Pension Plan Templates

A pension plan, also known as a retirement plan or superannuation, is a financial arrangement designed to provide income to individuals during their retirement years. This comprehensive document collection covers a wide range of topics related to pension plans, ensuring you have all the information you need to make informed decisions and navigate the complexities of retirement planning.

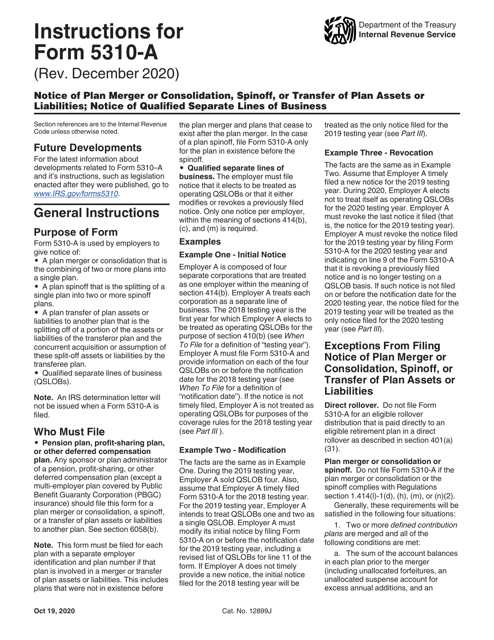

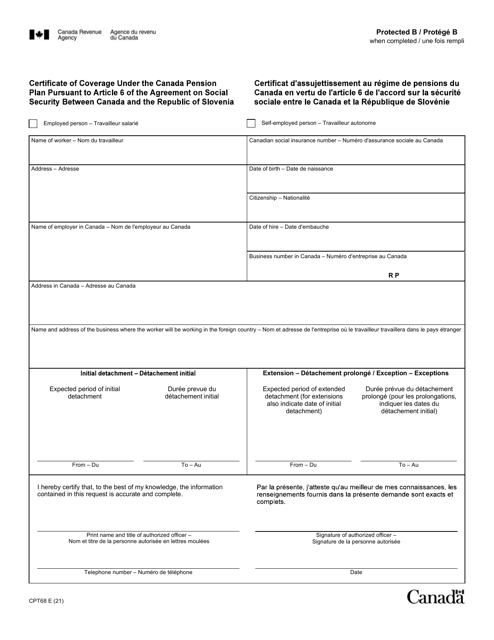

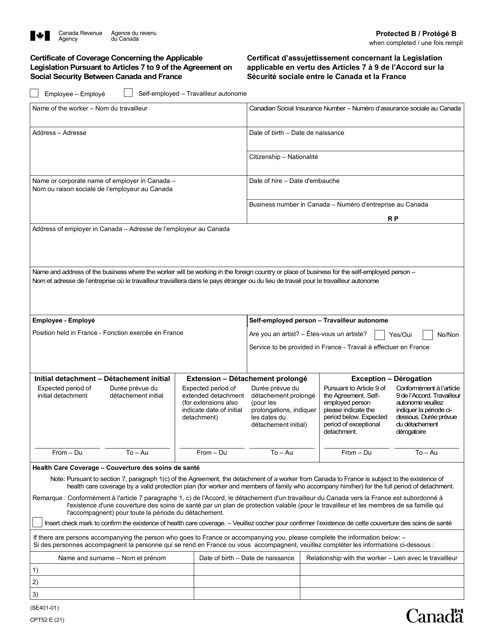

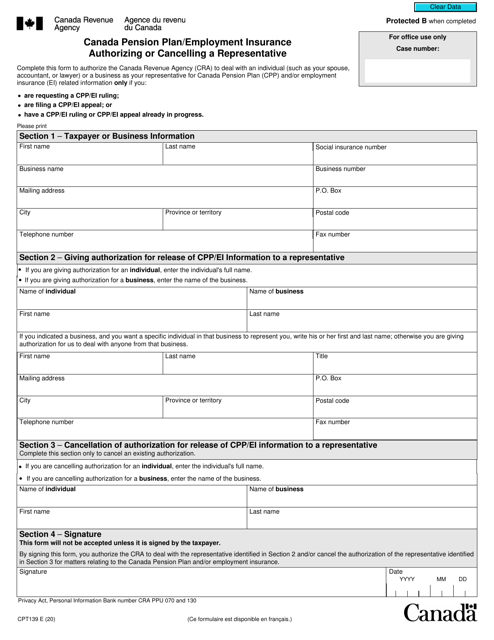

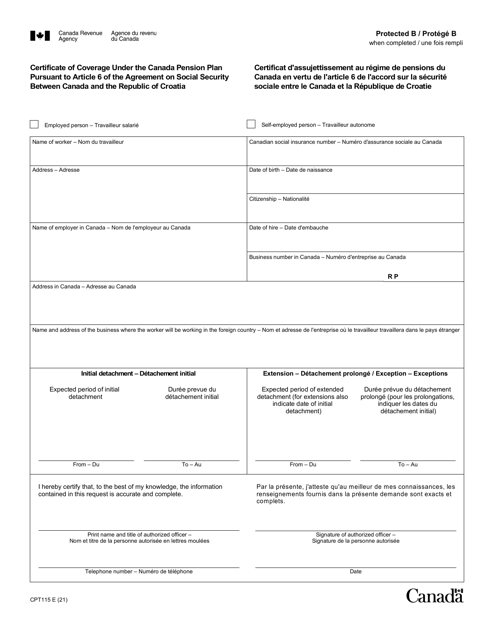

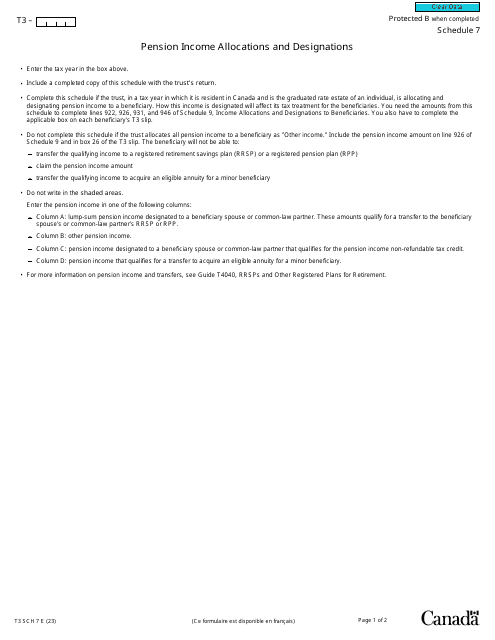

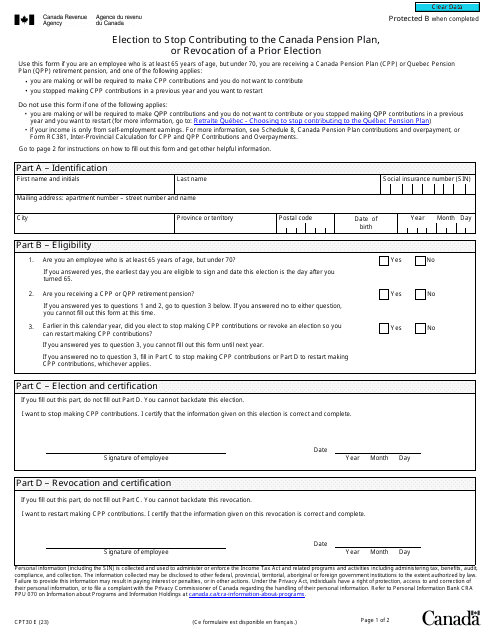

Whether you're an employer looking to establish a pension plan for your employees, or an individual seeking guidance on managing your retirement savings, this collection of documents has got you covered. From instructions for IRS Form 5310-A Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities, to the Form CPT127 Certificate of Coverage Under the Canada Pension Plan, there are resources tailored to meet your specific needs.

With the alternate names such as pension plan and pension plans, you can easily find the information you're looking for. Whether you're based in the United States, Canada, or other countries, this document collection includes valuable resources to help you understand the intricacies of pension plans and make informed decisions for your future.

Don't let the complexity of pension plans overwhelm you. With this comprehensive collection of documents, you'll have all the information you need at your fingertips to navigate the world of retirement planning with confidence and ease. Start exploring today and take control of your financial future.

