Tax Deed Templates

Tax Deed: The Essential Document for Property Ownership

Are you a homeowner looking to secure your property rights? Are you a real estate investor searching for profitable investment opportunities? Look no further than the tax deed, also known as deed tax or tax deed form.

A tax deed is a legal document issued by the county government that transfers ownership of a property from the delinquent taxpayer to the buyer at a tax sale. It serves as undeniable proof of ownership and guarantees your rights as a property owner.

With the tax deed in hand, you gain control over the property, allowing you to develop, sell, or rent it as you see fit. This invaluable document offers a range of benefits, including:

-

Secure Property Ownership: The tax deed provides legal protection, ensuring that you have exclusive rights to the property. You can build your dream house, start a business, or generate rental income without any concerns about losing your investment.

-

Lucrative Investment Opportunities: As an investor, the tax deed opens doors to profitable real estate deals. By purchasing properties at tax sales, you can acquire valuable assets at significantly reduced prices. With careful research and due diligence, you can turn these properties into lucrative investments or sell them for a handsome profit.

-

Government Assurance: The tax deed is a government-issued document that guarantees the legitimacy of the property transaction. It provides peace of mind, knowing that your ownership rights are protected by the state or county government.

-

Potential Surplus Funds: In some cases, a tax sale may result in surplus funds, which are the excess proceeds from the sale of a property. By filing an affidavit to claim these surplus funds, you can potentially recover additional money on top of your property investment. This can be a pleasant surprise that turns your investment into an even more lucrative venture.

Whether you're a homeowner or an investor, understanding the importance of the tax deed is crucial. Don't leave your property rights to chance – secure your future with this essential document. Reach out to your local government offices or legal professionals to learn more about the tax deed process and unlock the immense potential it holds.

Documents:

11

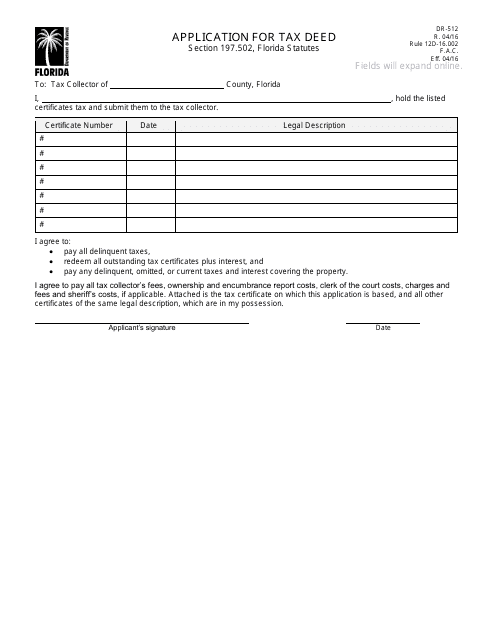

This form is used for applying for a tax deed in the state of Florida.

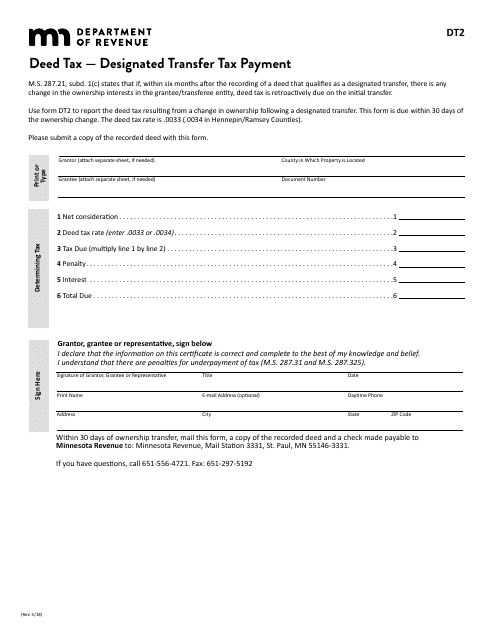

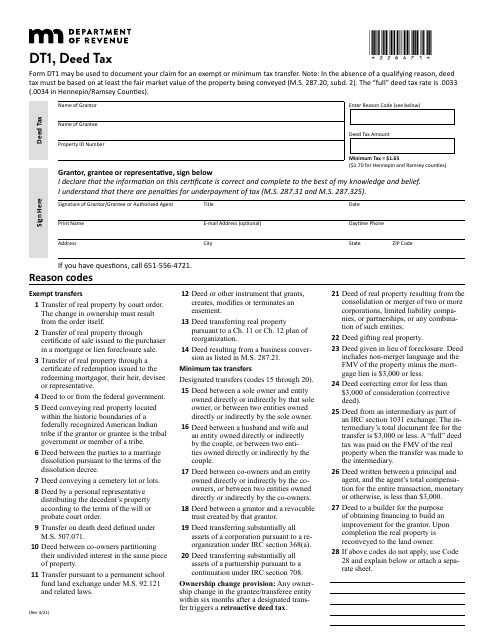

This form is used for paying the designated transfer tax in Minnesota for property deeds.

