Cash Flow Templates

Cash Flow Templates are used to track and compare the inflow and outflow of cash within a business or personal finances. These templates provide a structured format to record income, expenses, and other financial activities over a specified period. The main purpose of a Cash Flow Template is to help individuals or businesses understand and manage their cash flows effectively, ensuring that they have enough cash on hand to meet their financial obligations and make informed decisions regarding their financial health and future planning.

Documents:

32

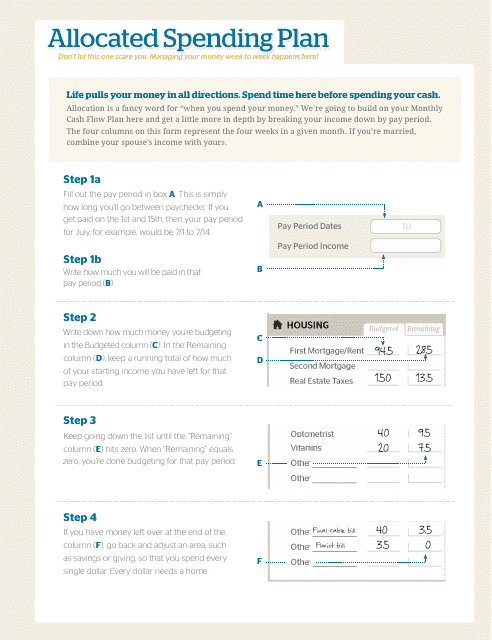

This document is a template for an allocated spending plan spreadsheet. It helps you track and manage your expenses and income effectively.

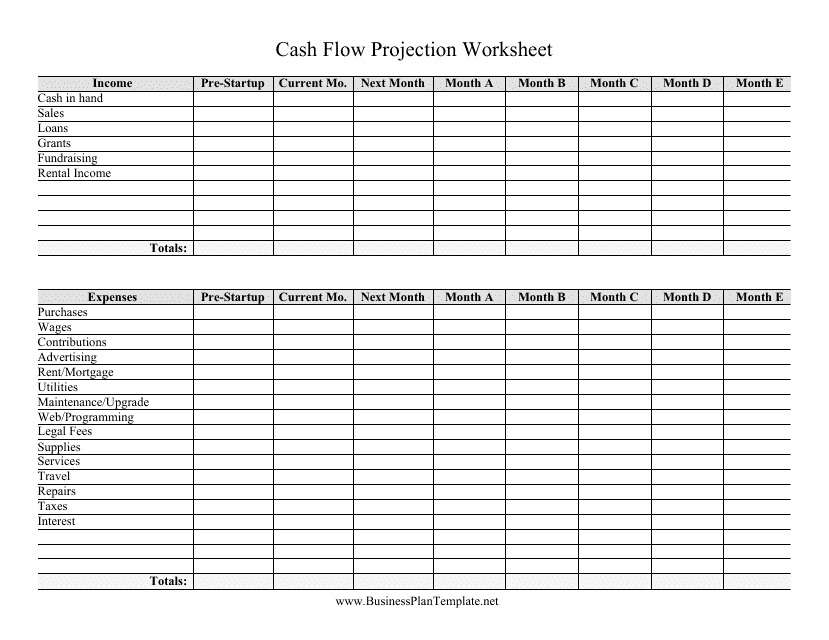

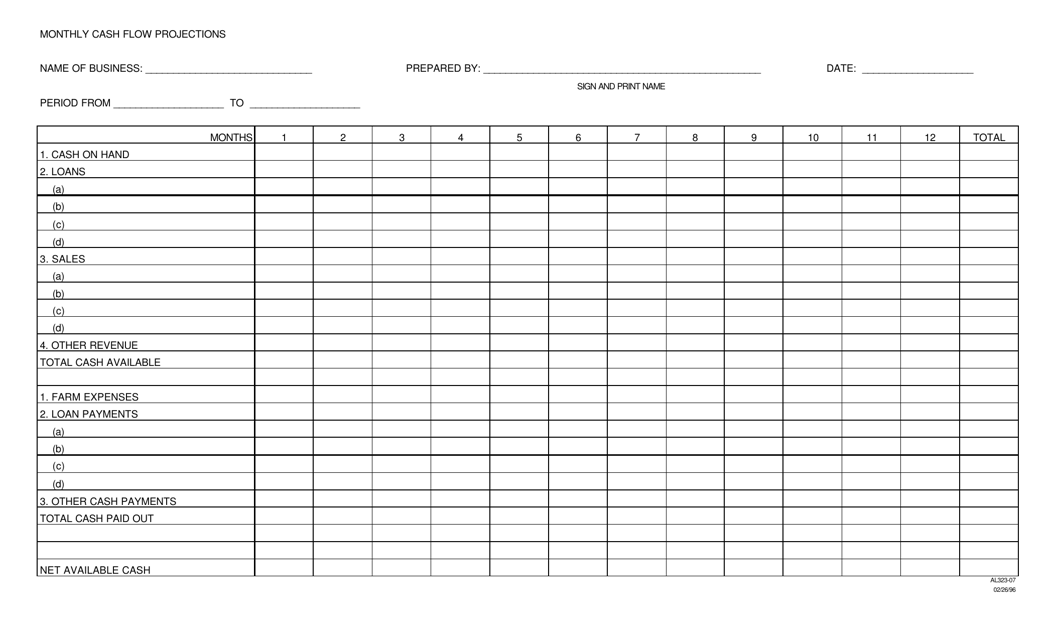

This document provides a spreadsheet that helps project and track cash flow. It allows you to forecast your incoming and outgoing cash to plan and manage your finances.