Documents:

107

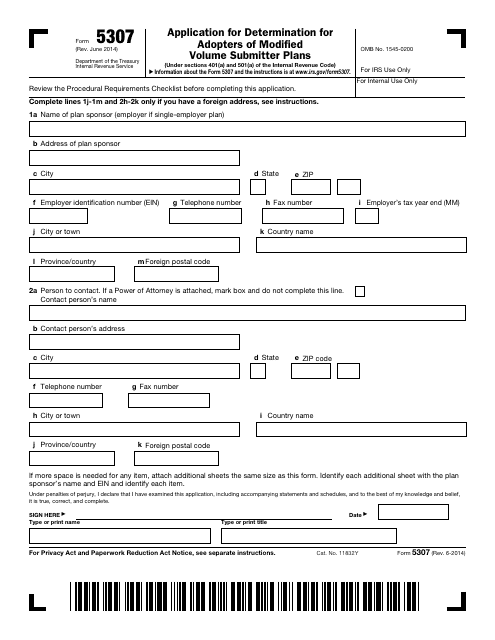

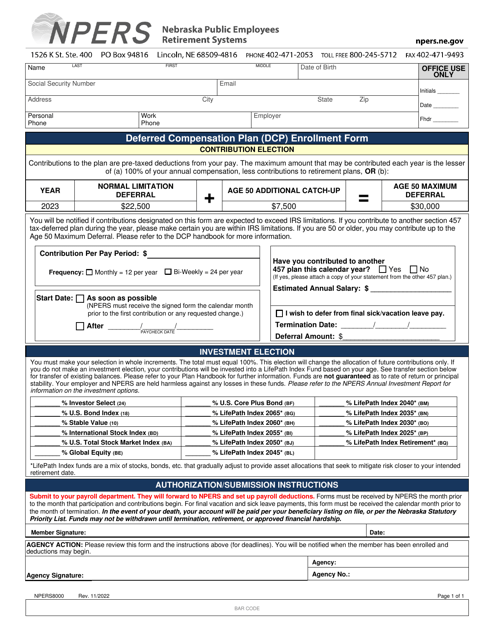

This Form is used for applying for determination for adopters of master or prototype or volume submitter plans with the IRS.

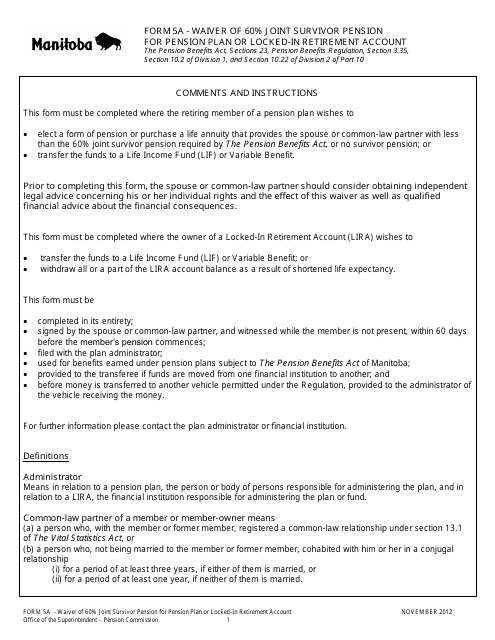

This form is used for waiving the 60% joint survivor pension for a pension plan or locked-in retirement account in Manitoba, Canada.

