Part Year Residents Templates

Are you a part-year resident and unsure about your tax obligations? Look no further! Our comprehensive collection of documents for part-year residents contains all the information you need to navigate your tax responsibilities effectively.

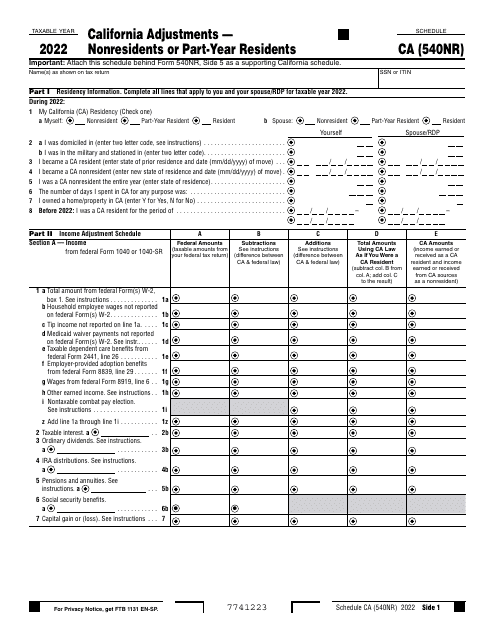

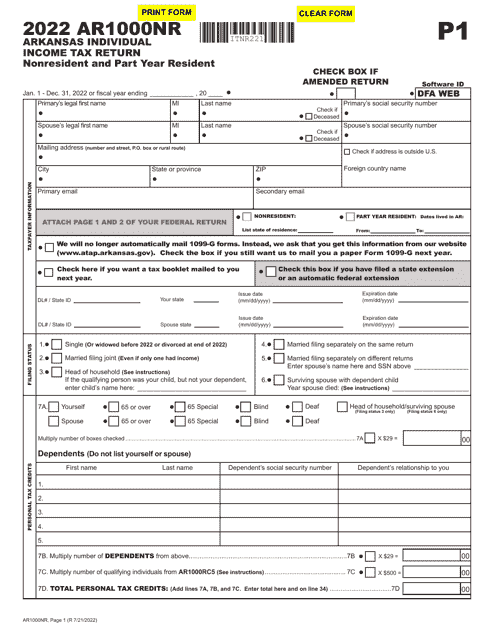

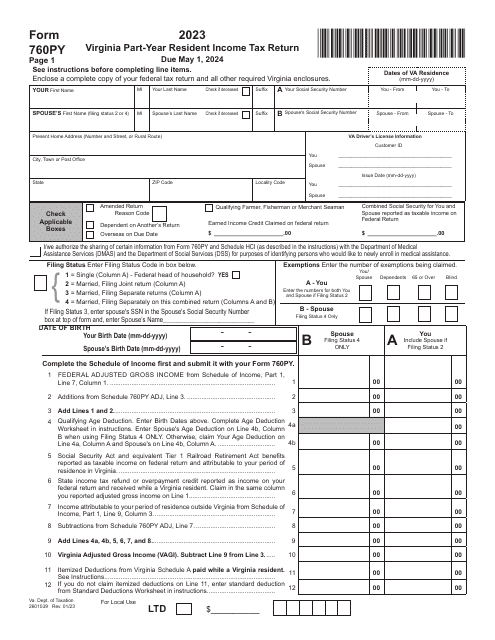

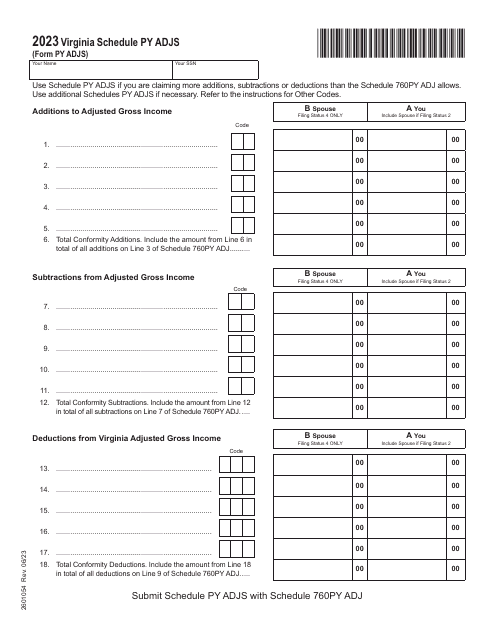

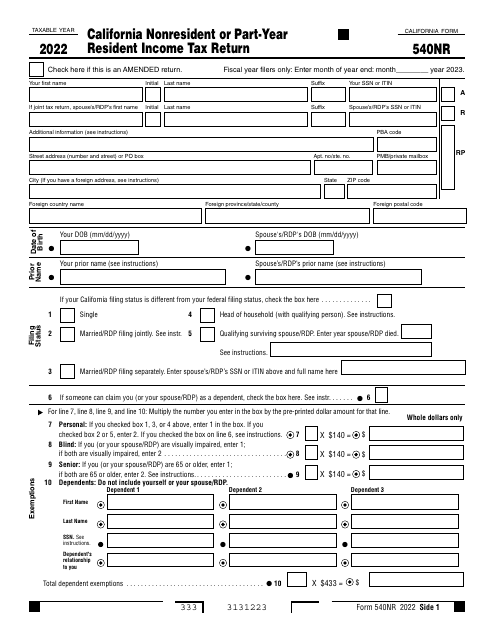

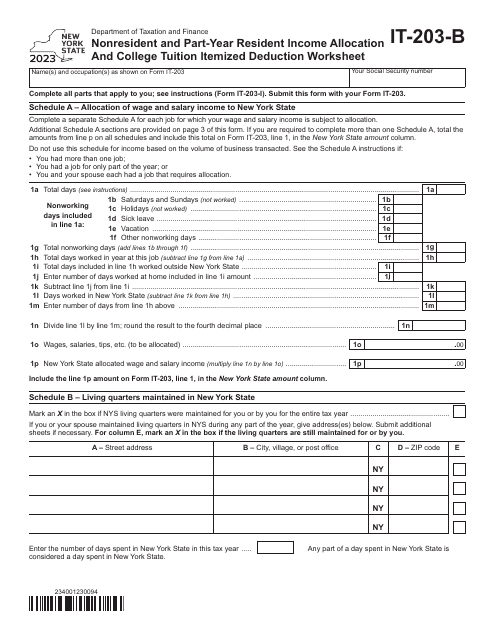

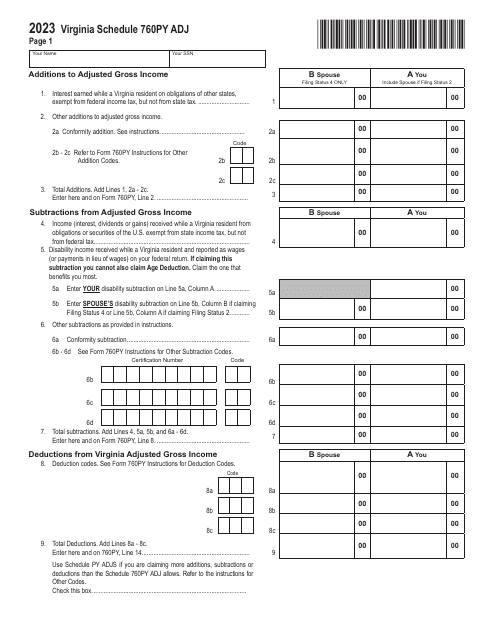

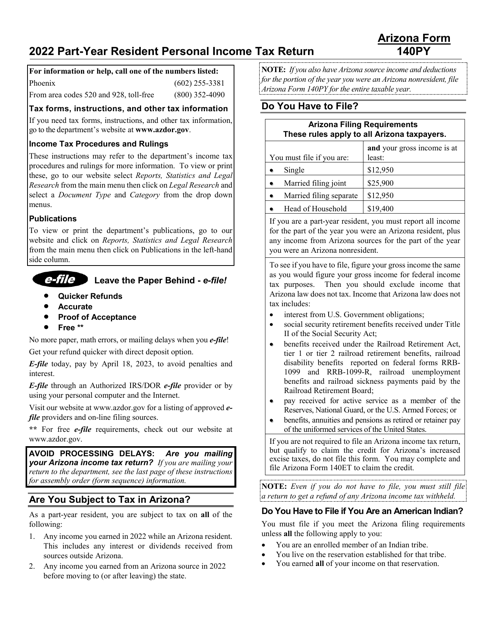

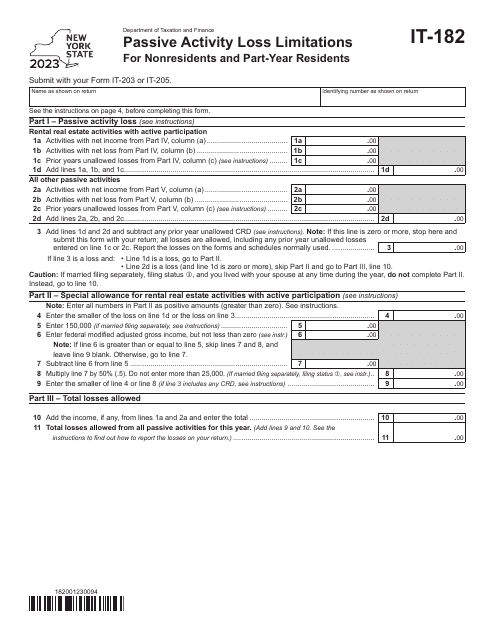

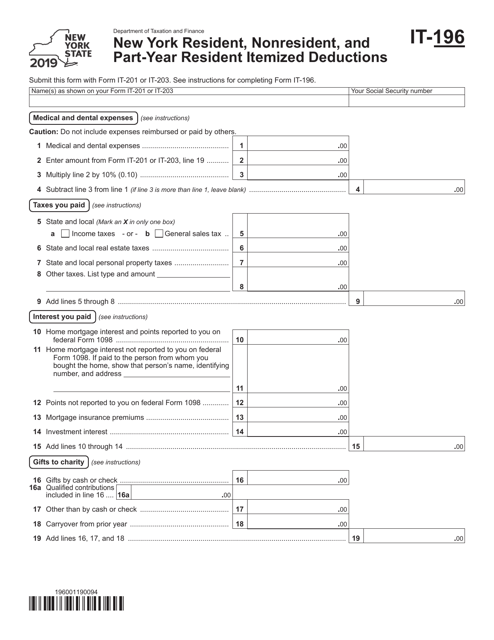

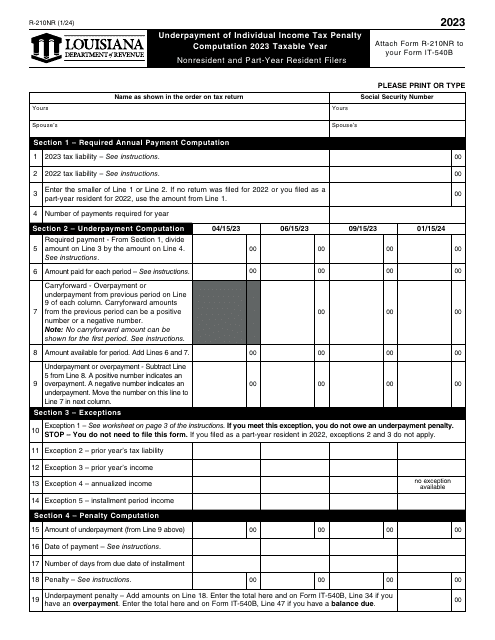

Whether you're a part-year resident in the USA, Canada, or other countries, we have you covered. Our collection includes various forms, such as the Schedule PY ADJS Supplemental Schedule of Adjustments for Part-Year Residents in Virginia, Form 540NR California Nonresident or Part-Year Resident Income Tax Return in California, and Form IT-203-X Amended Nonresident and Part-Year Resident Income Tax Return in New York. We also provide detailed instructions, like the Instructions for Form IT-196 New York Resident, Nonresident, and Part-Year Resident Itemized Deductions.

At Templateroller.com, we understand that taxes can be complicated, especially for part-year residents. That's why we have compiled this comprehensive collection of documents specifically tailored to your needs. Our alternate names like part-year residents, part-year resident, part-year residency, and part-year resident forms make it easy for you to find the information you're looking for.

Don't let tax season overwhelm you. Take advantage of our extensive collection of part-year resident documents today and ensure that you fulfill your tax obligations accurately and efficiently. Browse through our collection and access the resources you need with ease.

Note: For website SEO purposes, you may want to include keywords such as taxes, tax obligations, part-year residents, tax forms, and guidance for part-year residents in your text.

