Business Income Tax Templates

Are you a business owner or a self-employed individual? If so, understanding your obligations when it comes to business income tax is crucial. Business income tax, also known by its alternate name of business income tax, is the tax imposed on the income generated by businesses.

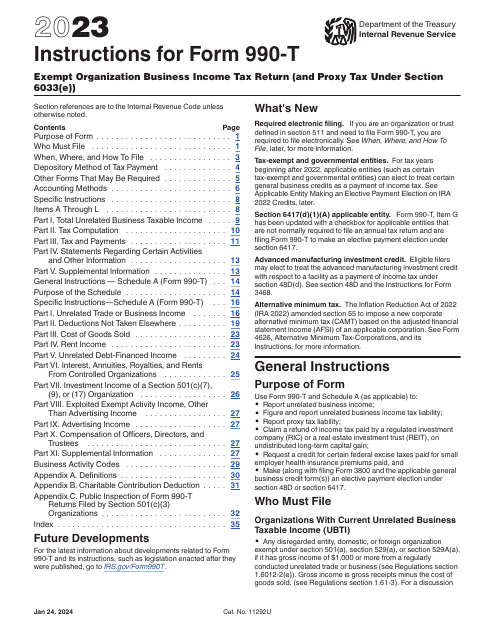

Filing your business income tax return accurately and on time is important to avoid penalties and ensure compliance with the law. Whether you are a sole proprietorship, partnership, corporation, or other business entity, you are required to report your income and pay your fair share of taxes.