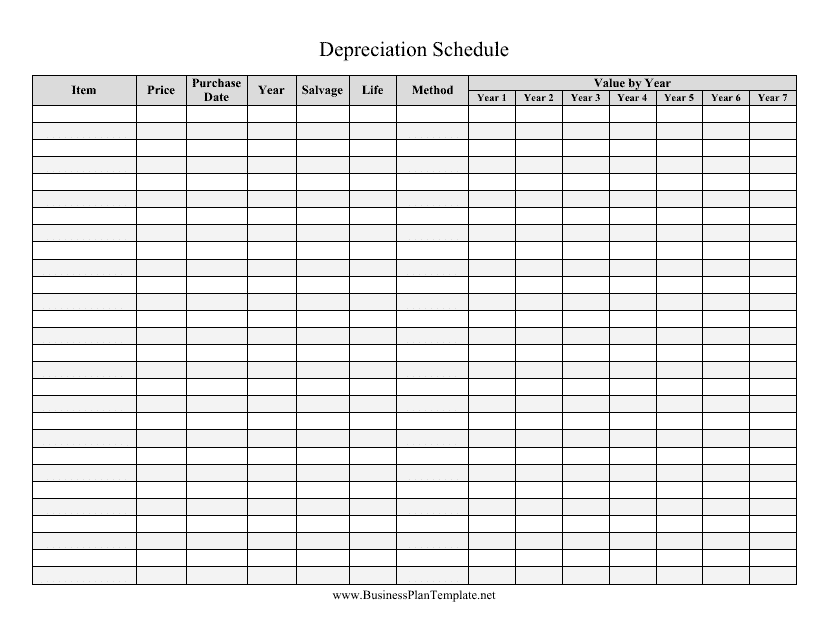

This document provides a template for creating a schedule that determines the depreciation of assets over time. It is useful for businesses to track the decrease in value of their assets for accounting and tax purposes.

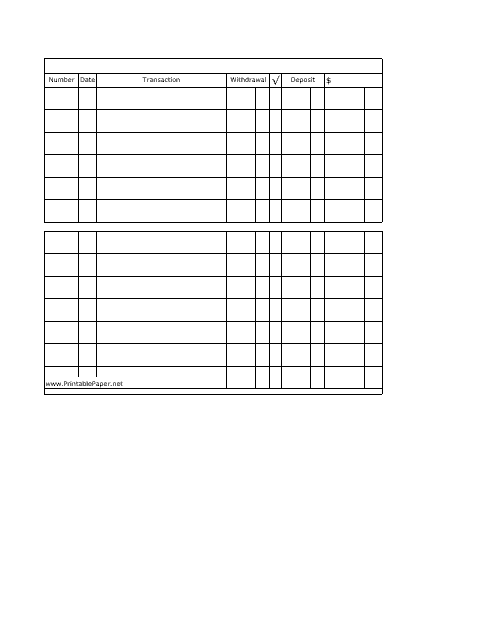

This template is used to create and organize a schedule for transactions. It helps you plan and track your transactions in an efficient manner.

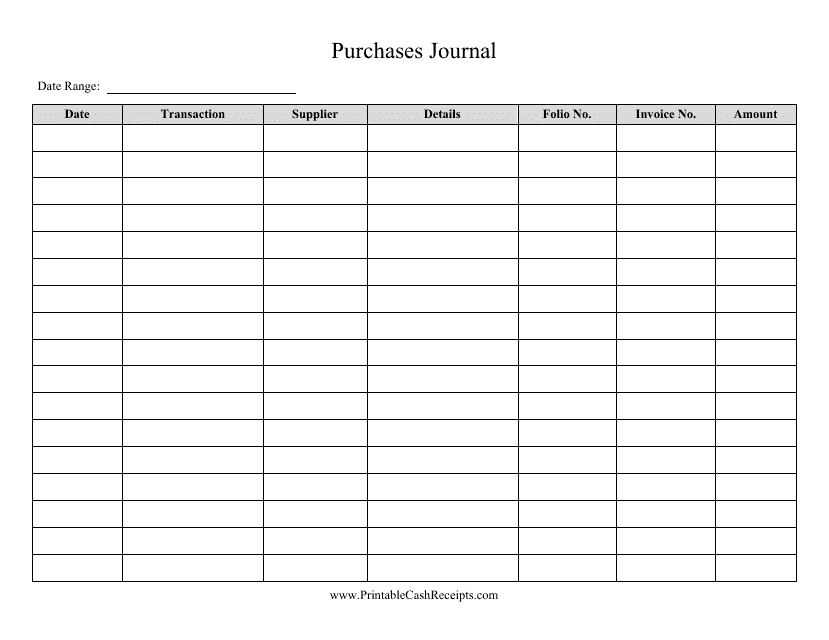

This document is a template for recording purchases made by a company. It includes columns for the date of purchase, vendor name, description of the item purchased, quantity, unit price, and total cost. The template is designed to help organize and track all purchases made by the company.

