Alternative Minimum Tax Templates

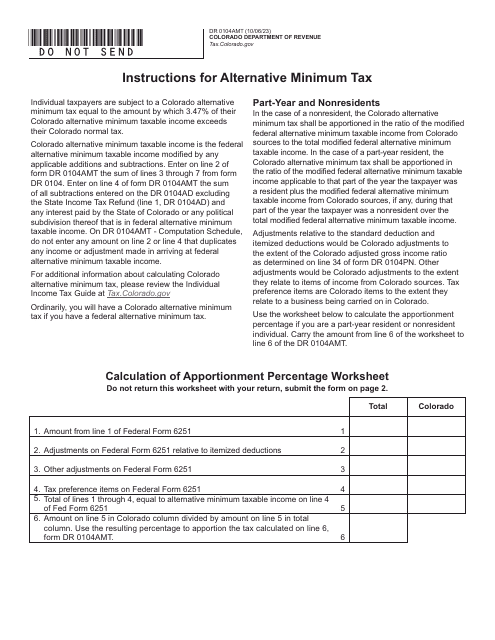

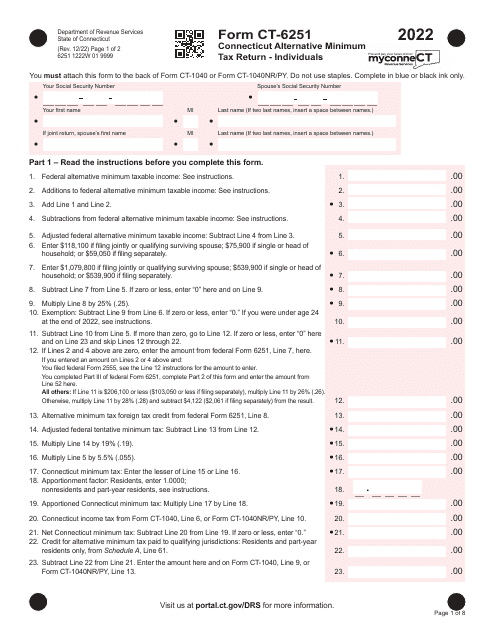

The Alternative Minimum Tax (AMT) is an additional tax system enforced in countries such as the USA, Canada, and others. It is designed to ensure that individuals, estates, and trusts with higher incomes or various tax benefits pay a minimum amount of tax. The AMT operates parallel to the regular tax system and calculates taxes differently, thereby acting as a safeguard against excessive tax deductions and exclusions.