Documents:

174

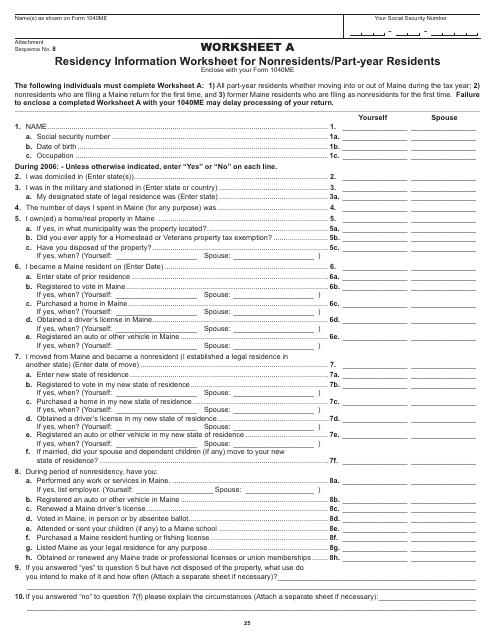

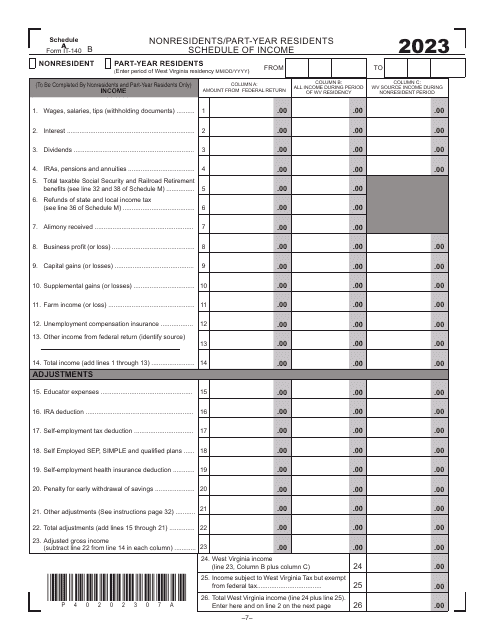

This document is a worksheet for nonresidents or part-year residents in Maine to provide information about their residency status. It helps determine their tax obligations.

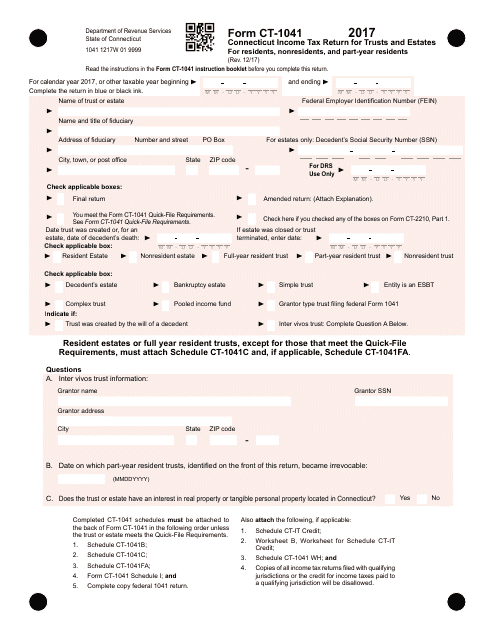

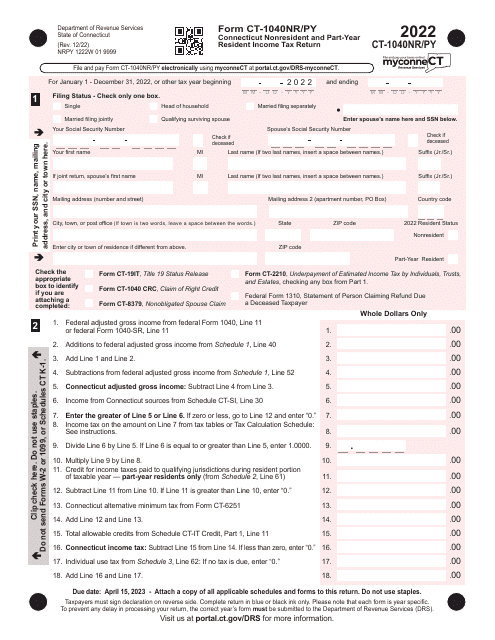

This Form is used for filing Connecticut state income tax return for trusts and estates. It is applicable for residents, nonresidents, and part-year residents in Connecticut.

