Tax Permit Templates

A tax permit is a crucial document required by businesses and individuals for conducting taxable activities in various states across the United States and Canada. It serves as an official authorization from the relevant tax authorities to collect, report, and submit taxes on behalf of the government.

Obtaining a tax permit ensures compliance with tax regulations and allows businesses to legally engage in activities involving taxable goods or services. The tax permit document, also known as a tax permit form, tax permits, or taxes permit, is an essential component of operating a lawful business.

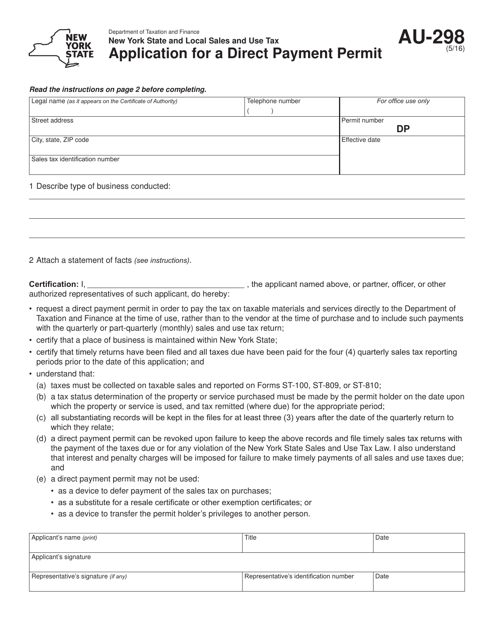

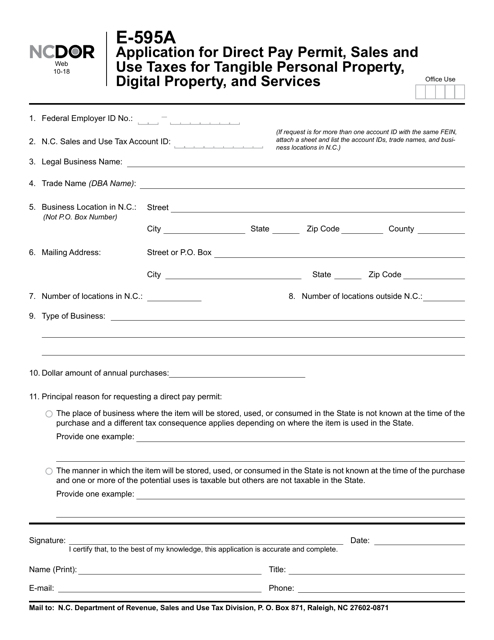

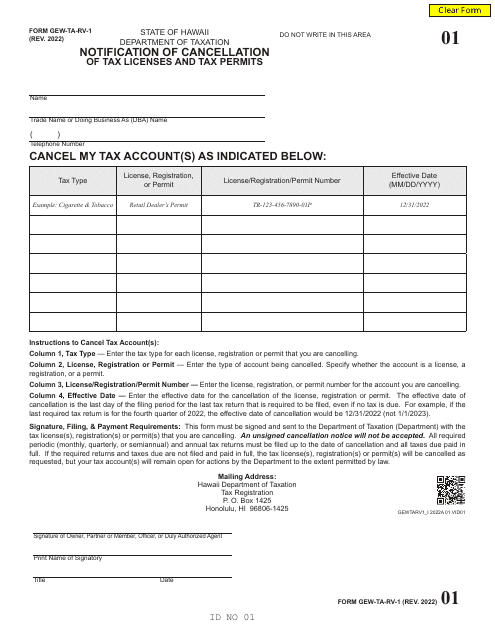

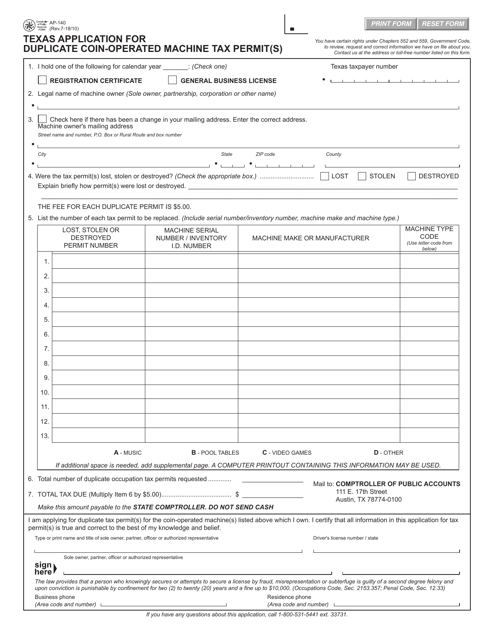

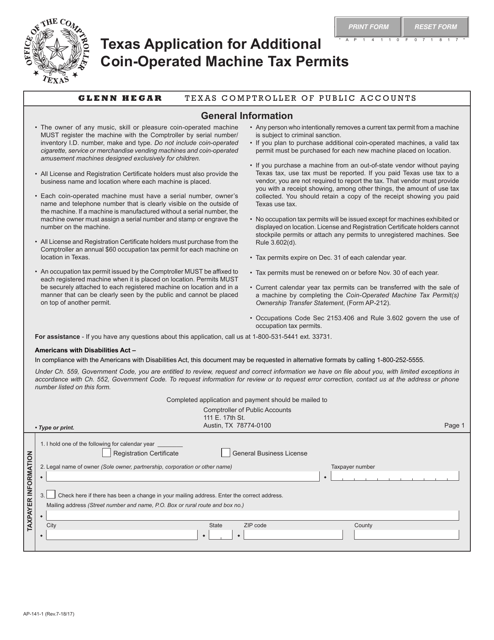

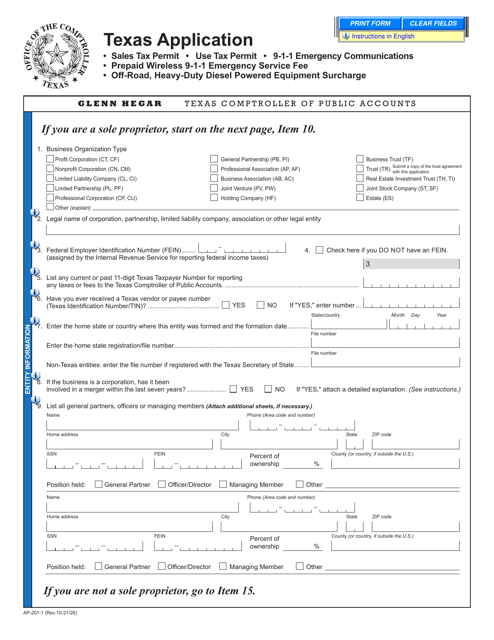