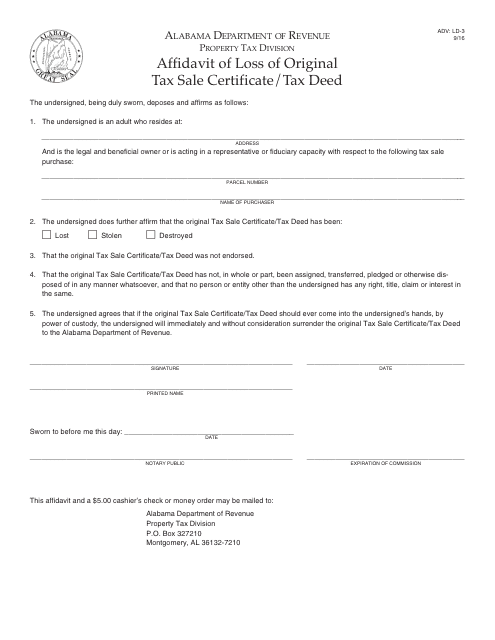

This form is used for declaring the loss of an original tax sale certificate or tax deed in Alabama.

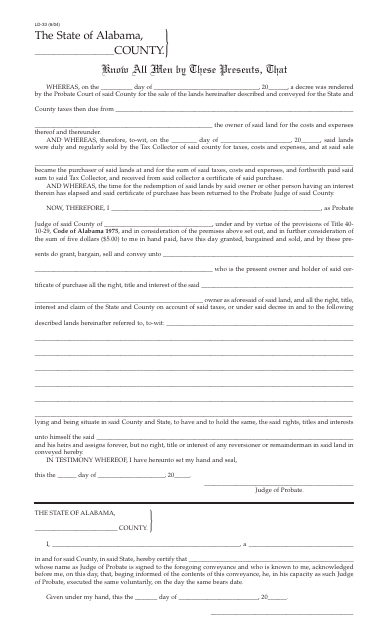

This document is for the issuance of a tax deed by the county in Alabama. It is used by the county for internal purposes only.

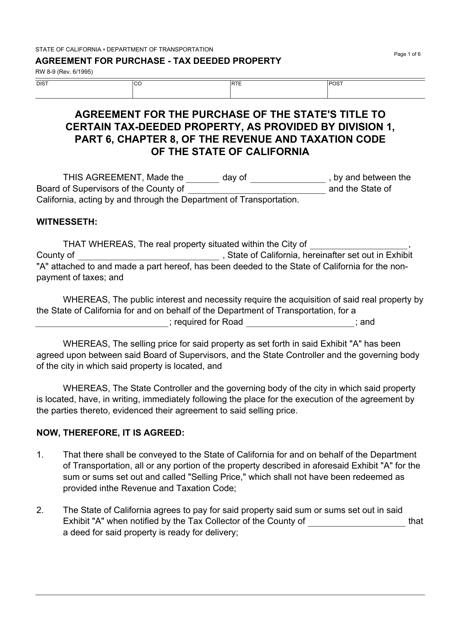

This form is used for creating an agreement for the purchase of a tax deeded property in California.

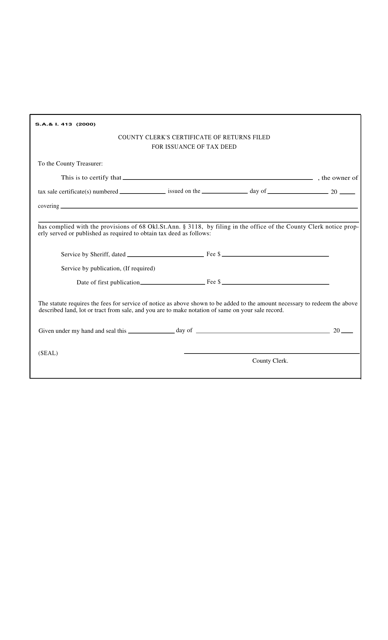

This Form is used for filing a County Clerk's Certificate of Returns for the issuance of a Tax Deed in Oklahoma.