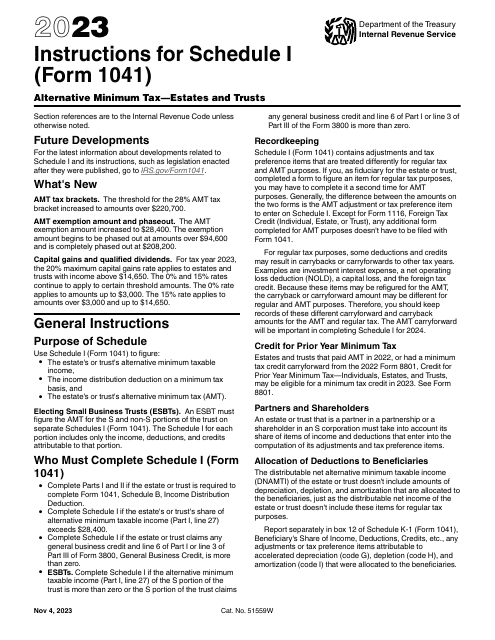

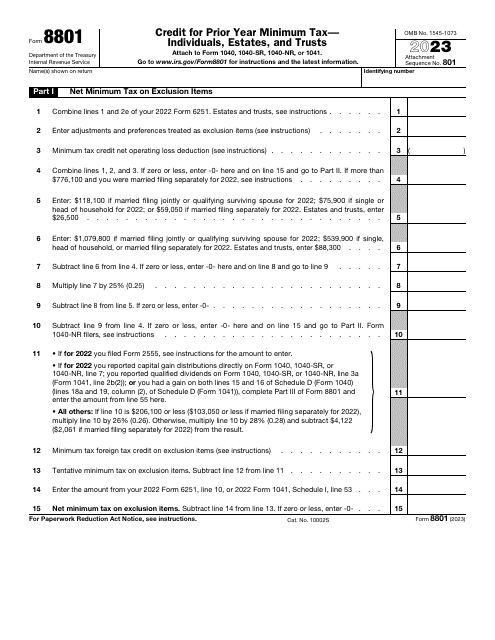

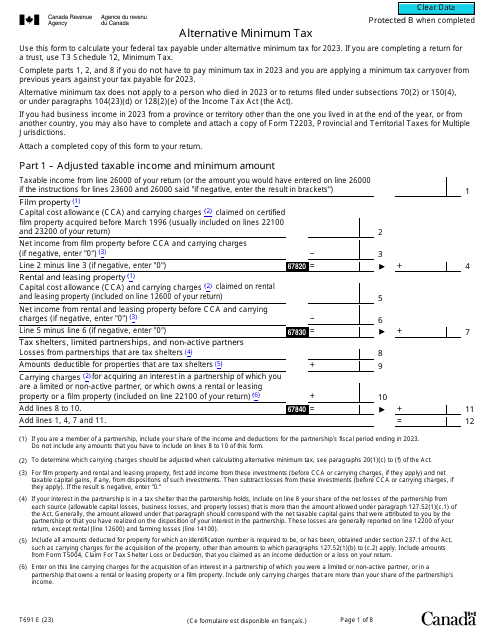

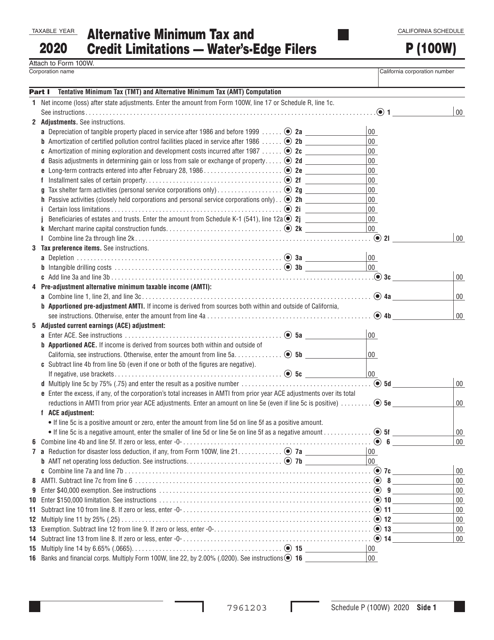

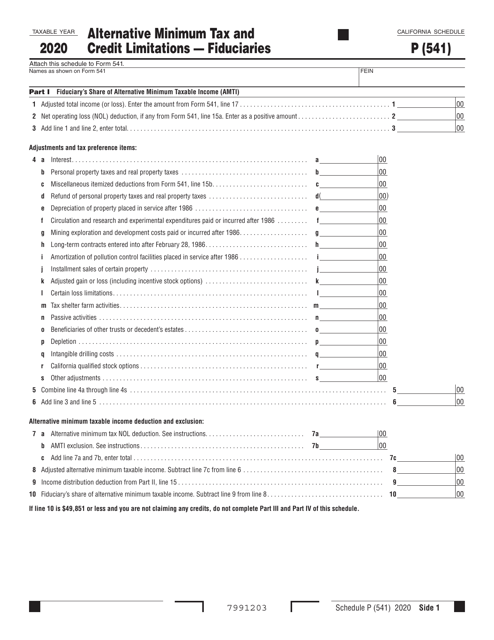

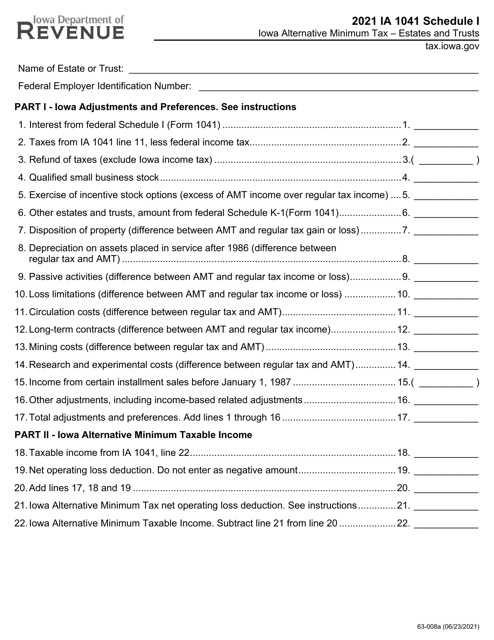

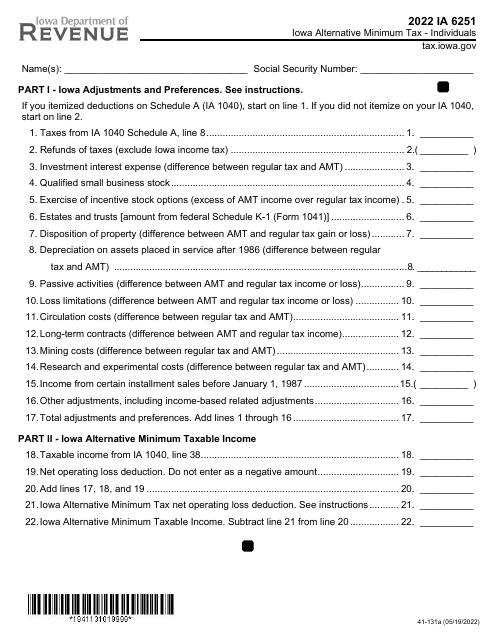

To comply with the AMT regulations, taxpayers are required to fill out specific forms and schedules. These documents provide a detailed breakdown of income, deductions, and credits that contribute to the AMT calculation. Some of the documents used to report AMT include the Form 41A720AMC Schedule AMC Alternative Minimum Calculation in Kentucky, Instructions for IRS Form 1041 Schedule I Alternative Minimum Tax for Estates and Trusts, Form T691 Alternative Minimum Tax in Canada, Form 100W Schedule P Alternative Minimum Tax and Credit Limitations for Water's-Edge Filers in California, and Schedule M2MT Alternative Minimum Tax for Estates and Trusts in Minnesota.

