Agricultural Use Templates

Welcome to our webpage dedicated to agricultural use. Agriculture has been a vital part of our society for centuries, and it continues to play a crucial role in providing food, fiber, and other essential resources. Our documents collection focuses on various aspects of agricultural use and offers valuable information for farmers, landowners, and government agencies.

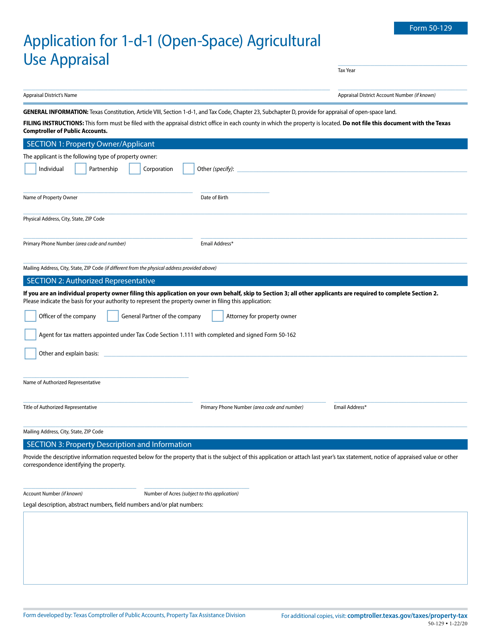

Within our agricultural use documents, you'll find a wide range of forms, instructions, and applications tailored to specific states and regions. These documents cover topics such as exemptions, classifications, tax refunds, affidavits, and special valuations related to agricultural or horticultural use.