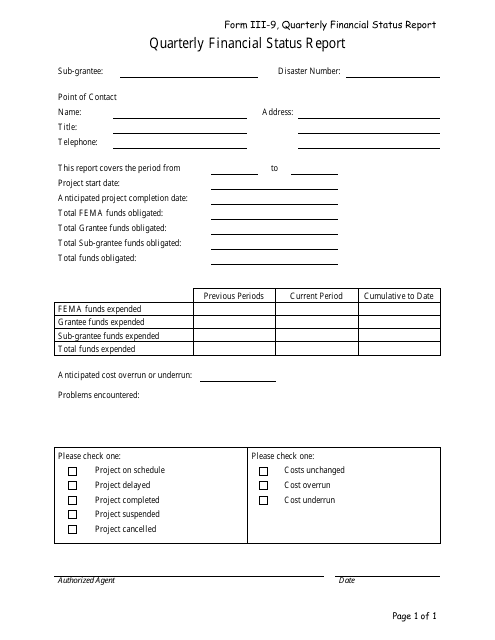

This document template is used for creating a quarterly report that provides an overview of the financial status of an organization. It includes key financial metrics and analysis to keep stakeholders informed about the financial performance.

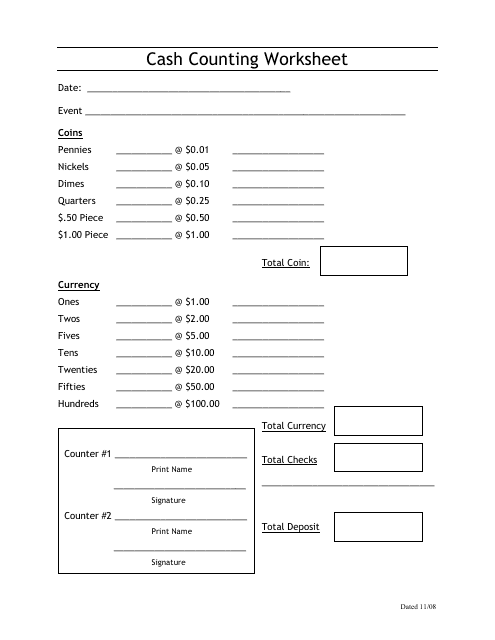

This document is used for keeping track of cash and conducting a count of the money. It helps to ensure accuracy and prevent discrepancies in cash transactions.

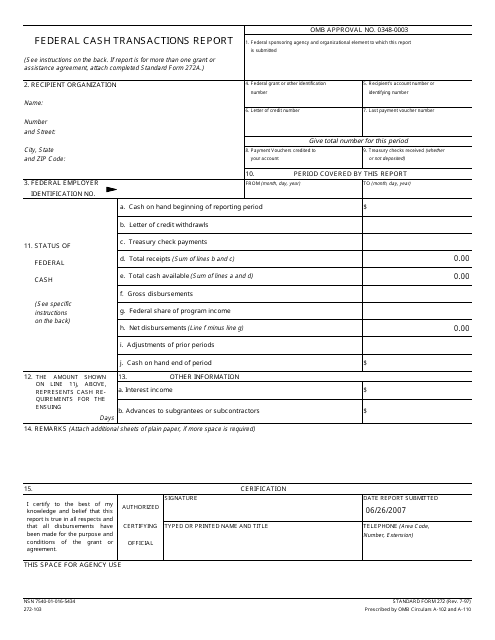

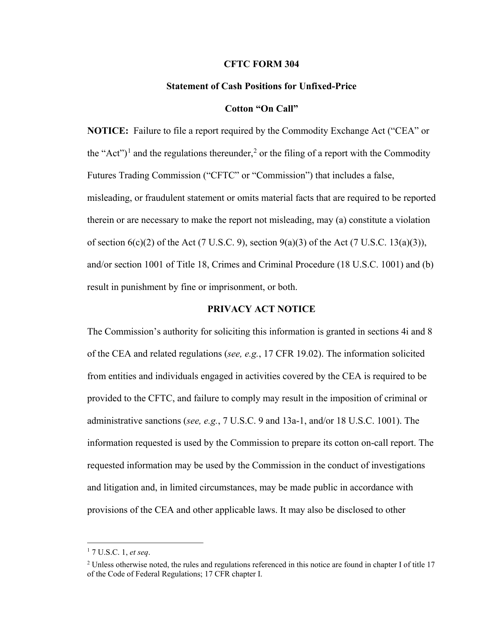

This document is used for reporting federal cash transactions.

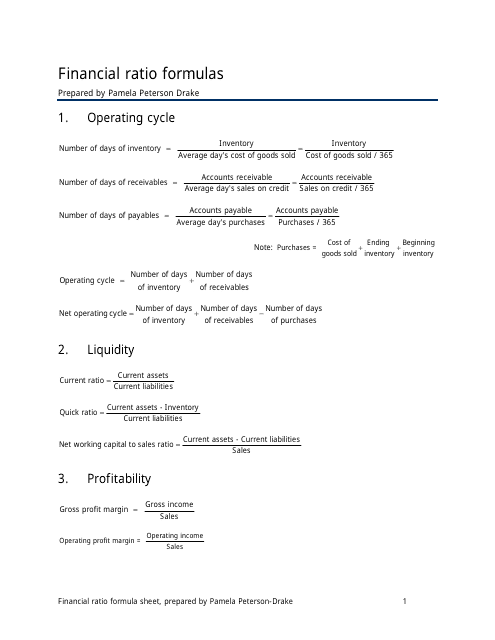

This document provides a template for calculating financial ratios. It includes formulas for common ratios like profitability, liquidity, and solvency. Use this template to analyze and assess the financial health of a company.

