Foreign Company Templates

Welcome to our webpage on foreign companies! Whether you are a foreign company looking to establish a presence in the United States or a local business wanting to collaborate with international partners, this page is your go-to resource for all things related to foreign companies.

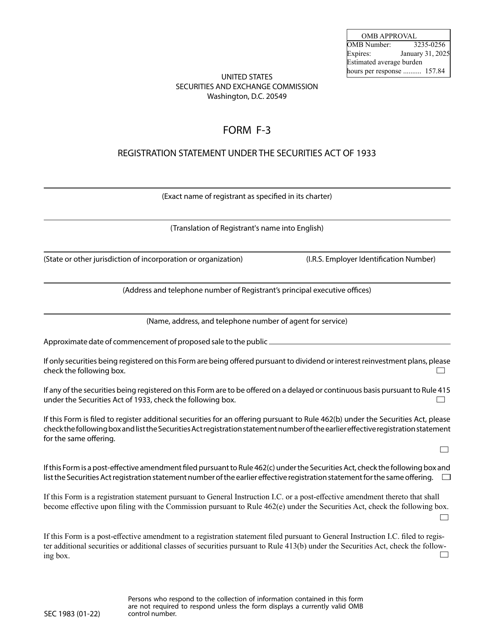

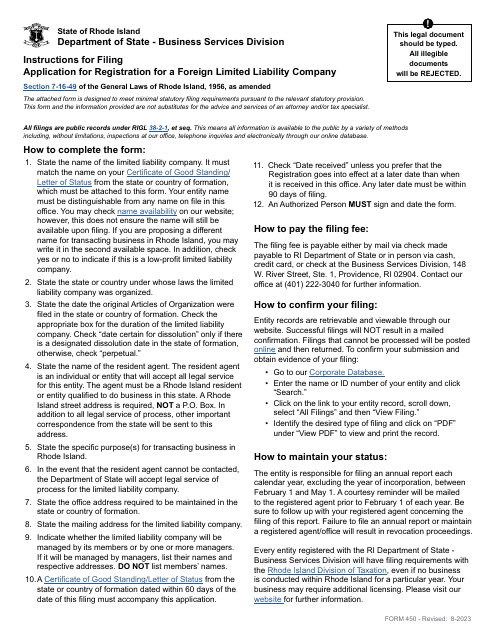

Our collection of documents includes a wide range of forms and applications designed specifically for foreign companies. These documents cover various aspects of doing business in the United States, such as registration, taxation, and compliance requirements. We understand that navigating the legal and administrative procedures can be overwhelming, which is why we have compiled these resources to make the process as easy as possible for you.