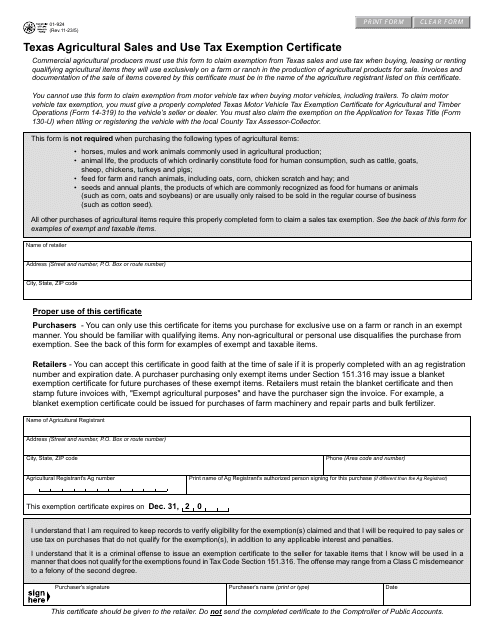

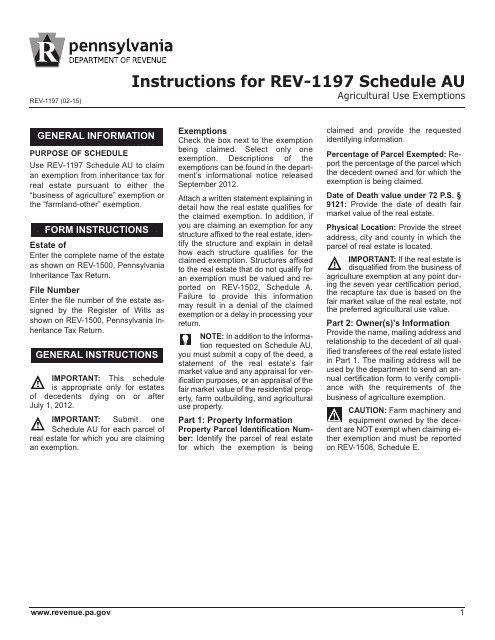

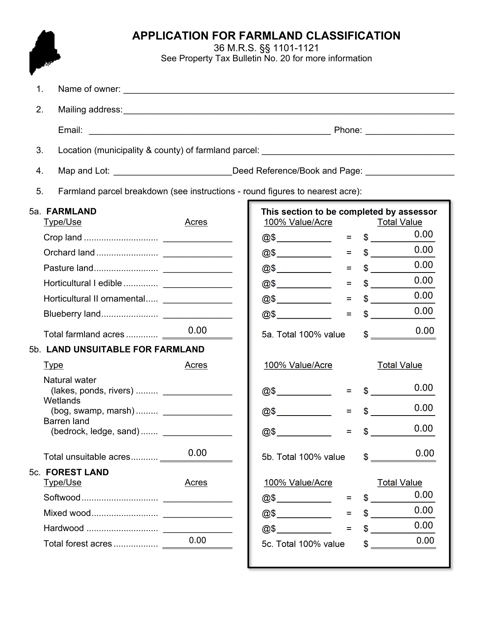

Our collection includes forms like the "Instructions for Form REV-1197 Schedule AU Agricultural Use Exemptions" from Pennsylvania, which provides guidance on how to apply for exemptions related to agricultural land use. Similarly, the "Application for Farmland Classification" from Maine allows farmers to apply for classification that brings various benefits and supports agricultural activities.

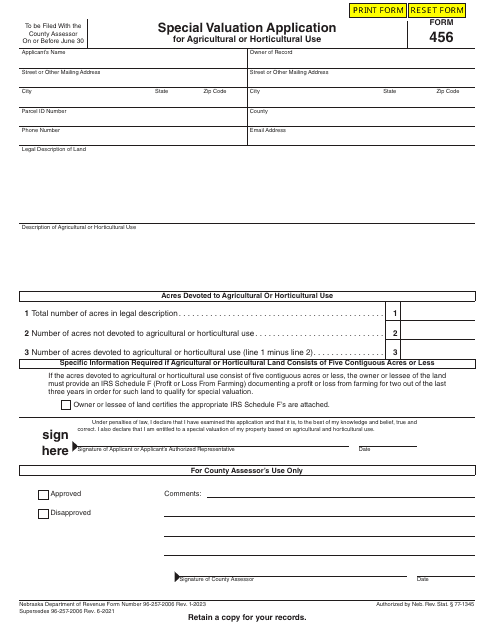

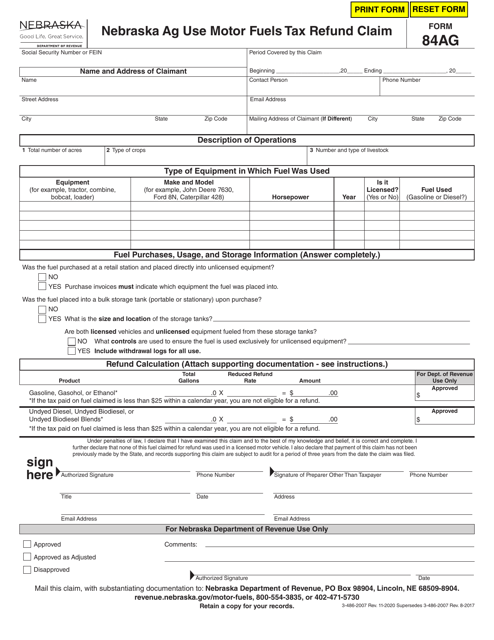

If you're a farmer in Nebraska, you can benefit from documents like the "Form 84AG (3-486-2007) Nebraska Ag Use Motor Fuels Tax Refund Claim." This form enables you to claim a refund on motor fuels tax when used for agricultural purposes. Additionally, the "Form 456 Special Valuation Application for Agricultural or Horticultural Use" in Nebraska assists farmers in applying for special valuations on their agricultural or horticultural land.

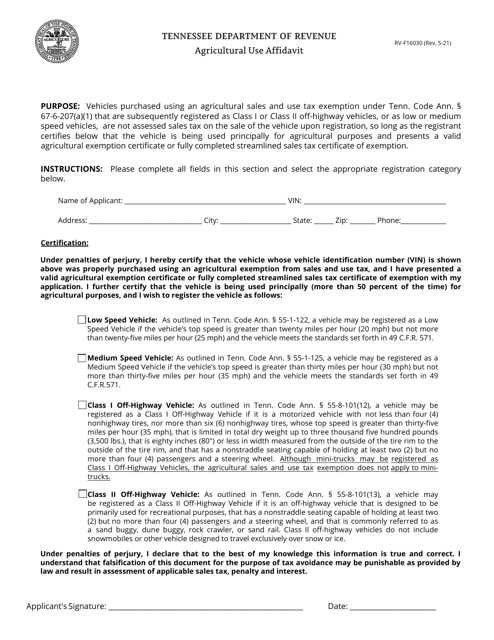

In Tennessee, the "Form RV-F16030 Agricultural Use Affidavit" validates the agricultural use of land and ensures compliance with relevant regulations.