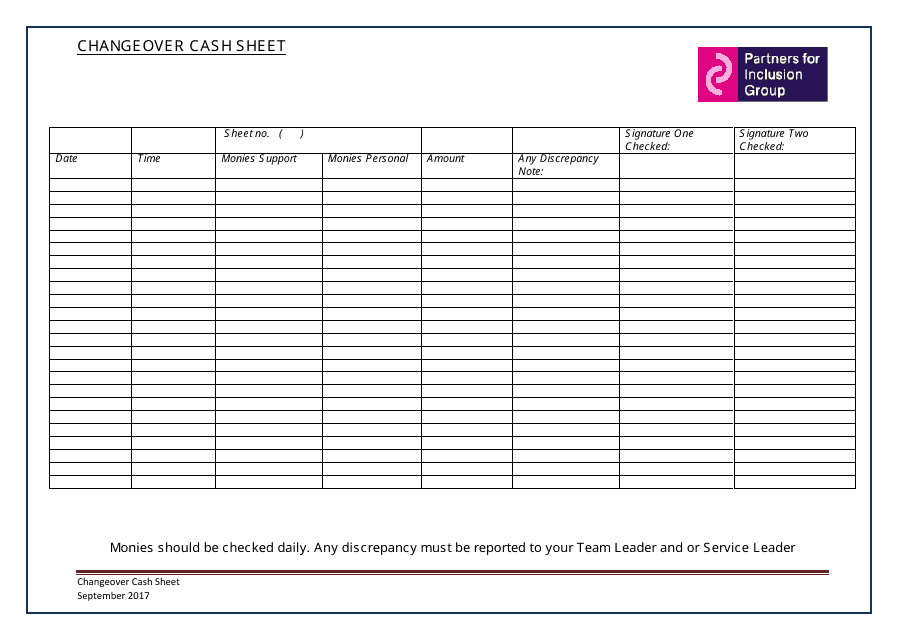

This document is a template for keeping track of cash during a changeover process. It helps to ensure accuracy and accountability when transferring cash between shifts or employees.

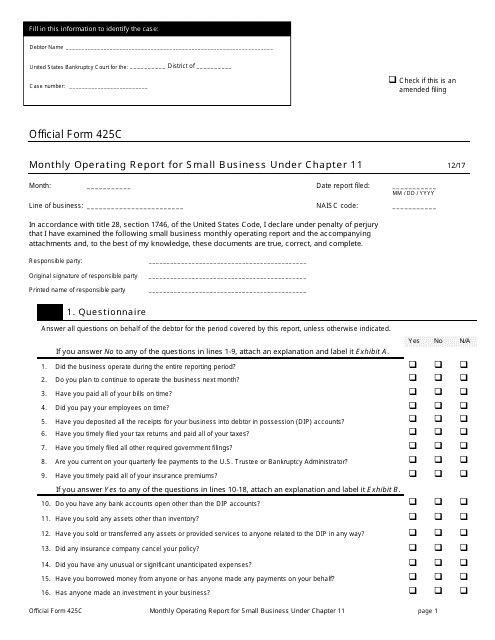

This Form is used for small businesses operating under Chapter 11 bankruptcy to provide a monthly report of their financial activities.

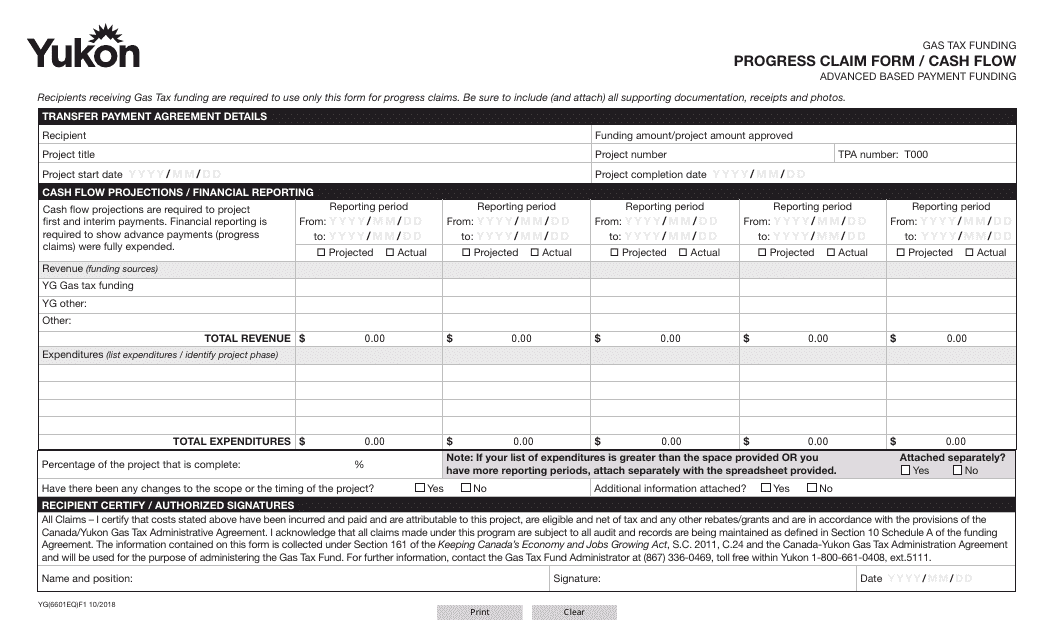

This form is used for submitting progress claims and cash flow information related to the Gas Tax Fund in Yukon, Canada.