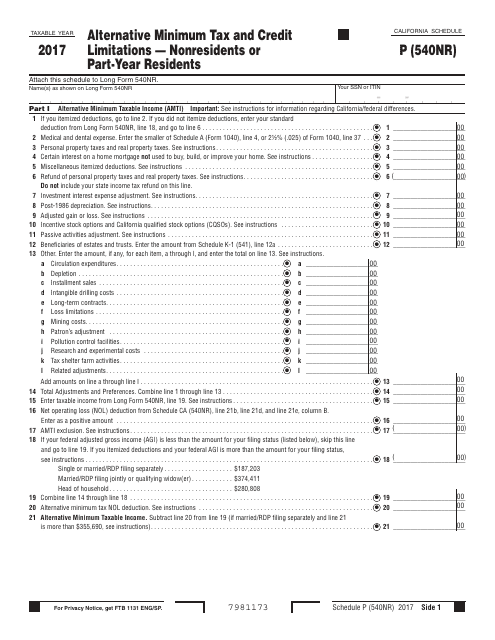

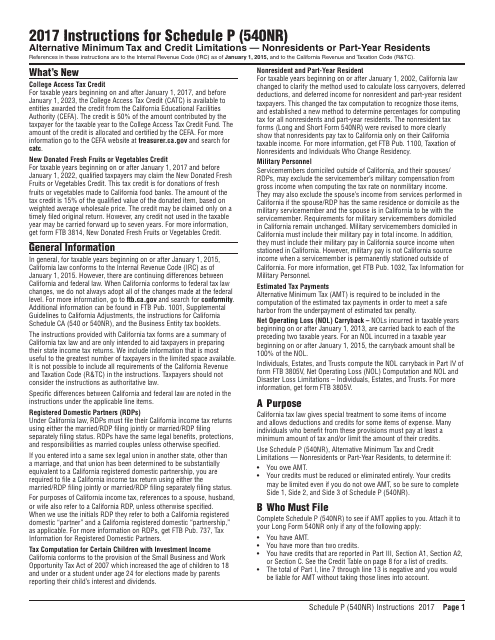

This Form is used for calculating the alternative minimum tax and credit limitations for nonresidents or part-year residents in California. It helps determine the amount of tax owed based on specific criteria and ensures that taxpayers are not subject to excessive tax burdens.

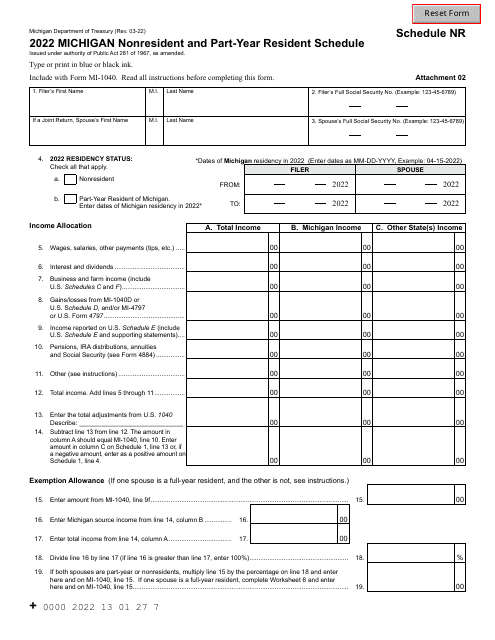

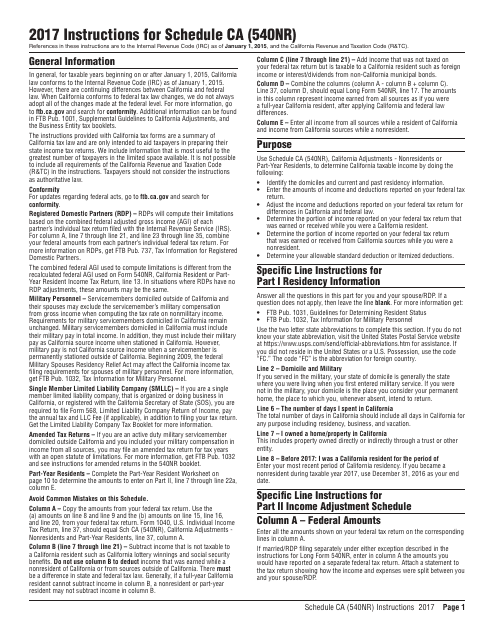

This document is used to provide instructions for completing Form 540NR Schedule CA for nonresidents or part-year residents of California. It specifies the adjustments that need to be made to the income, deductions, and credits reported on the tax return.