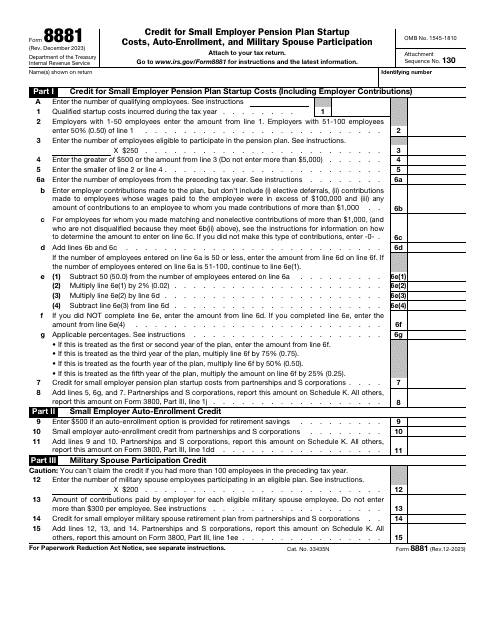

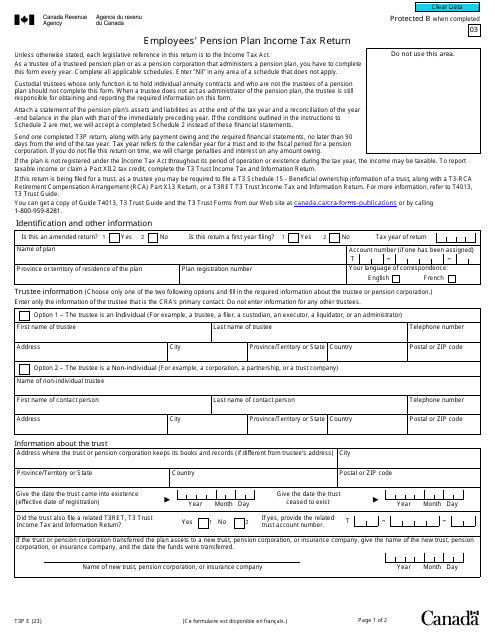

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

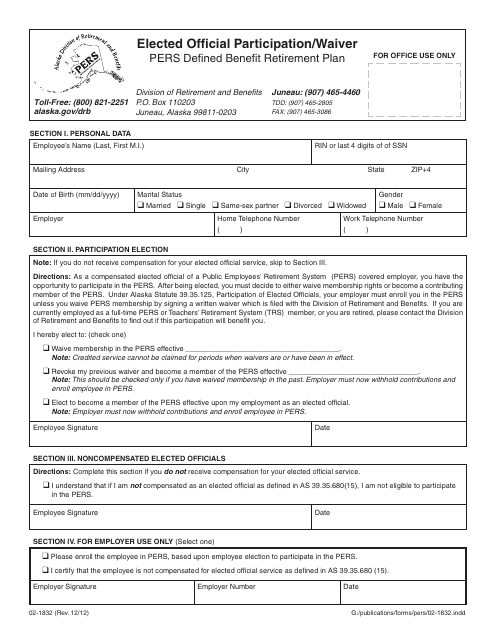

This form is used for elected officials in Alaska to participate or waive participation in the Pers Defined Benefit Retirement Plan.

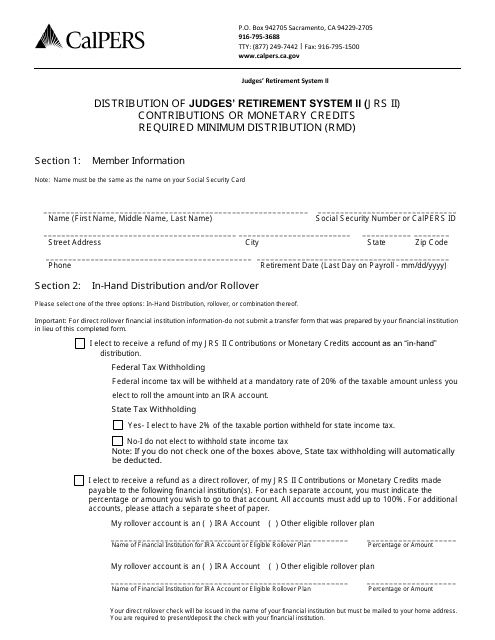

This type of document explains how the distribution of Judges' Retirement System II (JRS II) contributions or monetary credits is calculated in California. It also includes information on the required minimum distribution (RMD) for such contributions.

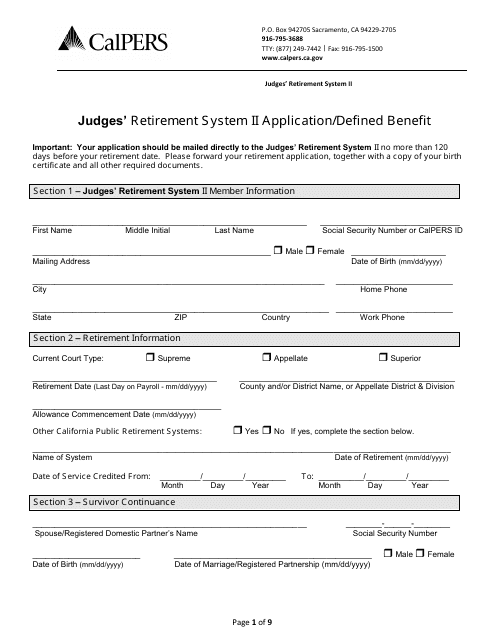

This document is for applying to the Judges' Retirement System II in California for defined benefits.