Whether you're a farmer seeking tax benefits, a landowner navigating agricultural use regulations, or a government entity managing agricultural programs, our agricultural use documents provide the necessary resources to simplify processes and ensure compliance.

Explore our extensive collection of agricultural use documents to find the forms, instructions, and applications that suit your specific needs. By leveraging these resources, you can streamline your operations, access potential benefits, and contribute to the vibrant agricultural sector.

Note: It's important to remember that the availability and requirements of these documents may vary based on your location. Always consult the relevant government entities or legal experts to ensure accuracy and compliance.

Documents:

18

This Form is used for reporting agricultural use exemptions in Pennsylvania. It provides instructions on how to fill out Schedule AU for claiming tax exemptions on agricultural properties.

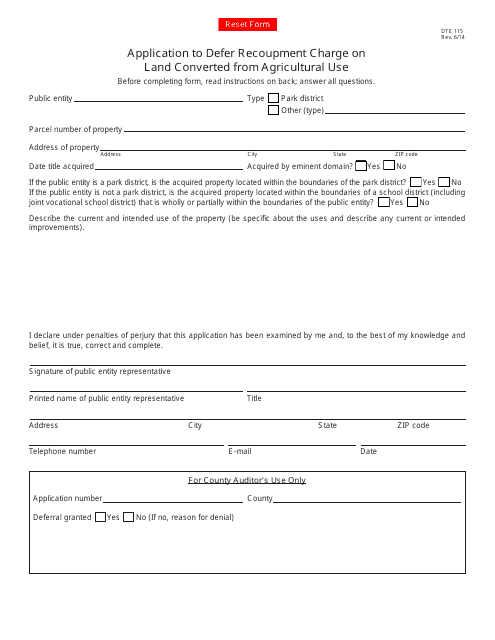

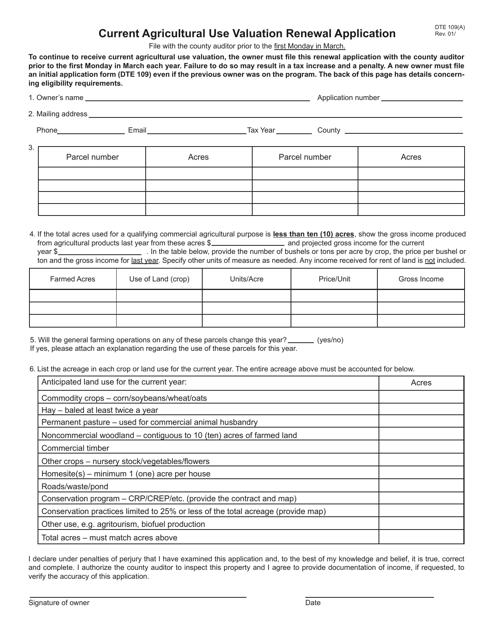

This form is used for applying to defer the recoupment charge on land that has been converted from agricultural use in Ohio.

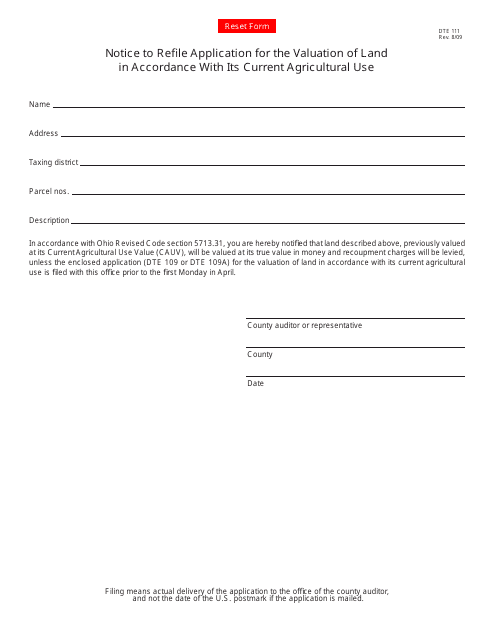

This Form is used for notifying applicants to refile their land valuation application in Ohio for agricultural use assessment purposes.

