Credit Carry Forward Templates

Are you looking to maximize your tax savings? Do you have unused tax credits from previous years? Our credit carry forward program allows you to carry forward those unused credits and apply them to future tax liabilities.

At Templateroller.com, we understand the importance of utilizing every available tax advantage. Our credit carry forward program is designed to help businesses and individuals make the most of their tax credits. By carrying forward unused credits, you can reduce your tax burden and potentially save thousands of dollars.

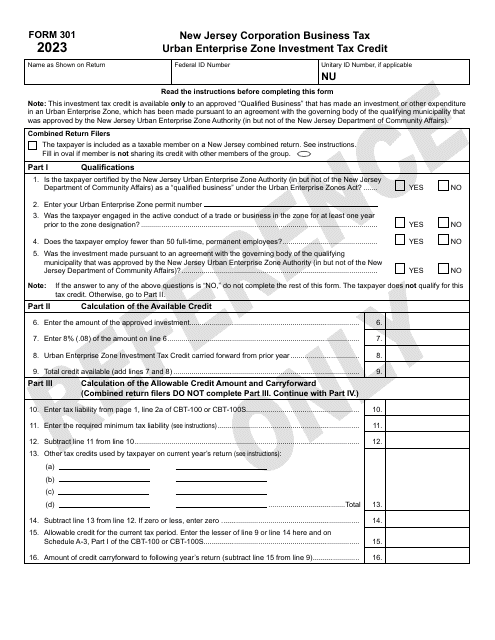

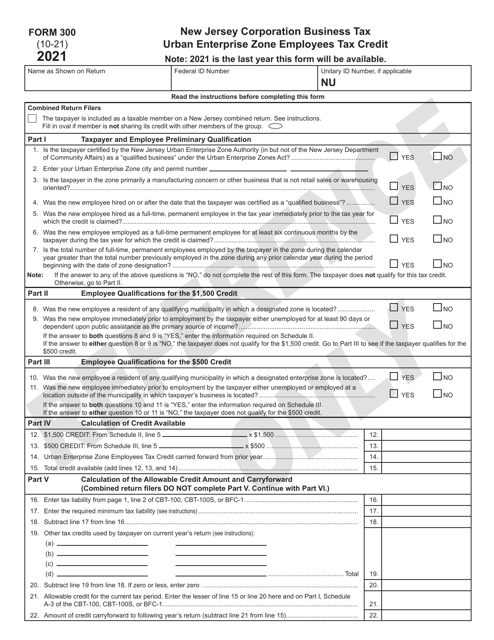

With our credit carry forward program, you can consolidate and carry forward a variety of tax credits from previous years. Whether it's investment tax credits, employees tax credits, or any other eligible credits, we ensure that you don't miss out on any tax savings. Our team of experts will guide you through the process, ensuring that all necessary forms, such as Form 301 Urban Enterprise ZoneInvestment Tax Credit and Credit Carry Forward, and Form 300 Urban Enterprise ZoneEmployees Tax Credit and Credit Carry Forward, are filed correctly.

Don't let your hard-earned tax credits go to waste. Take advantage of our credit carry forward program and put those credits to good use. Contact us today to learn more about how we can help you maximize your tax savings through our credit carry forward program.