This Form is used for nonresidents or part-year residents of California to calculate their alternative minimum tax and credit limitations, as required by Form 540NR Schedule P.

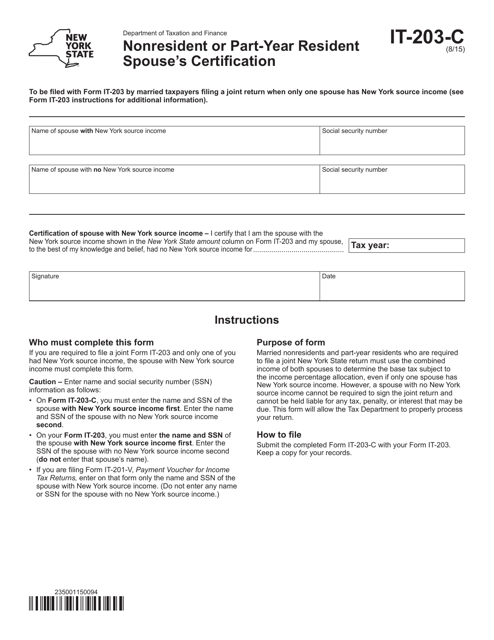

This form is used for nonresident or part-year resident spouses in New York to certify their residency status.

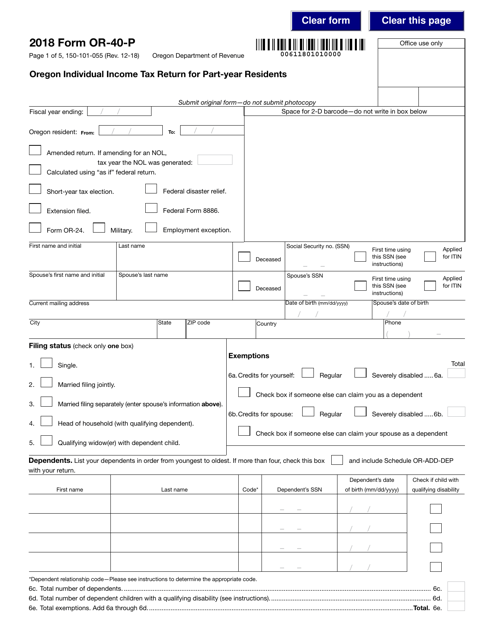

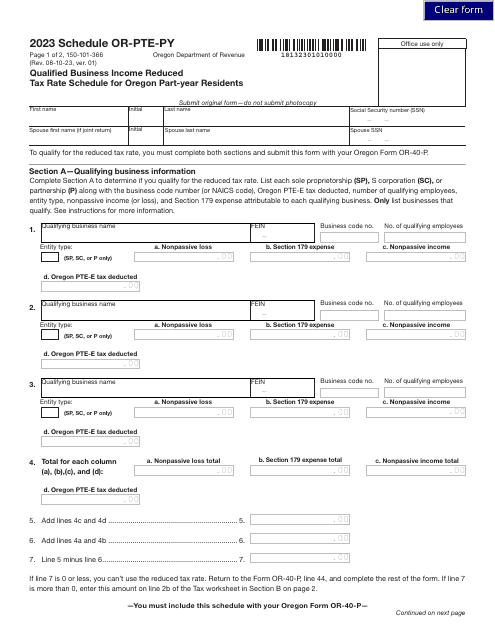

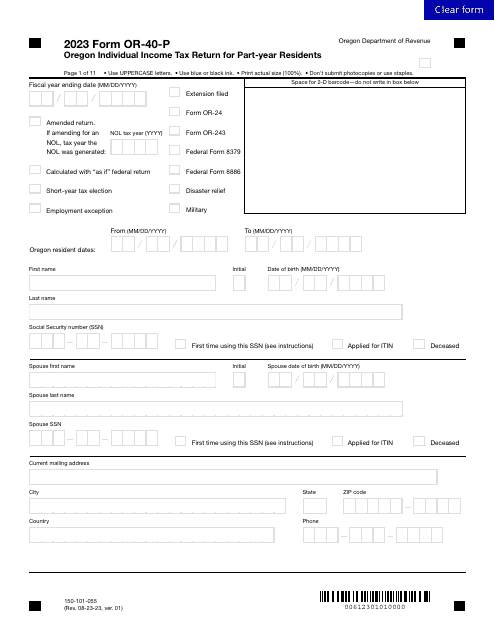

This form is used for Oregon residents who have earned income in the state for only part of the year to file their individual income tax return.