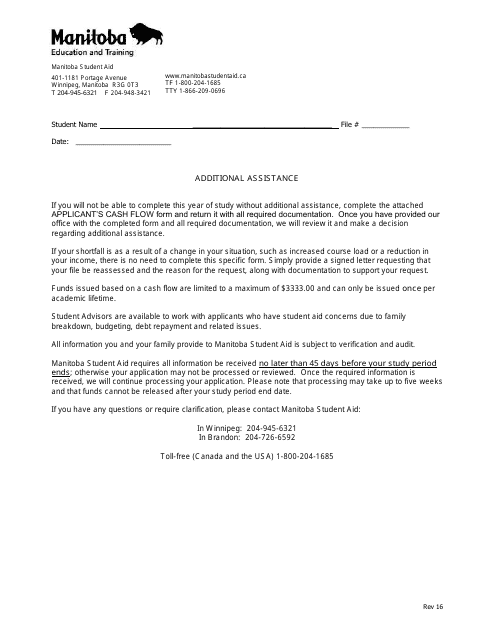

This document provides an overview of the applicant's cash flow in Manitoba, Canada. It includes information on their income, expenses, and other financial factors.

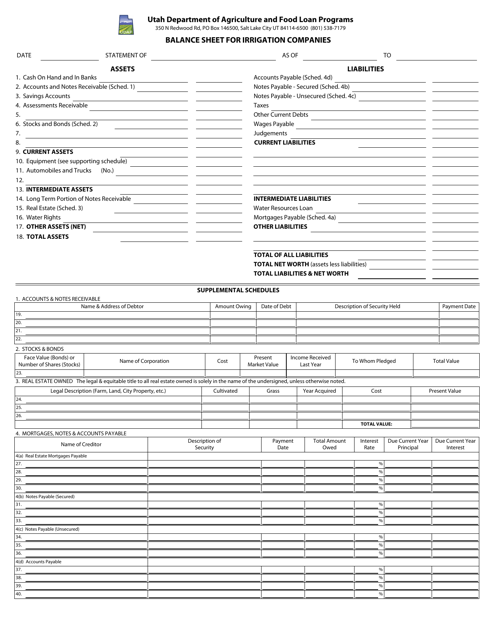

This document provides a detailed overview of the financial position and performance of irrigation companies in Utah. It showcases assets, liabilities, and shareholders' equity, giving valuable insights into the company's financial health.

This form is used for creating monthly cash flow projections in Hawaii. It helps individuals and businesses plan and track their income and expenses based on the unique financial circumstances in the state.

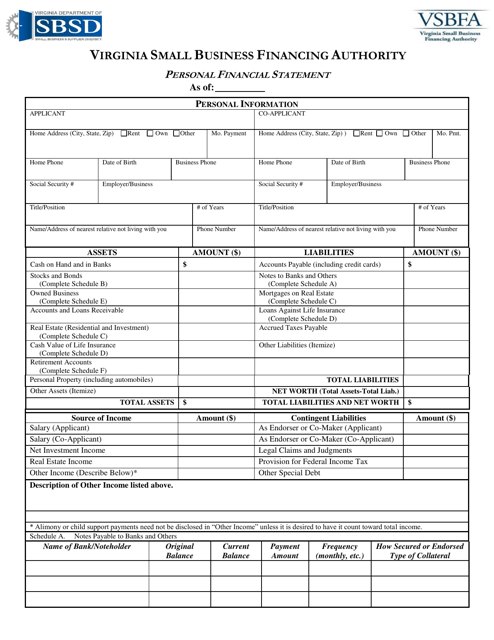

This document is used for summarizing an individual's financial situation in the state of Virginia. It includes details about assets, liabilities, income, and expenses.