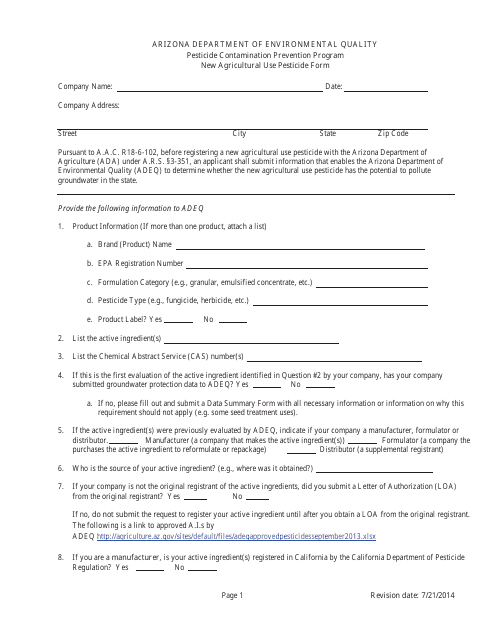

This Form is used for requesting permission to use new agricultural pesticides in Arizona.

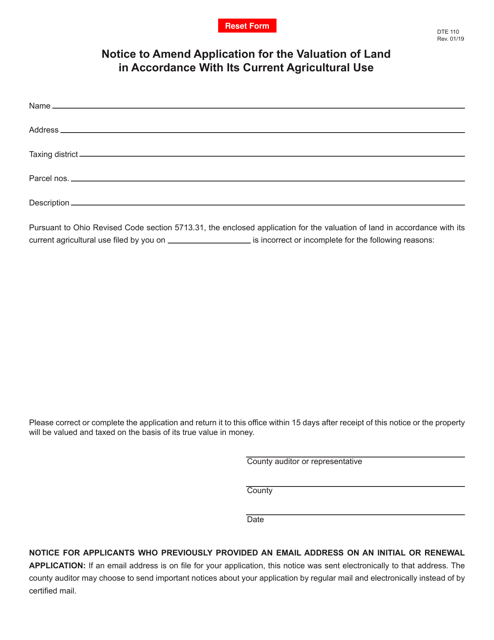

This form is used for notifying the Ohio Department of Taxation about changes in the application for the valuation of agricultural land.

This Form is used for claiming a refund of motor fuels tax paid on ag use in Nebraska.