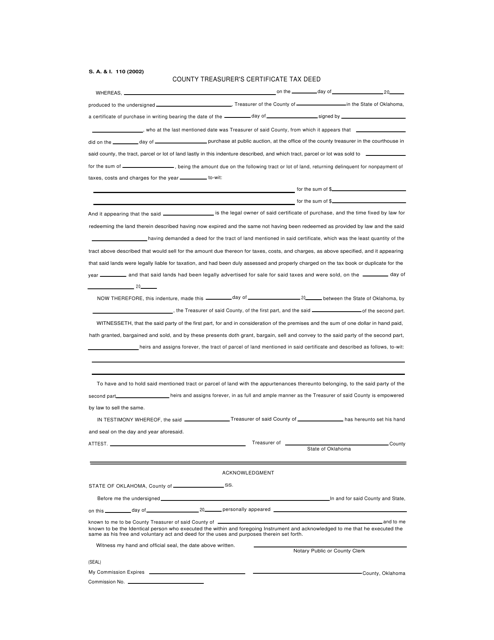

This document is used for obtaining a county treasurer's certificate for a tax deed in Oklahoma.

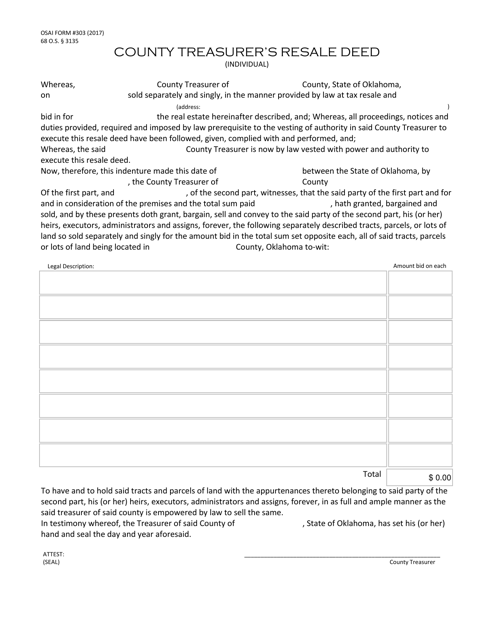

This document is used for transferring ownership of a property through a resale deed in Oklahoma.

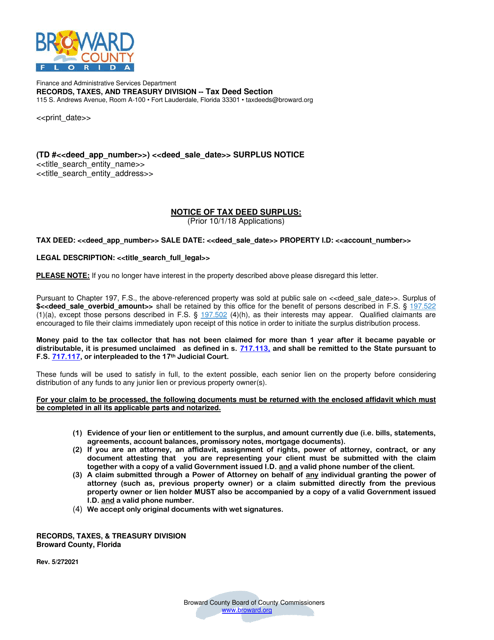

This document is used for filing an affidavit to claim surplus funds from a tax deed sale in Broward County, Florida, which occurred before October 1, 2018.

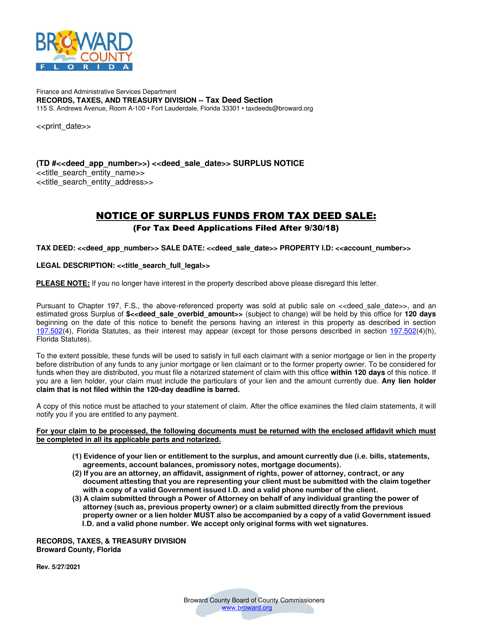

This document is used for filing an affidavit to claim surplus funds from a tax deed sale in Broward County, Florida that occurred after September 30, 2018.

This form is used for paying the deed tax in the state of Minnesota. It is used when transferring ownership of real property through a deed.