Paycheck Deductions Templates

Are you looking for information on paycheck deductions? Find all you need to know about paycheck deductions and how they affect your earnings here. Paycheck deductions, also known as paycheck deduction or wage garnishment, refer to the amounts withheld from an employee's paycheck by their employer. These deductions can include various types of withholdings such as tax withholdings, wage garnishments, child support payments, and other voluntary or involuntary payroll deductions.

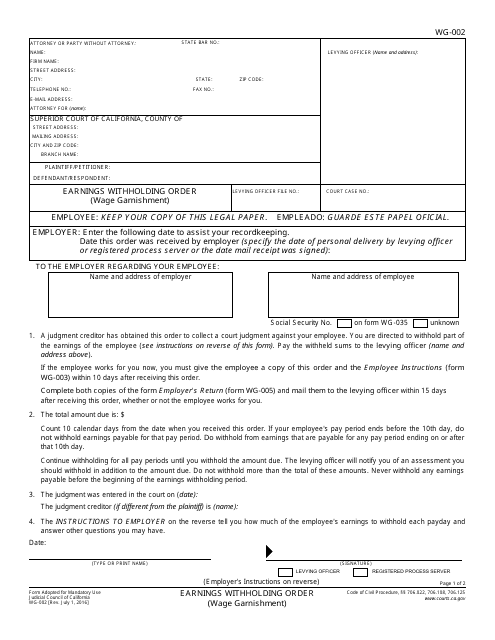

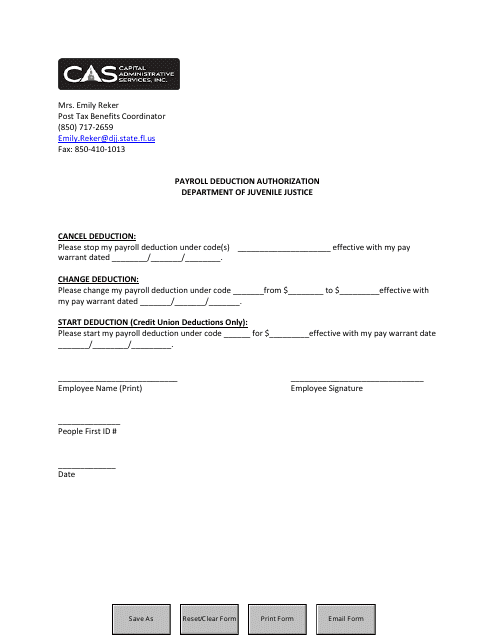

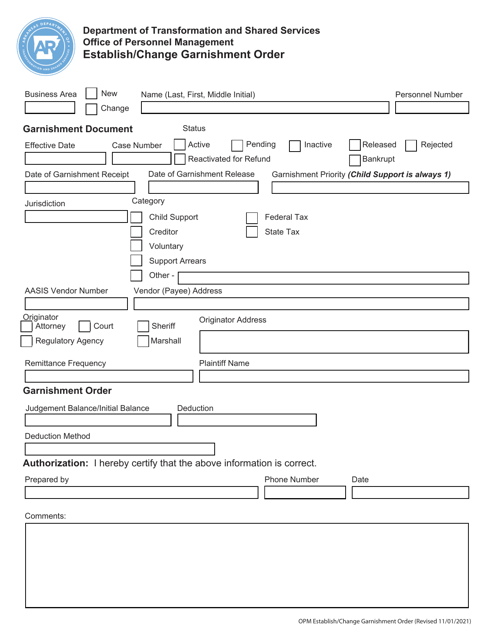

Our comprehensive collection of documents will guide you through the intricacies of paycheck deductions, ensuring you have a clear understanding of the different forms and processes involved. For instance, you can find Form WG-002 Earnings Withholding Order (Wage Garnishment) specific to California, providing instructions on how wage garnishments are implemented in the state. Similarly, the Payroll Deduction Authorization Form for Florida explains the authorized deductions that can be made from an employee's paycheck under specific circumstances.

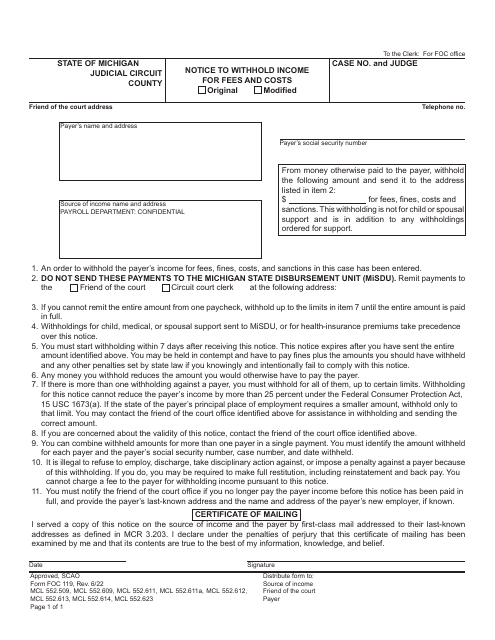

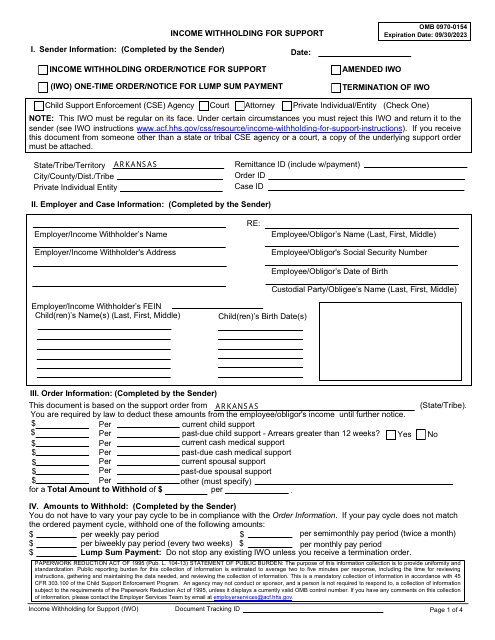

Furthermore, we offer resources like the Income Withholding for Support document, which are essential for employers who need to deduct child support payments from an employee's wages. These documents provide instructions and guidelines for employers to follow, ensuring compliance with state regulations regarding income withholding for support.

Whether you are an employee trying to understand the deductions on your paycheck or an employer seeking guidance on how to process paycheck deductions accurately, our extensive collection of documents can provide you with the information you need. Don't navigate the complexities of paycheck deductions alone – let us be your guide.

(Note: If this information is not sufficient, please let me know, and I will provide more details.)

Documents:

6

This form is used for requesting wage garnishment in California. It is known as Form WG-002 Earnings Withholding Order.

This form is used for authorizing payroll deductions in the state of Florida. It allows employees to specify the amount of money to be deducted from their paycheck for various purposes such as retirement contributions, insurance premiums, or charitable donations.