Foreign Trade Zone Templates

Welcome to our webpage dedicated to foreign trade zones, also known as FTZs. A foreign trade zone is a designated area within a country's borders where goods can be imported, stored, and processed without being subject to customs duties or other trade restrictions. This allows businesses to operate in a more cost-effective and competitive manner.

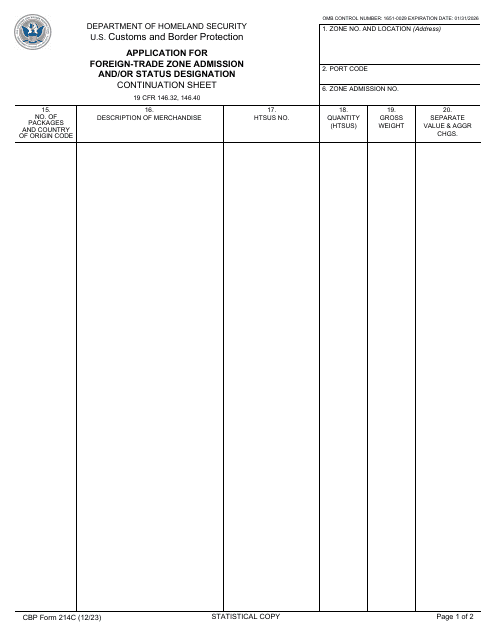

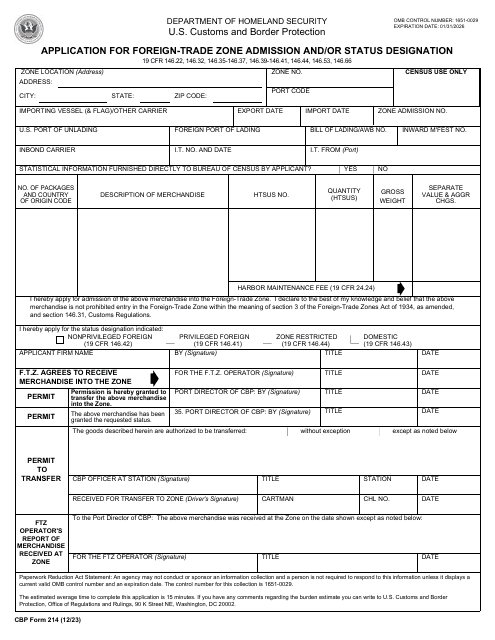

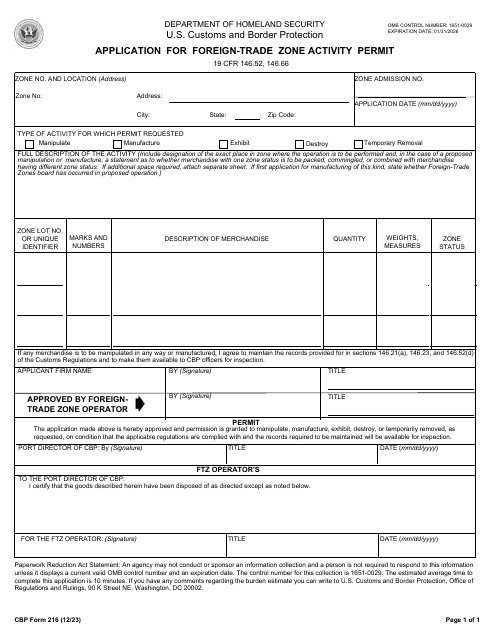

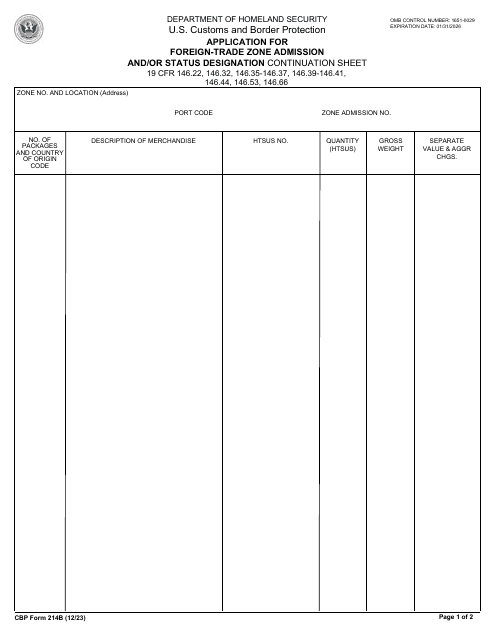

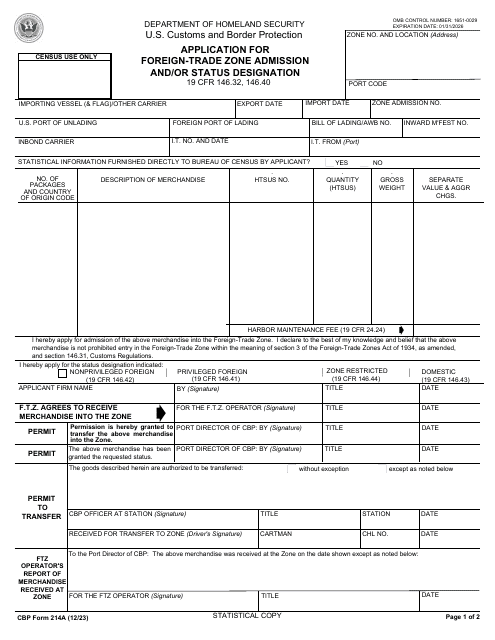

At our webpage, you will find a comprehensive collection of documents related to foreign trade zones that can help you navigate the process of admission, status designation, and activity permits. These documents include the CBP Form 214 Application for Foreign-Trade Zone Admission and/or Status Designation, CBP Form 214B Application for Foreign-Trade Zone Admission and/or Status Designation - Continuation Sheet, CBP Form 216 Application for Foreign-Trade Zone Activity Permit, and CBP Form 214A Application for Foreign-Trade Zone Admission and/or Status Designation, among others.