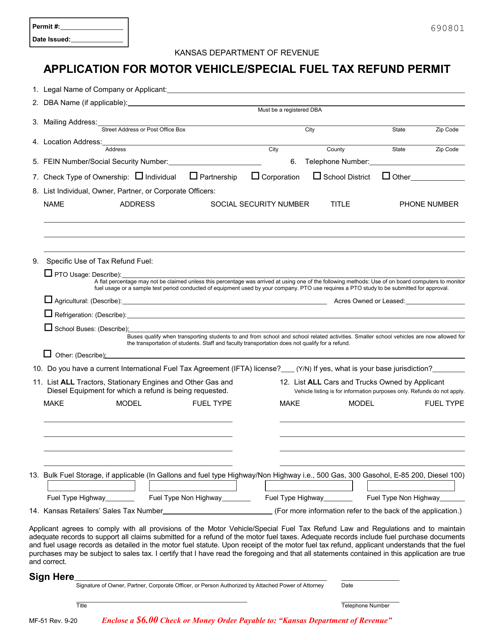

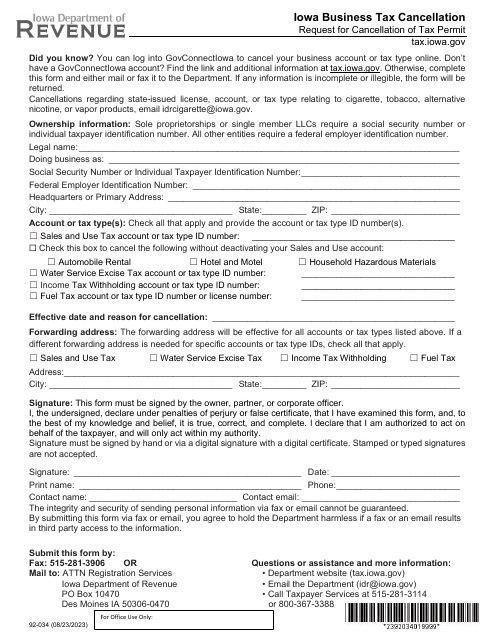

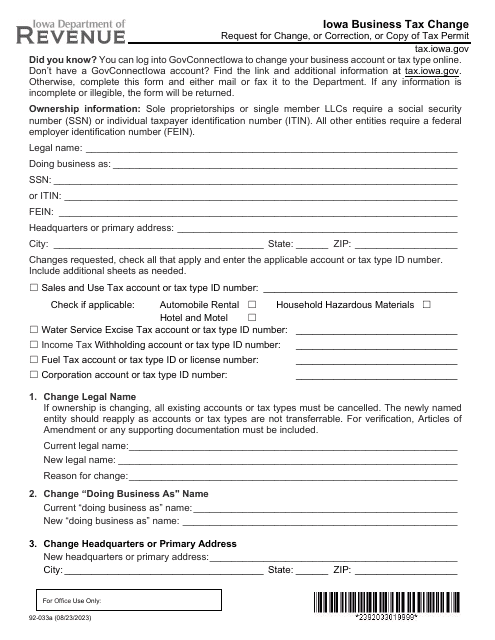

Whether you need to apply for a new tax permit, request a duplicate or additional permits, or make changes/corrections to an existing permit, there are specific forms designed for each purpose. For example, the Form AU-298 Application for a Direct Payment Permit - New York, Form AP-140 Texas Application for Duplicate Coin-Operated Machine Tax Permit(S) - Texas, Form AP-141 Texas Application for Additional Coin-Operated Machine Tax Permits - Texas, Form AP-201 Texas Application for Texas Sales and Use Tax Permit - Texas, and Form 92-033 Iowa Business Tax Change - Request for Change, or Correction, or Copy of Tax Permit - Iowa are just a few examples of the various tax permit forms available.