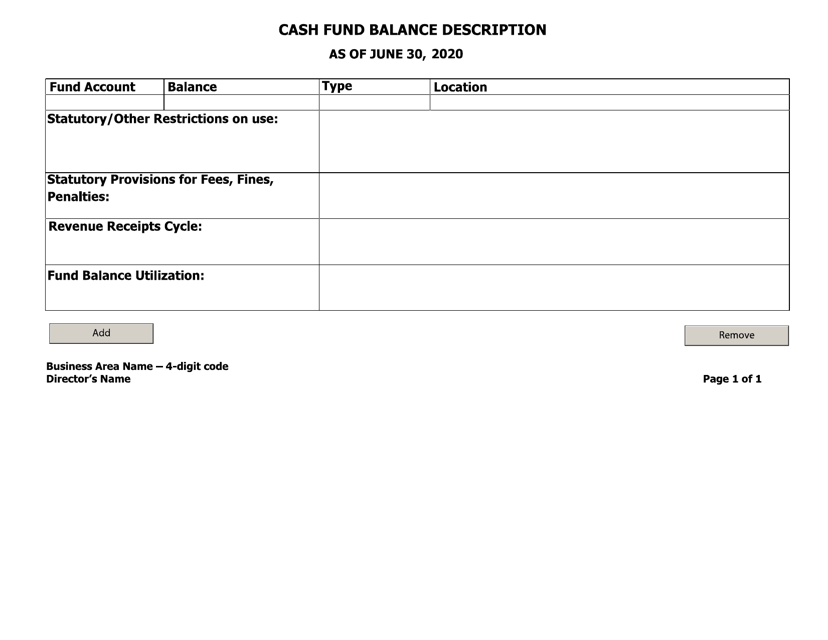

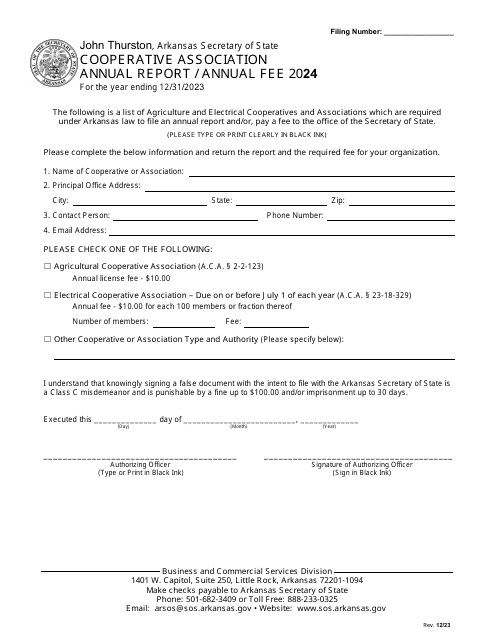

This document provides a description of the cash fund balance in Arkansas. It explains how the balance is calculated and used in the state's financial operations.

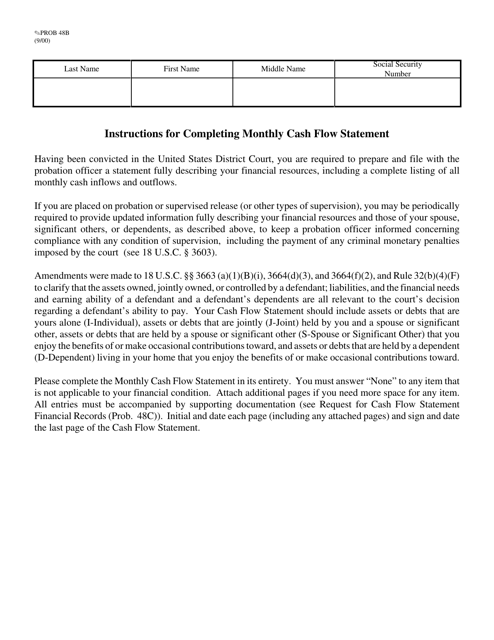

This form is used for recording and analyzing the monthly cash flow of a business or organization. It helps track the inflows and outflows of cash to monitor financial health and make informed decisions.

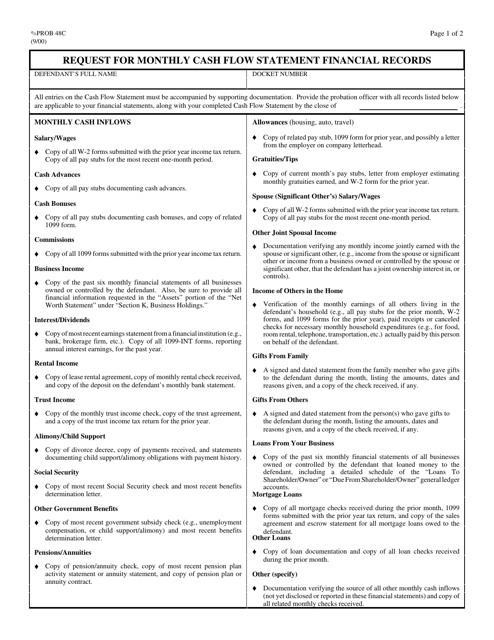

This form is used for requesting a monthly cash flow statement for financial records.

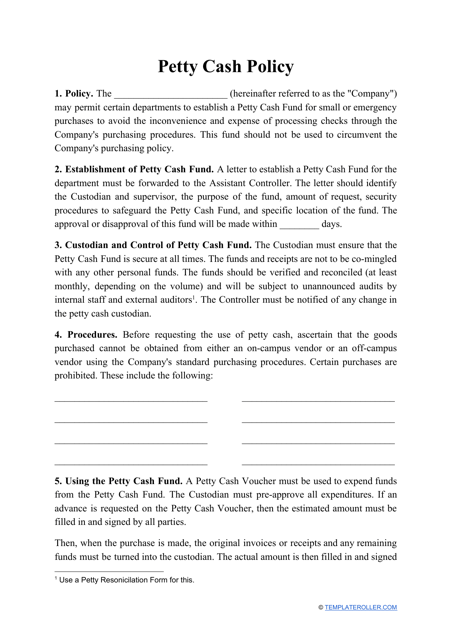

This document is created by a company in order to provide guidelines for employees on how to use employer given petty cash.

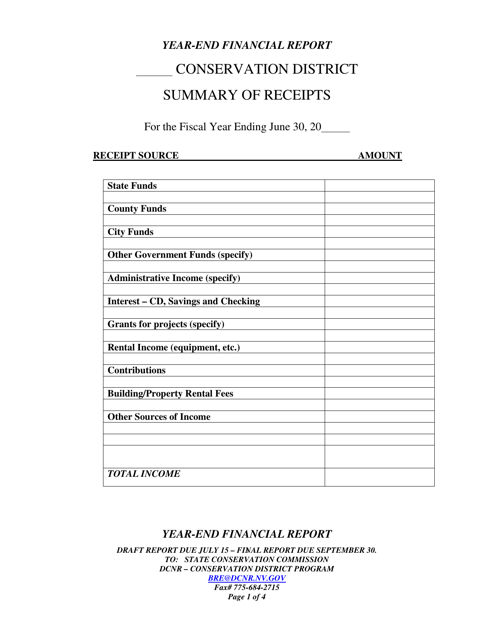

This document provides a summary of the financial activities and performance of a company or organization in Nevada at the end of the year. It includes details about revenue, expenses, profits, and other financial metrics.