Whether you are a business looking to establish operations in a foreign trade zone or an individual seeking information on the benefits and requirements of operating within an FTZ, our webpage provides easy access to the necessary documents and resources. By utilizing FTZs, businesses gain a competitive edge by reducing costs, streamlining customs procedures, and enhancing supply chain efficiency.

Visit our webpage today to explore the full range of documents and resources related to foreign trade zones. Streamline your entry into the world of international trade and take advantage of the numerous benefits provided by FTZs.

Documents:

14

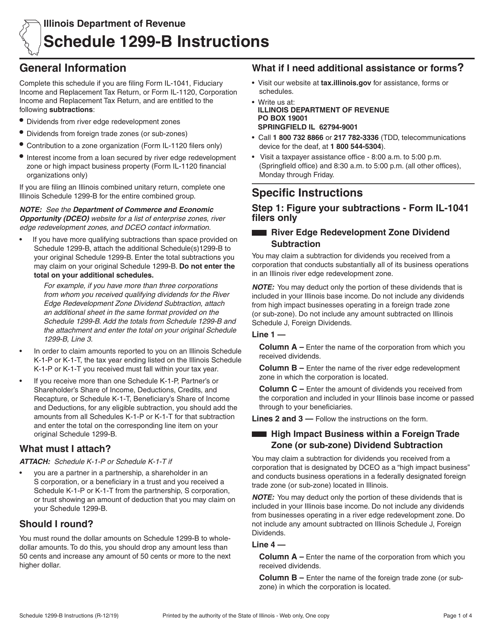

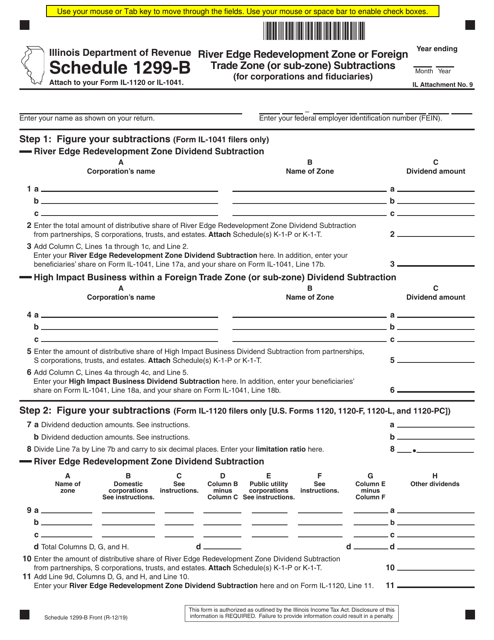

This form is used for corporations and fiduciaries in Illinois to report and claim deductions for activities related to River Edge Redevelopment Zones or Foreign Trade Zones. It provides instructions on how to accurately calculate and report these subtractions for tax purposes.

This document is used by corporations and fiduciaries in Illinois to claim subtractions related to the River Edge Redevelopment Zone or Foreign Trade Zone activities.