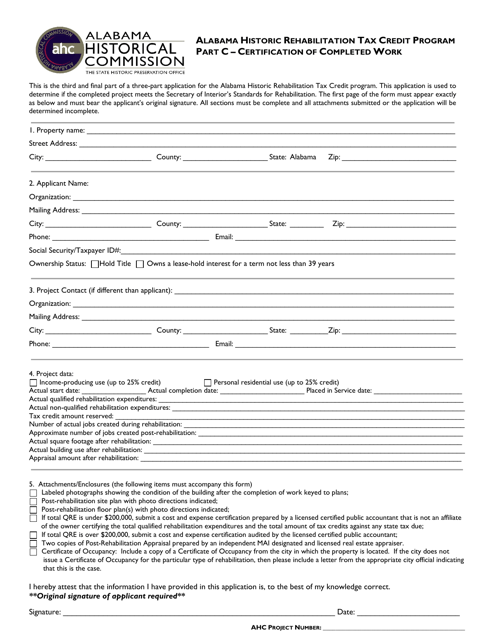

This document certifies the completion of work for the Alabama Historic Rehabilitation Tax Credit Program.

This form is used for making amendments to the Alabama Historic Rehabilitation Tax Credit Program.

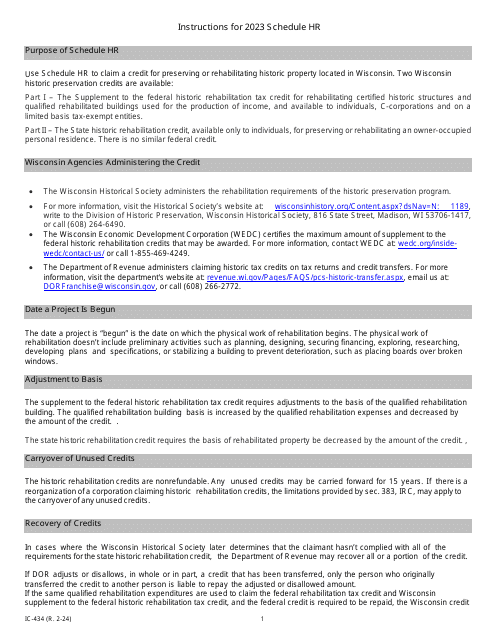

Instructions for Form IC-034 Schedule HR Wisconsin Historic Rehabilitation Credits - Wisconsin, 2023

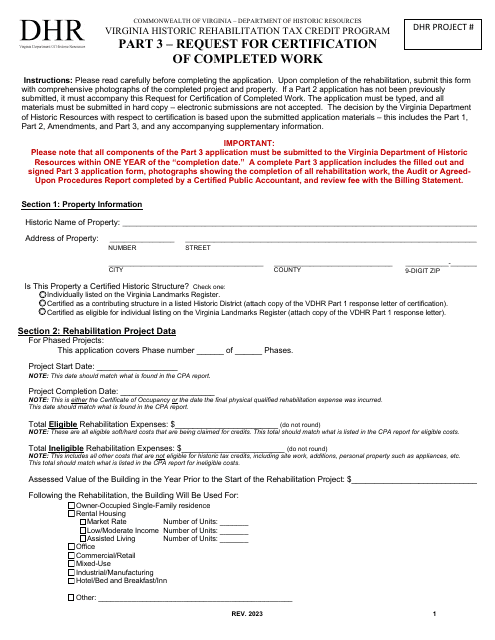

This document is used for requesting certification of completed work for the Virginia Historic Rehabilitation Tax Credit Program in Virginia.

This form is used for providing additional information for the Alabama Historic Rehabilitation Tax Credit Program in Alabama.