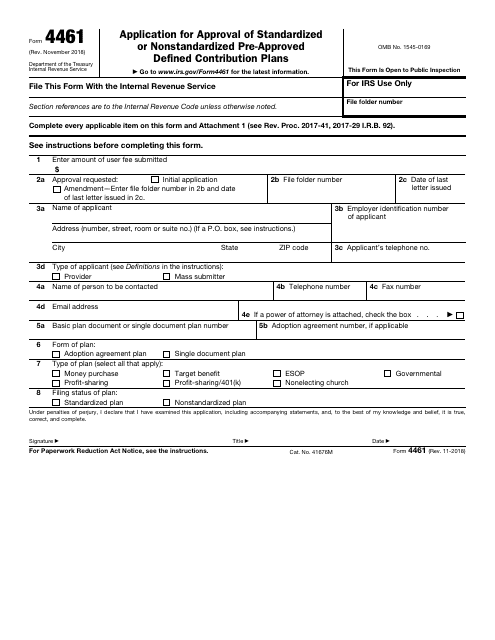

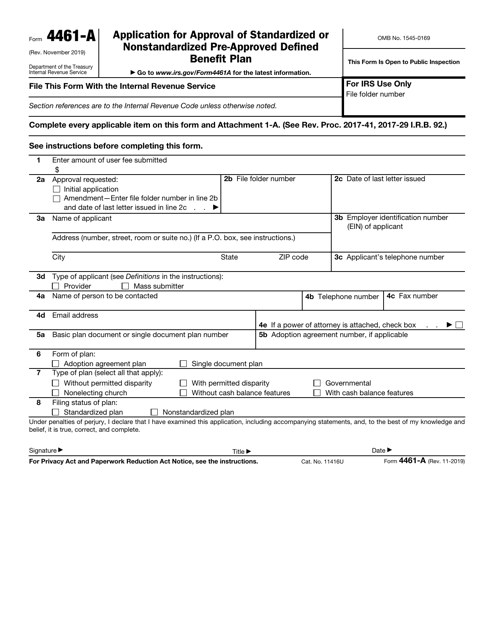

This form is used for applying for approval of standardized or nonstandardized pre-approved defined contribution plans with the IRS.

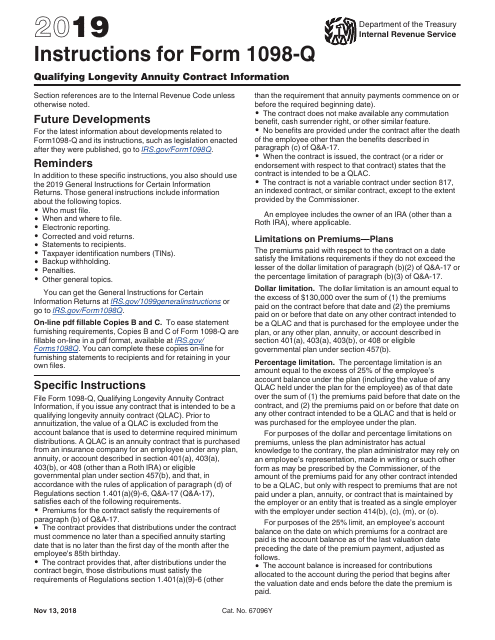

This document provides instructions for completing IRS Form 1098-Q, which is used for reporting information related to qualifying longevity annuity contracts.

