Credit for Taxes Templates

Are you looking for ways to reduce the amount of taxes you owe? If so, you may be eligible for various credits for taxes paid. These credits can help you lower your tax liability and save money.

The credit for taxes, also known as the credit for tax, is a valuable resource for individuals and businesses alike. It provides relief to taxpayers who have already paid taxes to another state or country. By claiming this credit, you can offset the taxes paid elsewhere against your current tax liability.

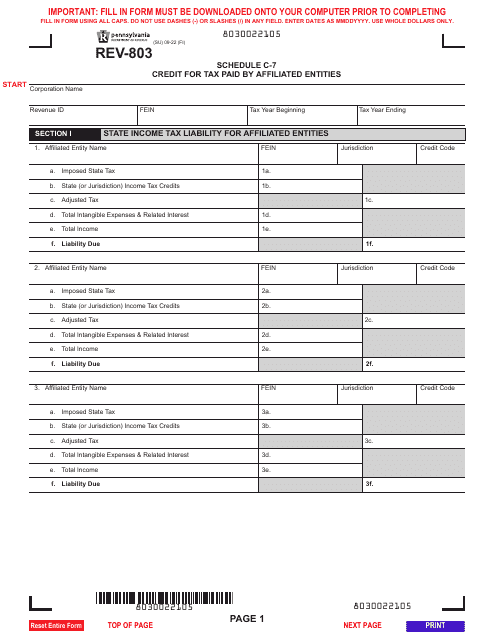

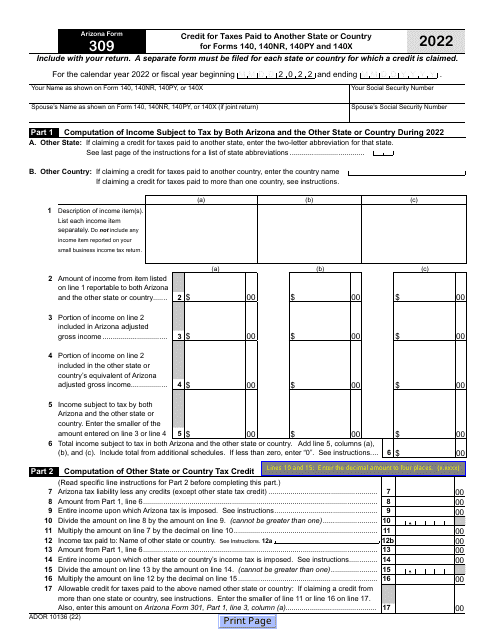

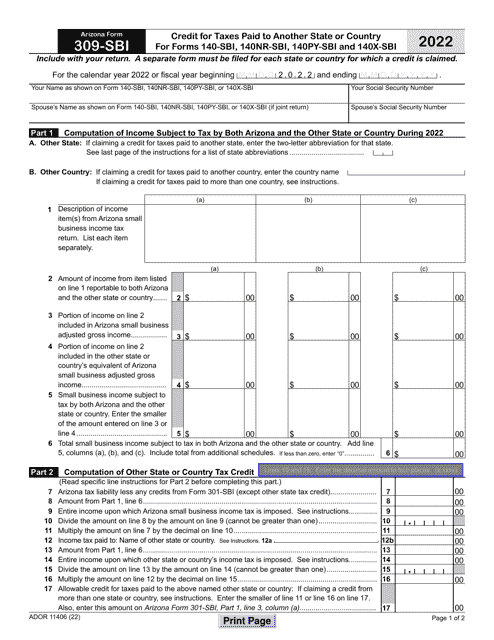

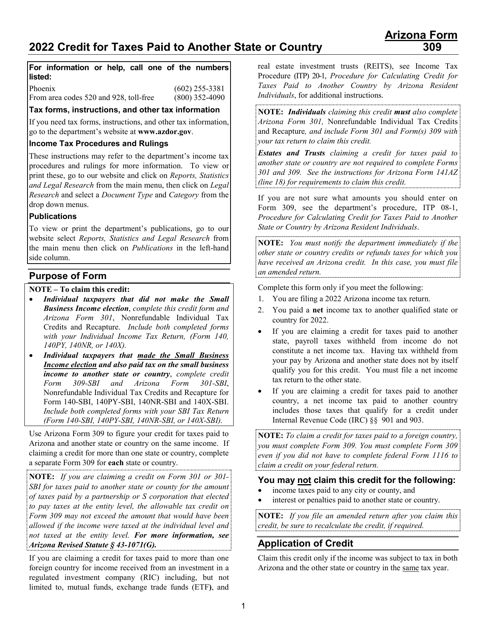

One example of a document related to the credit for taxes is the Form REV-803 Schedule C-7 Credit for Tax Paid by Affiliated Entities in Pennsylvania. This form allows affiliated entities to allocate and claim credit for taxes paid. Similarly, in Arizona, you can utilize the Arizona Form 309 (ADOR10136) to claim the Credit for Taxes Paid to Another State or Country. This document ensures that you receive the appropriate credit for taxes paid outside Arizona.

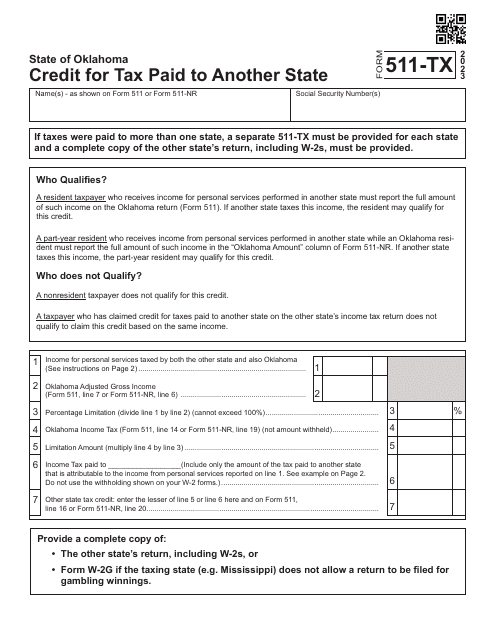

If you're a resident of Oklahoma, the Form 511-TX Credit for Tax Paid to Another State is the document you need to take advantage of the credit for taxes paid to another state. It allows you to report the taxes paid elsewhere and claim the relevant credit on your Oklahoma tax return.

It's worth noting that instructions accompanying these documents can provide additional information to help you understand the credit for taxes and how to claim it properly. For instance, the Instructions for Arizona Form 309, ADOR10136 guide you through the process of completing and filing the form accurately.

Don't miss out on the opportunity to reduce your tax burden. Explore the credit for taxes available in your jurisdiction and make use of the relevant forms and instructions to ensure you receive the credits you deserve.

Documents:

6