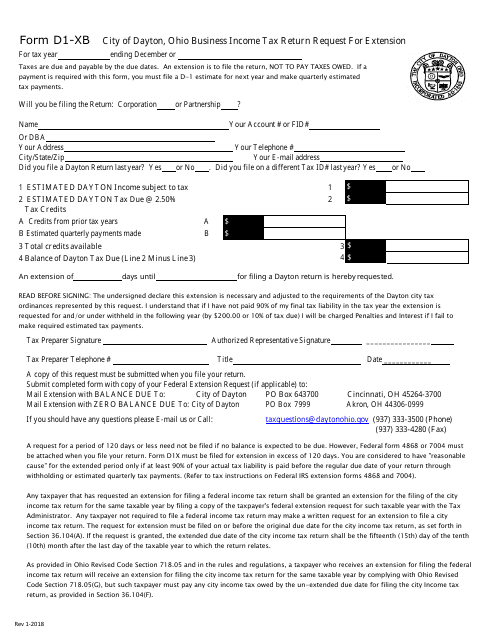

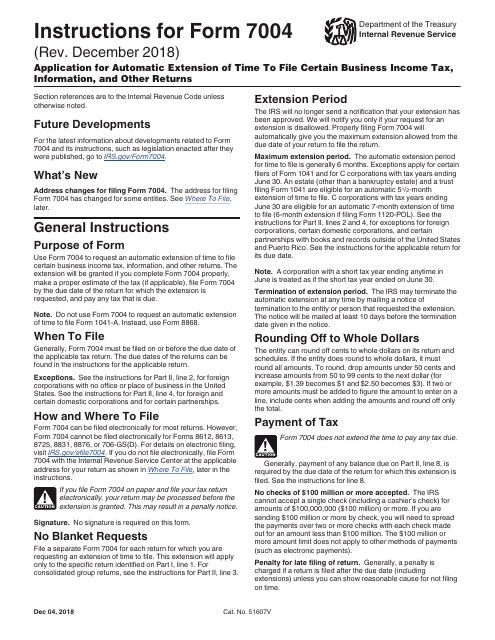

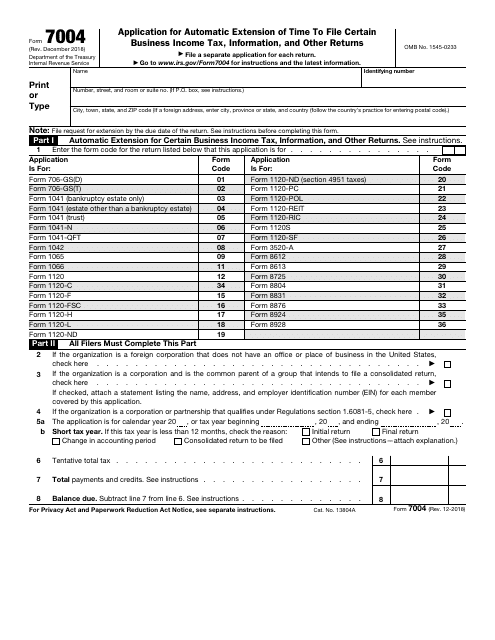

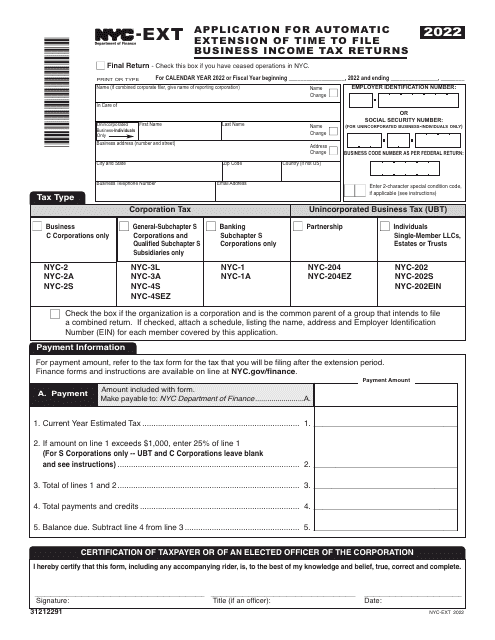

To assist you in fulfilling these obligations, various documents are available, such as the Form D1-XB Business Income Tax Return Request for Extension, which can be used to request an extension for filing your business income tax return with the city of Dayton, Ohio. Additionally, the IRS provides instructions for Form 7004, which is an Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. This form can grant you additional time to file your federal business income tax return.