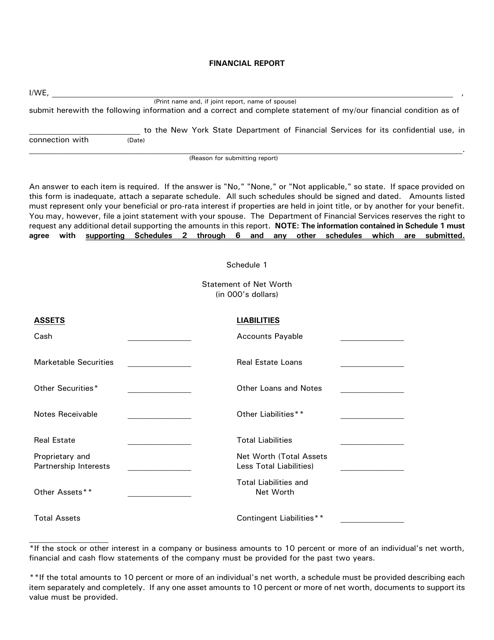

This financial report provides a comprehensive overview of the financial status of New York. It includes information about revenues, expenses, and other financial data related to the city.

This document is used for keeping track of cash transactions in Ohio. It helps individuals or businesses in Ohio monitor their cash flow and track any cash expenses or receipts.

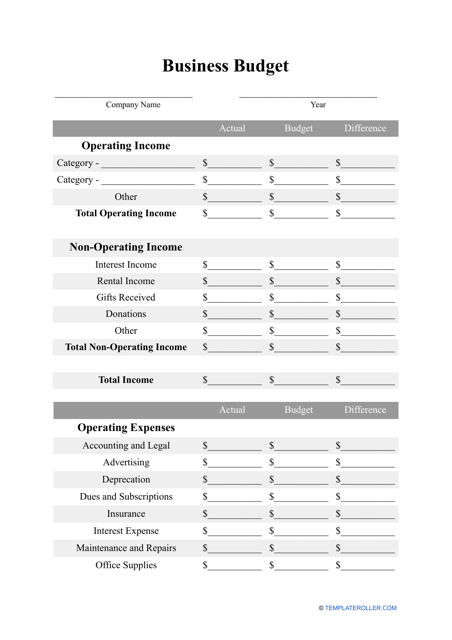

This template acts as an estimate of a company's revenue, expenses, and investments over a week, month, or year.

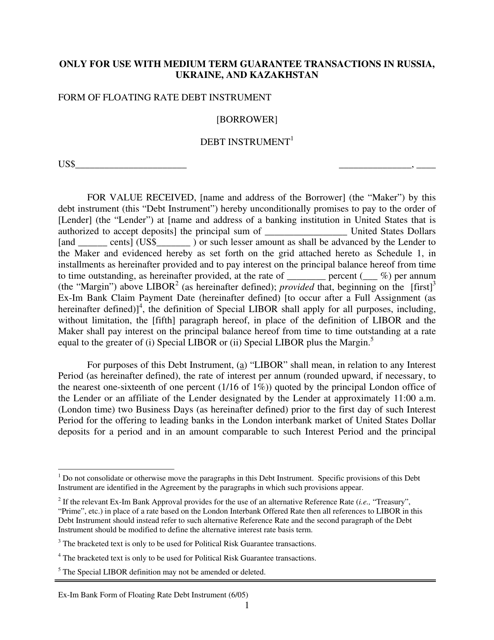

This document is a form used for creating a floating rate debt instrument. It outlines the terms and conditions of the loan, including the interest rate that will fluctuate based on a designated benchmark.

