Foreclosure Laws Templates

Foreclosure Laws are an essential aspect of real estate law that govern the legal process and procedures for the foreclosure of mortgaged properties. These laws ensure that the rights of both borrowers and lenders are protected during foreclosure proceedings. In the United States, foreclosure laws may vary from state to state, but the general principles and objectives remain the same.

Foreclosure laws provide a framework for procedures such as filing a foreclosure complaint, notifying the borrower of the foreclosure, and conducting a foreclosure sale. These laws aim to balance the interests of both parties involved in a foreclosure and ensure a fair and transparent process.

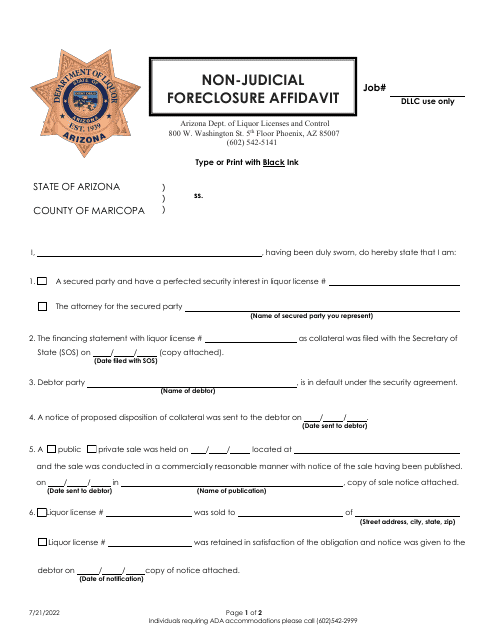

With a variety of alternate names such as "foreclosure regulations" or "laws on property foreclosure," these state-specific documents play a crucial role in safeguarding the rights and interests of property owners and lenders. Whether it's the Foreclosure Consultant Bond in New Jersey or the Non-judicial Foreclosure Affidavit in Arizona, these documents serve as key components of the overall foreclosure process.

Understanding and complying with foreclosure laws is essential for individuals and businesses involved in the real estate industry. Whether you are a homeowner facing foreclosure or a lender seeking to recover a debt, having knowledge of these laws can help protect your rights and navigate through the complex legal procedures.

If you're looking for guidance or information on foreclosure laws in your state or jurisdiction, it is advisable to consult a qualified legal professional with expertise in real estate and foreclosure matters. They can provide you with accurate and up-to-date information, ensuring that you are well-informed and prepared to handle any foreclosure-related issues.

In summary, foreclosure laws, also known as foreclosure regulations or laws on property foreclosure, are a critical set of legal guidelines governing the foreclosure process. These laws protect the rights of borrowers and lenders and ensure a fair and transparent process for all parties involved. While the specific details may vary from state to state, understanding and complying with these laws is crucial for anyone involved in the real estate and foreclosure industry.

Documents:

12

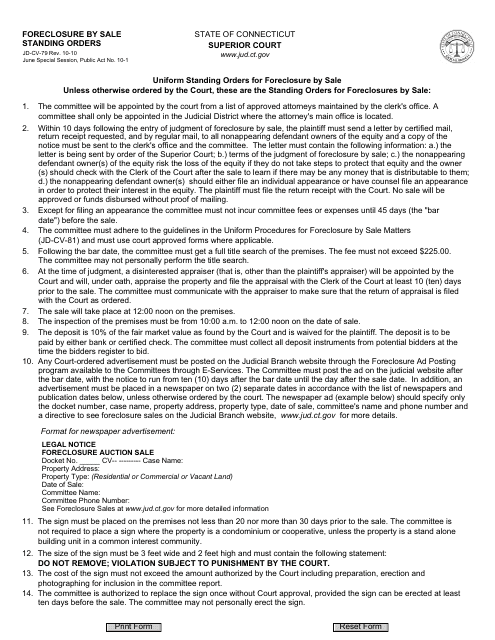

This Form is used for foreclosure by sale in Connecticut. It provides the standing orders that need to be followed during the foreclosure process.

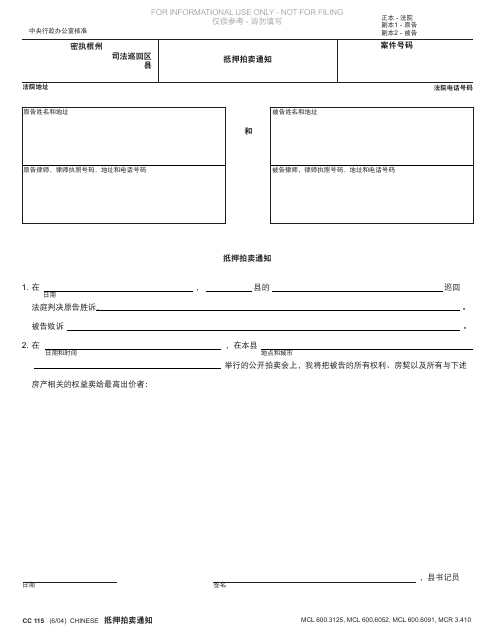

This form is used for notifying interested parties about a foreclosure sale in Michigan. It specifically targets the Chinese-speaking community.

