General Business Credit Templates

Are you a business owner looking to maximize your tax savings? Look no further than the General Business Credit. This collection of documents and instructions provided by the IRS is designed to help businesses claim various tax credits and reduce their overall tax liability.

Whether you're eligible for credits related to research and development activities, energy-efficient initiatives, or even low-income housing investments, the General Business Credit has you covered. By taking advantage of these tax incentives, your business can keep more money in its pocket and reinvest it in growth and innovation.

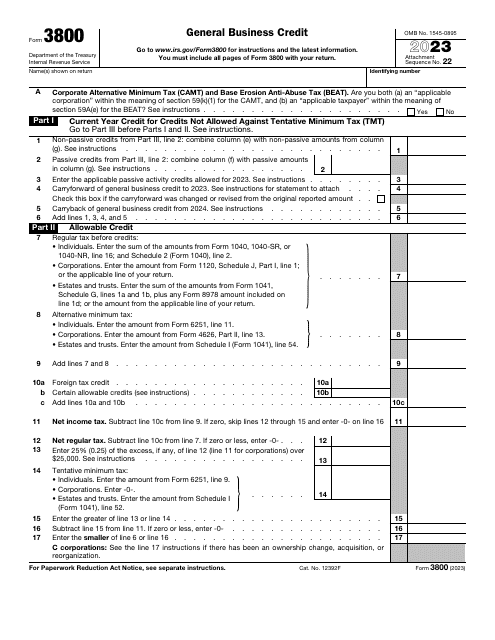

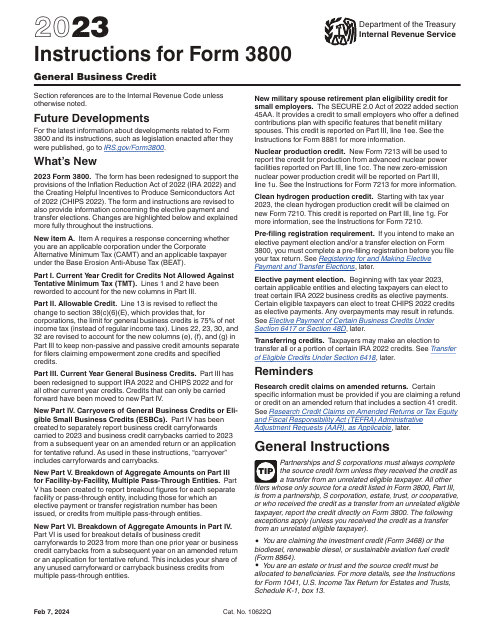

The General Business Credit documents include clear and concise instructions on how to fill IRS Form 3800, allowing you to accurately report and claim the credits you're entitled to. These instructions provide guidance on the various credit categories, calculations, and documentation required to support your claims.

With the General Business Credit documents in hand, you can simplify and streamline the process of claiming tax credits. By following the instructions provided, you can ensure that you are maximizing your tax-saving opportunities and staying in compliance with IRS regulations.

So, if you're ready to take advantage of the many tax credits available to businesses, don't wait any longer. Access the General Business Credit documents today and start saving money on your taxes. Your business's financial health will thank you.

(Note: The text above is an example of how the output can be generated. You may come up with a different text based on the given information.)