IRS Guidance Templates

Welcome to our comprehensive collection of IRS guidance documents. Whether you are a taxpayer looking for assistance or a tax professional seeking in-depth instructions, our library is designed to provide you with the information you need.

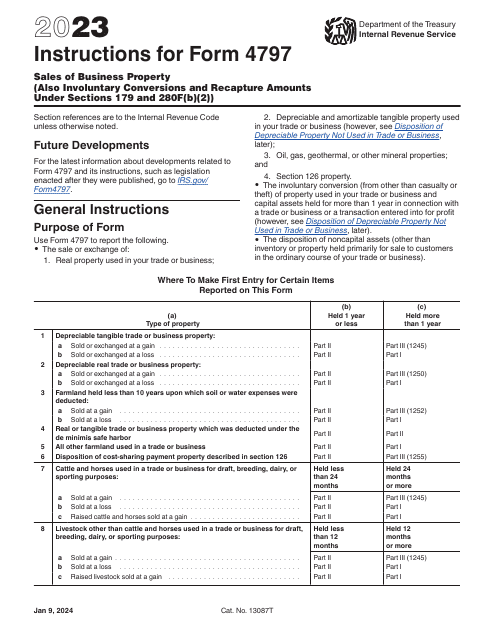

Our extensive collection covers a wide range of topics, ensuring that you have access to the necessary resources to navigate the intricacies of the tax system. From understanding your role as a taxpayer to specific instructions for forms such as IRS Form 8853 Archer MSAs and Long-Term Care Insurance Contracts, IRS Form 8606 Nondeductible IRAs, IRS Form 1095-A Health Insurance Marketplace Statement, and IRS Form 4797 Sales of Business Property, we have you covered.

We know that taxation can sometimes feel overwhelming, which is why our guidance documents are structured in a user-friendly manner. Each document provides clear instructions, explanations, and examples to help you better comprehend the complex tax codes.

Whether you are an individual taxpayer or a business entity, our IRS guidance documents are designed to provide clarity and support in your tax-related endeavors. With our collection of guidance documents, you can stay informed, compliant, and confident in navigating your tax obligations.

Documents:

7

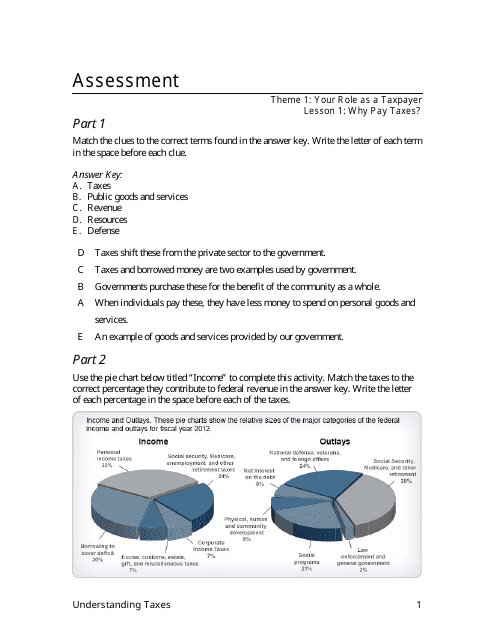

This document is a taxpayer assessment answer sheet provided by the IRS. It assists taxpayers in understanding and completing their taxes correctly.