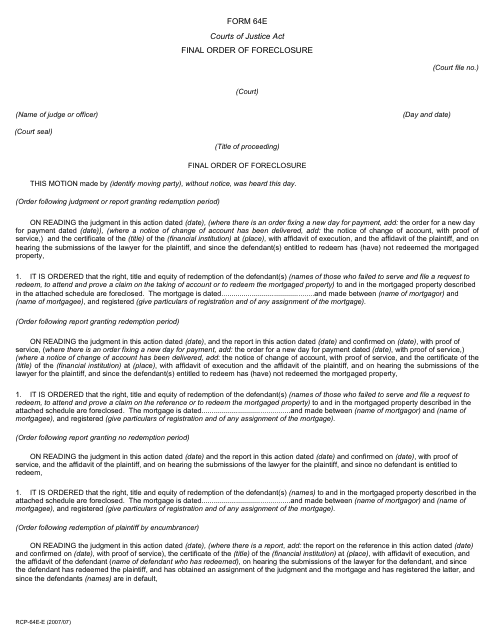

This form is used for obtaining the final order of foreclosure in Ontario, Canada. It is a legal document that finalizes the process of foreclosure on a property.

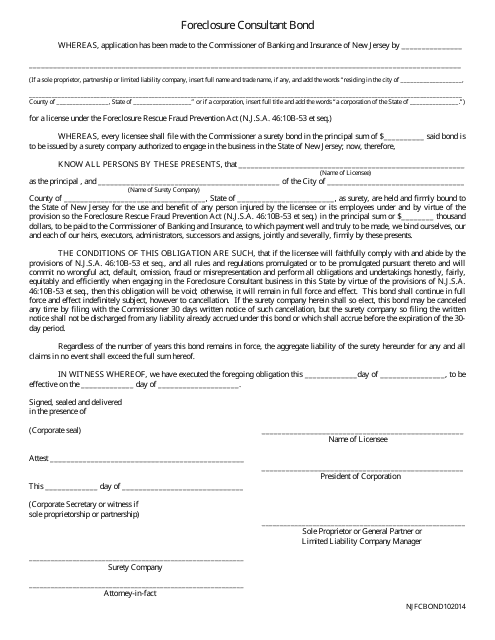

This Form is used for obtaining a foreclosure consultant bond in New Jersey. This bond is required for individuals or companies that offer foreclosure consulting services in the state. It provides financial protection to the state and consumers in case the consultant fails to fulfill their obligations.

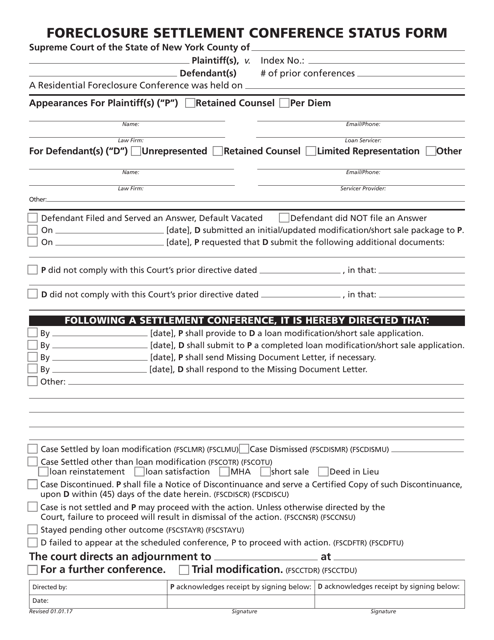

This form is used to check the status of a foreclosure settlement conference in New York.

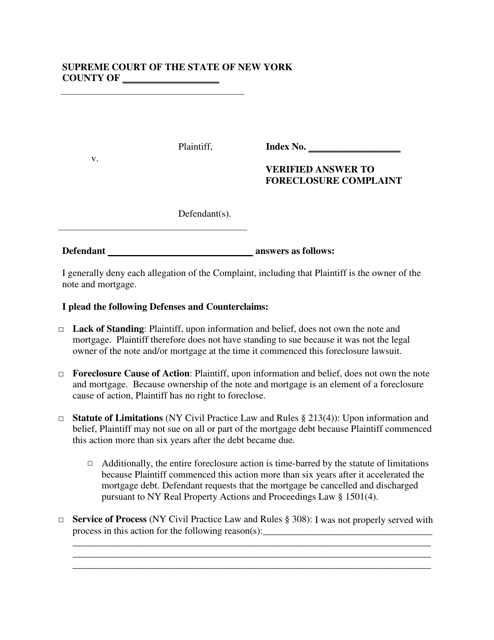

This document is used to respond to a foreclosure complaint in the state of New York. It allows the homeowner to provide a written defense or challenge the proceedings in court.

