Impuestos Personales Templates

Are you looking for information on personal taxes? Look no further! Our comprehensive collection of documents covers everything you need to know about personal taxes from the United States and other countries. Whether you're a Spanish speaker or need instructions in English, we have you covered.

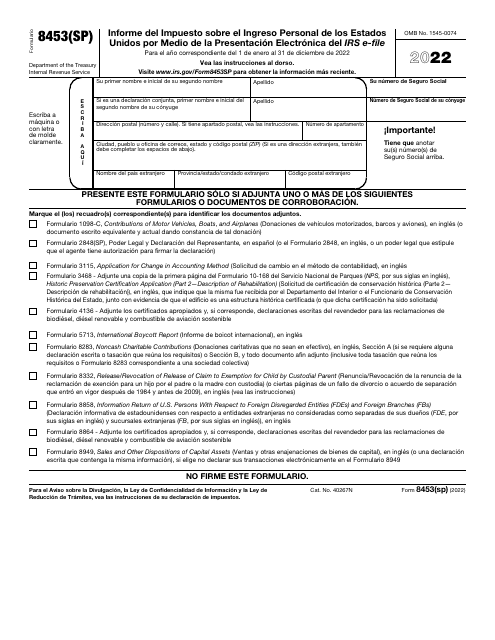

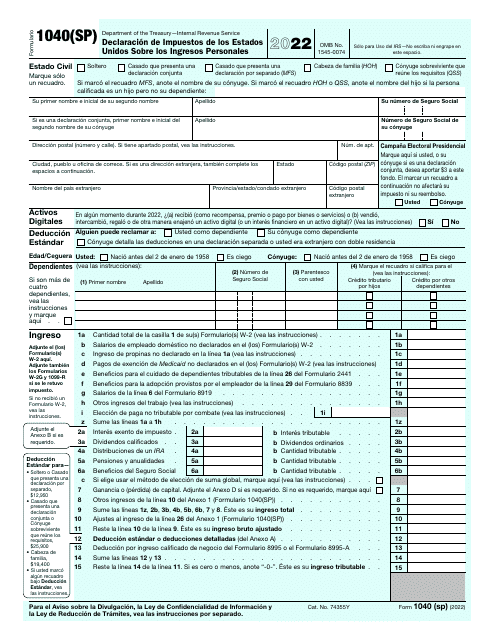

Our documents include forms such as the IRS Formulario 8453(SP) Informe Del Impuesto Sobre El Ingreso Personal De Los Estados Unidos Por Medio De La Presentacion Electronica Del IRS E-File (Spanish) and the IRS Formulario 1040(SP) Declaracion De Impuestos De Los Estados Unidos Sobre Los Ingresos Personales (Spanish). These forms are essential for reporting and filing your personal tax returns accurately.

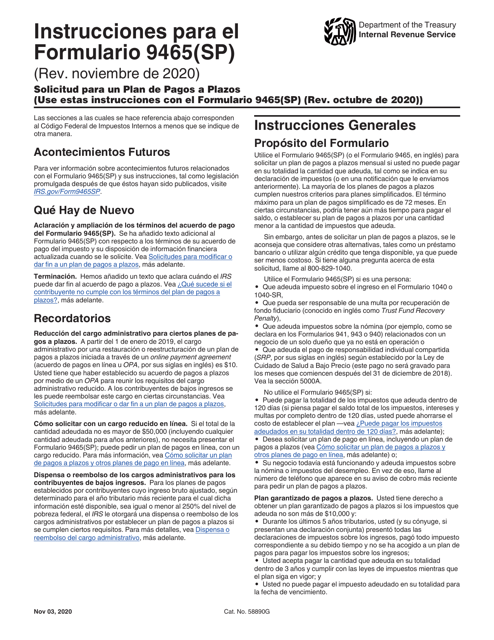

If you're looking for guidance on setting up a payment plan, we have the Instrucciones para IRS Formulario 9465(SP) Solicitud Para Un Plan De Pagos a Plazos (Spanish). This document will walk you through the process of requesting a installment agreement for your tax payments.