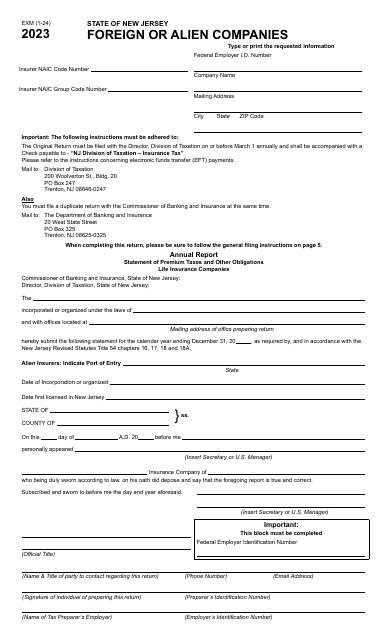

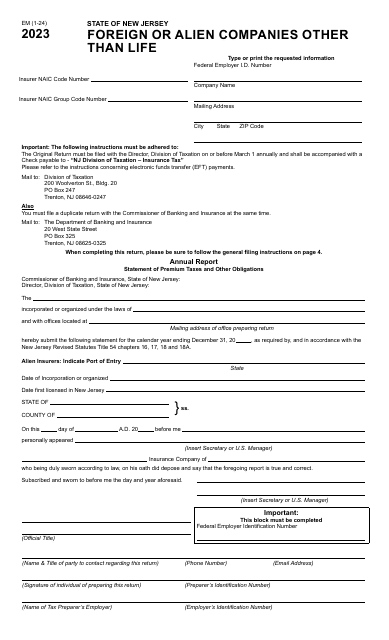

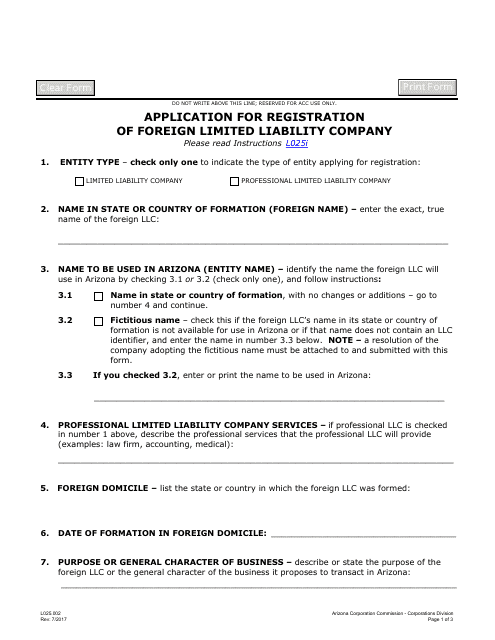

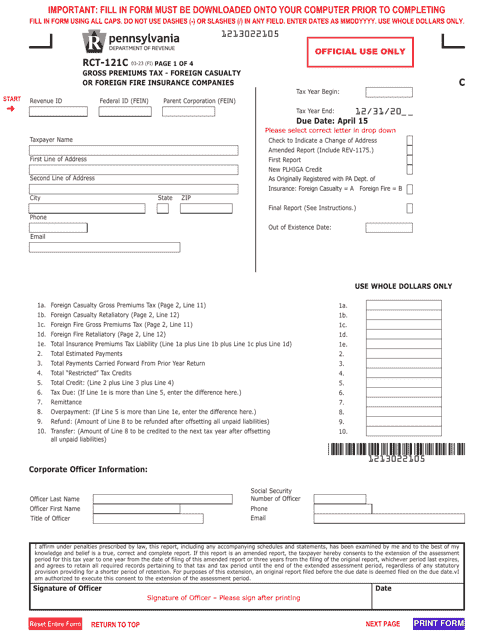

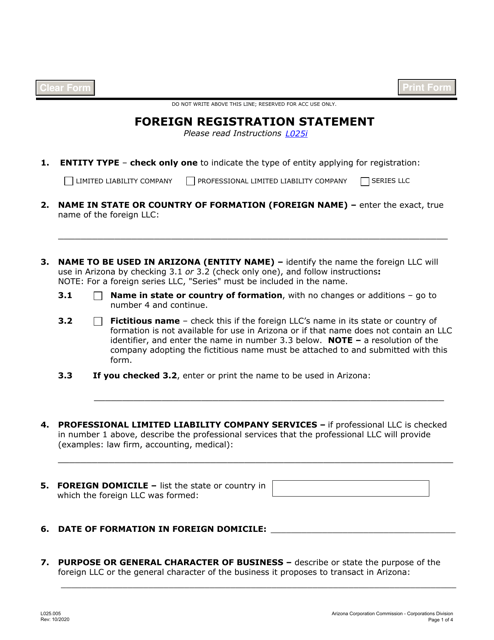

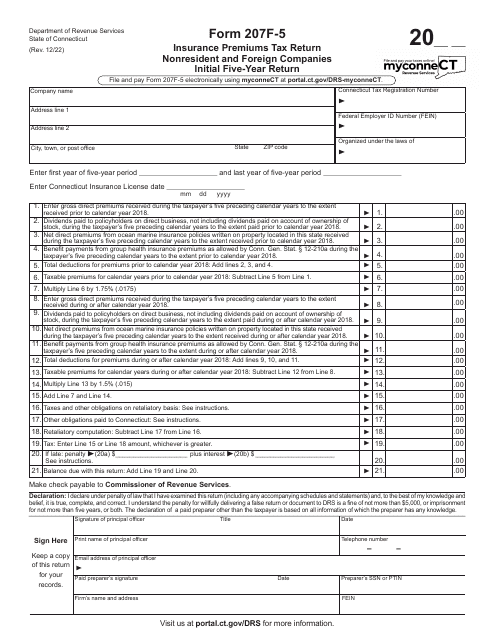

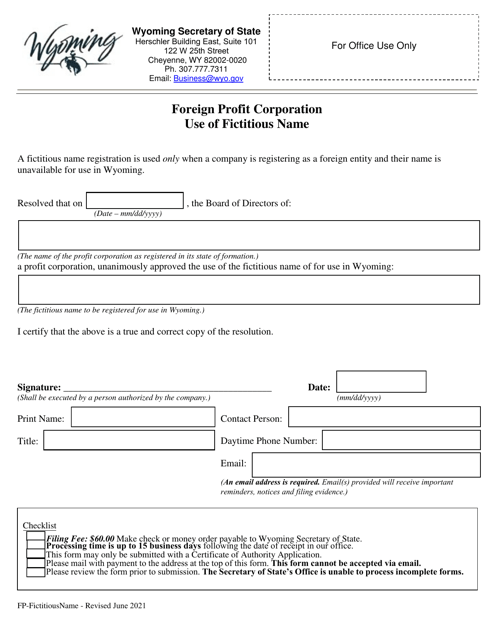

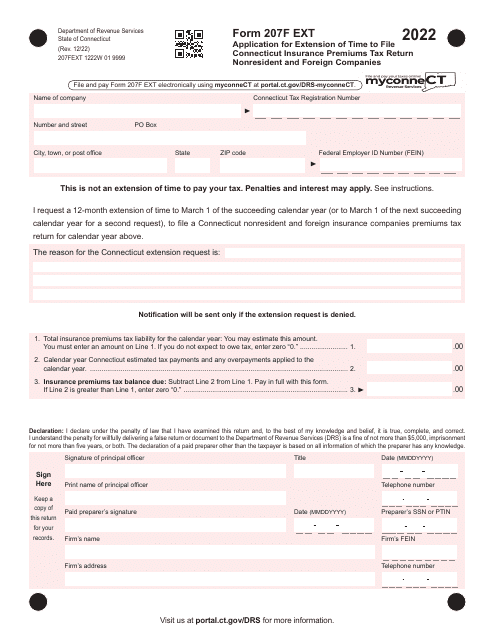

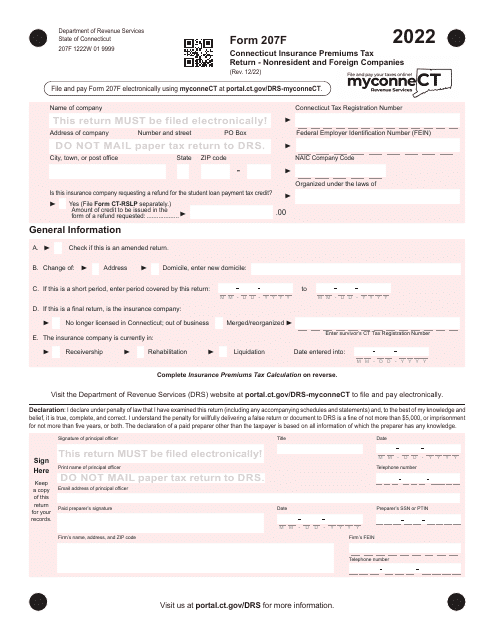

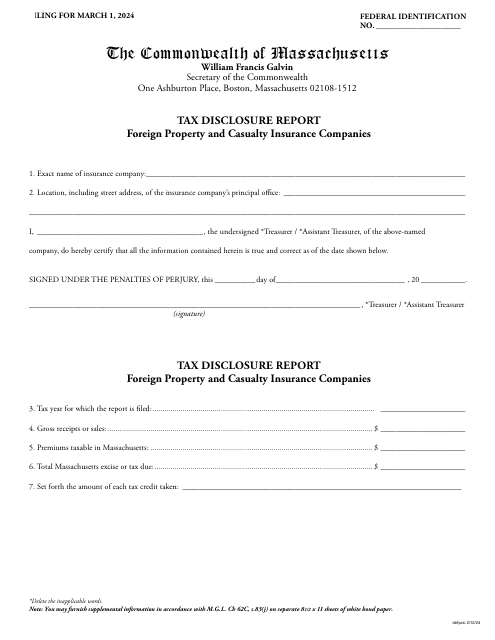

Some of the forms you can find in our collection include the Form RCT-121C Gross Premiums Tax for Foreign Casualty or Foreign Fire Insurance Companies in Pennsylvania, the Form L025 Foreign Registration Statement in Arizona, and the Form 207F-5 Insurance Premiums Tax Return Nonresident and Foreign Companies Initial Five-Year Return in Connecticut. We also provide resources on topics such as the use of fictitious names for foreign profit corporations in Wyoming and the application process for amending a certificate of registration for foreign limited liability companies in New Mexico.

Our goal is to empower foreign companies with the knowledge and tools they need to successfully navigate the U.S. business landscape. By providing access to these documents, we aim to streamline the process and help you meet all the necessary requirements to operate legally and efficiently.

Explore our collection of documents for foreign companies and take the first step towards establishing your presence in the United States. With our resources at your fingertips, you'll be well-equipped to embark on a successful business venture or collaboration. Don't let administrative barriers hold you back - let us guide you through the process.