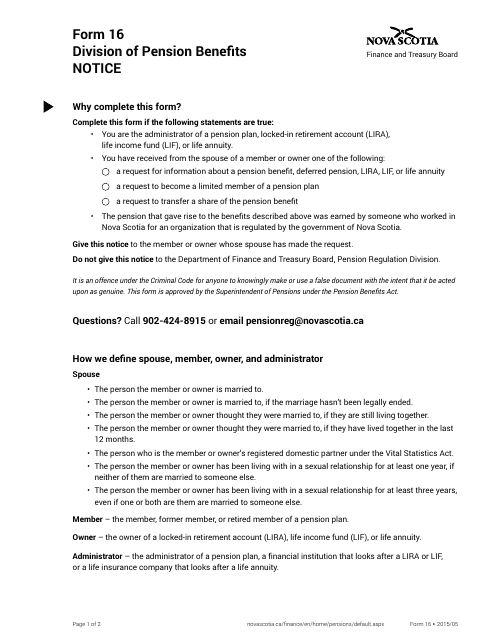

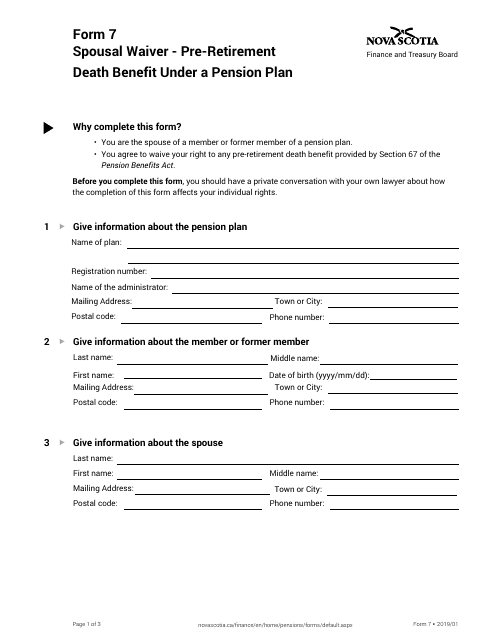

This Form is used for notifying the division of pension benefits in Nova Scotia, Canada.

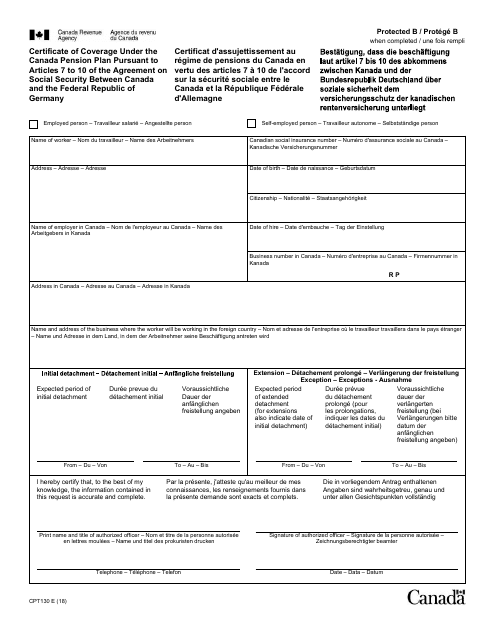

This type of document is for obtaining a certificate of coverage under the Canada Pension Plan for individuals covered by the social security agreement between Canada and Germany. It is available in both English and French.

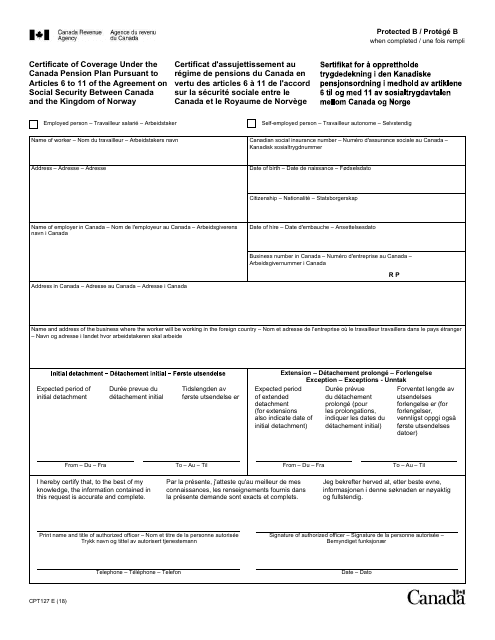

This form is used to certify coverage under the Canada Pension Plan for individuals covered by the social security agreement between Canada and Norway. The form is available in both English and French.

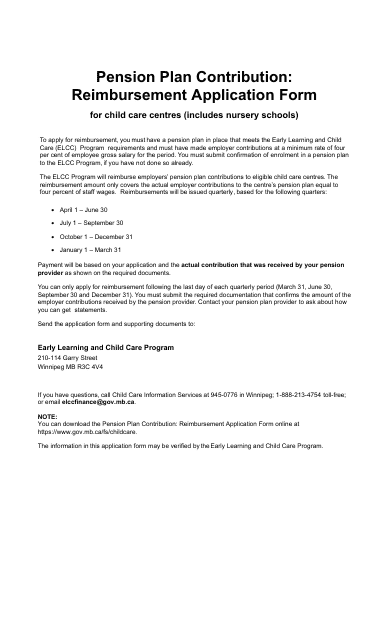

This form is used for applying for reimbursement of pension plan contributions in Manitoba, Canada.

This Form is used for spouses in Nova Scotia to waive their pre-retirement death benefit under a pension plan.

