Limitation Period Templates

When it comes to legal matters involving taxes and assessments, it's important to understand the concept of limitation periods. These periods refer to the timeframe within which certain actions can be taken or claims can be made. They are designed to provide a reasonable time limit for individuals and organizations to address tax-related issues.

At the heart of these limitation periods is the avoidance of lengthy and protracted legal battles. By imposing time constraints, the aim is to ensure a fair and efficient resolution to tax matters. These limitation periods apply to both the United States and Canada, providing guidelines and deadlines for individuals and businesses to abide by.

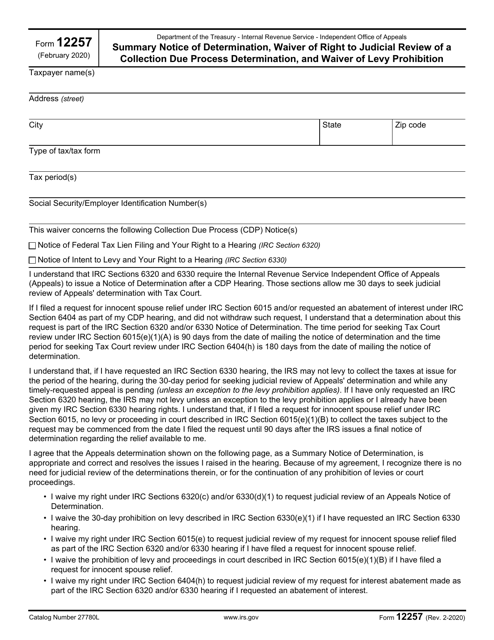

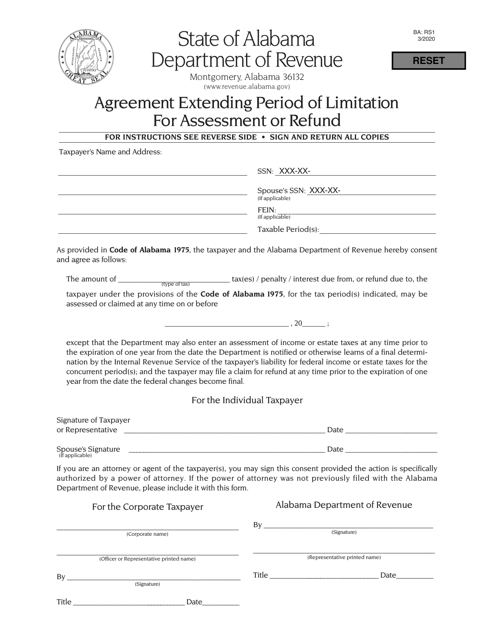

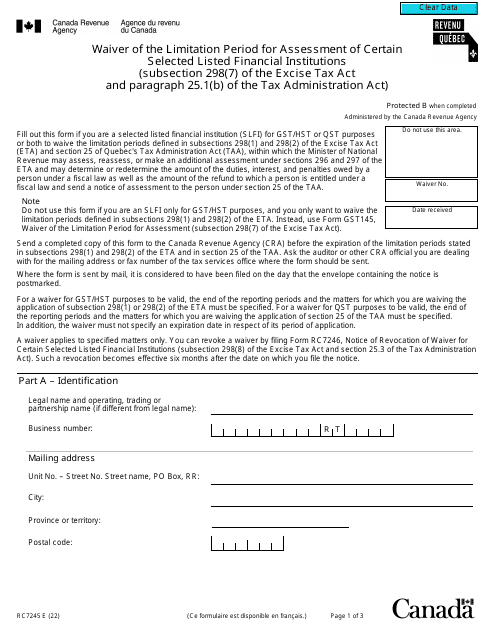

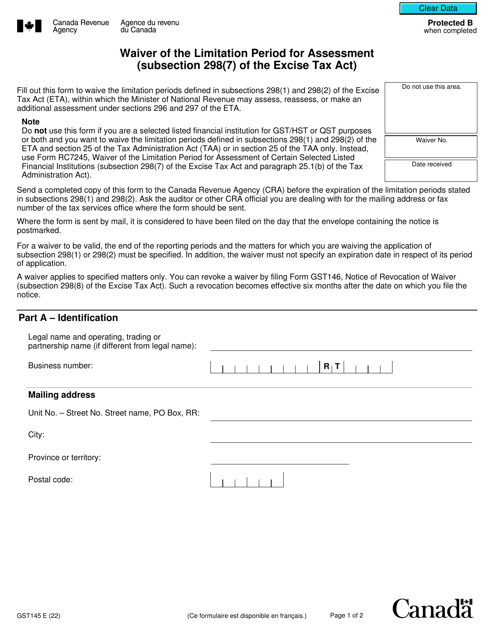

Within this collection of documents, you will find a range of forms and waivers associated with limitation periods. These documents include the IRS Form 12257 Summary Notice of Determination, Waiver of Right to Judicial Review of a Collection Due Process Determination, Waiver of Suspension of Levy Action, and Waiver of Periods of Limitation in Section 6330(E)(1) in the United States, as well as the Form RC7245 Waiver of the Limitation Period for Assessment of a Selected Listed Financial Institution, Form GST145 Waiver of the Limitation Period for Assessment, and other related documents in Canada.

Whether you are an individual taxpayer, a business owner, or a tax professional, understanding and adhering to limitation periods is crucial for navigating the complex world of taxation. These documents will provide you with the necessary information and tools to effectively manage your tax-related obligations.

Documents:

8