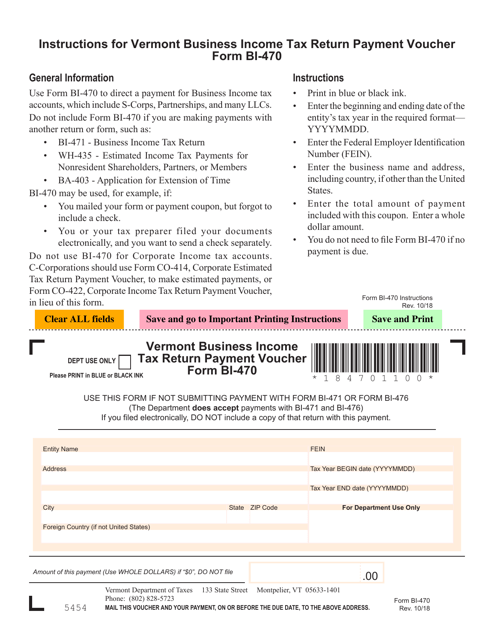

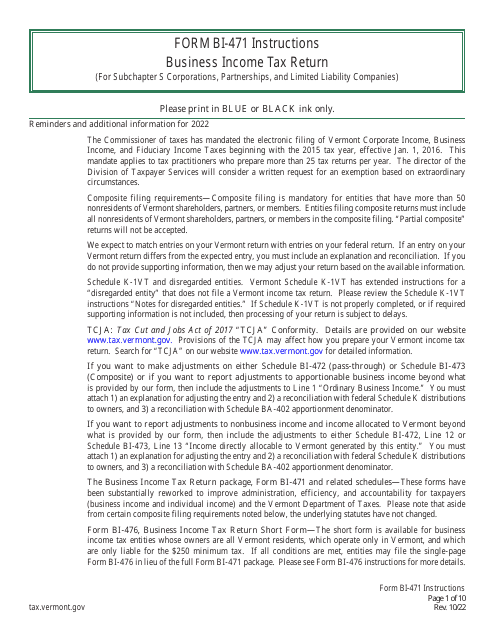

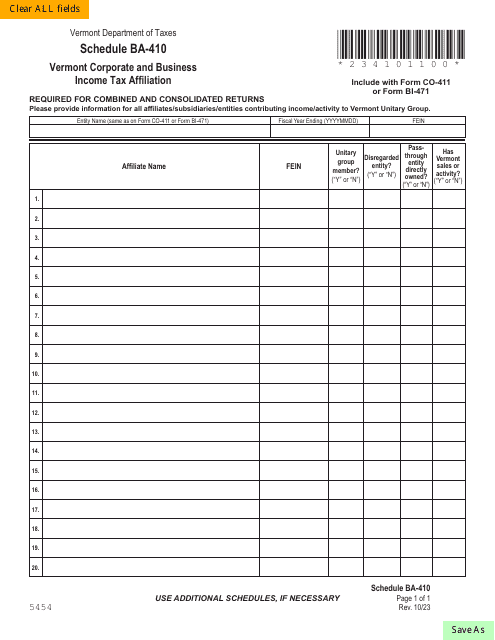

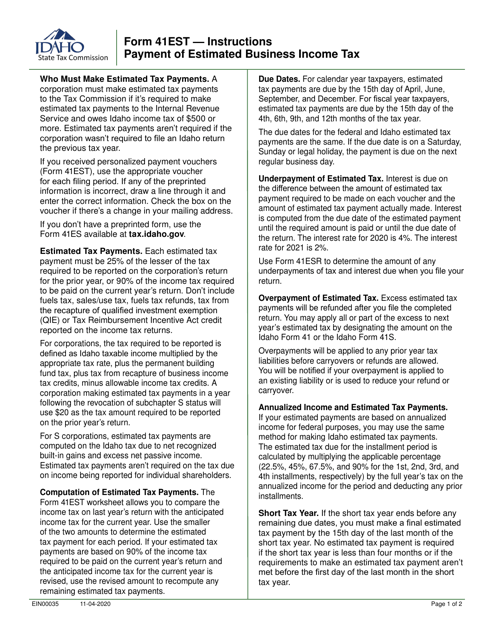

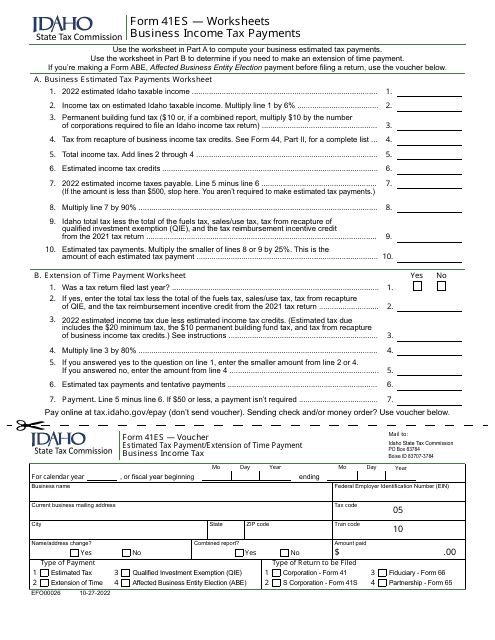

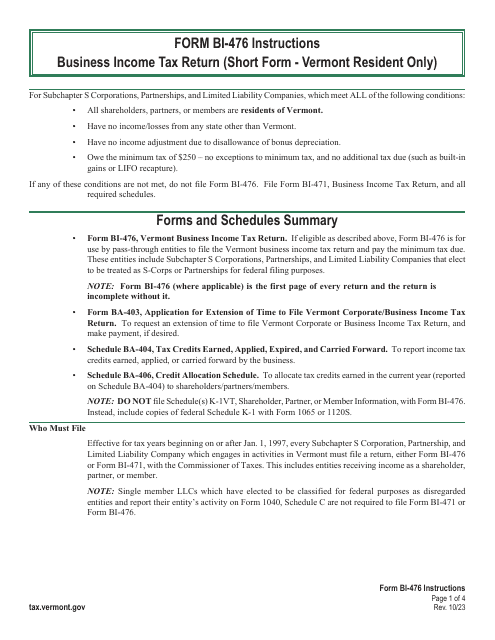

If you operate a business in Vermont, the state provides detailed instructions for the VT Form BI-471 Business Income Tax Return. On the other hand, if you are a resident of Idaho, you can utilize Form 41ES (EFO00026) to make estimated tax payments or request an extension of time to pay your business income tax.

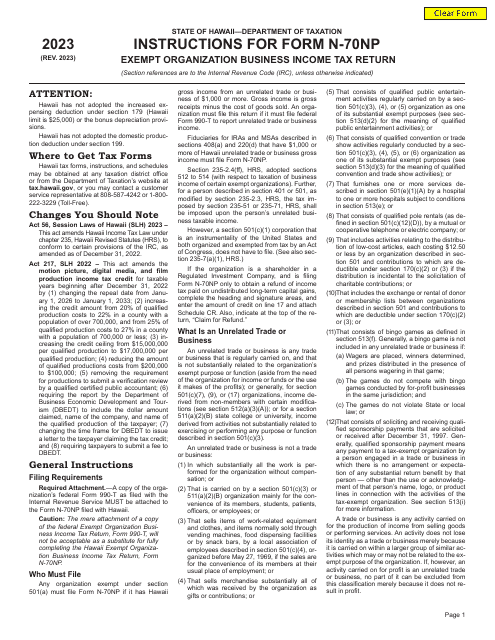

Lastly, if you run an exempt organization in Hawaii, you will need to file a Form N-70NP Exempt Organization Business Income Tax Return. It is essential to familiarize yourself with the specific instructions for this form to ensure compliance with the state's regulations.

Navigating the complexities of business income tax can be overwhelming, but with the right resources and documents, you can fulfill your obligations accurately and efficiently. If you need any assistance or have specific questions, consult a tax professional or refer to the relevant documents to ensure you are meeting all your tax obligations.