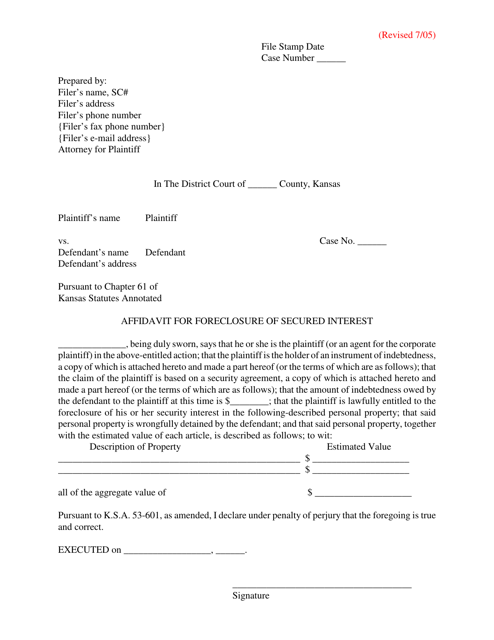

This document is used for confirming the foreclosure of a secured interest in the state of Kansas. It is a legal declaration that validates the foreclosure process.

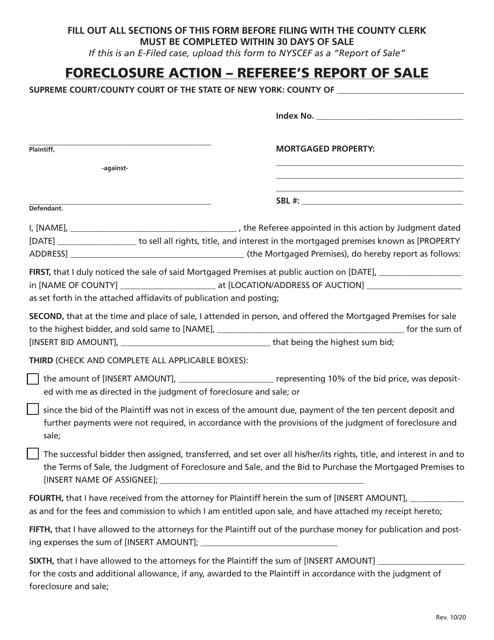

This document is a report filed by a referee in a foreclosure action in New York after a property is sold. It provides details of the sale and its results.

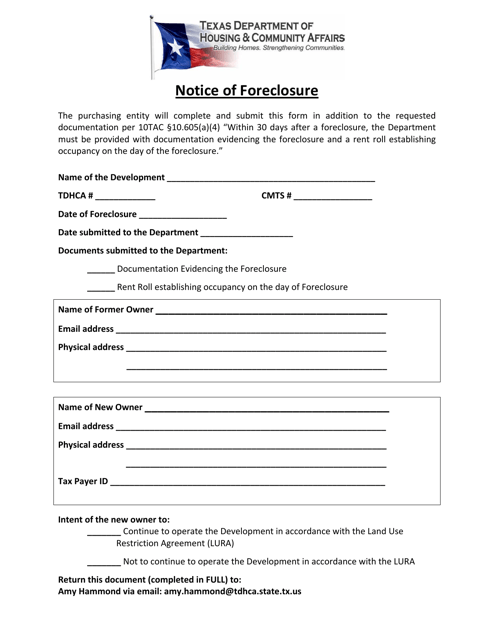

This document is a notice that informs the recipient of a foreclosure in Texas. It provides information about the foreclosure process and what actions the recipient should take.

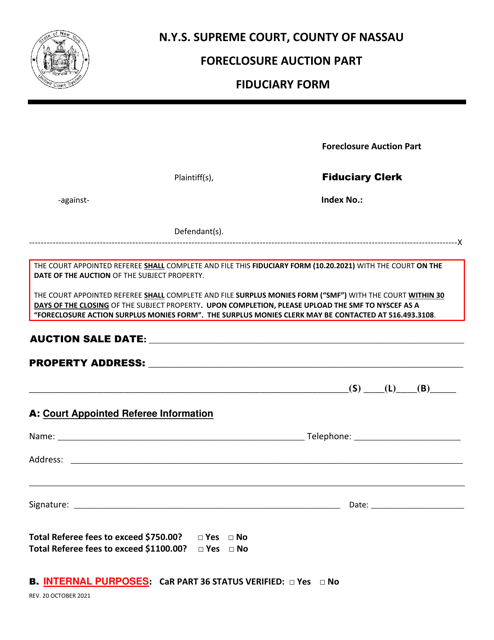

This form is used for the foreclosure auction process in Nassau County, New York. It may be a part of the fiduciary responsibilities involved in handling foreclosed properties.