These forms are necessary tools that help businesses navigate the complex realm of tax compliance, enabling them to operate within the boundaries of the law while maximizing their financial stability. It is important to stay updated on the tax permit requirements of your specific jurisdiction to ensure uninterrupted business operations and avoid potential penalties or legal consequences.

If you are unsure about the tax permit process or need assistance with completing the required forms, seeking guidance from a tax professional or contacting the respective tax authorities in your state or province is highly recommended. Remember, having the appropriate tax permits protects both your business and your customers, ensuring a smooth and compliant operation.

Documents:

24

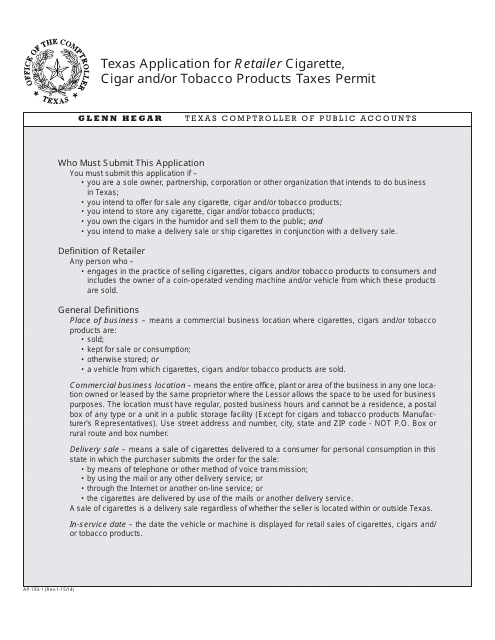

This Form is used for applying for a permit to sell cigarettes, cigars, and/or tobacco products in the state of Texas.