Documents:

20

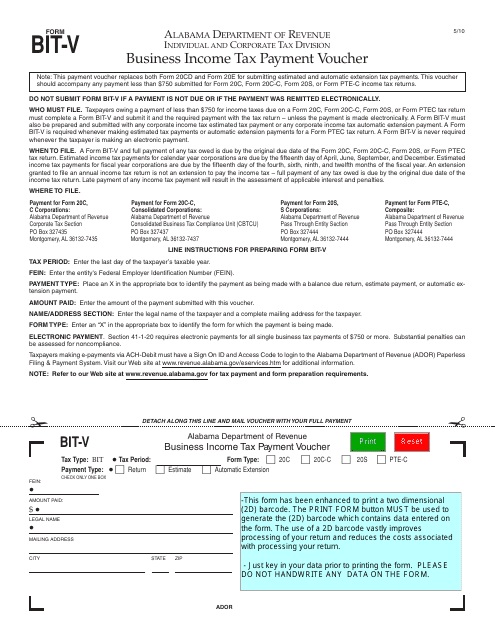

This Form is used for submitting business income tax payment in the state of Alabama.

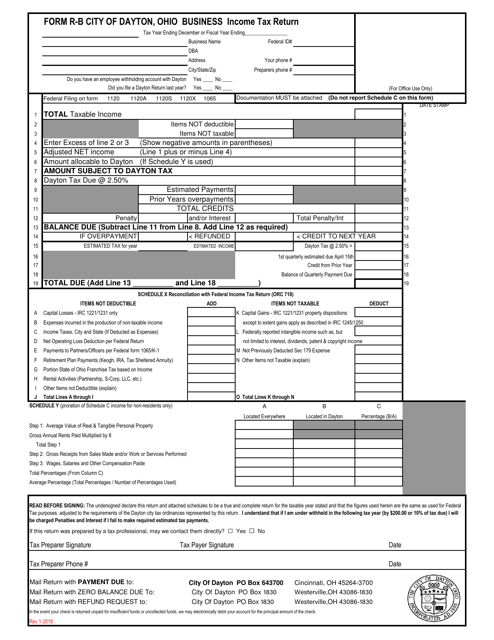

This form is used for requesting an extension to file the business income tax return for the City of Dayton, Ohio.

This form is used to request an automatic extension of time to file certain business income tax returns.

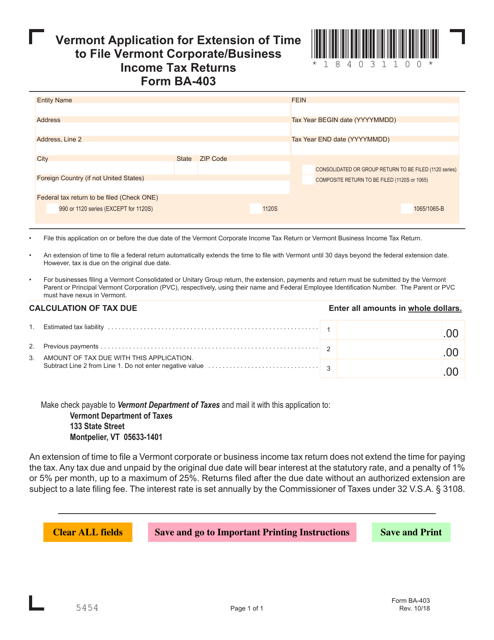

This Form is used for making a payment for the Vermont Business Income Tax Return.

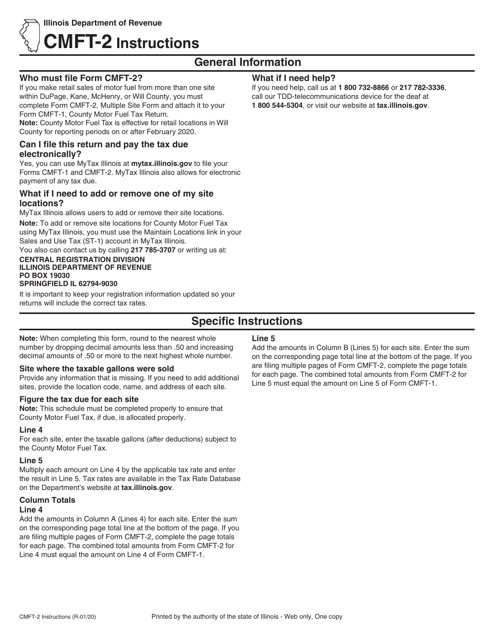

This Form is used for reporting multiple sites in Illinois. It provides instructions for filling out Form CMFT-2.

This document is used for making estimated tax payments or requesting an extension of time to pay business income tax in the state of Idaho.

This Form is used for businesses in Dayton, Ohio to file their income tax return with the city.