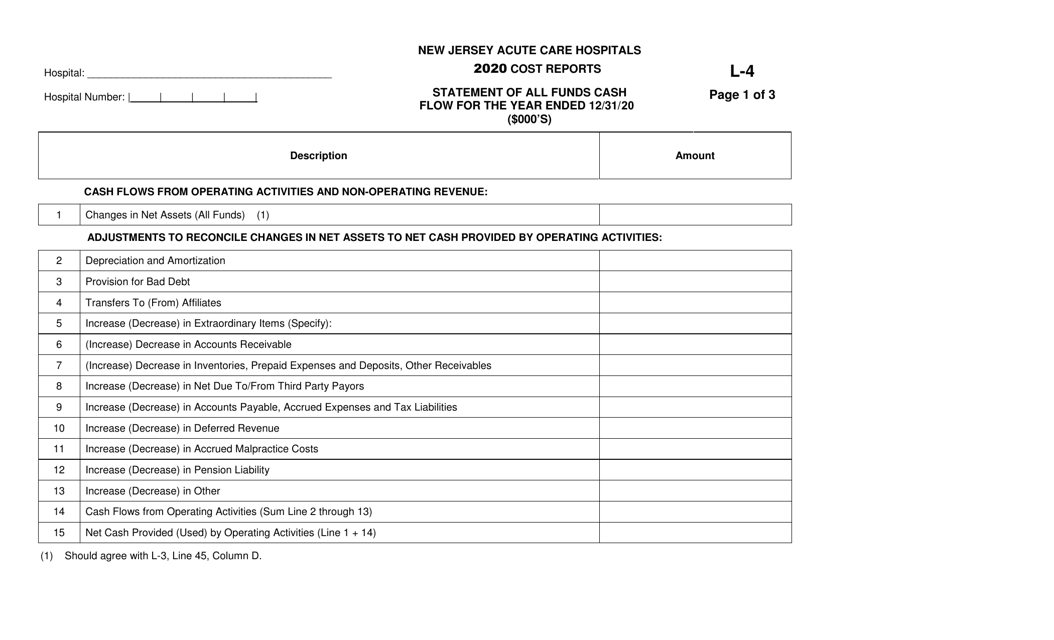

This form is used for reporting the cash flow of all funds for acute care hospitals in New Jersey. It is used to track and analyze the financial transactions of these hospitals.

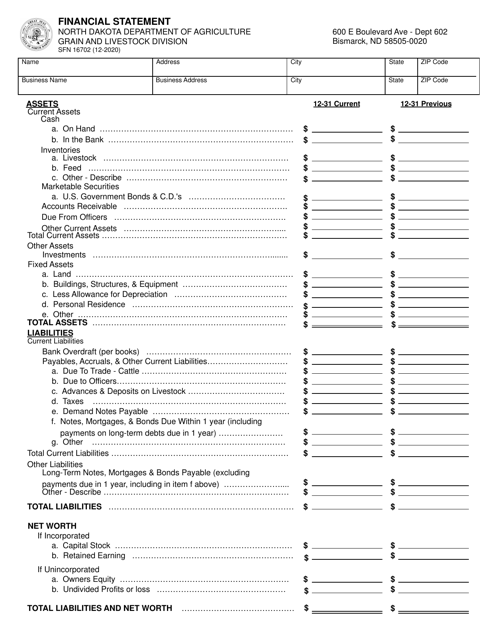

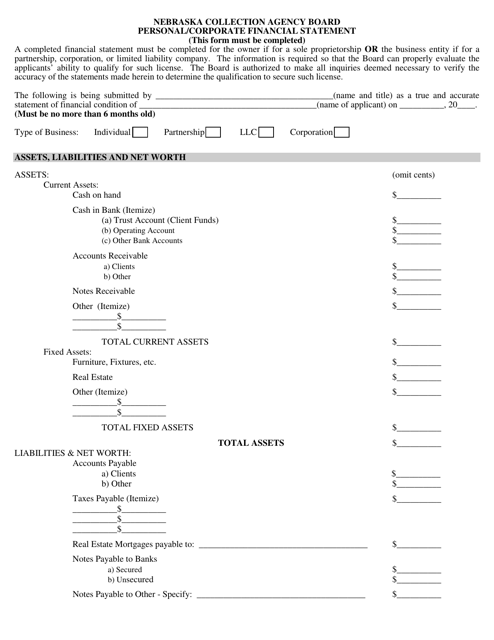

This document is used for assessing the financial standing of individuals or businesses in Nebraska. It includes details of assets, liabilities, income, and expenses.

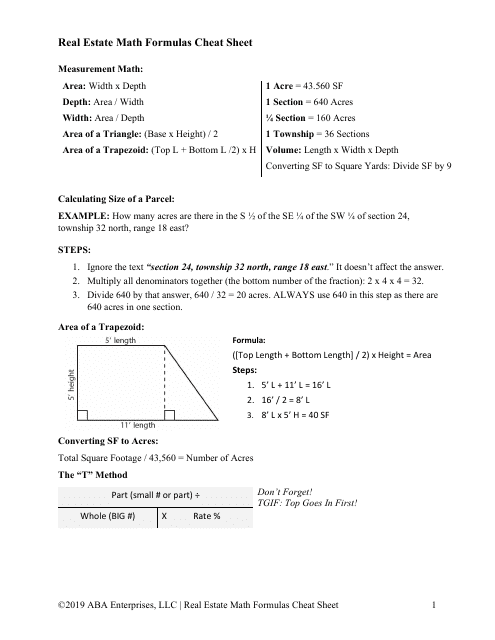

This document provides a cheat sheet of real estate math formulas used in property calculations and transactions. It is a helpful tool for real estate agents, investors, and anyone involved in the real estate industry.

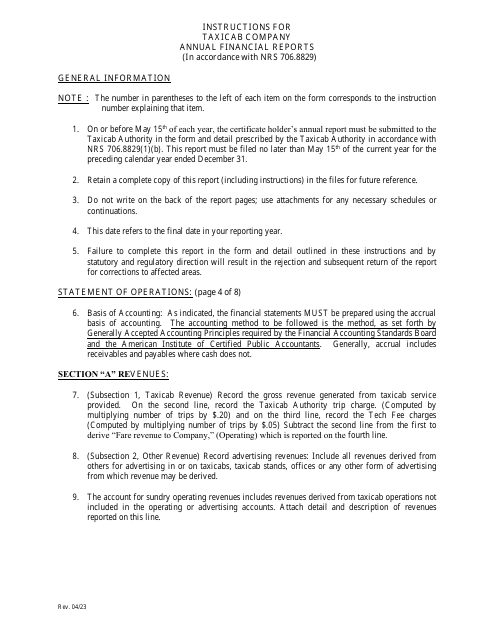

This document is used by taxicab companies in Nevada for annual financial reporting. It includes financial statements and information about their revenues, costs, and overall business performance over the year.