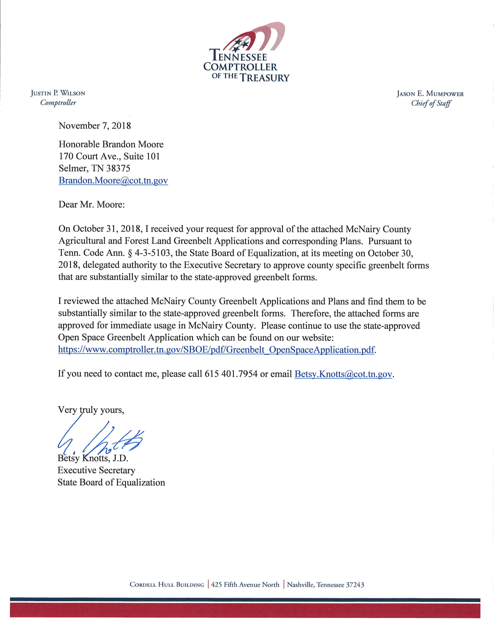

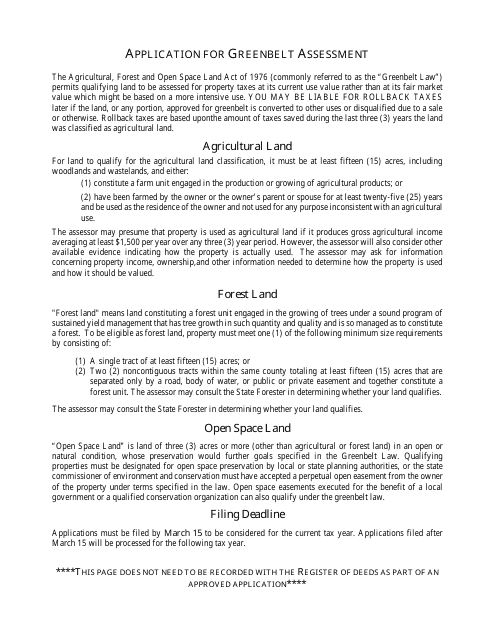

This form is used for applying for a greenbelt assessment in McNairy County, Tennessee. Greenbelt assessment is a program that provides property tax incentives for landowners who maintain agricultural or forested land. By applying for this assessment, landowners can potentially lower their property taxes.

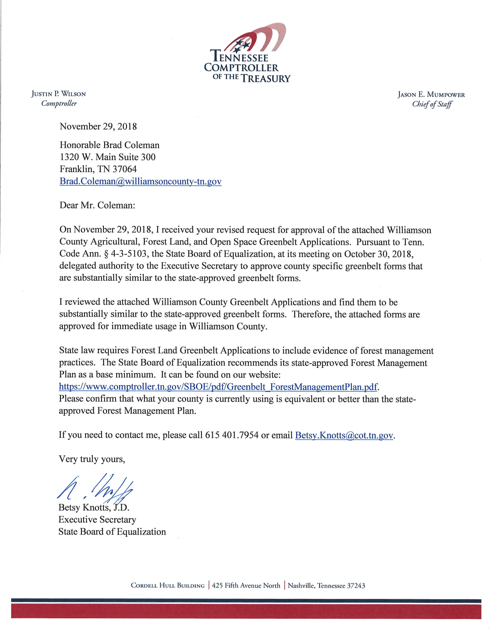

This document is used for applying for a Greenbelt Assessment in Williamson County, Tennessee.

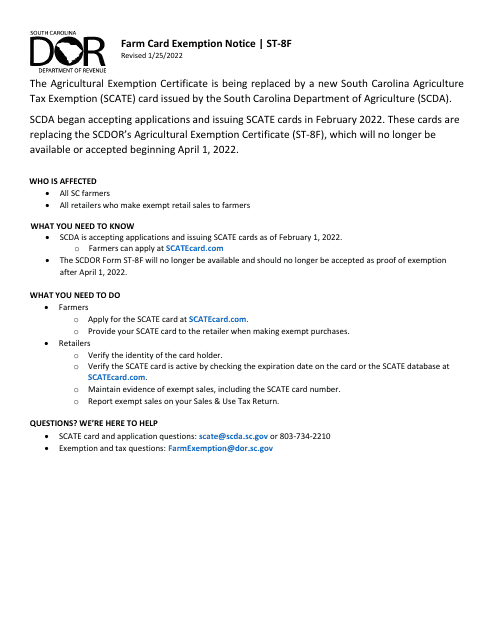

This form is used for claiming an exemption from sales and use tax on agricultural products in South Carolina. It is specifically for farmers and agricultural businesses.

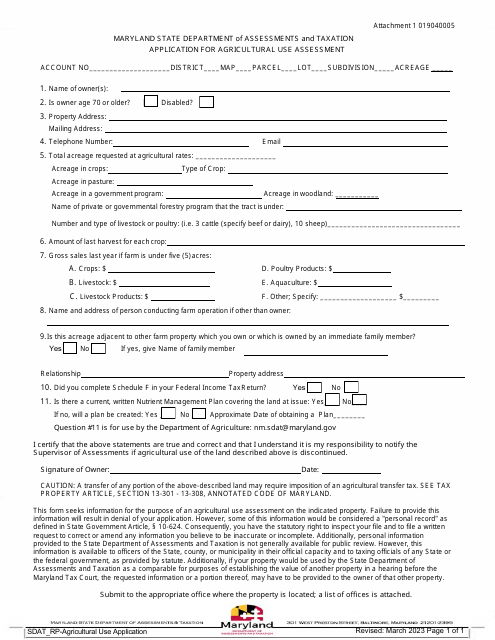

This document is used for applying for agricultural use assessment in the state of Maryland.