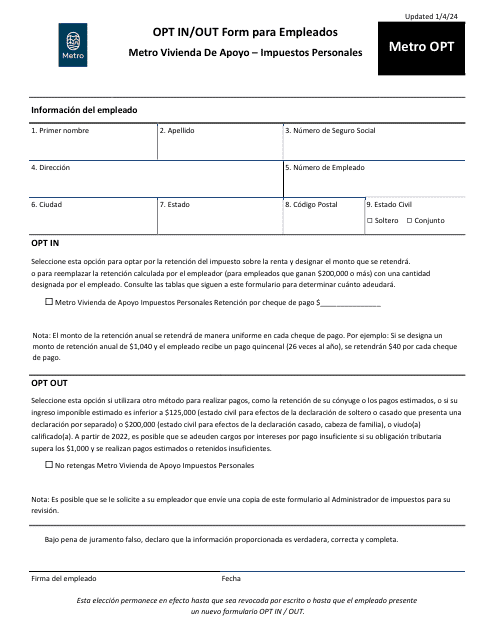

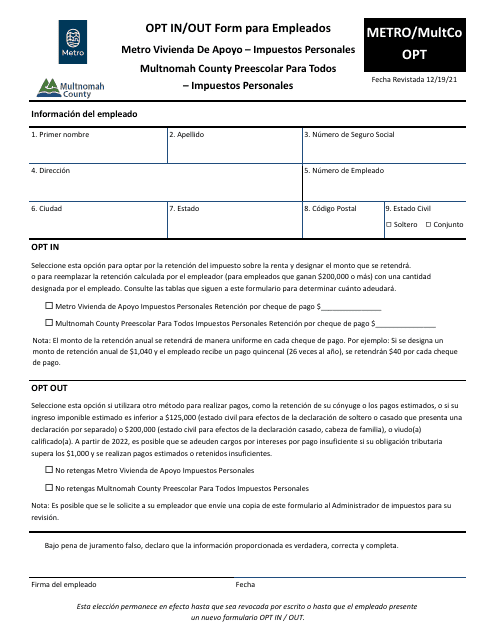

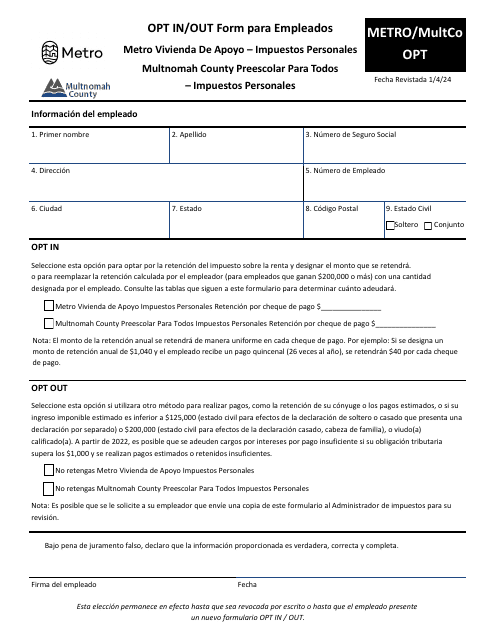

Additionally, we have the Formulario METRO/MULTCO OPT Opt in/Out Form Para Empleados - Metro Vivienda De Apoyo - Multnomah County Preescolar Para Todos - Impuestos Personales - Multnomah County, Oregon (Spanish) and the Formulario METRO/MULTCO OPT Opt in/Out Form Para Empleados - Metro Vivienda De Apoyo - Multnomah County Preescolar Para Todos - Impuestos Personales - Oregon (Spanish). These forms pertain to specific programs and tax options available in Multnomah County, Oregon.

Ensure that you have all the necessary information and resources to navigate the world of personal taxes. Our collection of documents is here to assist you every step of the way.

Documents:

12

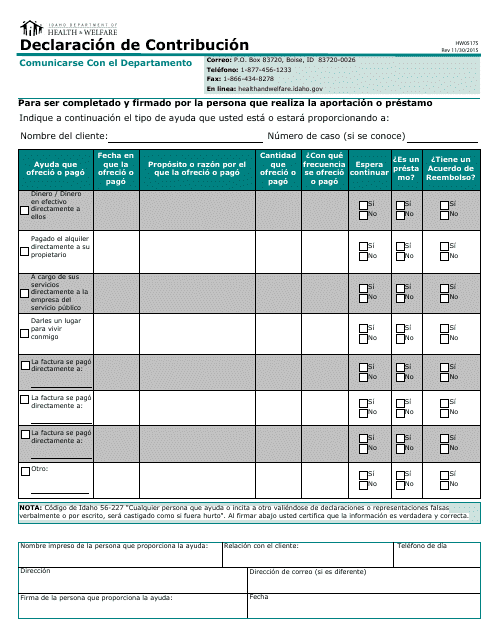

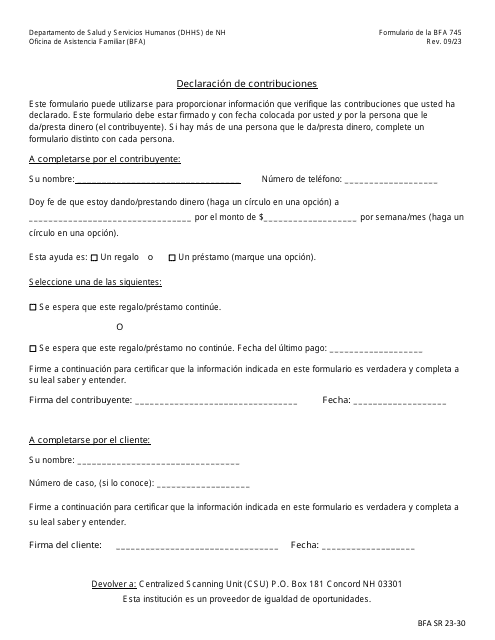

This Form is used for declaring contributions in the state of Idaho.

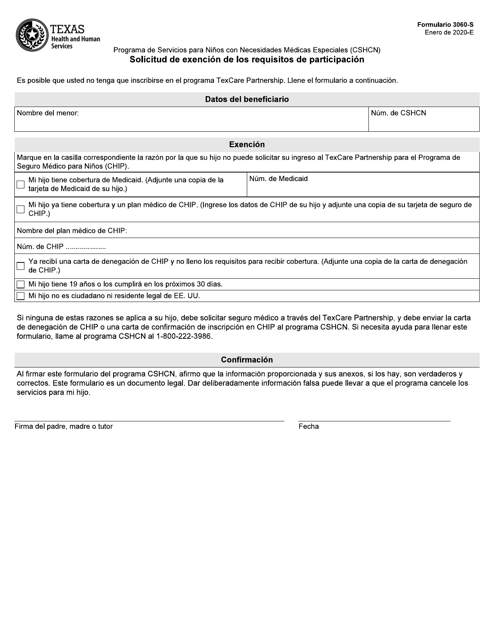

This form is used for requesting an exemption from participation requirements in Texas.