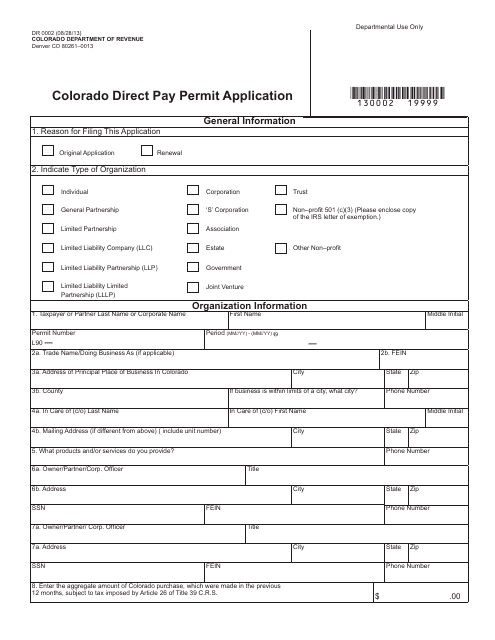

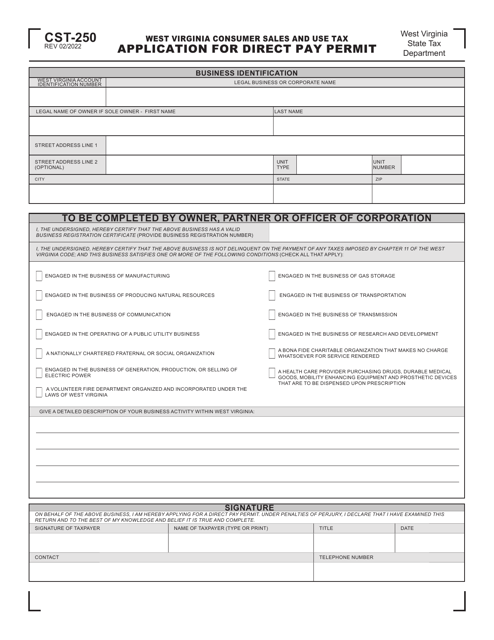

This form is used for applying for a direct pay permit in the state of Colorado.

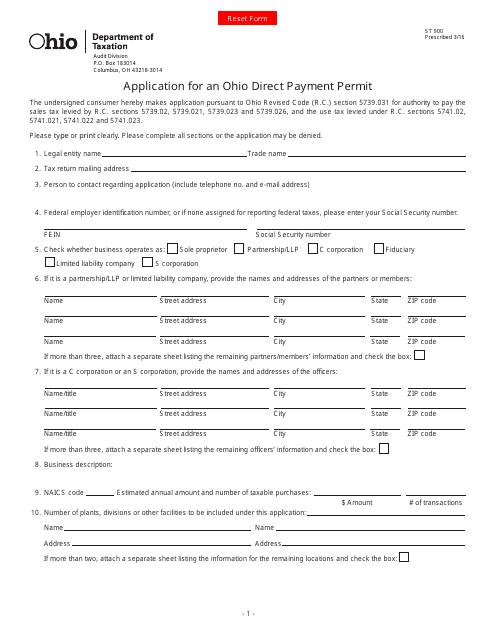

This Form is used for applying for an Ohio Direct Payment Permit in Ohio.

This form is used for applying for a Direct Payment Permit in New York. It allows businesses to directly pay sales tax rather than collecting it from customers.

This form is used for applying for a Direct Pay Permit for sales and use taxes in North Carolina for tangible personal property, digital property, and services.