By accurately completing these forms and adhering to AMT guidelines, taxpayers can ensure compliance with tax laws and avoid penalties. It is crucial to consult with tax professionals or study the relevant instructions while preparing these documents to ensure accuracy.

For more information on the Alternative Minimum Tax and related forms, consult our comprehensive collection of AMT documents. This collection includes forms, schedules, and instructions from various jurisdictions, all designed to help taxpayers navigate the complex world of alternative minimum taxation and manage their tax liabilities efficiently.

Note:

Documents:

51

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

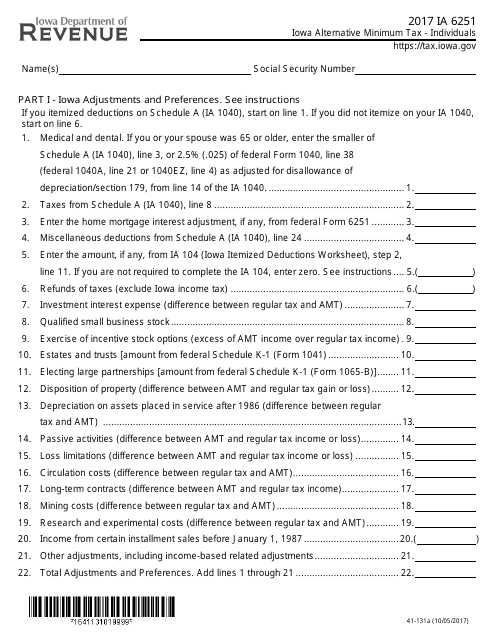

This Form is used for calculating the alternative minimum tax for individuals in the state of Iowa.

