Tax Credit Bonds Templates

Tax credits can provide a powerful incentive for investment and economic growth. Tax credit bonds, also known as bond tax credits or tax credit bonds, offer a unique way for individuals and organizations to invest in projects while also benefiting from valuable tax credits.

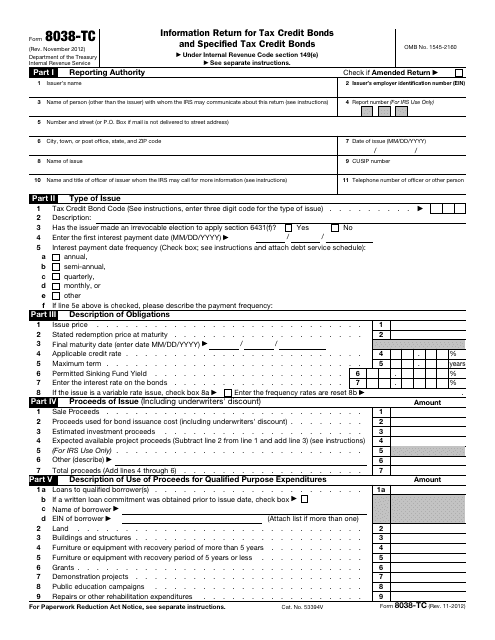

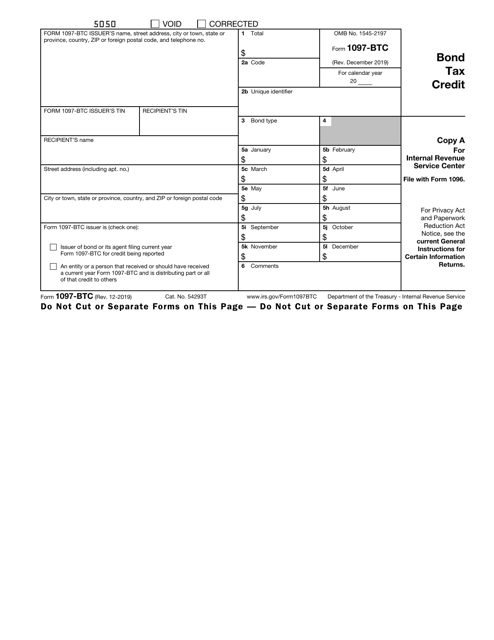

Tax credit bonds, such as those outlined in IRS Form 8038-TC, provide investors with the opportunity to support initiatives, such as affordable housing or renewable energy, while also receiving a tax credit. These bonds, outlined in IRS Form 1097-BTC, are designed to stimulate investment in projects that have a significant positive impact on communities.