This document is used for applying for a duplicate coin-operated machine tax permit(s) in Texas.

This form is used for applying for additional coin-operated machine tax permits in the state of Texas.

This form is used for applying for a registration certificate and tax permit for coin-operated machines in Texas. It is required for individuals or businesses operating these types of machines within the state.

This form is used for applying for various licenses and tax permits related to coin-operated machines in Texas.

This form is used for applying for an oil and gas well servicing tax permit in the state of Texas.

This document is used for applying for a permit to sell cigarettes, cigars, and/or tobacco products in Texas.

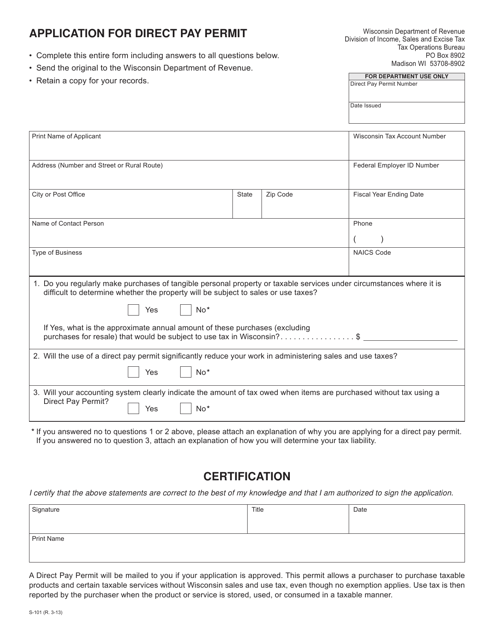

This form is used for applying for a direct pay permit in Wisconsin.

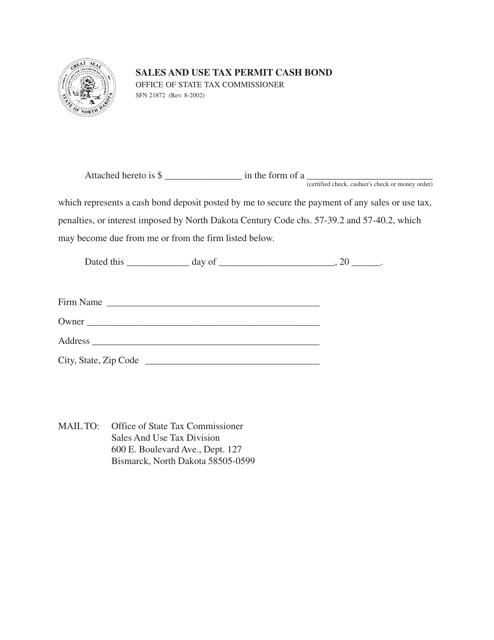

This form is used for obtaining a cash bond for a sales and use tax permit in North Dakota.

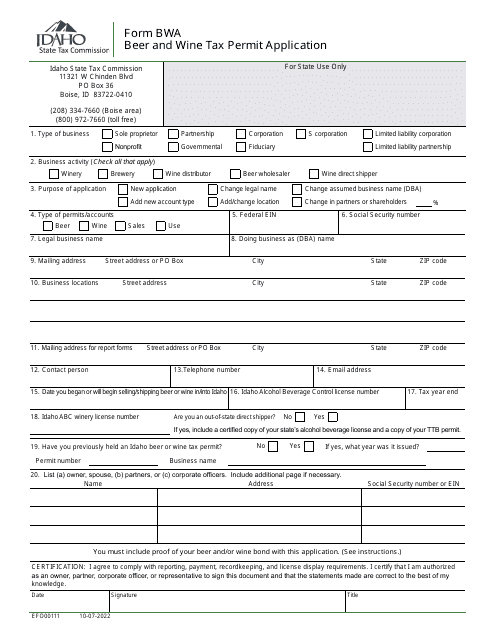

This document is an application form for obtaining a Beer and Wine Tax Permit in the state of Idaho. It is used by individuals or businesses who want to sell beer and wine and need a permit to do so.