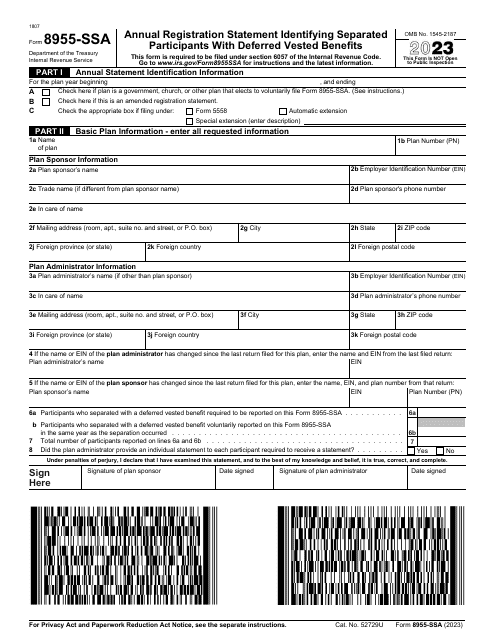

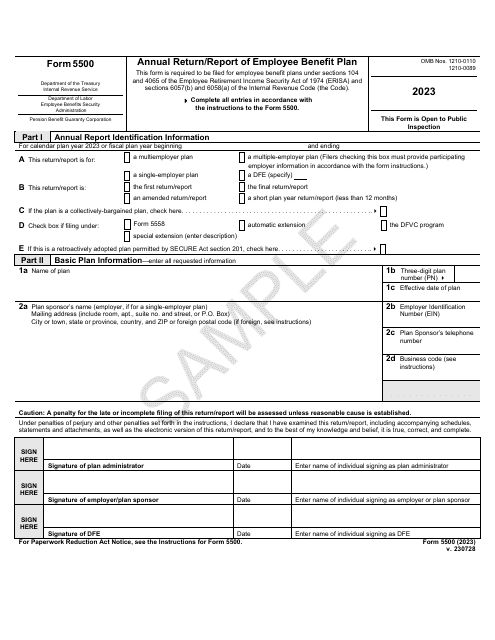

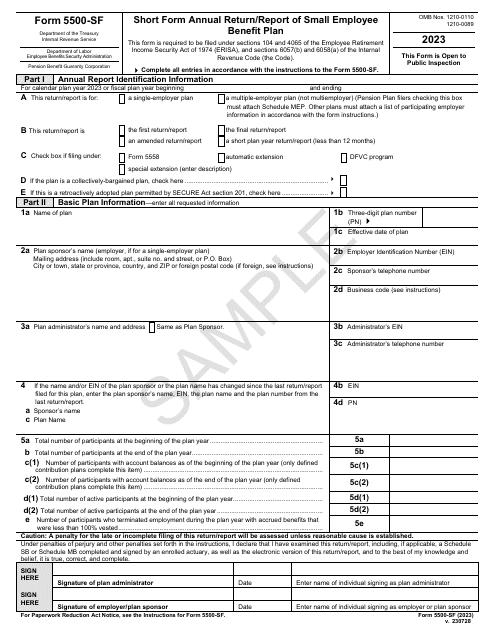

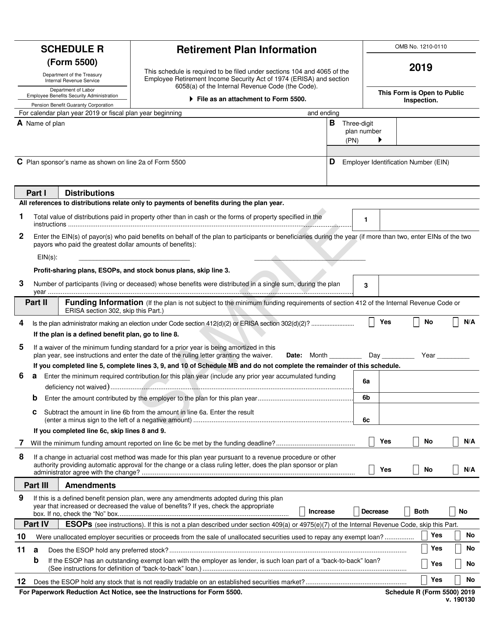

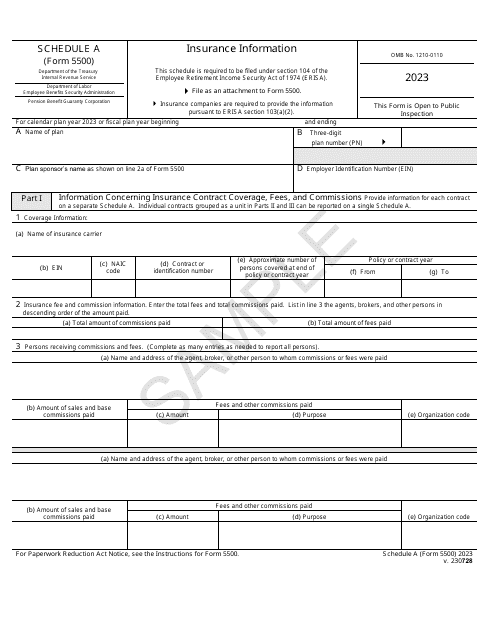

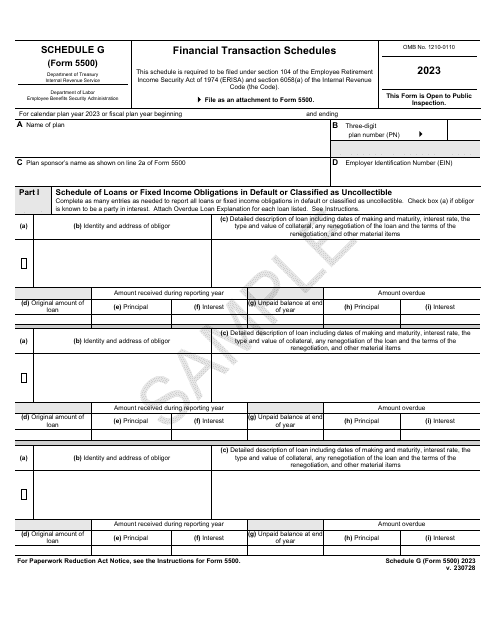

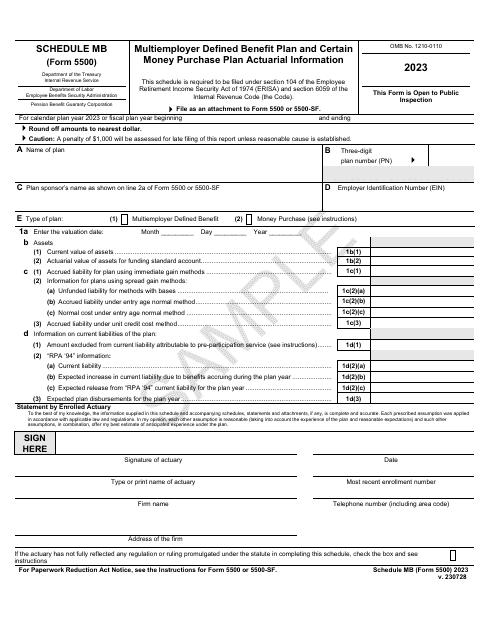

This document was issued by the Internal Revenue Service (IRS), the Department of Labor (DOL), and the Pension Benefit Guaranty Corporation (PBGC). It is a formal instrument used by employers that manage the employee benefit