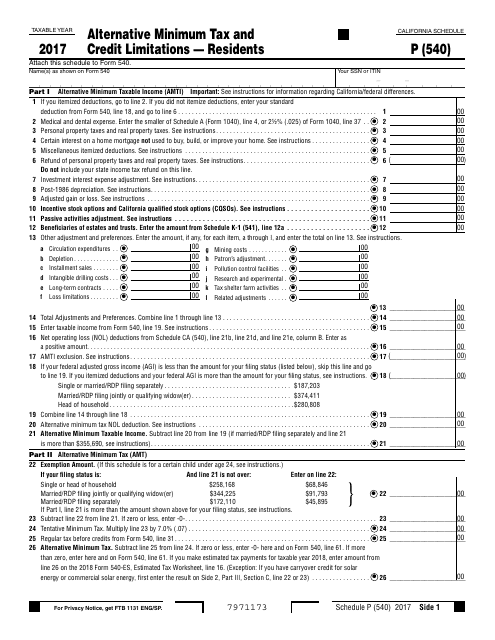

This form is used for calculating the alternative minimum tax and credit limitations for residents of California on their Form 540 tax return.

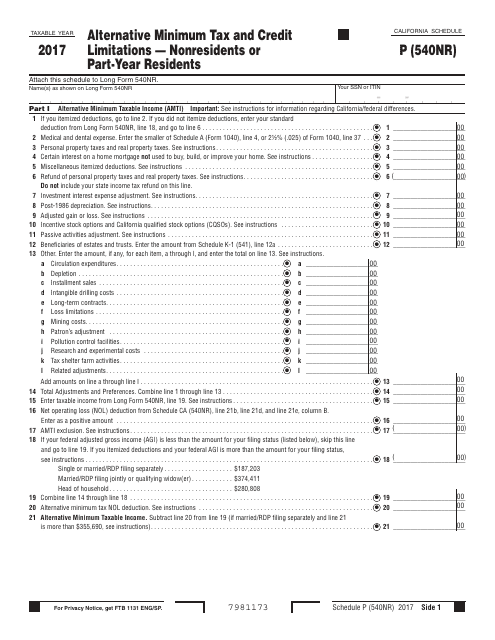

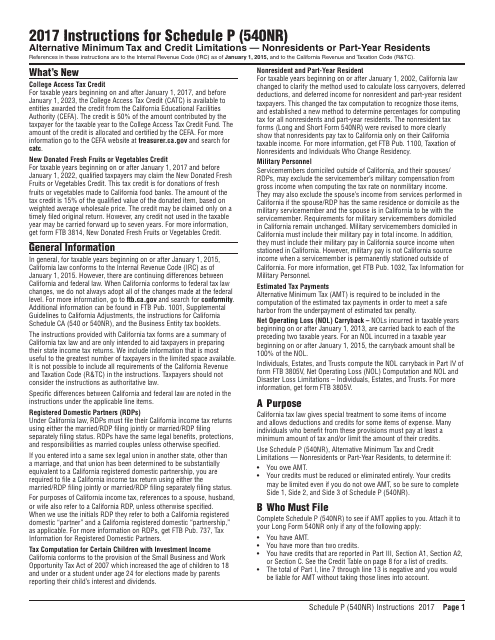

This Form is used for calculating the alternative minimum tax and credit limitations for nonresidents or part-year residents in California. It helps determine the amount of tax owed based on specific criteria and ensures that taxpayers are not subject to excessive tax burdens.

This Form is used for nonresidents or part-year residents of California to calculate their alternative minimum tax and credit limitations, as required by Form 540NR Schedule P.

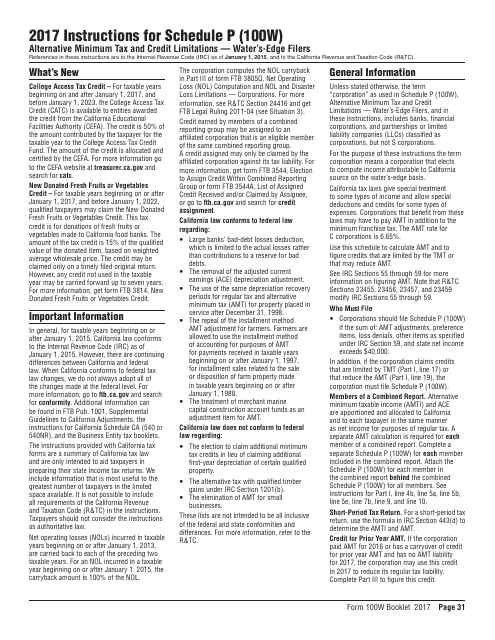

This document is used to provide instructions for filling out Schedule P of Form 100W for California water's-edge filers. It includes information on alternative minimum tax and credit limitations.