Documents:

22

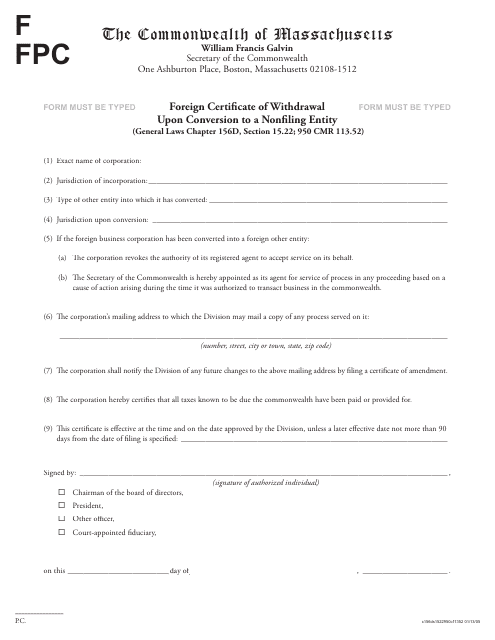

This document is used for withdrawing a foreign corporation from filing requirements in Massachusetts after converting to a nonfiling entity.

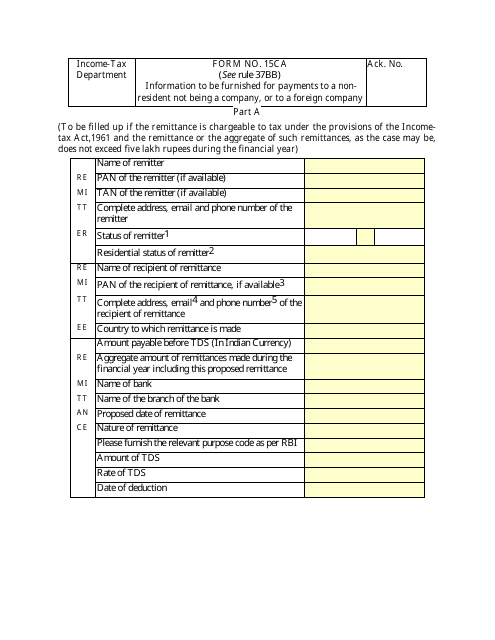

This form is used for providing information about payments made to non-residents or foreign companies in India. It is necessary for tax purposes and ensuring compliance with Indian regulations.

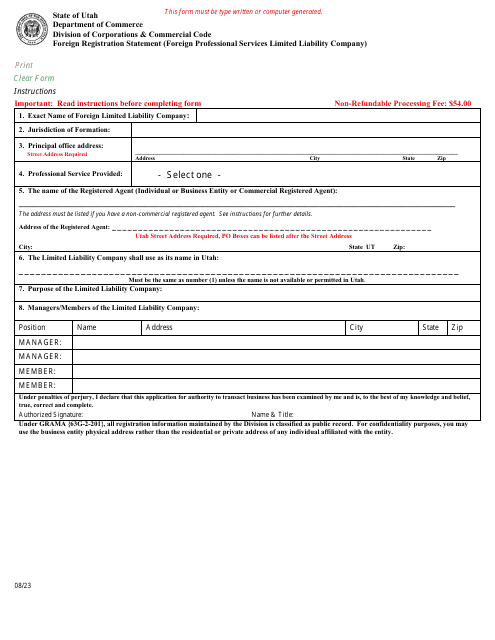

This Form is used for foreign limited liability companies to apply for registration in the state of Arizona.

This form is used for foreign businesses that want to register in Arizona. It allows them to provide the necessary information to the state government.

This document explains the requirements and process for a foreign profit corporation to use a fictitious name in the state of Wyoming.

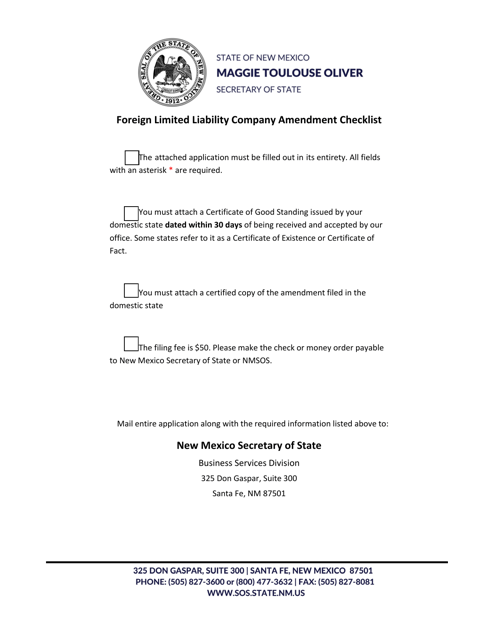

This document is used for applying for an amended certificate of registration for a foreign limited liability company in the state of New Mexico. It is used to update or modify the existing registration information.