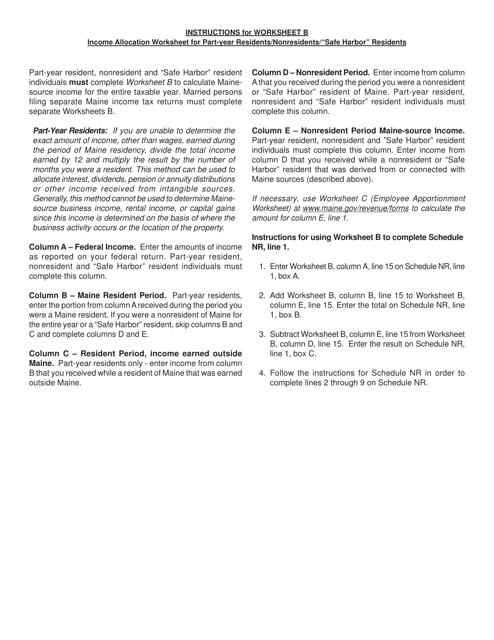

This form is used for allocating income for part-year residents, nonresidents, and "safe harbor" residents in Maine. It provides instructions for completing Worksheet B of the income allocation worksheet.

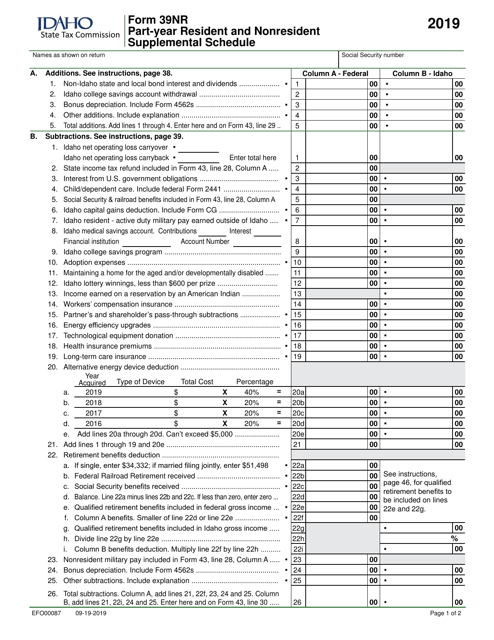

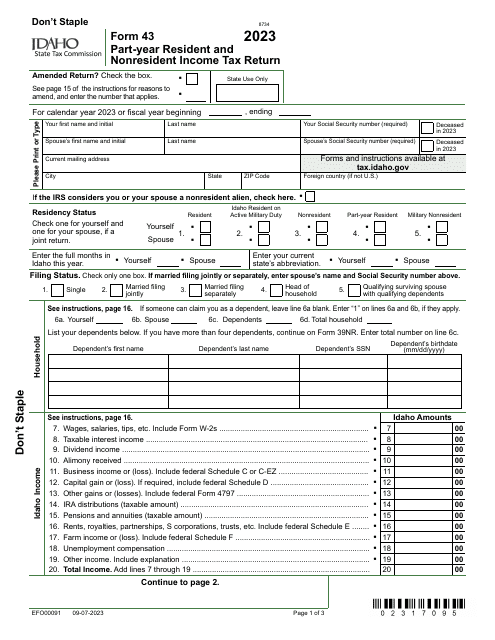

This document is used in Idaho for part-year residents and nonresidents to report additional income and deductions.

This Form is used for reporting itemized deductions for New York state residents, nonresidents, and part-year residents on their tax return.