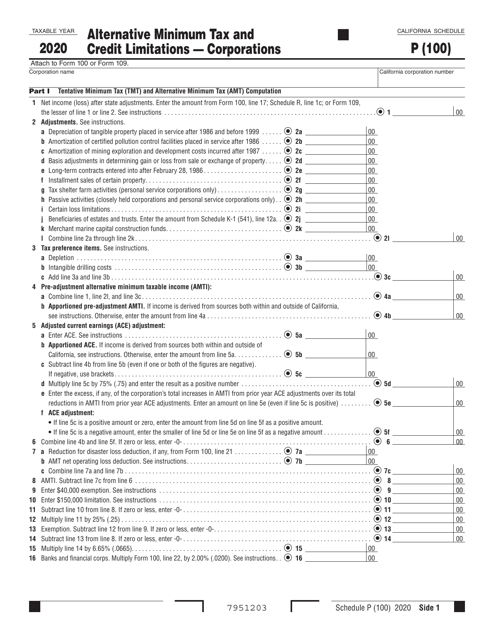

Form 100 Schedule P Alternative Minimum Tax and Credit Limitations - Corporations - California, 2020

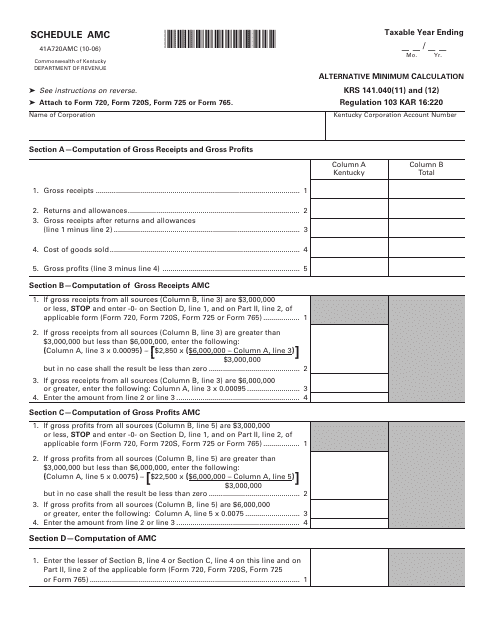

This form is used for calculating the alternative minimum tax in Kentucky.

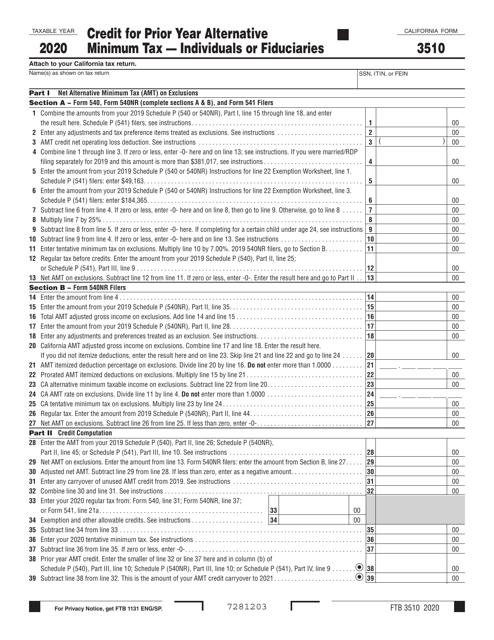

This Form is used for calculating alternative minimum tax and credit limitations for fiduciaries in California.

This Form is used for calculating the Iowa Alternative Minimum Tax for Estates and Trusts in Iowa.