program to inform the authorities about the qualifications of the plan, investments made to the plan, and financial details of the program.

This form is used for applying for a determination from the IRS for an employee benefit plan.

This document is used for agreeing and choosing to pre-fund employer contributions to a defined benefit pension plan in California.

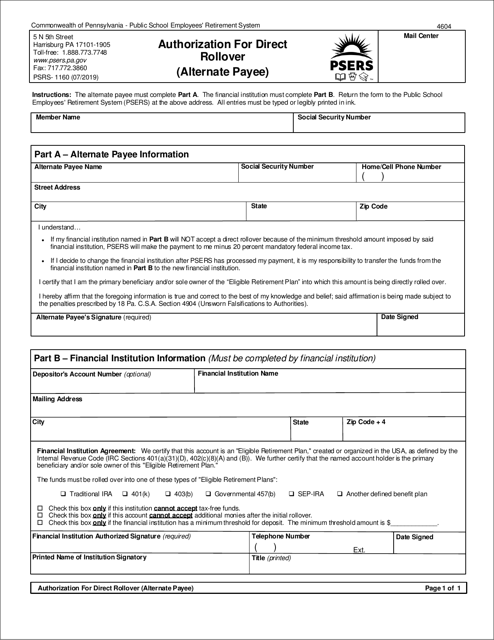

This form is used for authorizing a direct rollover of retirement funds to an alternate payee in Pennsylvania.