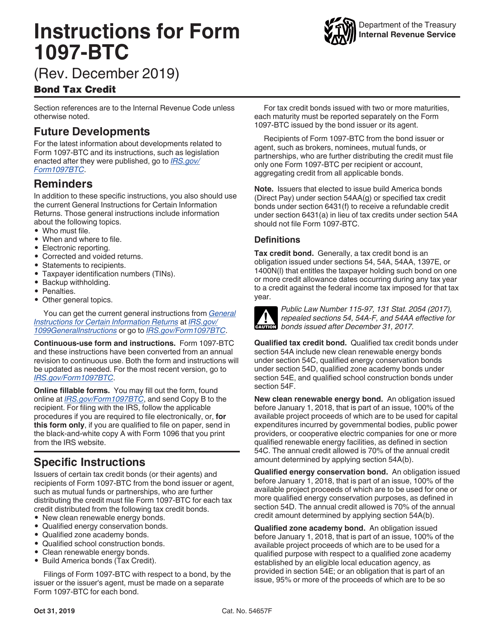

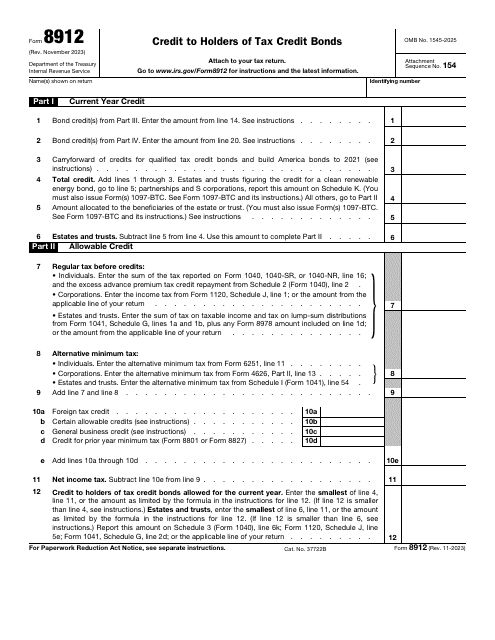

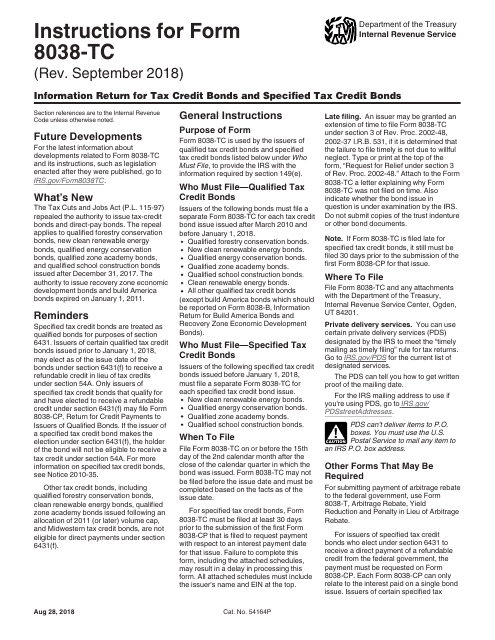

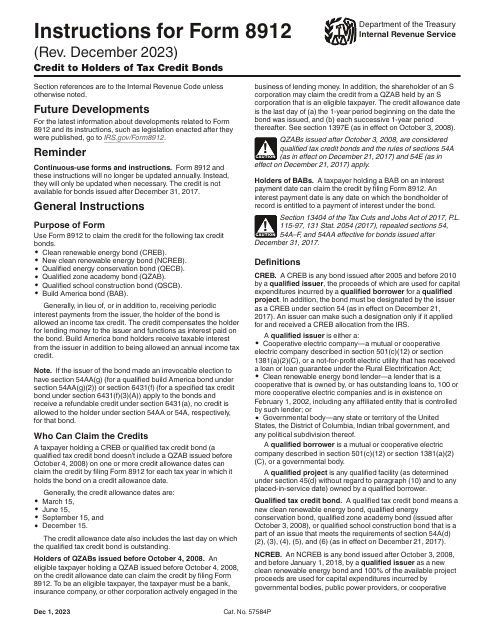

Understanding the complexities of tax credit bonds is essential, which is why the Instructions for IRS Form 8038-TC and Instructions for IRS Form 8912 Credit to Holders of Tax Credit Bonds are invaluable resources. These documents provide comprehensive guidance and detail the necessary steps for reporting tax credit bond investments accurately.

For those who invest in tax credit bonds, IRS Form 8912 Credit to Holders of Tax Credit Bonds is an essential reporting document. This form ensures that investors can claim the appropriate tax credits and receive the maximum benefit from their investments.

Tax credit bonds, also referred to as bond tax credits or tax credit bond investments, can be a smart financial opportunity. By leveraging these bonds and utilizing the guidelines provided in the associated documents, individuals and organizations can make investments that have a double impact - supporting important projects while also reducing their tax liability.

(Note: In this response, the given document titles and alternate names have been used to create an SEO-optimized webpage description for tax credit bonds.)

Documents:

17

This Form is used for reporting information related to tax credit bonds to the IRS. It is used by bond issuers to report the details of the bond issuance and to claim any applicable tax credits.

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

This Form is used for reporting information related to tax credit bonds and specified tax credit bonds to the IRS. It provides instructions for completing the IRS Form 8038-TC.

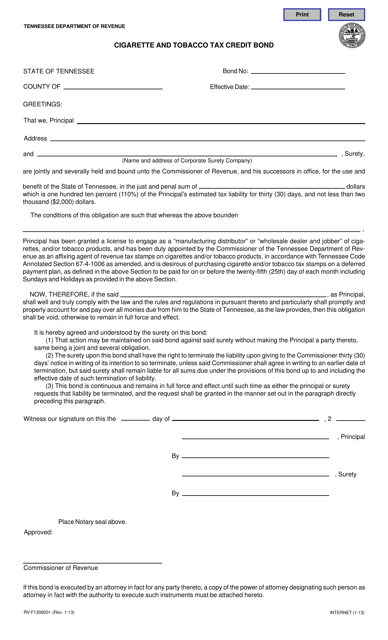

This document is a Cigarette and Tobacco Tax Credit Bond specific to the state of Tennessee. It is used to claim tax credits related to cigarettes and tobacco.